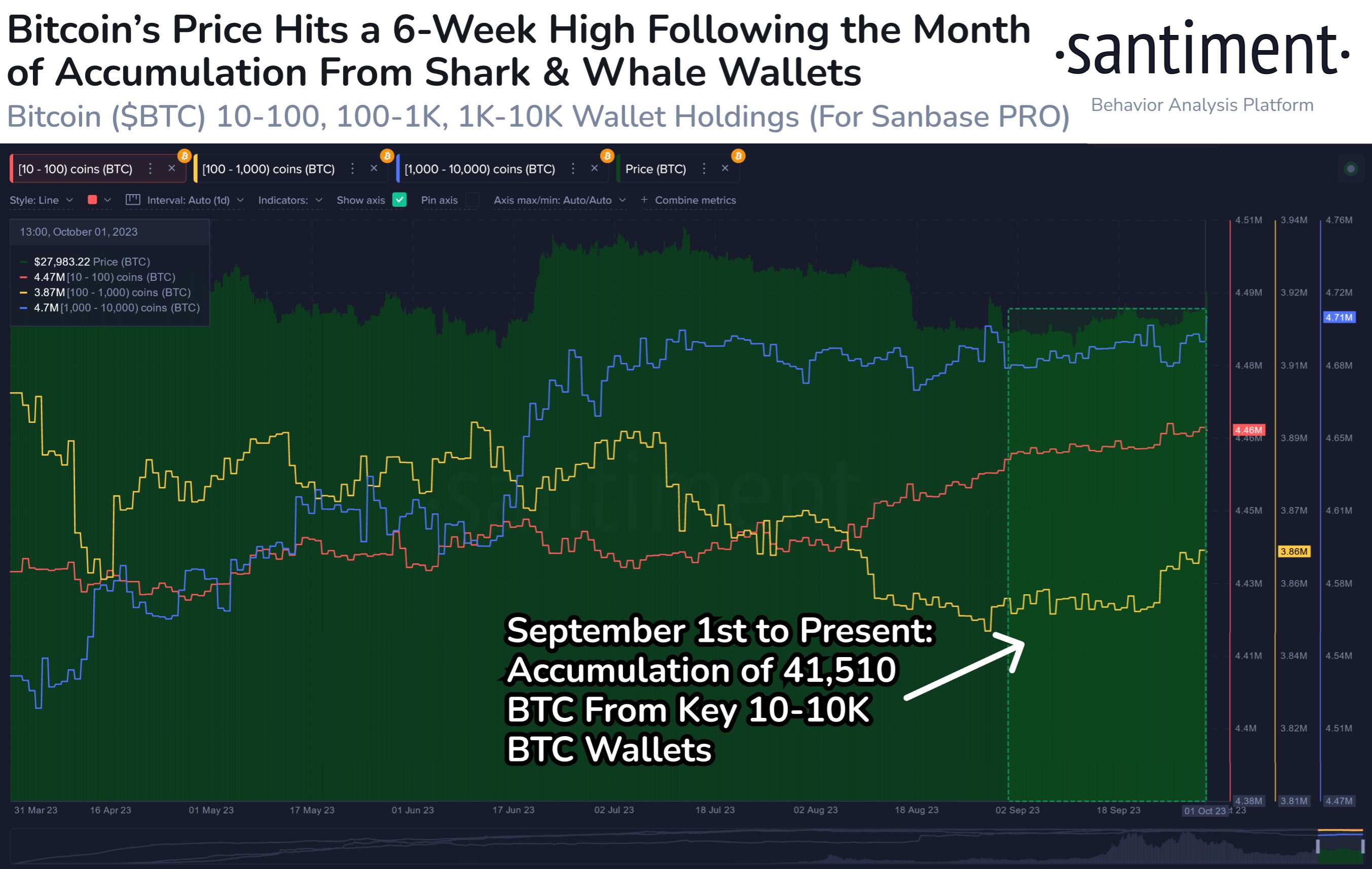

Massive Bitcoin (BTC) holders have been snapping up the highest crypto asset because the starting of September, in accordance with the crypto analytics agency Santiment.

Santiment notes that Bitcoin sharks and whales, or entities holding between 10-10,000 BTC, have amassed a mixed $1.17 billion since September 1st.

The agency says that the buildup sample makes it extra doubtless that BTC will witness a return to the $30,000 value degree, until these holders begin dumping their Bitcoin holdings.

Bitcoin is buying and selling at $27,853 at time of writing and is up practically 3% previously 24 hours. The highest-ranked crypto asset by market cap briefly surged above $28,000 on Monday, the primary time it has jumped above that value level since August.

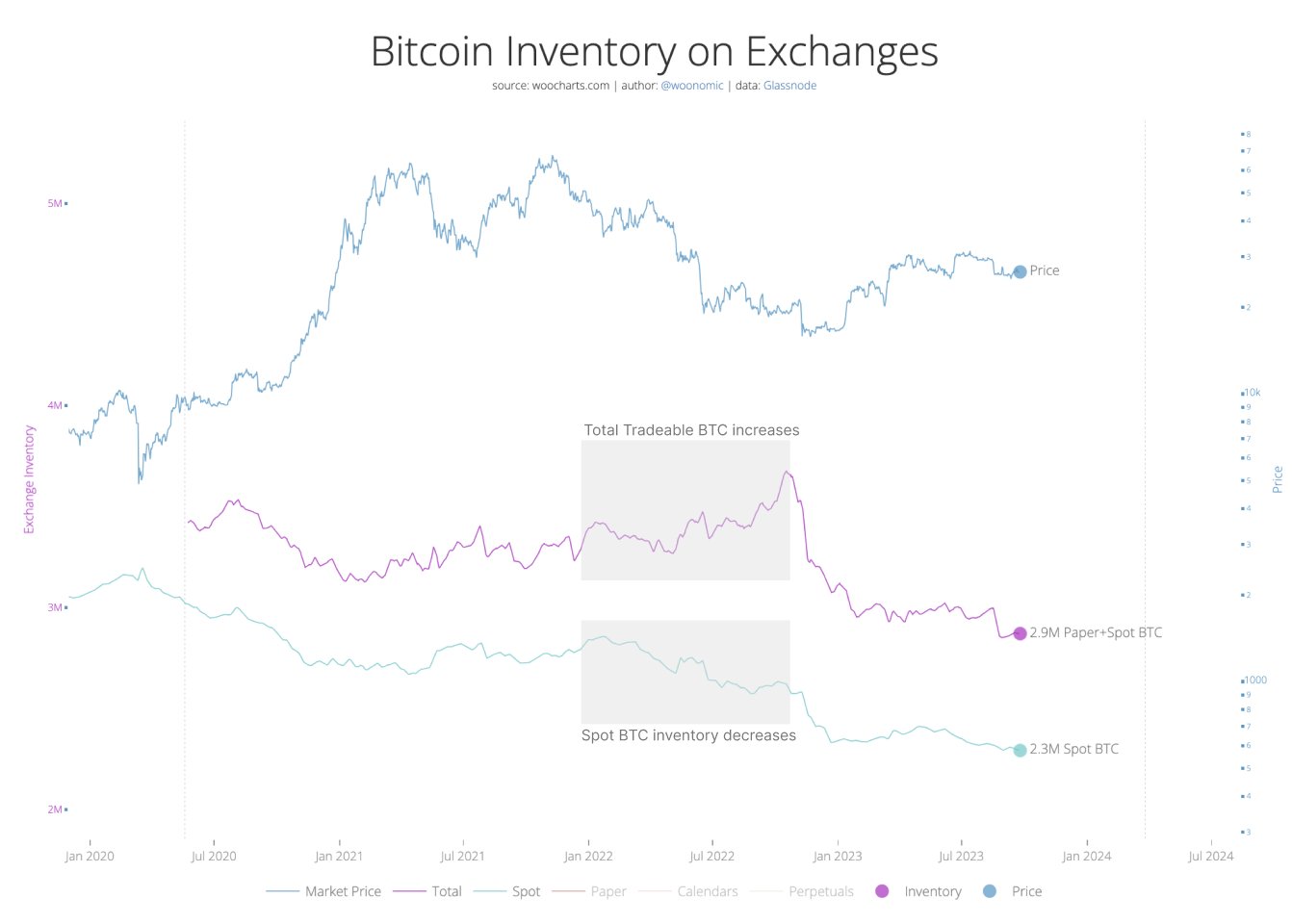

Not everybody agrees with Santiment’s evaluation, nonetheless. Common Bitcoin analyst Willy Woo not too long ago told his a million followers on the social media platform X that purchasing up the stock of BTC on exchanges received’t really assist increase the asset’s value.

“This can be a fallacy. This occurred all by the 2022 bear. There’s no provide shock as a result of artificial BTC through futures markets added to stock. The market made a backside when futures markets relented.

If an investor desires to purchase publicity to BTC, they’ll now purchase a futures ETF (exchange-traded fund). This doesn’t create a provide shock as these are simply paper bets on value going up, a hedge fund can take the opposite aspect of the wager, you’ve minted a brand new artificial BTC. And the restrict on that is infinite.”

In keeping with Woo, the approval of a spot-based Bitcoin ETF will assist “rectify this problem.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney