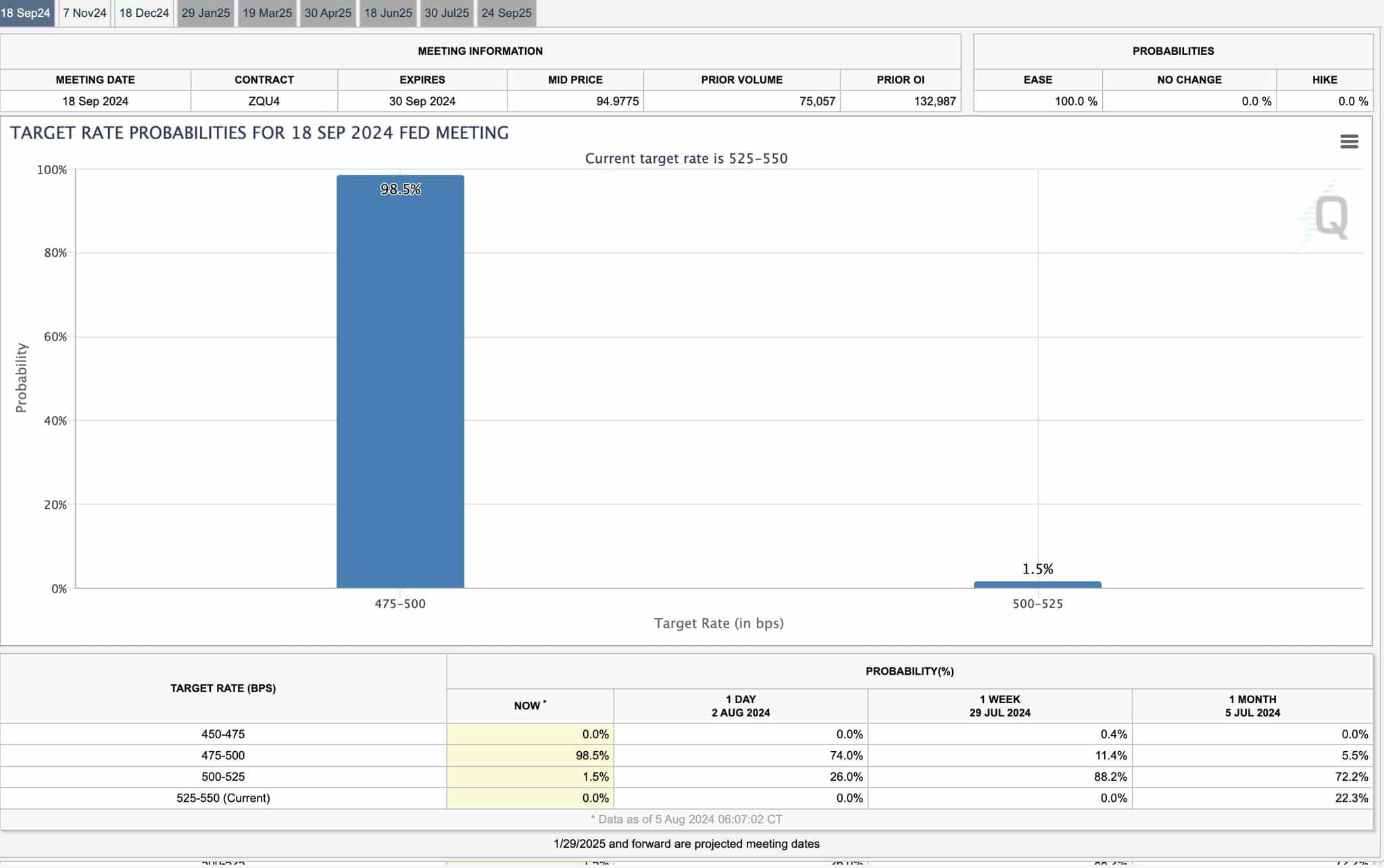

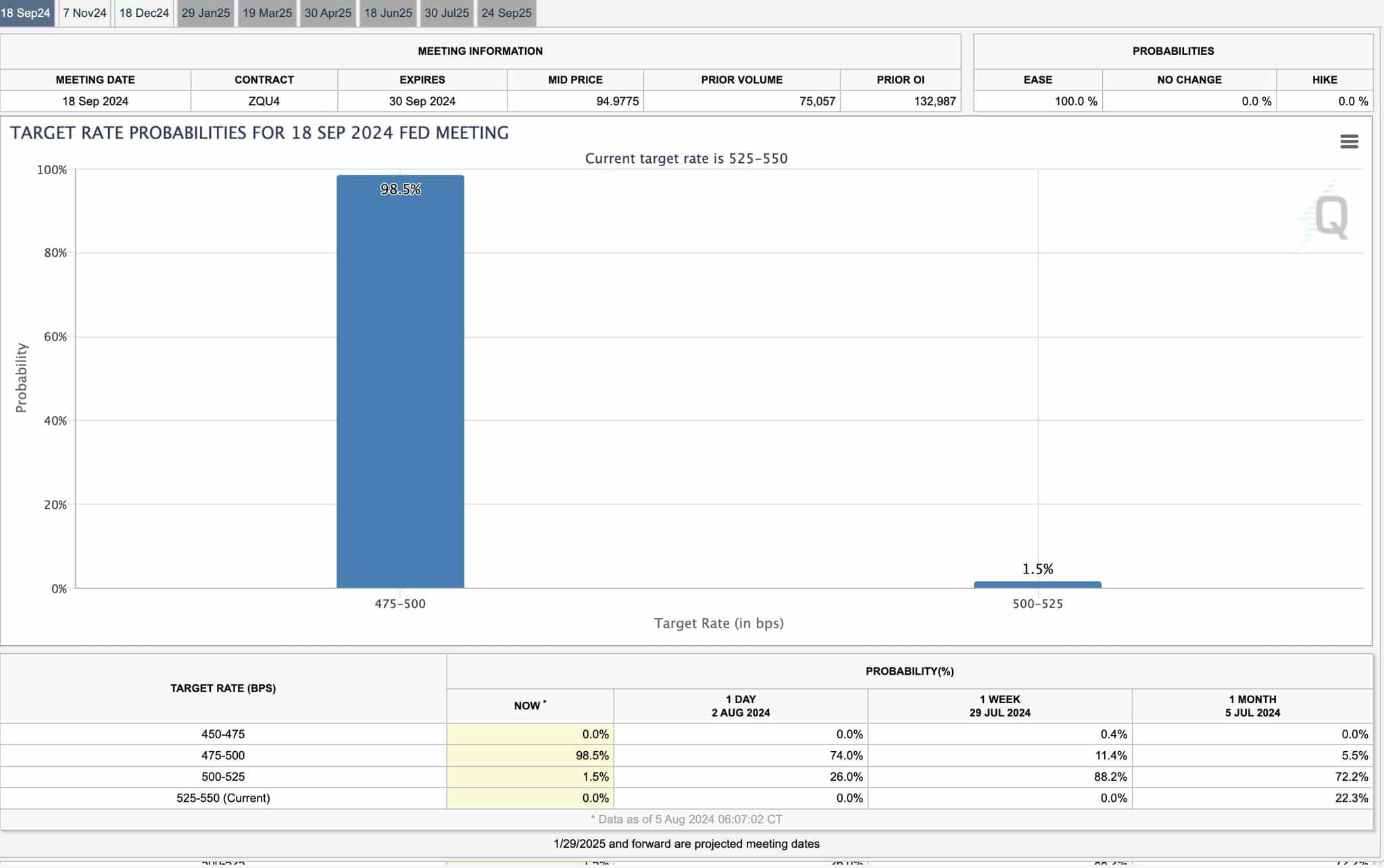

- The FED anticipated to chop charges from September to December month-to-month.

- Prime property to contemplate shopping for in response to delayed fee choices sample.

The Federal Reserve lower rates of interest too late in 2020, raised them too late in 2022, and once more they’re slicing them too late in 2024, as market analyst Patric noted on X (previously Twitter).

This constant delay in choices has impacted monetary markets. It’s now anticipated that the Fed will lower charges from September to December month-to-month as per goal fee possibilities.

That is difficult for the general public however helpful for cryptocurrencies. The Fed delayed these actions as a result of slicing charges isn’t advisable when inflation is excessive, as it may well hurt the economic system.

Now, with fears of a recession, inflation is not the one concern.

Supply: CME Group

Chopping rates of interest and probably printing more cash is a short-term repair for the economic system.

Nevertheless, it hurts strange individuals who solely have money as a result of it causes inflation, making their cash much less helpful. This occurred in 2020 as properly.

This sample of delayed fee choices can create alternatives to purchase sure property. Individuals want to concentrate on how these modifications affect their financial savings and think about investing in property that may shield their wealth in opposition to inflation.

Listed here are the three property to contemplate shopping for in response to this sample:

BTC: Covid crash vs. recession crash

Earlier than a giant bull market, we regularly see a giant crash or an extended consolidation section. Bitcoin’s value motion in 2020 is just like 2024.

After breaking out of a descending wedge in 2020, BTC rallied to a brand new ATH following the COVID-19 crash.

This raises the query: Will historical past repeat for Bitcoin? Presently, Bitcoin continues to be in a major consolidation section, and the massive breakout has but to occur, however it is going to, absolutely.

Supply: TradingView

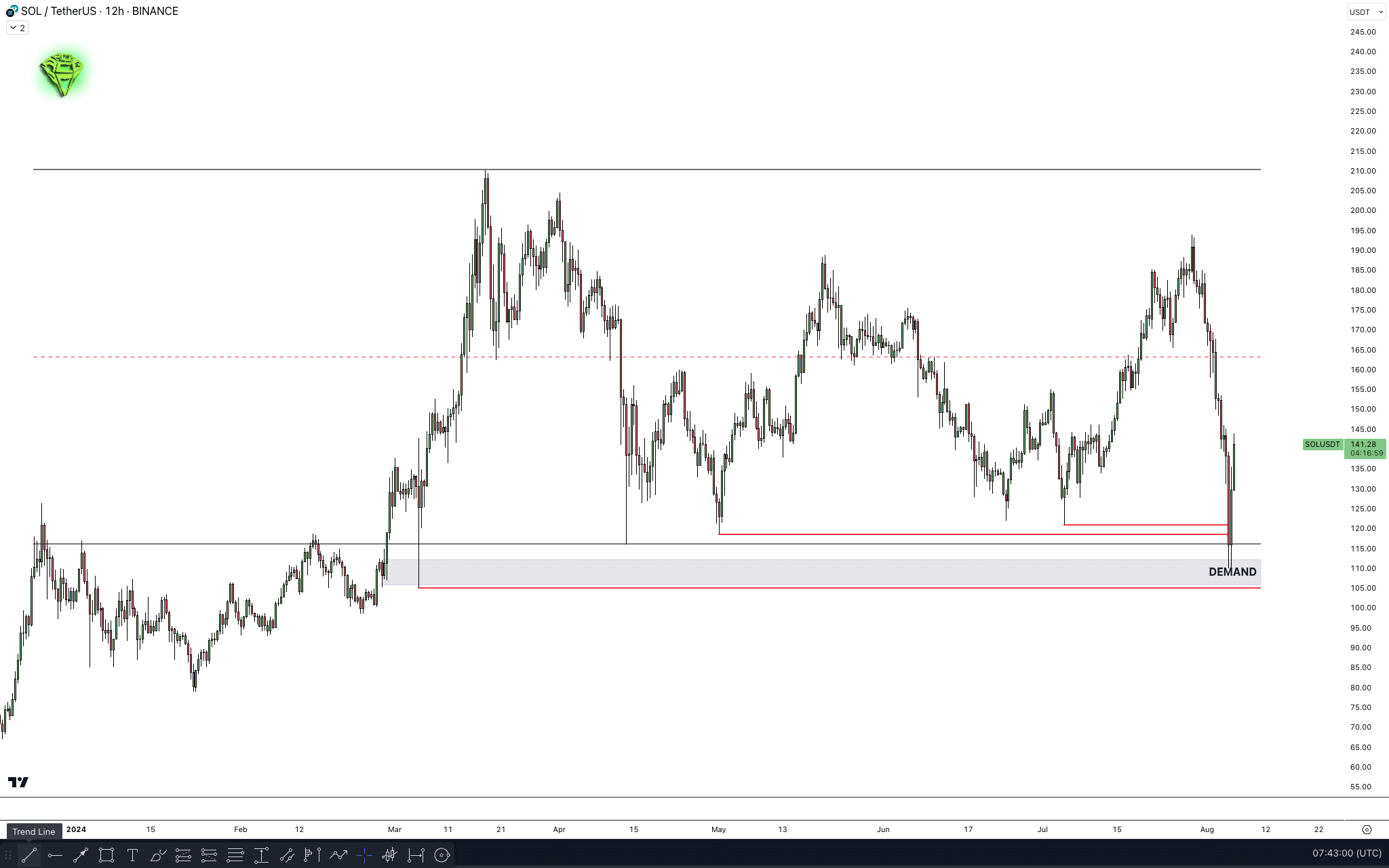

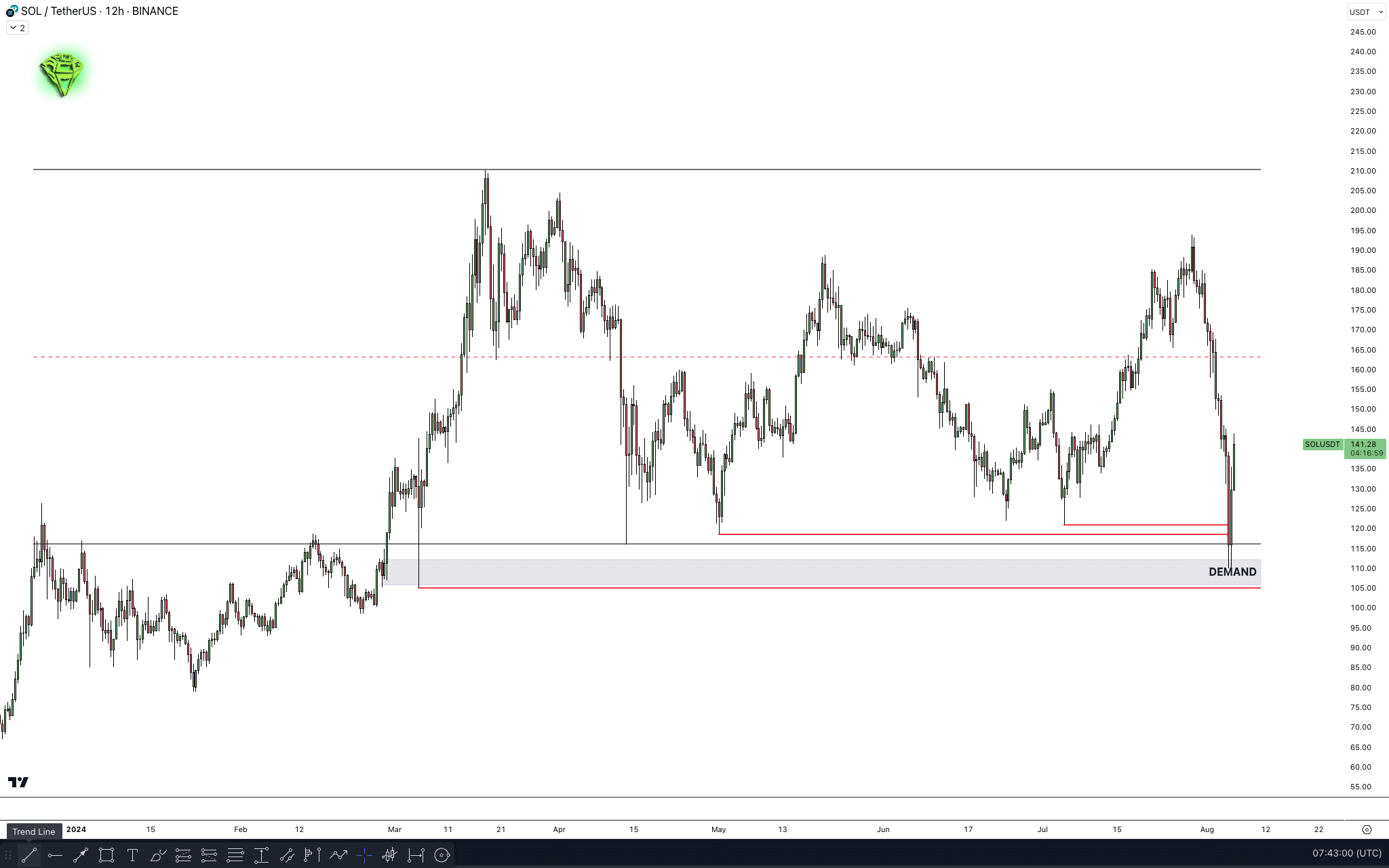

Solana rejected at $110 assist

The SOL chart is wanting promising. It examined the vital $110 assist and resistance degree after which bounced again inside the vary.

This motion touched a key demand degree and cleared many decrease costs. There’s no want to purchase instantly throughout a value surge, but when the value dips, Solana is an efficient choice to contemplate.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

DOGE assessments resistance-turned assist degree

Dogecoin is bouncing again from a key assist degree, making it choice for long-term positive factors regardless of the present market crash.

The worth has proven a robust restoration at this degree, and with the formation of a double backside, it signifies potential for vital returns within the coming months.

Supply: TradingView