Abstract:

- The rely of recent addresses buying and selling BTC has rallied.

- This leap has occurred regardless of the robust resistance confronted at $30,000.

- As BTC’s value continues to commerce sideways, many holders have taken to coin distribution.

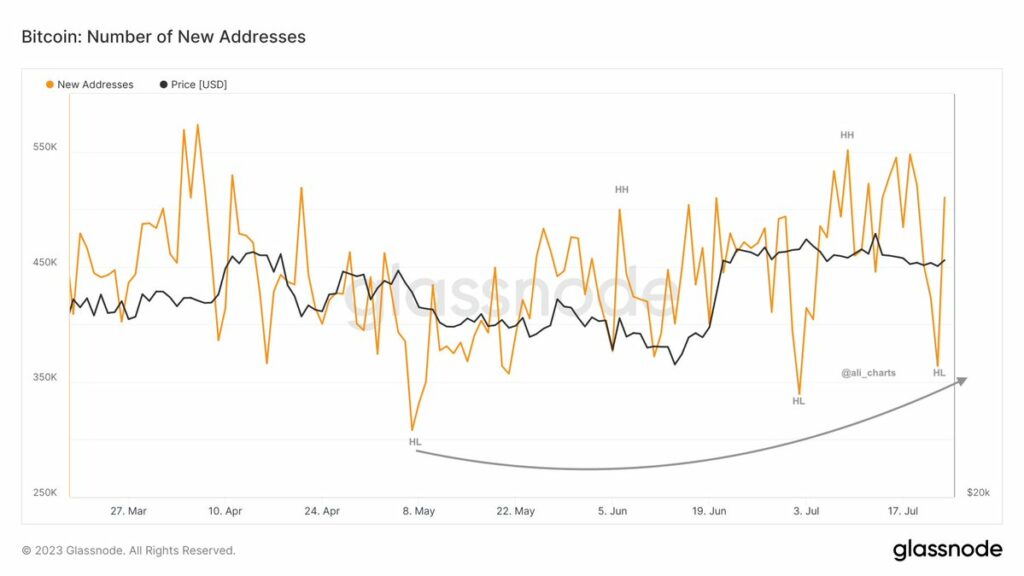

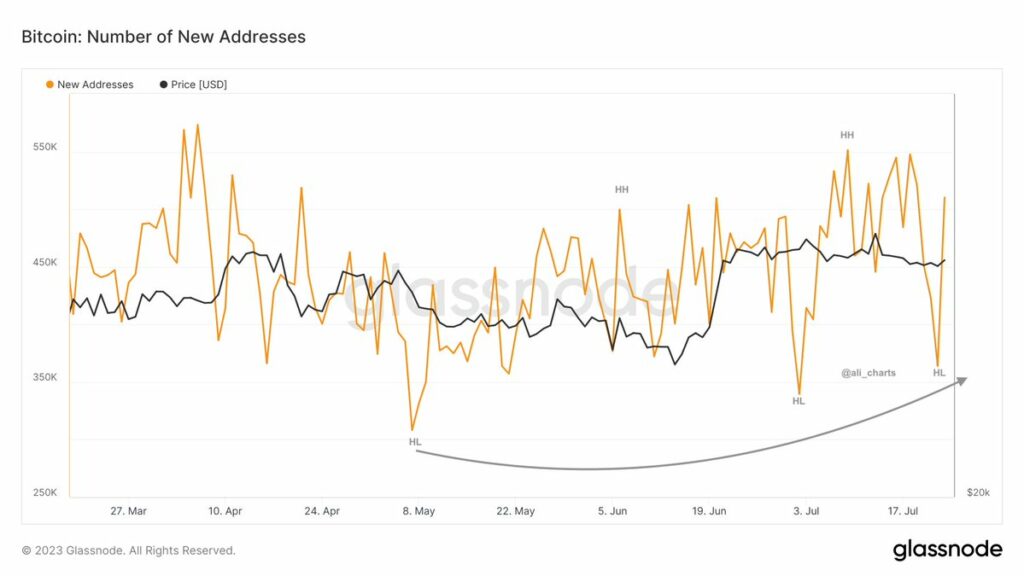

New demand for main coin Bitcoin [BTC], continues to climb regardless of its sideways value motion inside the $28,000 and $30,000 areas since April, knowledge from Glassnode revealed.

An evaluation of the coin’s day by day new addresses rely on a 30-day shifting common revealed an uptick since 22 Might. Since then, the day by day rely of recent addresses that accomplished BTC transactions has grown by 19%. In line with knowledge from Glassnode, as of 25 July, over 450,000 new addresses accomplished at the least one transaction that concerned BTC.

BTC accumulation dwindles because the coin struggles to interrupt resistance

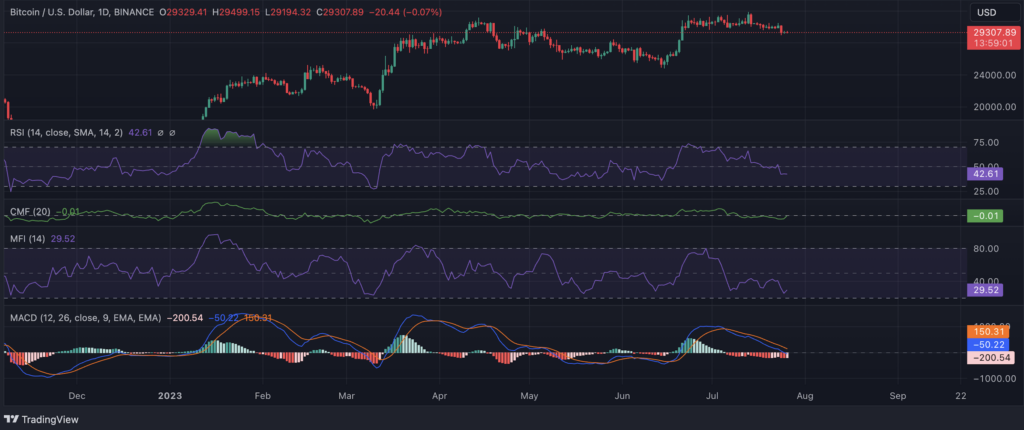

At press time, BTC exchanged arms at $29,212. With robust resistance confronted on the $30,000 value degree, detrimental sentiments have returned to the day by day market.

As detrimental sentiments ravage the market, accumulation amongst day merchants has plummeted. In line with value actions gleaned on a D1 chart, key momentum indicators launched into a downtrend on the time of writing.

The coin’s Relative Power Index rested under its impartial line at 42.61. BTC’s Cash Stream Index (MFI) was 29.39 deep within the oversold territory.

Additional, BTC’s On-balance quantity (OBV) has trended downward since June finish. At press time, this was 102.15 million.

When BTC’s OBV declines, it implies that the quantity of property being offered outweighs the quantity of property being purchased. It typically alerts a big shift in sentiment from constructive to detrimental, the place extra merchants consider promoting the king coin is safer than shopping for it.

Moreso, BTC’s Chaikin Cash Stream (CMF) was under the middle zero line on the time of writing. A CMF within the detrimental territory suggests elevated liquidity exit from the market. When the BTC CMF is detrimental, the promoting strain dominates the market over the desired interval.

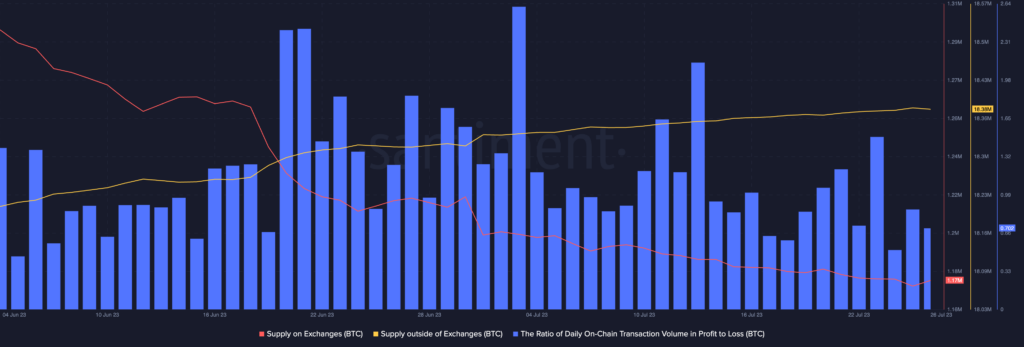

With many not sure of the coin’s subsequent value route, its provide on exchanges climbed prior to now 24 hours. In line with data from on-chain knowledge supplier, Santiment, the BTC provide to cryptocurrency exchanges elevated by virtually 2% within the final 24 hours.

When the trade reserve of an asset will increase on this method, it suggests elevated sell-offs. This might be BTC merchants promoting off their coin holdings to hedge towards future losses. Nonetheless, whereas BTC gross sales rallied prior to now 24 hours, the ratio of transactions in losses exceeded these in revenue.