- Bitcoin’s rebound sparks debate amongst buyers like Tapiero and Novogratz on future prospects.

- Uncertainties stay about Fed cuts and laws.

After bleeding in crimson for weeks, Bitcoin [BTC] seems to be recovering, as indicated by its latest worth motion. On the time of writing, BTC was buying and selling at $62,150, reflecting a slight improve of 0.39%.

Notably, on the 14th of Might, BTC additionally skilled a short rally, surpassing the $63,000 mark earlier than retracing barely.

This latest motion in Bitcoin’s worth has sparked appreciable dialogue and pleasure throughout social media platforms.

Execs diverging views BTC

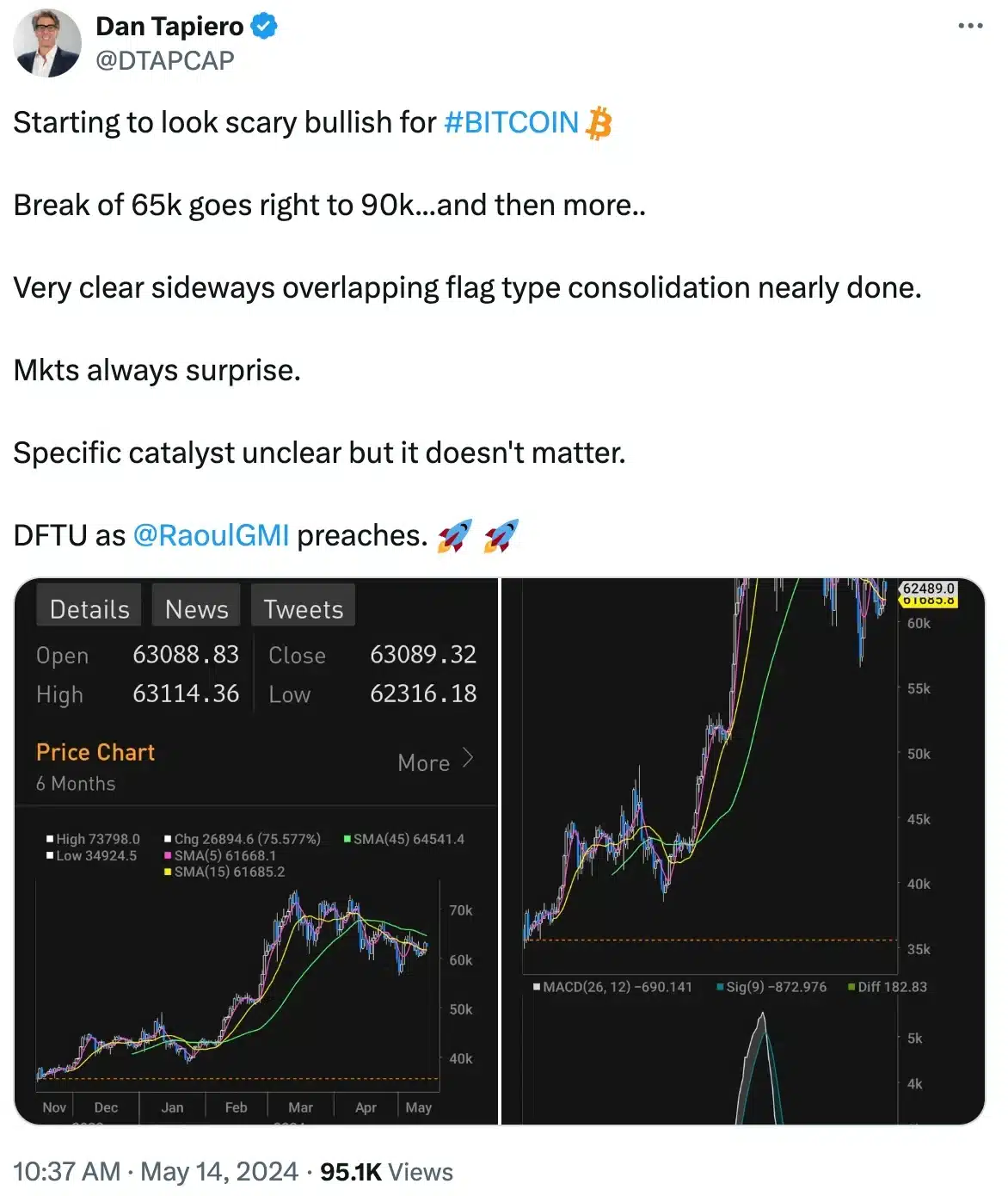

One distinguished determine contributing to this discourse is Dan Tapiero, a macro investor and fund supervisor, who holds the assumption that BTC is on the verge of attaining contemporary all-time highs (ATHs).

Taking to X (previously Twitter) he famous,

Supply: Dan Tapiero/X

Nevertheless, Galaxy Digital Holdings Ltd. founder Michael Novogratz predicts BTC will probably commerce inside a good vary this quarter as conventional finance continues to undertake crypto.

Based on Bloomberg, Novogratz stated,

“We’re within the consolidation section in crypto. Bitcoin, Ethereum, and all the things else, Solana will consolidate, what does that imply?”

He added,

“It means in all probability someplace between $55,000 and $75,000 till the subsequent set of circumstances, the subsequent set of market occasions carry us increased.”

Moreover, he attributed the earlier all-time excessive of roughly $73,000 to the launch of US spot Bitcoin exchange-traded funds (ETFs) and the Bitcoin halving occasion.

Seeing the present market pattern, he believes that the market has stagnated resulting from decreased optimism about potential Federal Reserve fee cuts, regardless of robust financial indicators.

Bitcoin dominance marks a milestone

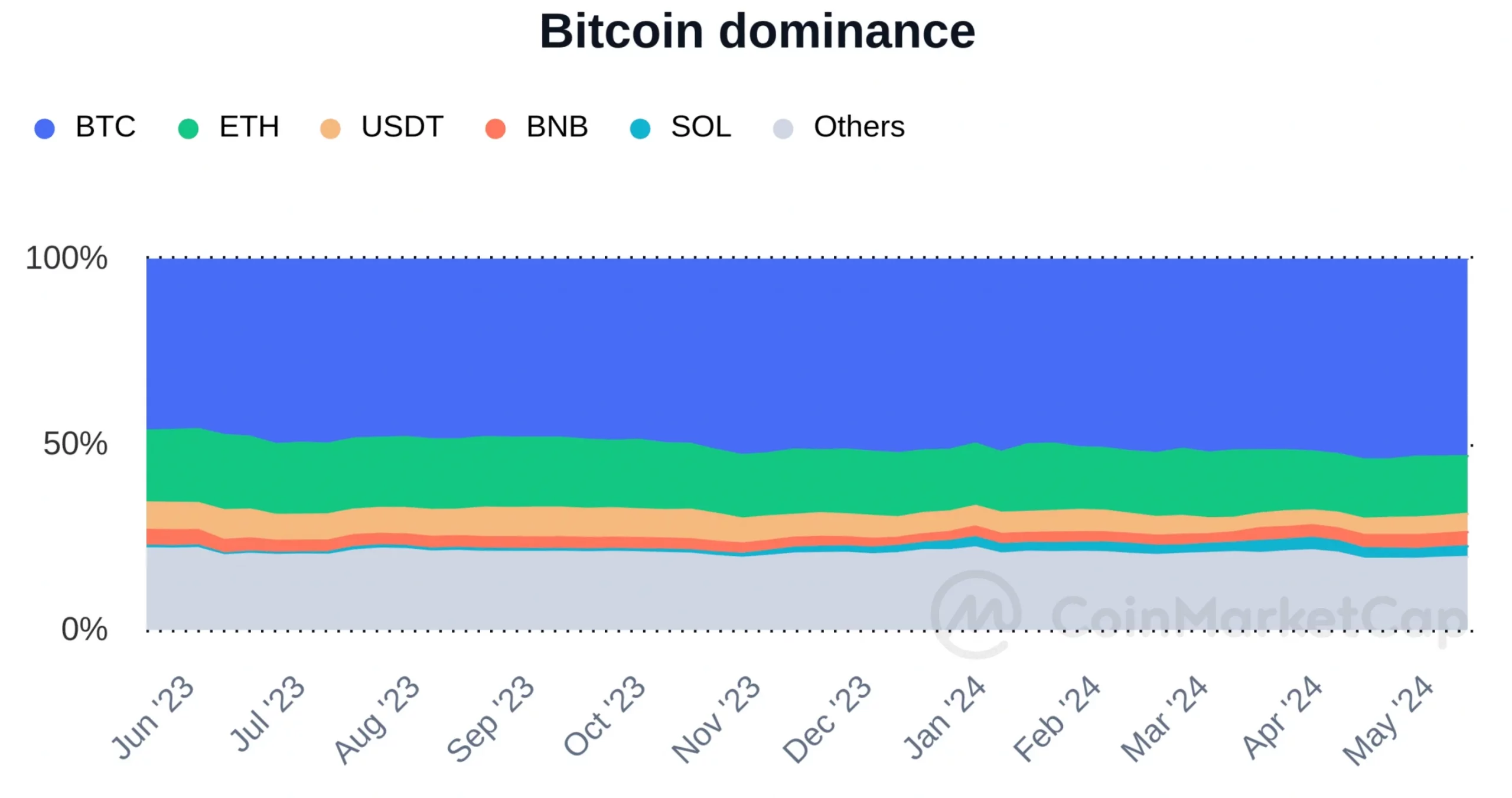

Effectively, this appears to be kinda unfaithful as regardless of fluctuations in BTC’s worth, its market dominance has persistently remained above 50%.

Based on CoinMarketCap knowledge, Bitcoin at present accounts for about 51% of the entire cryptocurrency market capitalization.

Supply: CoinMarketCap

Therefore, BTC’s worth may escape of this consolidation section if both the Federal Reserve begins chopping charges or the upcoming election brings readability to the crypto regulatory panorama.

What lies forward for Bitcoin?

In conclusion, whereas historic tendencies present steering, they don’t assure future outcomes. Thus, there’s a large likelihood of market fluctuations and sideways actions within the upcoming days.

And, if we go by Michaler Saylor’s phrases,

“There are millions of pension funds in the US managing ~$27 trillion in property. They’re all going to want some #Bitcoin.”