- Extra BTC has left the exchanges in the previous couple of days.

- BTC was nonetheless buying and selling under the $60,000 worth vary.

Bitcoin [BTC] has skilled a major decline for the reason that starting of the month. Curiously, regardless of this downturn, there was a notable withdrawal from exchanges. That is stunning given the substantial quantity of Bitcoin reportedly offered off lately.

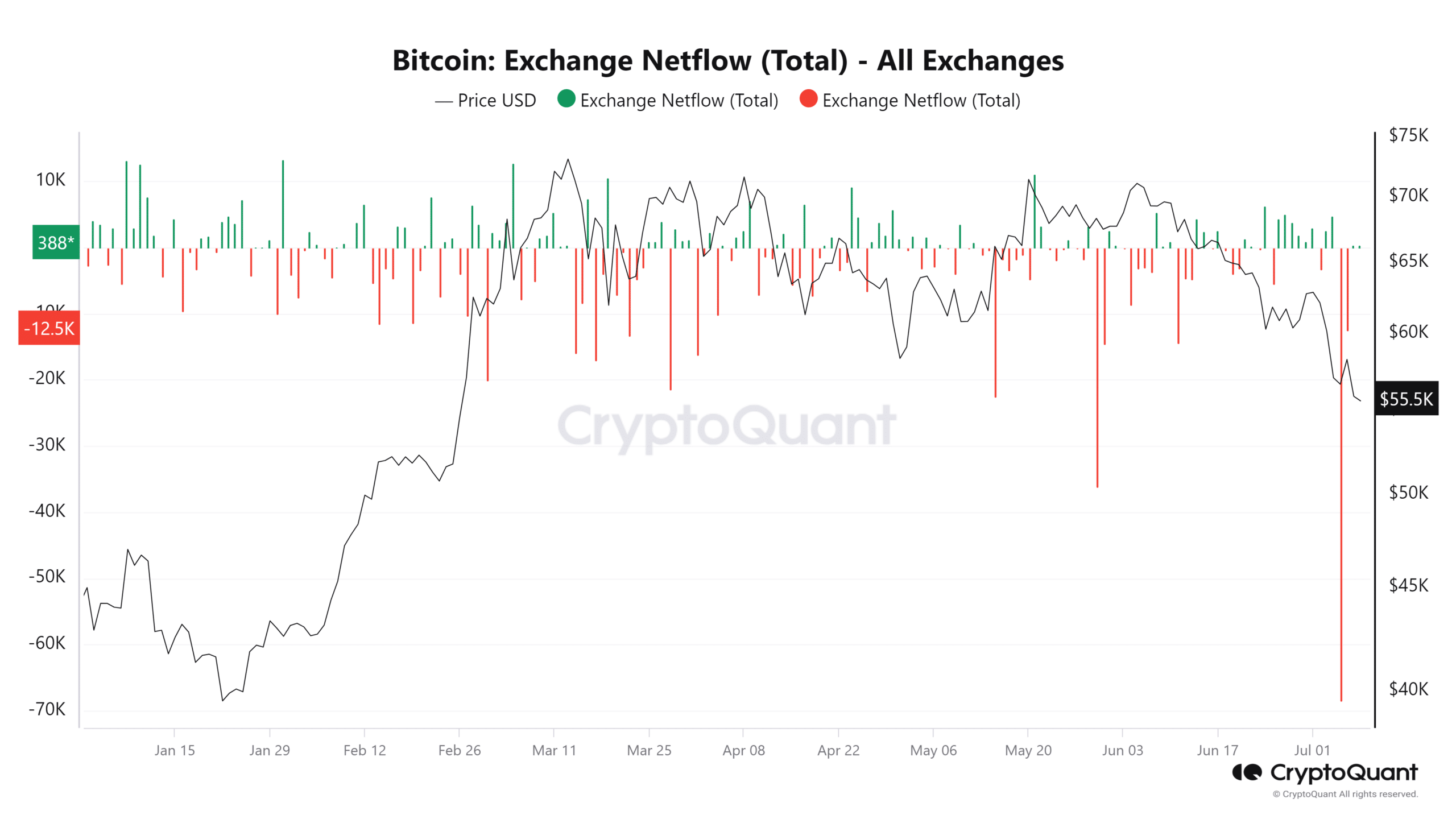

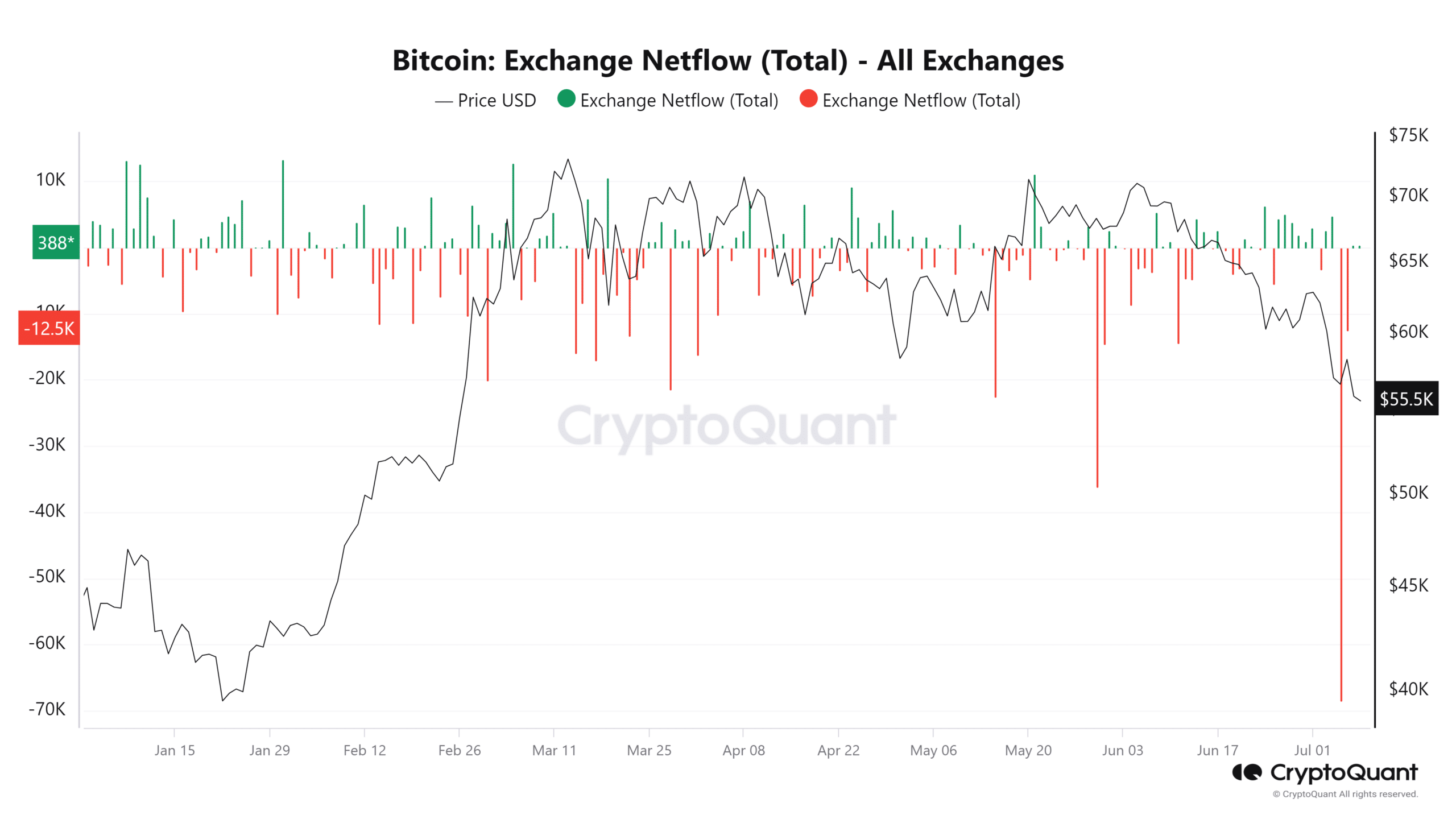

Bitcoin netflow exhibits huge withdrawals

Just lately, Bitcoin has exhibited an intriguing sample relating to its circulation on exchanges.

Evaluation of the circulation knowledge on CryptoQuant revealed that there was a higher outflow than influx in latest days. The information highlighted fifth July as a major day, with a internet outflow of over -68,500 BTC.

Additionally, this was the very best for the yr, valued at roughly $3.8 billion based mostly on that day’s change fee. The following day additionally recorded a considerable outflow, with over -12,550 BTC leaving exchanges, value about $730.9 million.

Supply: CryptoQuant

This development of Bitcoin being withdrawn from exchanges, particularly amidst a worth decline, is noteworthy.

Usually, such actions might be interpreted as a bullish sign, suggesting that holders decide to carry onto their property quite than promote, at the same time as Bitcoin breaks via help ranges.

This conduct typically displays a collective expectation amongst buyers that costs could get better, prompting them to withdraw their holdings to their wallets.

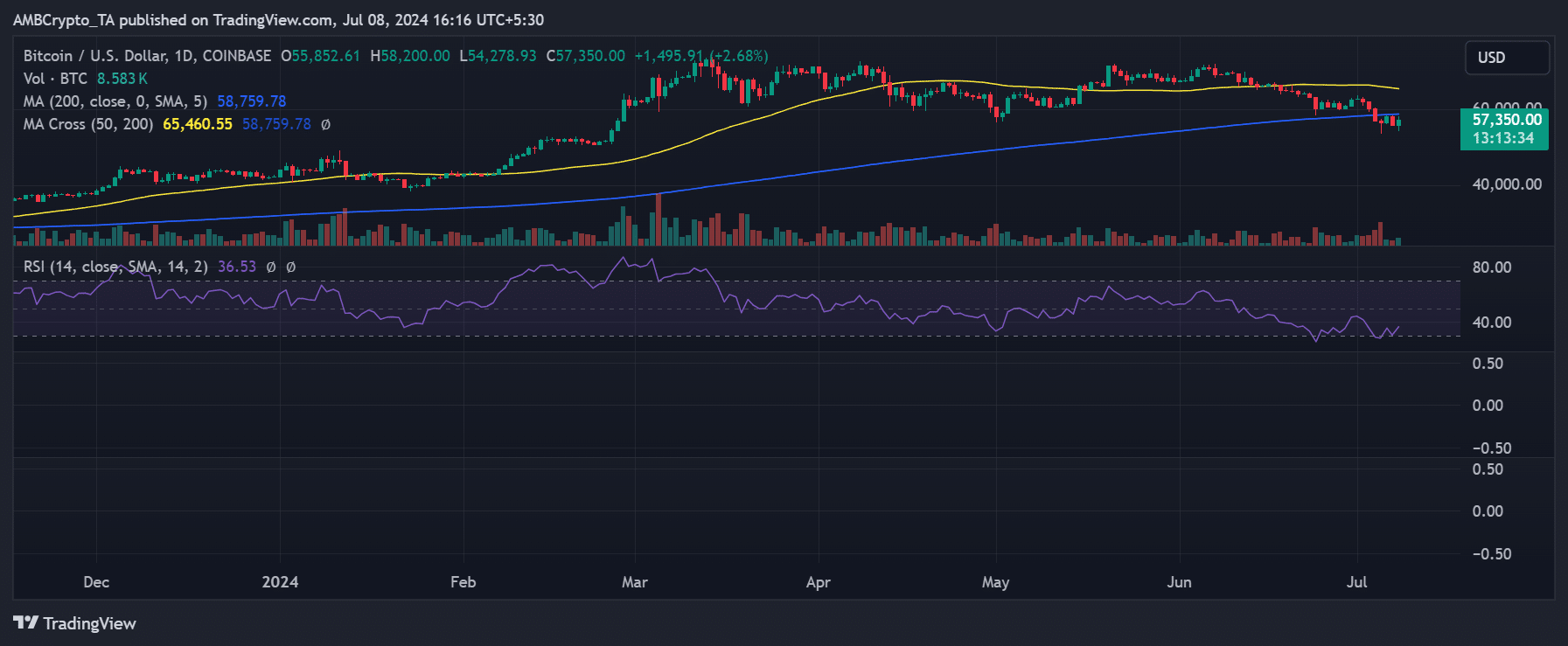

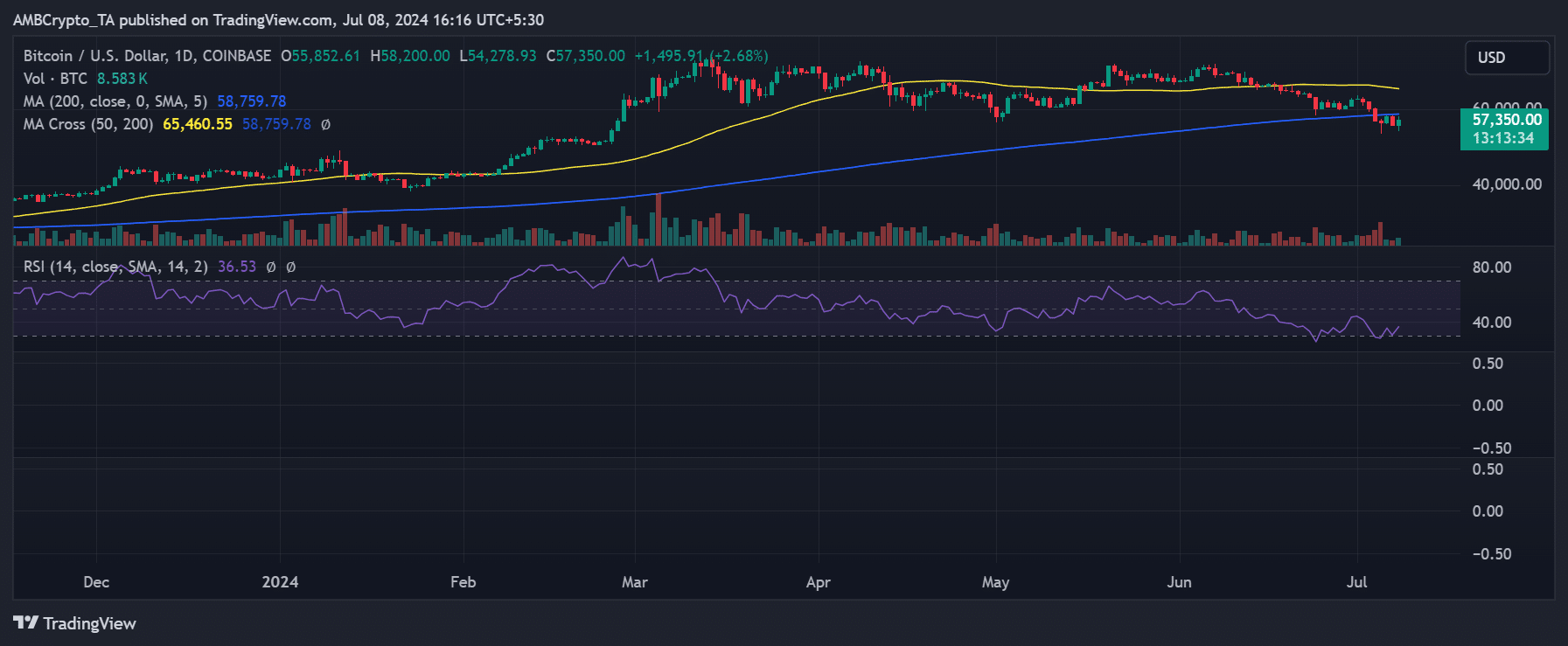

Bitcoin sees slight enchancment

AMBCrypto’s evaluation of Bitcoin on a every day timeframe chart highlighted that its lengthy shifting common, depicted by a blue line, is at the moment appearing as a right away resistance degree. This resistance is located across the $58,900 to $59,000 vary.

As of this writing, BTC was buying and selling at roughly $57,200, marking a rise of over 2%. This uptick adopted a notable 4.10% decline within the earlier buying and selling session, which had diminished its worth to round $55,850.

Supply: TradingView

Moreover, the Relative Power Index (RSI) was under 37, indicating that the asset remained in a powerful bearish development. An RSI under this degree usually signifies the asset is oversold, suggesting that promoting stress has been predominant.

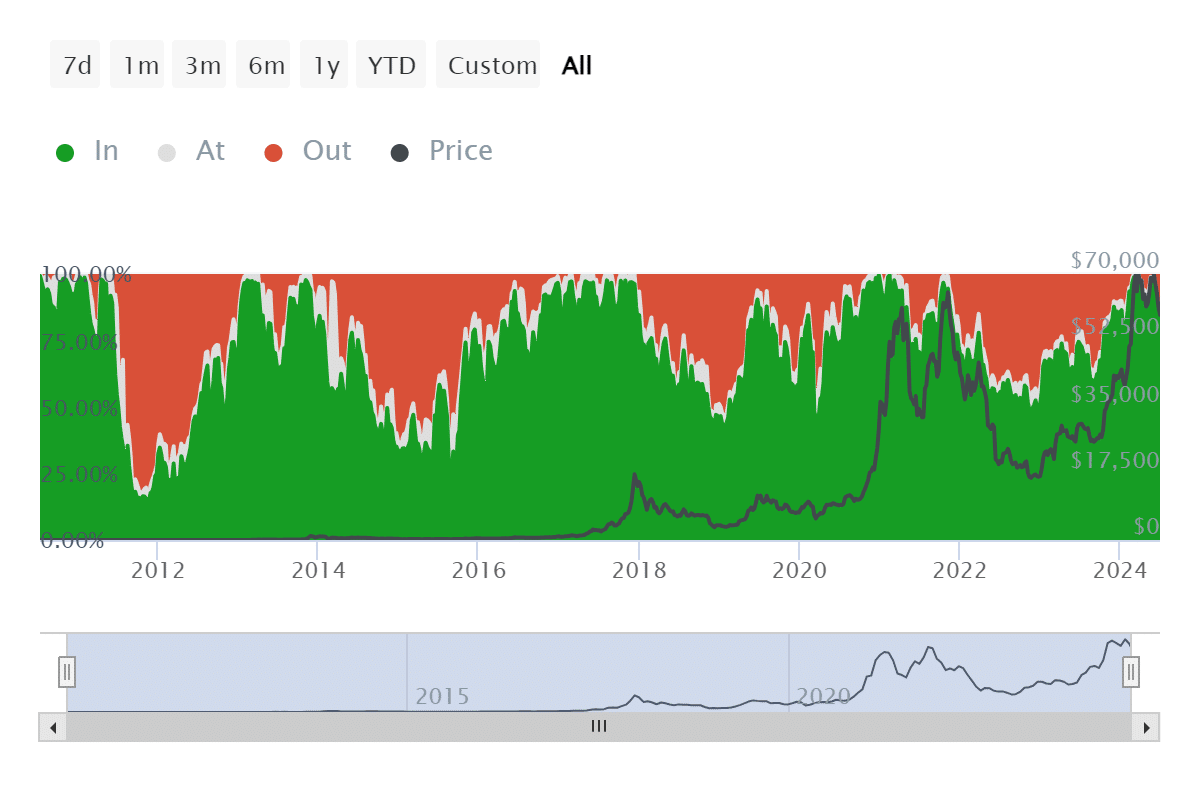

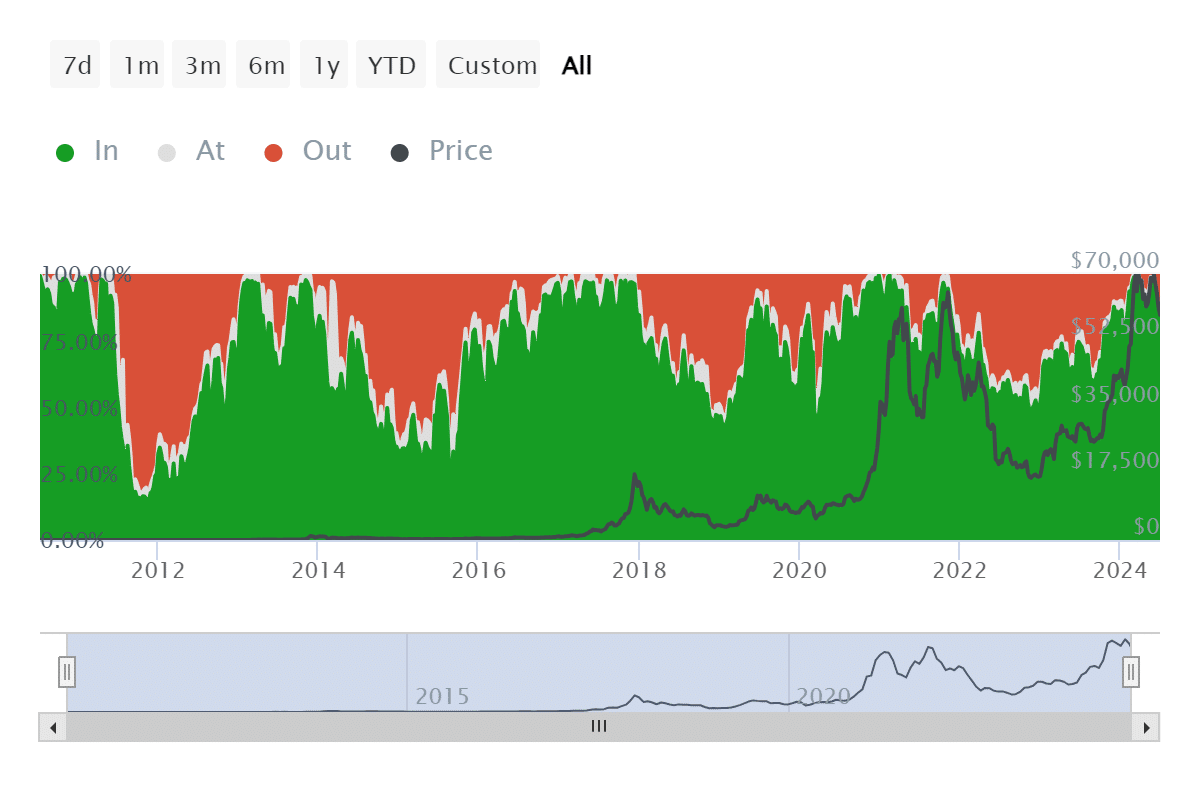

Extra holders stay at a loss

Evaluation from IntoTheBlock specializing in Bitcoin holders’ profitability signifies that many are at the moment experiencing losses.

Supply: IntoTheBlock

Learn Bitcoin (BTC) Worth Prediction 2024-25

The International In/Out of Cash index revealed that roughly 5.43 million addresses, accounting for nearly 64% of all holders, are holding Bitcoin at a loss.

Conversely, about 2.87 million addresses, representing practically 34% of holders, are worthwhile.