- Bitcoin noticed a slight restoration after the decline.

- Liquidation has tapered off after the value decline triggered a spike.

Bitcoin [BTC] skilled a major drop within the final buying and selling session, which resulted in a surge in liquidations. On account of this decline, merchants who bought Bitcoin previously 30 days at the moment are going through losses.

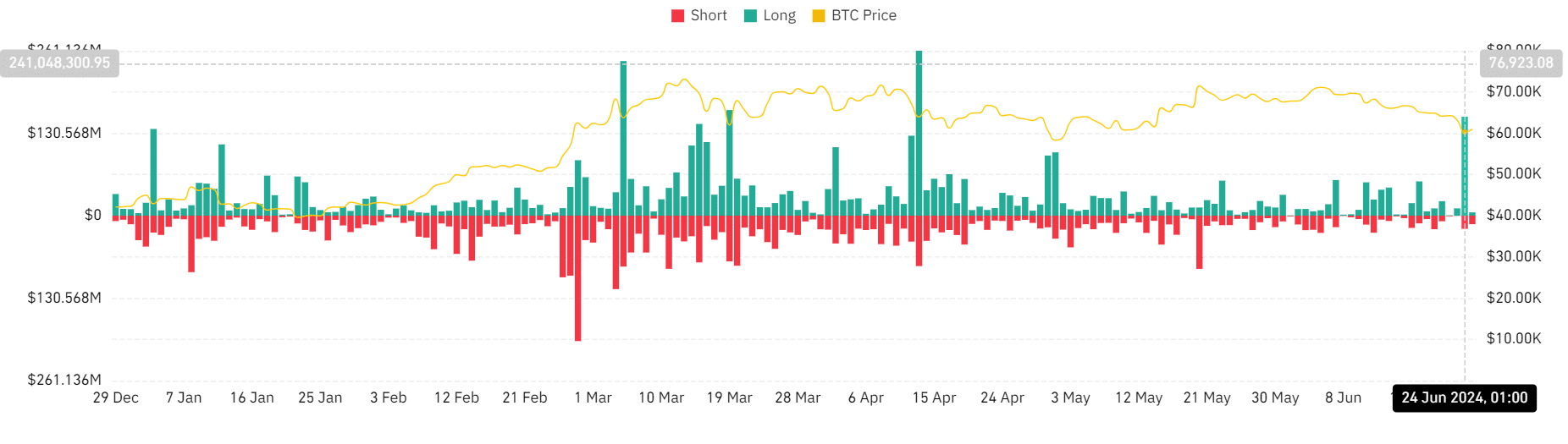

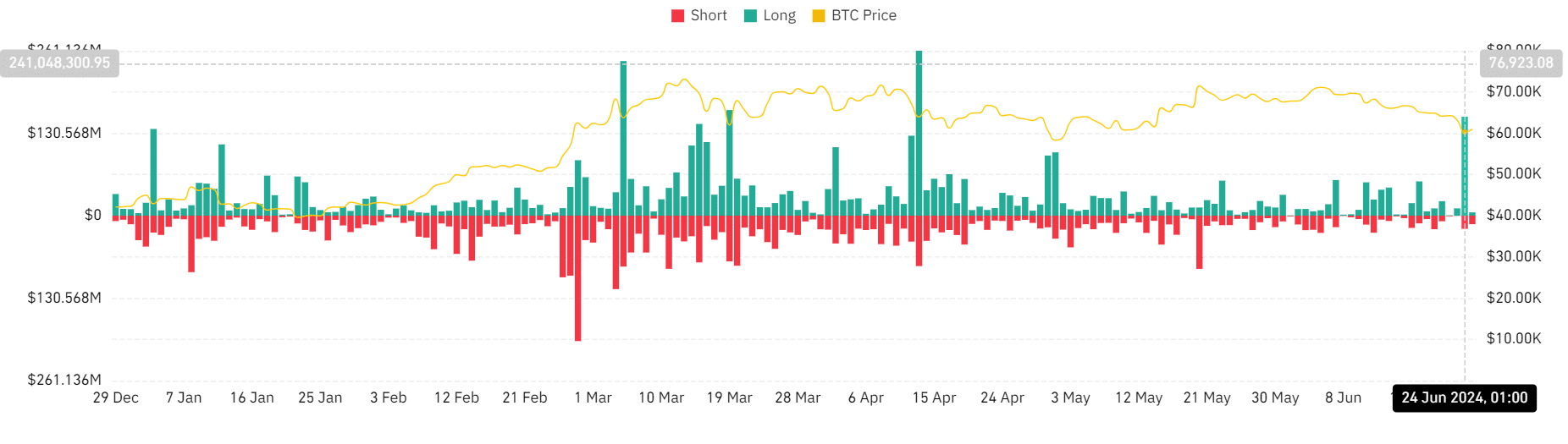

Bitcoin liquidations spike

AMBCrypto’s evaluation of Bitcoin’s liquidation chart on Coinglass revealed a major enhance in liquidation quantity on the twenty fourth of June. The spike was primarily triggered by a pointy drop in Bitcoin’s worth.

It resulted in substantial liquidations, particularly amongst lengthy positions, which accounted for over $156 million.

In distinction, brief positions noticed liquidations amounting to round $21 million, indicating that merchants who had wager on a worth enhance have been essentially the most affected.

Supply: Coinglass

As of this writing, though there had been a slight enhance in Bitcoin’s worth, brief positions have been experiencing extra liquidations.

The amount of brief liquidations was round $13.5 million, whereas lengthy liquidations have been decrease, at round $5.2 million.

This shift instructed that merchants who anticipated a continued worth decline have been now going through losses because of the worth rebound.

Bitcoin sees a slight enhance

AMBCrypto’s take a look at Bitcoin’s worth development revealed a notable drop on the twenty fourth of June, with its worth plunging to a low of $58,414 in the course of the buying and selling session.

By the session’s shut, it had partially recovered to round $60,263 but nonetheless recorded a 4.60% decline from its opening worth. This drop triggered vital liquidations out there.

Supply: Buying and selling View

As of this writing, its worth had risen to roughly $61,300, reflecting a rise of round 1.70%. Through the decline, the Relative Power Index (RSI) for Bitcoin fell beneath 30, signaling a powerful bearish development.

Though the RSI has barely recovered above this important threshold, it instructed that whereas there was a minor enchancment, BTC nonetheless predominantly exhibited sturdy bearish momentum.

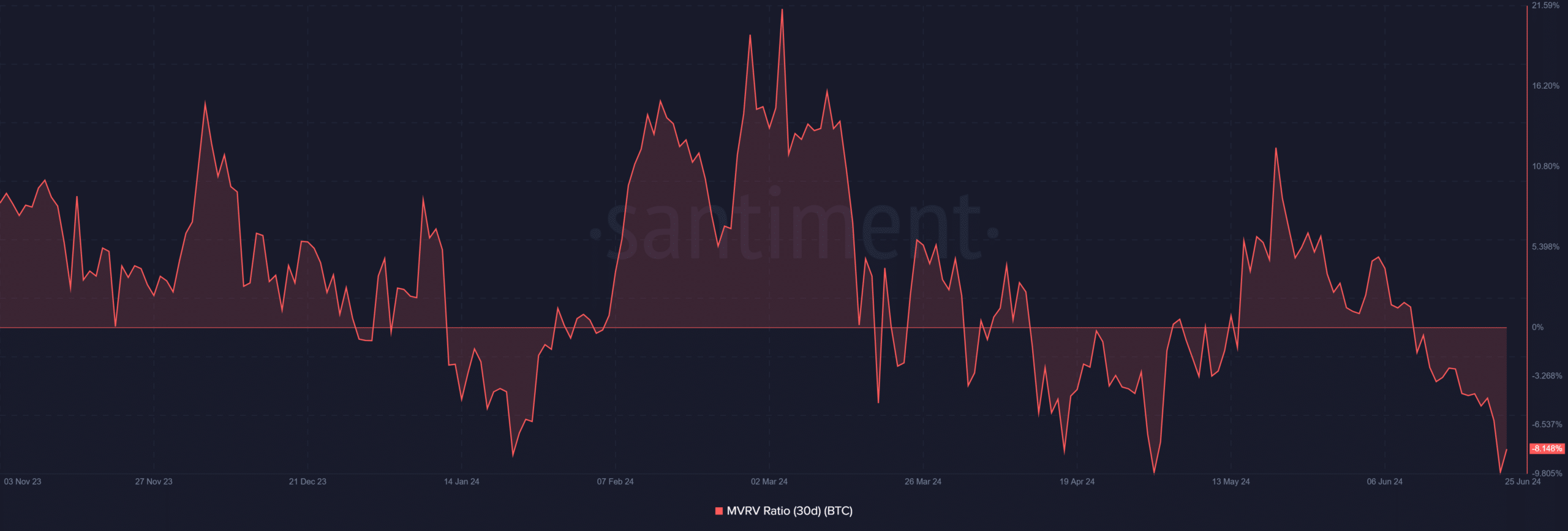

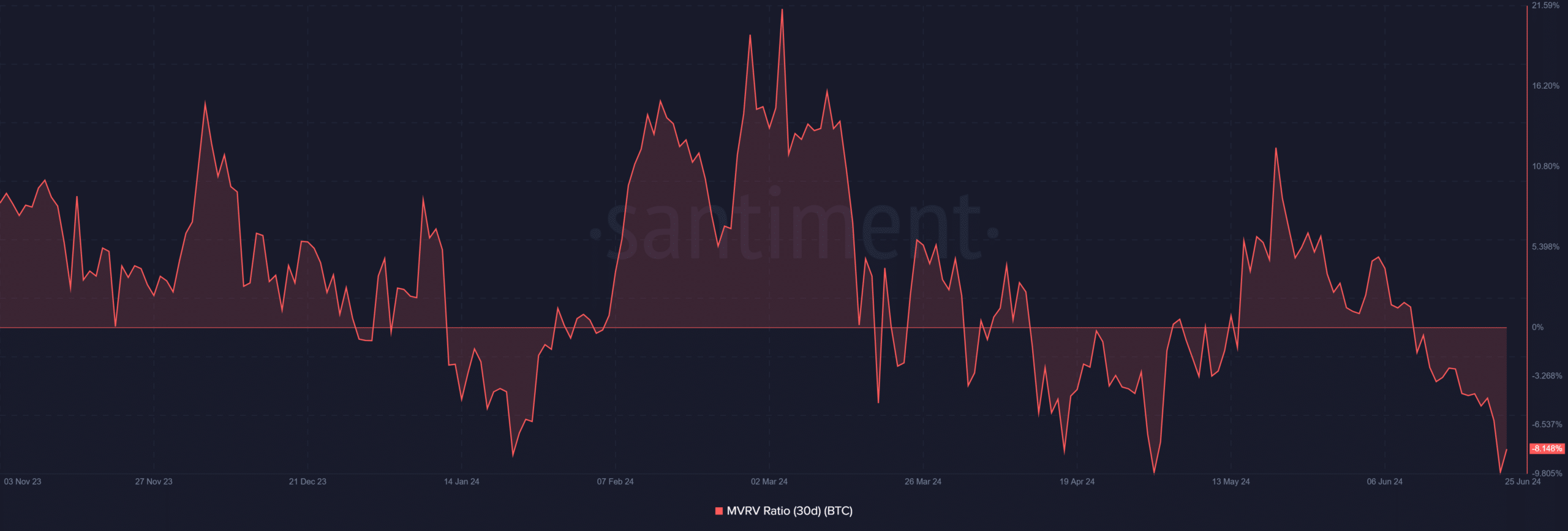

BTC holders at a loss

The evaluation of Bitcoin’s 30-day Market Worth to Realized Worth (MVRV) ratio, as reported on Santiment, revealed a regarding development of decline.

This ratio, which compares the market worth of an asset to its realized worth, dipped beneath zero across the tenth of June.

The dip indicated that the typical market individuals have been holding Bitcoin at a price decrease than their buying worth.

The current worth drop exacerbated this case, with the MVRV ratio plummeting to roughly -9.7% on the twenty fourth of June.

Supply: Santiment

As of this writing, there had been a slight restoration within the MVRV ratio to round -8.14%, but it remained damaging.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This ongoing damaging worth instructed that merchants who acquired Bitcoin over the previous 30 days have been nonetheless going through losses on their investments.

A damaging MVRV ratio is commonly seen as an indicator that the asset is undervalued and that present holders have purchased at increased costs than the present market is keen to pay, sustaining a bearish sentiment out there.