- Exercise on the Bitcoin community gave the impression to be chargeable for a big a part of miners’ income

- General exercise and NFT curiosity additionally declined

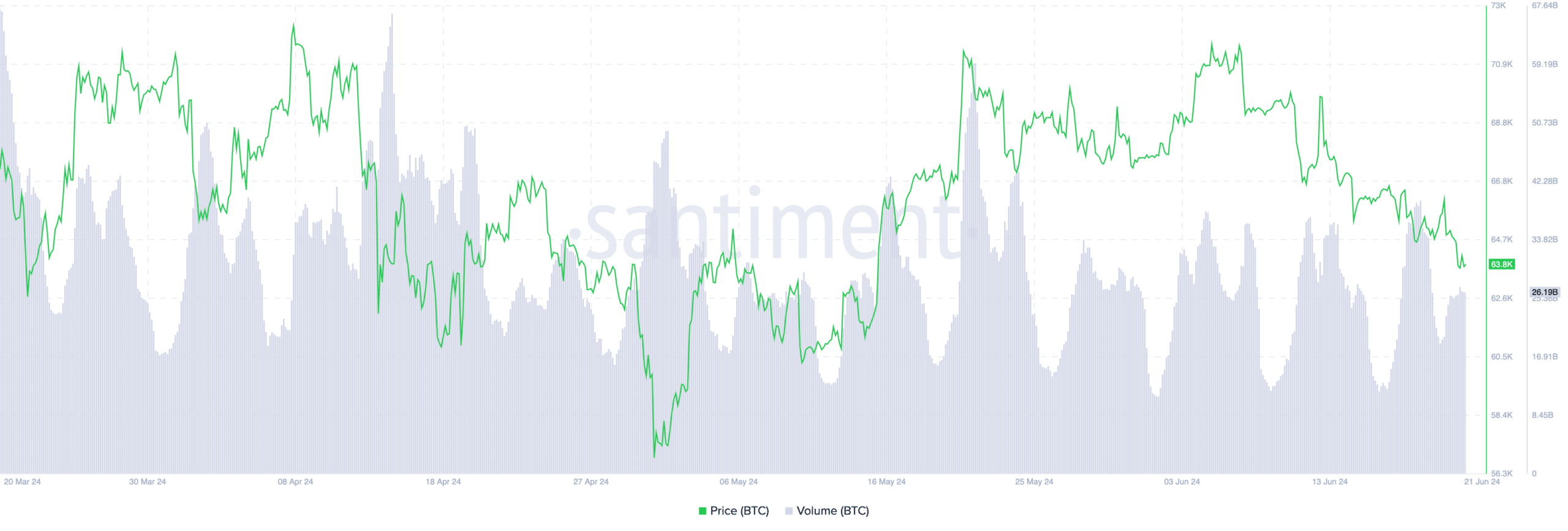

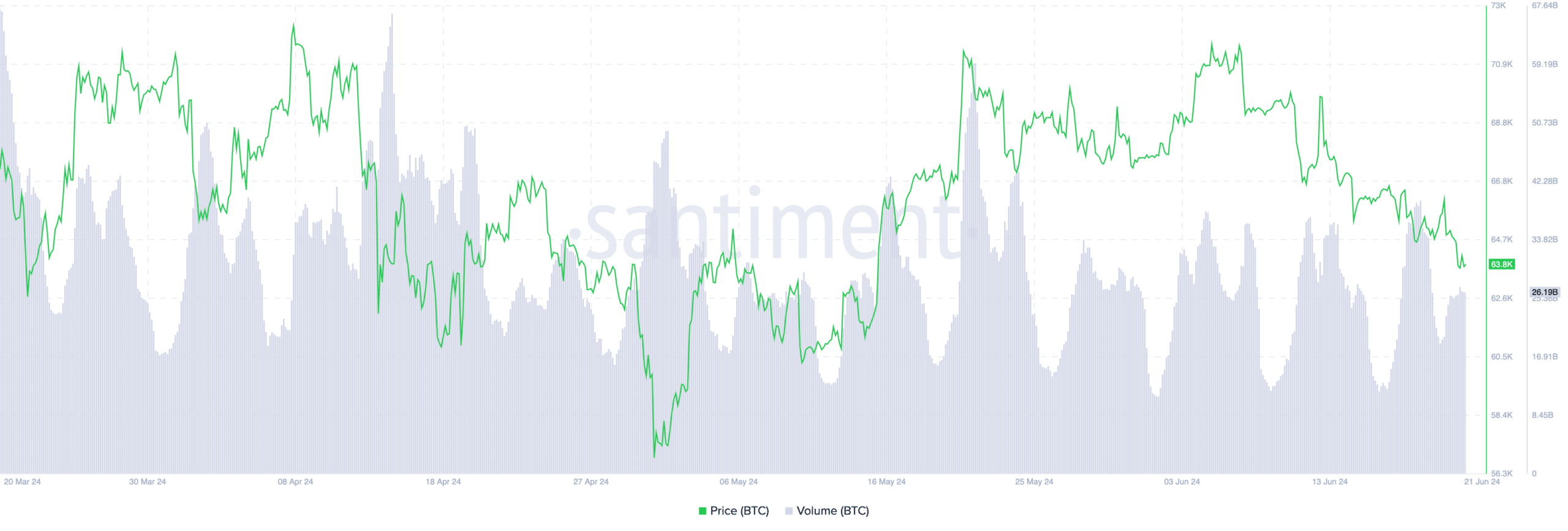

Ever since Bitcoin [BTC] slipped previous the $65,000-level, the general sentiment across the king coin has began to show unfavorable on the charts.

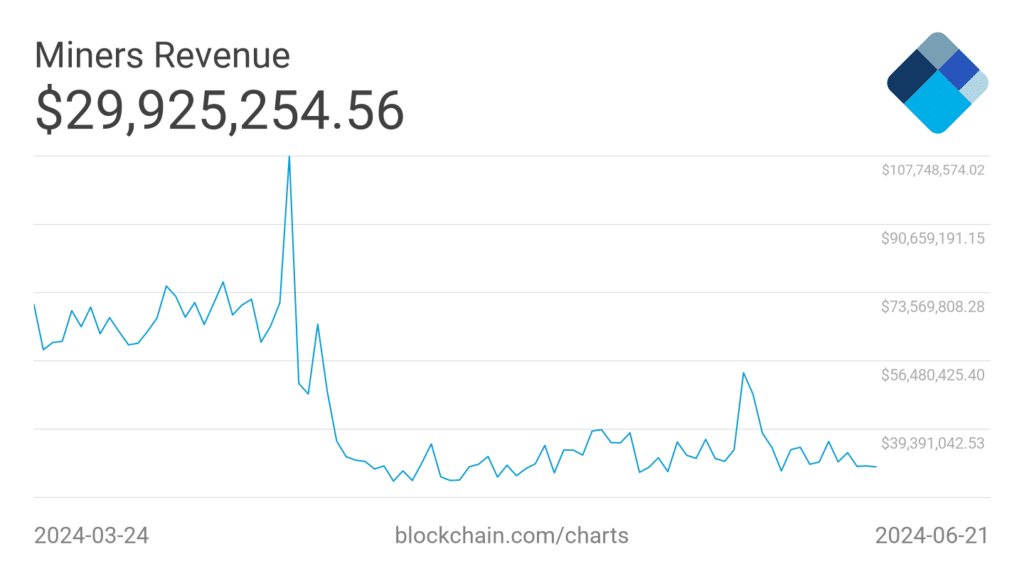

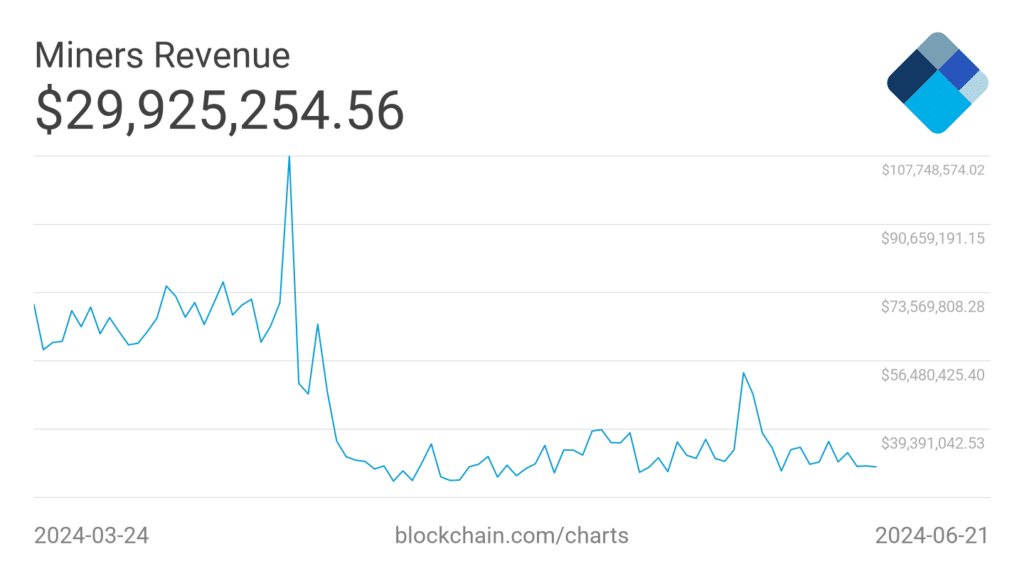

State of the miners

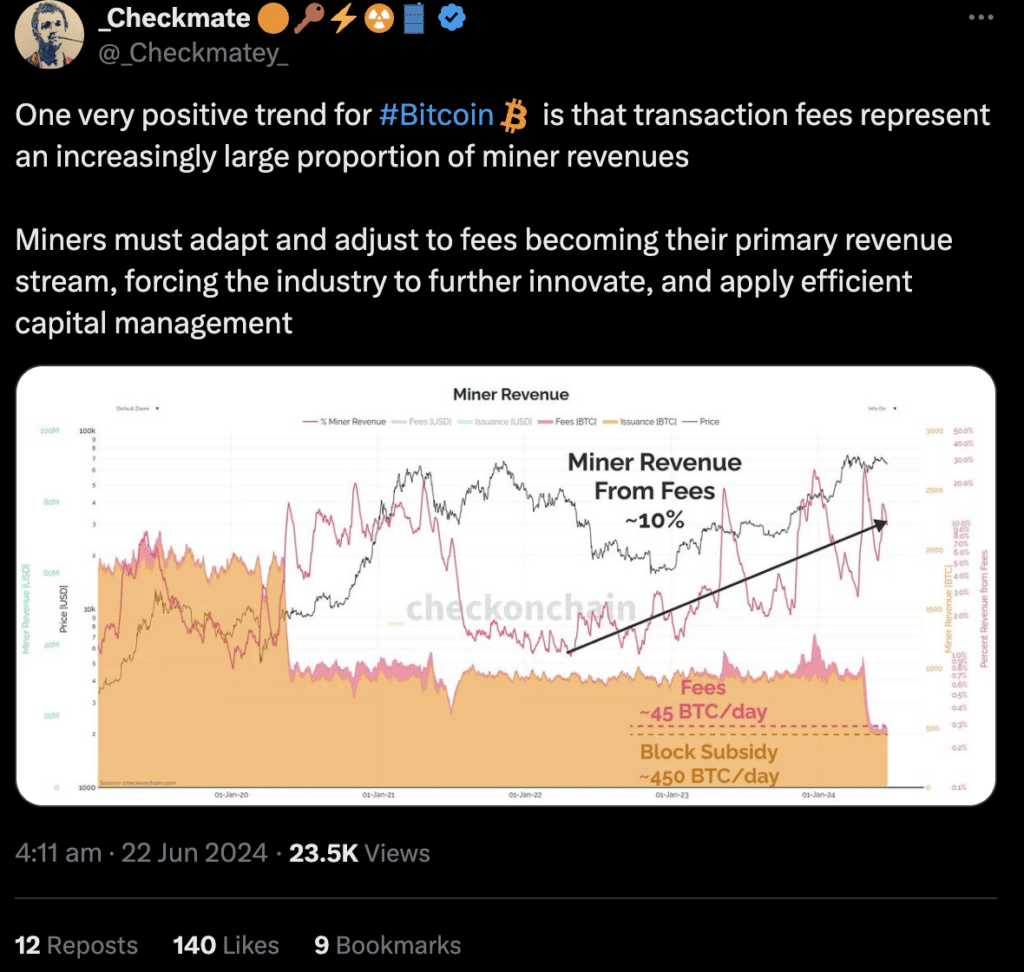

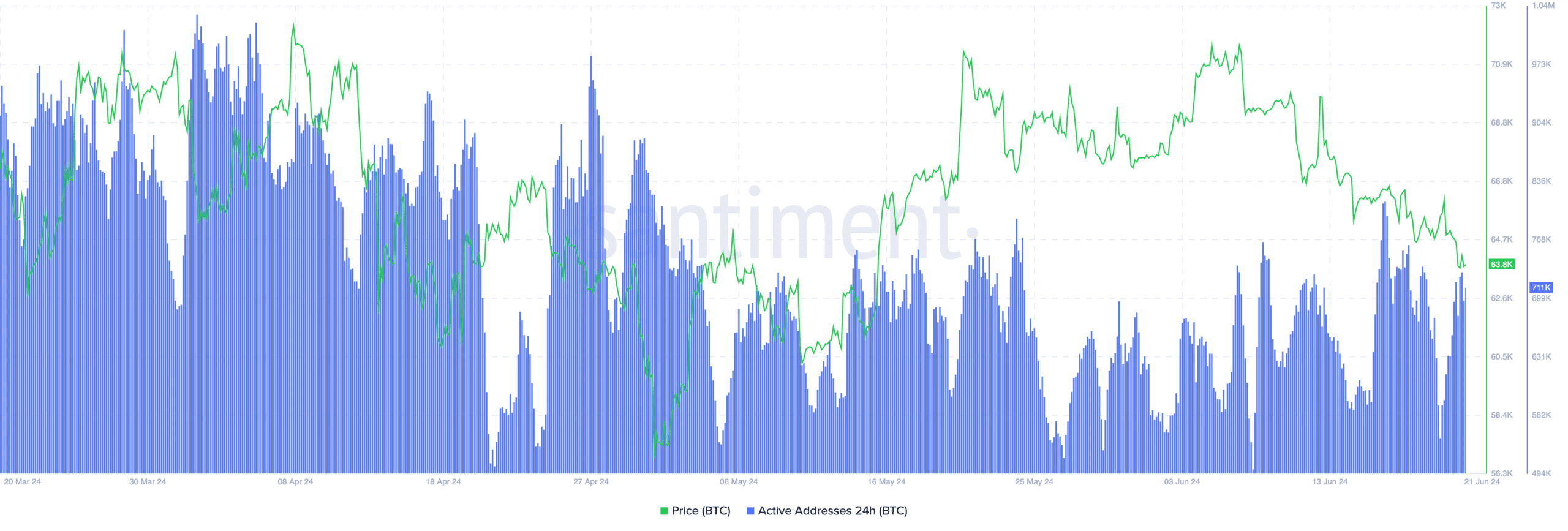

One optimistic pattern that has emerged is that transaction charges have gotten an more and more good portion of miner income. This pattern could be attributed to the restricted provide of Bitcoin being created because of the halving and the variety of transactions on the community rising because the starting of the 12 months. Consequently, miners are capturing extra worth from charges to course of transactions.

This shift in income stream will necessitate miners adapting to the altering ecosystem. They might want to regulate charges changing into their main supply of earnings, forcing the trade to additional innovate and apply environment friendly capital administration methods.

With a purpose to stay worthwhile, miners will seemingly search for methods to optimize their operations and scale back prices.

Supply: X

A serious decline in exercise

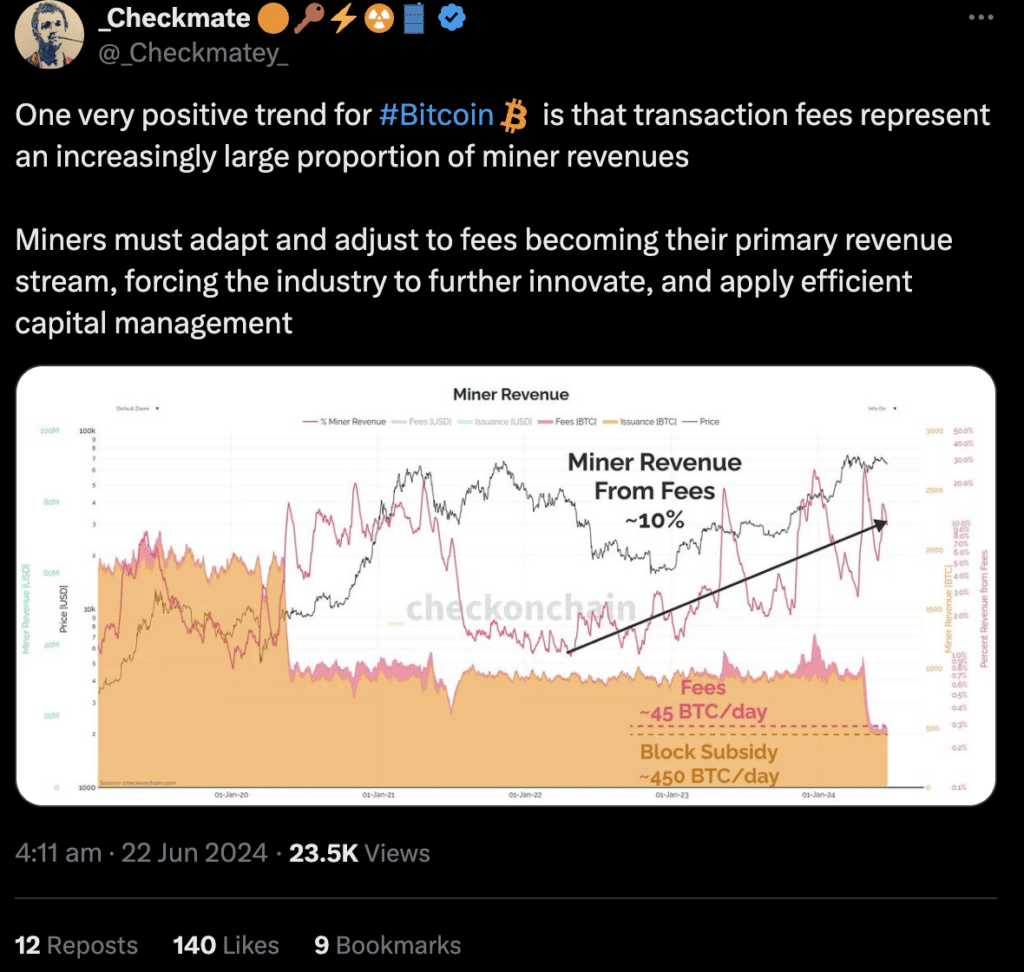

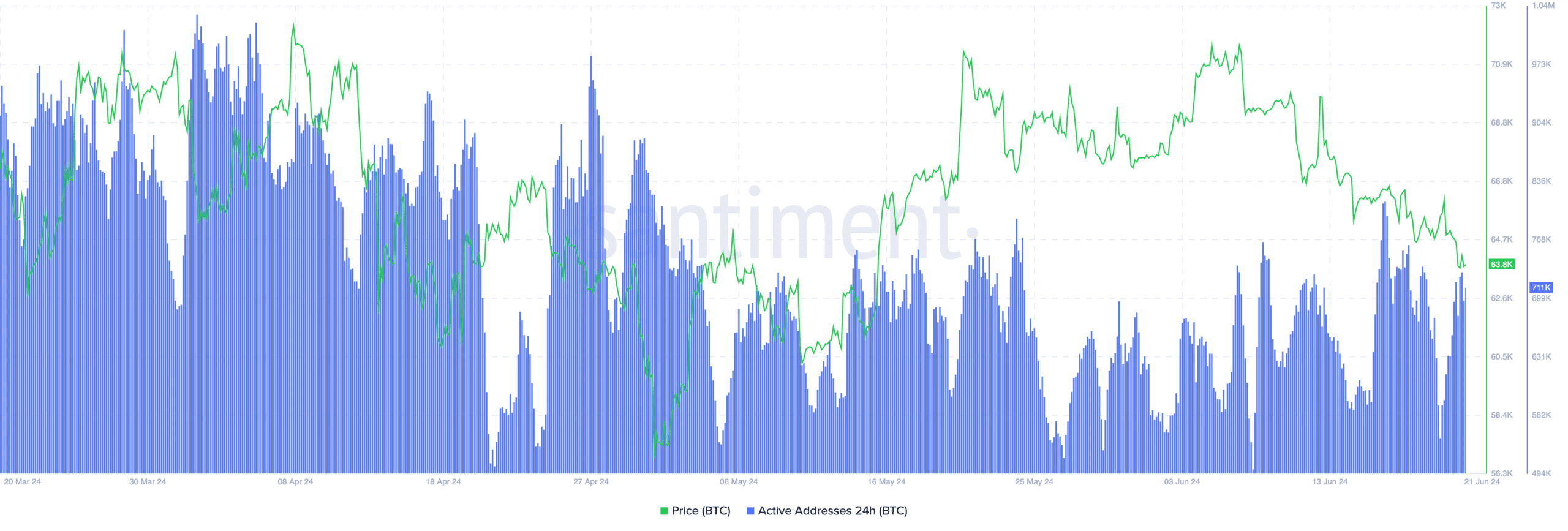

Nonetheless, this over-dependence on exercise on the Bitcoin community could be problematic for the miners as effectively. For instance, AMBCrypto’s evaluation of Santiment’s knowledge revealed that the each day lively addresses on the Bitcoin community declined materially over the previous few months.

If exercise on the community continues to fall, so will the flexibility of miners to generate income.

Supply: Santiment

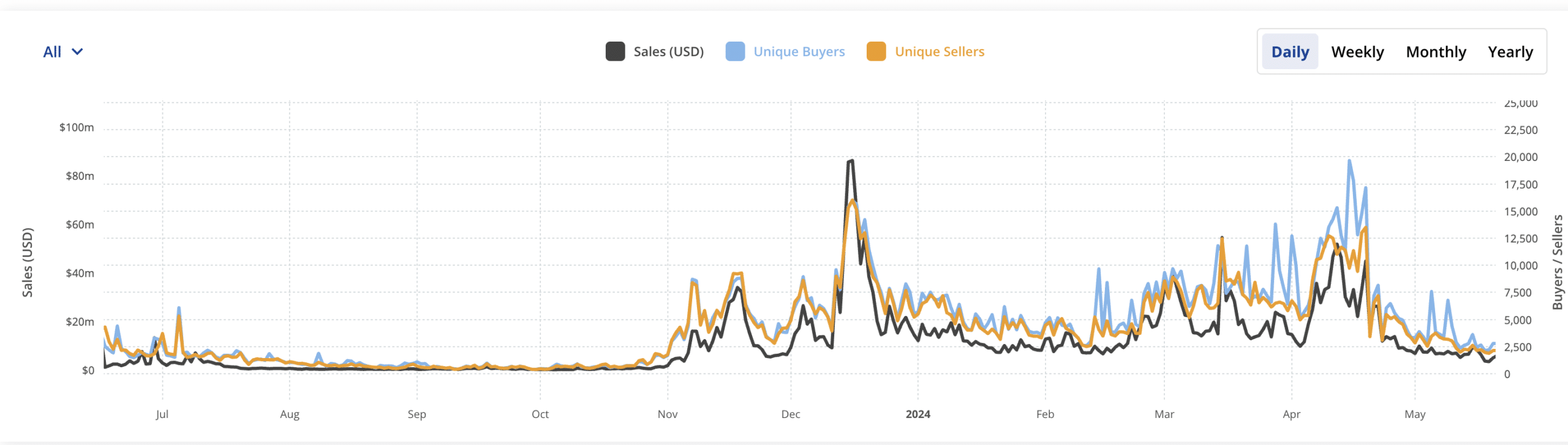

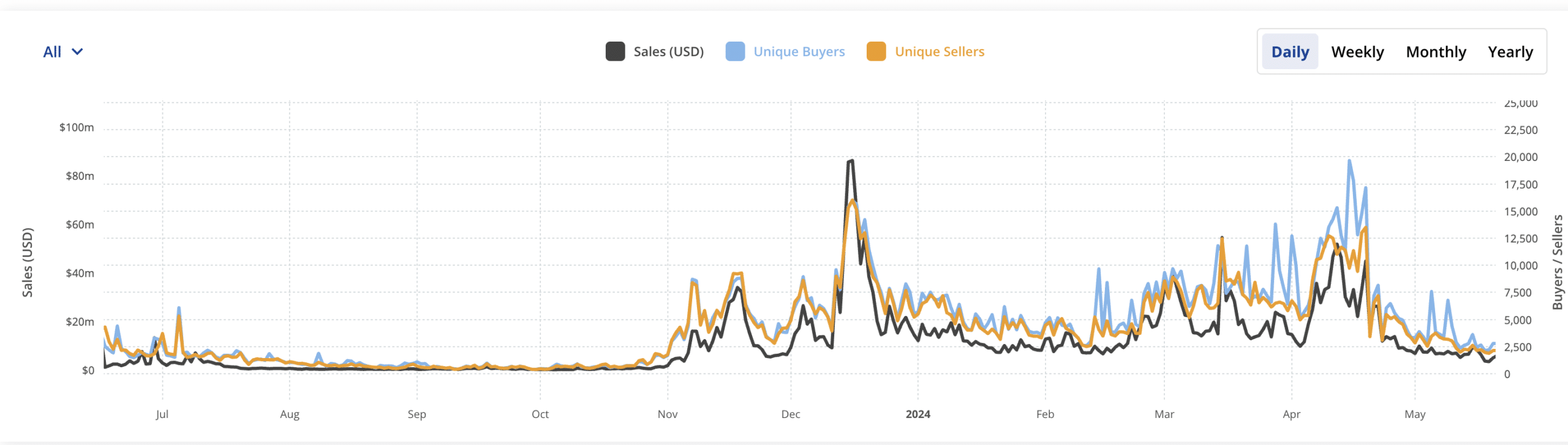

Furthermore, the NFT volumes on the Bitcoin community fell materially too.

Only in the near past, the Bitcoin community misplaced its prime spot when it comes to NFT gross sales to Ethereum. On the time of writing, Bitcoin stood third on the NFT gross sales entrance, with Polygon overtaking Bitcoin on the rankings too.

Supply: Crypto SlamDue to the declining curiosity in Bitcoin’s ecosystem, the miners is perhaps affected negatively. Over the previous few weeks, the each day miner income fell from $50 million to $30 million. If the income generated by these miners continues to say no, these miners will likely be pressured to promote their BTC holdings to stay worthwhile.

As a consequence of this, extreme promoting strain on BTC may pull the crypto’s value decrease on the charts.

Supply: Blockchain.com

Learn Bitcoin’s [BTC] Value Prediction 2024-25

On the time of writing, BTC was buying and selling at $64,262.42, with no main positive factors seen within the final 24 hours. This corresponded with a 19% fall within the crypto’s quantity over the aforementioned interval too.

Supply: Santiment