- Bitcoin pushed to noteworthy short-term zone, elevating chance of short-term profit-taking.

- Current promote shocks have retail merchants on the sidelines, will worth discovery set off the subsequent wave of FOMO?

Bitcoin [BTC] jumped above $66,000 on seventeenth July for the primary time in three weeks, driving on a powerful bullish wave fueled by a number of components, together with Trump surviving an assassination try.

This recent rally has triggered hopes amongst BTC holders, of a possible push into worth discovery.

Whereas the newest bullish efficiency signifies the return of confidence amongst Bitcoin traders, not everyone seems to be satisfied that it will likely be a easy experience to a brand new ATH.

BTC’s pump has thus far pushed above its short-term holder realized worth. A scenario that would change the tide or current a promote wall.

The worth crossing above its short-term holder realized worth indicators that Bitcoin’s short-term merchants could also be compelled to take income. Expectations of extra upside would nevertheless chase away the bears particularly if there may be not sufficient pleasure available in the market.

Retail merchants are nonetheless on the sidelines

Knowledge additionally signifies that there was low retail participation within the newest rally. In different phrases, whales and establishments have fueled the rally that we have now witnessed within the final two weeks.

An indication that the retail class are nonetheless fearful concerning the impression of the Mt. Gox Bitcoin sell-off.

What we all know thus far is that Bitcoin is about $8,000 away from a big rally. It additionally has room for extra upside earlier than retesting the subsequent main resistance stage.

Nonetheless, profit-taking from traders that purchased the dip will possible yield some resistance and a possible pullback throughout the subsequent few days.

For now, any incoming promote stress has to cope with robust demand from institutions aping into Bitcoin ETFs. The retest of sub $60,000 costs introduced an surprising alternative for a lot of whales and retail traders to dollar-cost common into Bitcoin.

What does the present market setting imply for Bitcoin?

Bitcoin’s bearish circumstances for many of June and the primary week of July might have eroded retail investor confidence. This will likely clarify why we’re seeing low participation, together with the prolonged excessive rates of interest which have negatively affected retail’s buying energy.

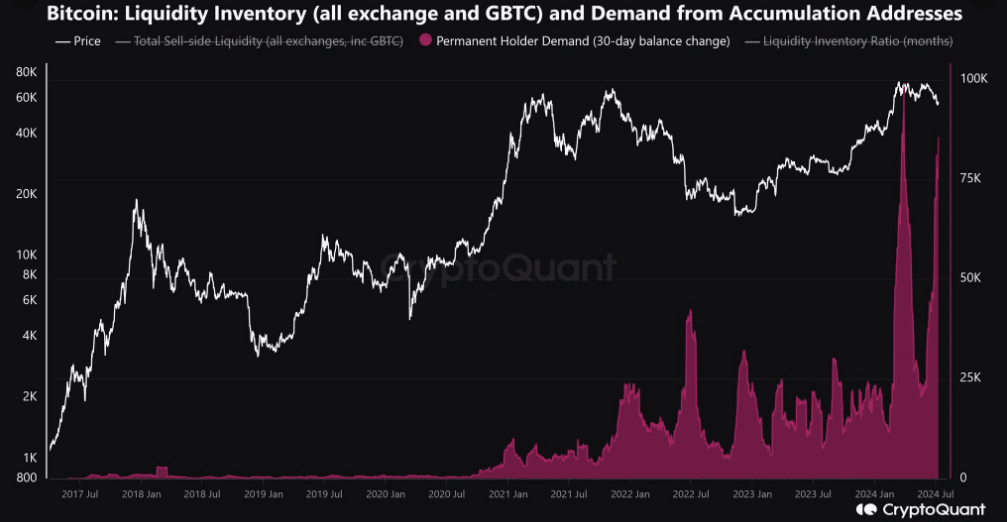

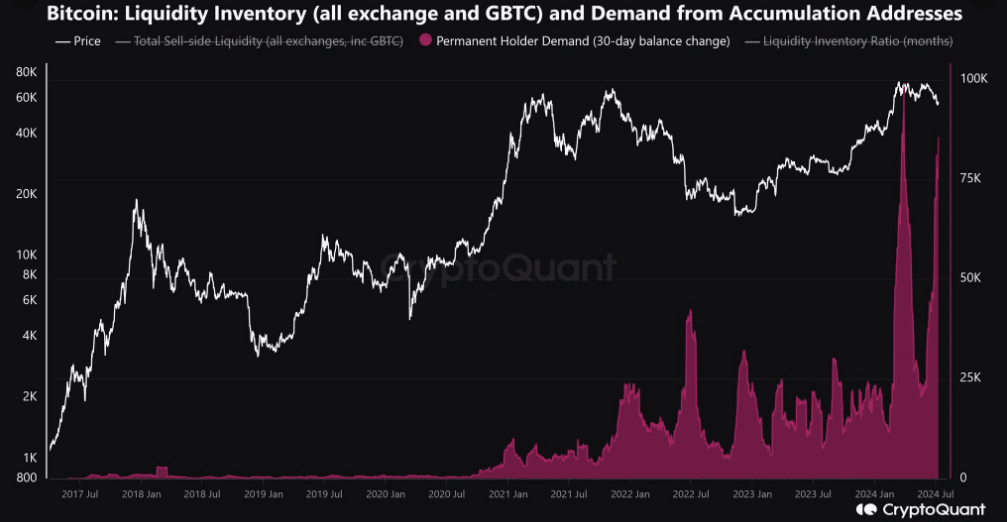

On the flip facet, the demand from establishments might revive pleasure available in the market. This coincides with observations indicating that long-term holder demand can be ramping up.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Bitcoin’s rising long-term holder stock is a wholesome long-term sign that may assist the expectations of upper costs.

A continued upside would set the stage for retail FOMO throughout the subsequent few days or even weeks. A scenario that would current but extra alternatives for liquidations and doubtlessly sizable pullbacks.