- Sentiment throughout social media platforms for Bitcoin declined considerably over the previous few days.

- ETF inflows for BTC surged regardless of the detrimental sentiment.

Bitcoin’s [BTC] latest decline in worth has impacted a number of cryptocurrencies throughout the board, as the general market outlook has turned detrimental.

Sentiment will get bearish

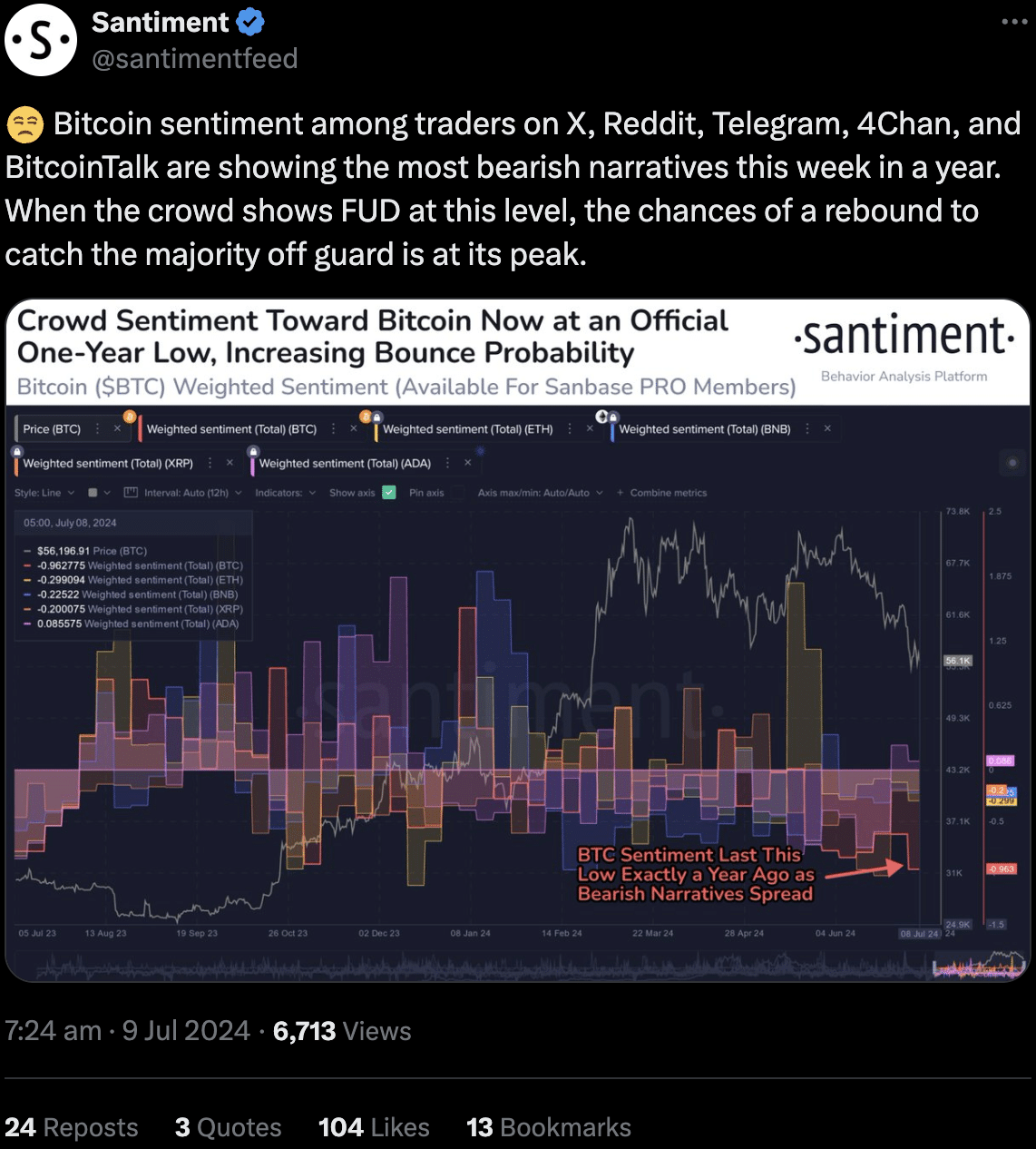

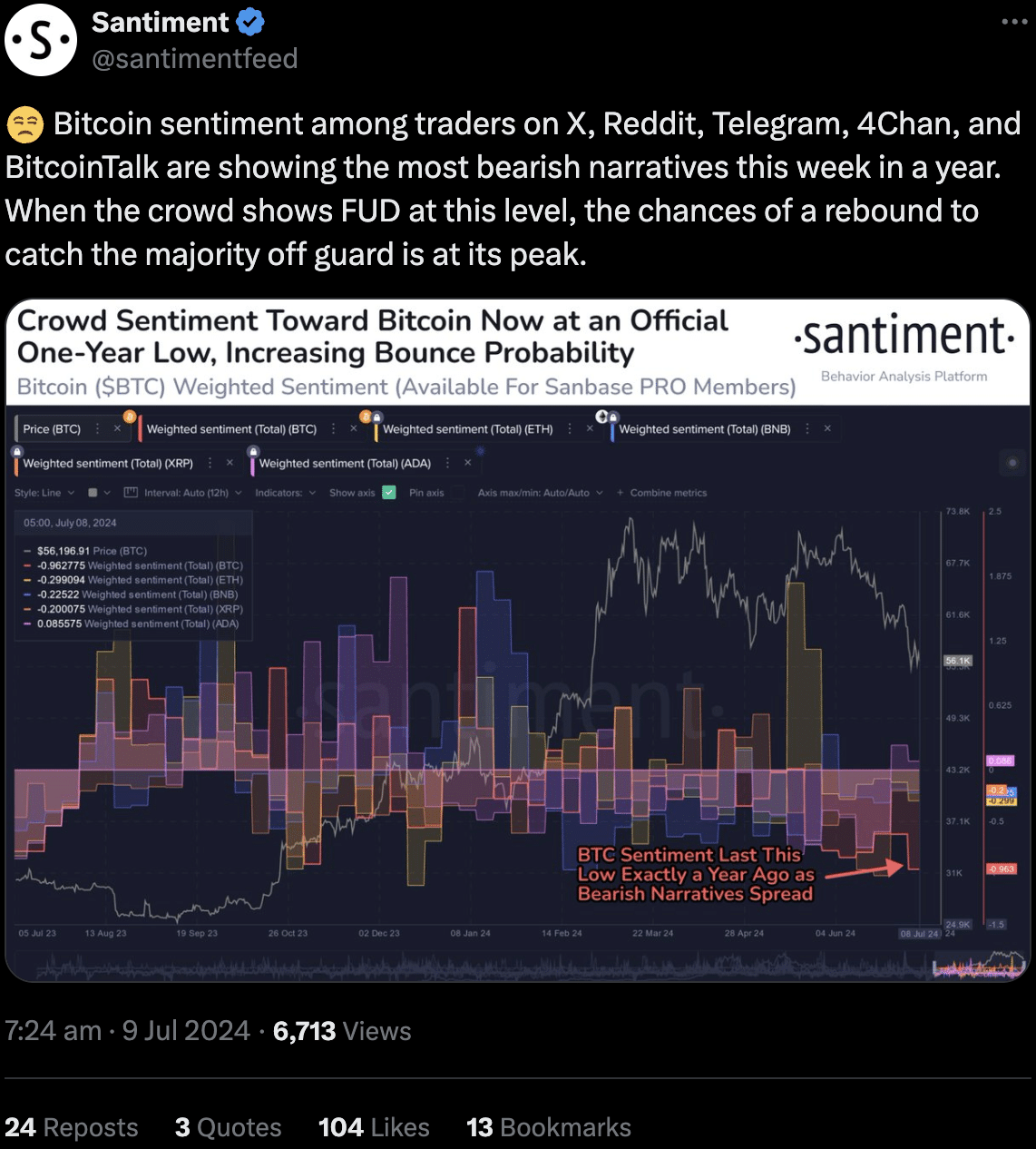

In response to Santiment’s information, this week, Bitcoin sentiment throughout social media platforms like X (previously Twitter), Reddit, Telegram, 4Chan, and BitcoinTalk has plunged to its most bearish level in a yr.

Merchants had been expressing excessive concern, uncertainty, and doubt (FUD) at an unprecedented stage. This negativity might really sign a shopping for alternative.

Traditionally, when the gang will get this bearish, it could possibly create an opportunity for a pointy rebound that catches the bulk off guard.

So, whereas the FUD could be deafening, it may be an indication {that a} worth swing is on the horizon.

Supply: X

Inflows on the rise

Bitcoin spot ETFs witnessed their highest each day web influx in over three weeks on the eighth of July. The full influx reached $295 million, indicating sturdy investor urge for food for Bitcoin regardless of the latest worth stoop.

This constructive sentiment got here even because the German authorities bought a record-breaking quantity of BTCs yesterday, amounting to $915.3 million.

Breaking down the ETF inflows, Grayscale’s GBTC attracted $25.08 million, whereas BlackRock’s IBIT noticed a considerably bigger influx of $187 million. Constancy’s FBTC additionally recorded a wholesome influx of $61.54 million.

These figures recommend that traders are more and more turning to identify ETFs as a handy and controlled solution to acquire publicity to Bitcoin.

The $295 million web influx represents new capital getting into the Bitcoin market via ETFs. This elevated demand might push the worth of BTC upwards, particularly if it’s sustained over time.

It additionally signifies that regardless of declining sentiment throughout social media, establishments and fiat traders are bullish about BTC’s future.

Supply: SoSoValue

How are holders doing?

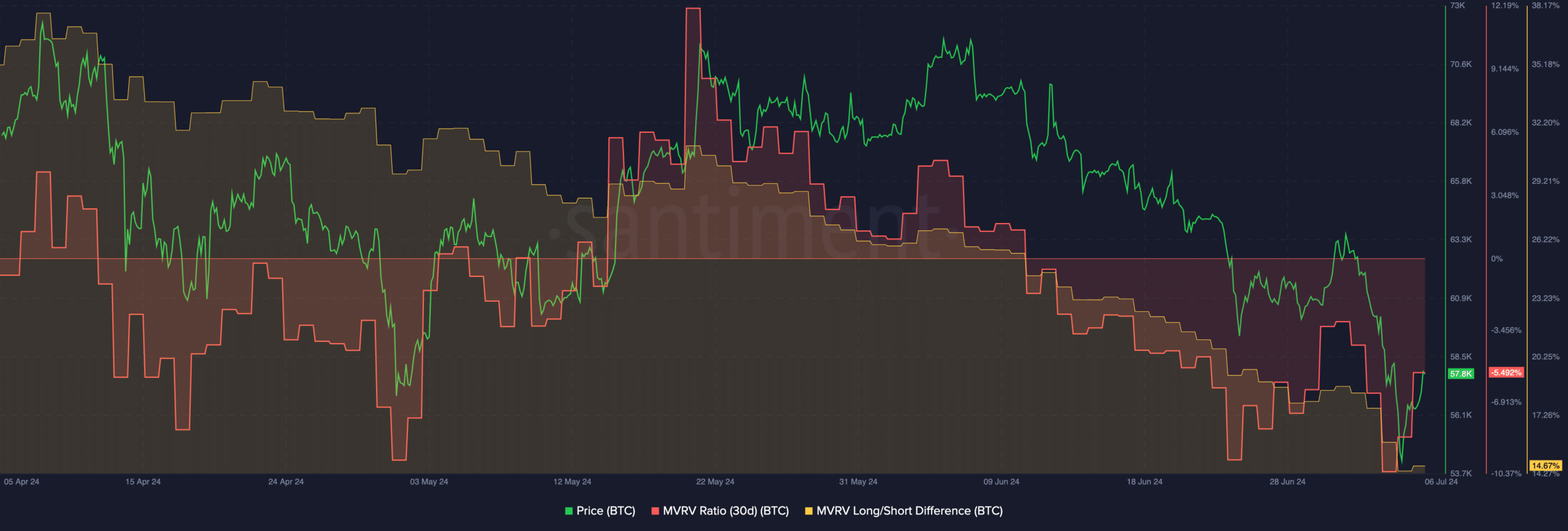

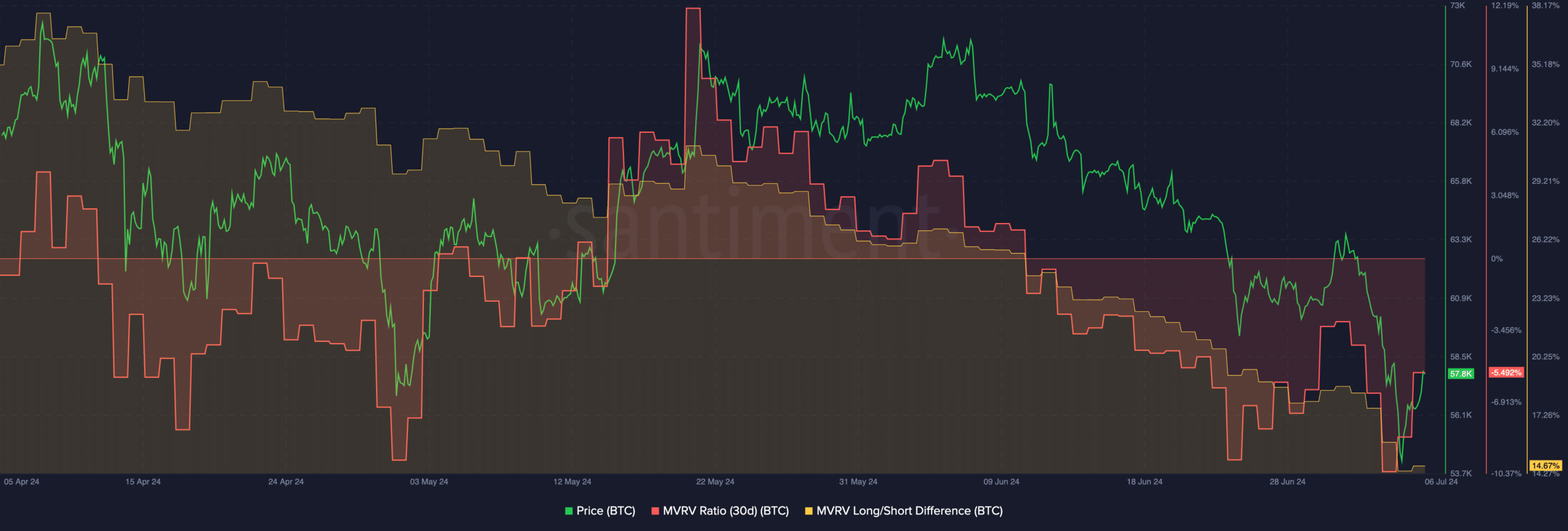

At press time, BTC was buying and selling at $57,404.26. Within the final 24 hours, the worth of BTC grew by 3.87%. Additionally, the MVRV ratio for BTC fell considerably in the previous few days regardless of the latest surge in worth.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

This indicated that the profitability of the addresses had declined, and most addresses wouldn’t revenue in the event that they bought their holdings.

Though this could impression sentiment negatively, it additionally provides much less of an incentive for BTC addresses to promote their holdings, which leads to lowered promoting strain on the community.

Supply: Santiment