- Bitcoin’s volatility might push the worth to $50K regardless of market optimism.

- Investor sentiment was divided over shopping for the dip.

Regardless of rumors of Bitcoin [BTC] doubtlessly crossing the $70K mark within the close to future, the present worth trajectory of the main cryptocurrency was regarding.

Nonetheless, many stay unconcerned. Notably, Anthony Pompliano, in a current dialog with Fox Enterprise, mentioned,

“I feel that retail buyers and establishments have each realized that Bitcoin is a resilient asset that’s going to be price much more 5 or 10 years from now than it’s in the present day and due to this fact when there are these dips they have a look at them as shopping for alternatives.”

Echoing comparable sentiment was X (previously Twitter) account Bitcoin for Freedom.

“If this dip makes you scared it is advisable examine #bitcoin extra.”

The current market fluctuations have reignited the traditional “shopping for the dip” technique, attracting merchants and buyers looking forward to potential bargains.

There are contrasting views

But, this optimistic method isn’t widespread. Markus Thielen, CEO of 10x Analysis, expressed a extra cautious stance in a separate submit, suggesting that the present timing may not be preferrred for such optimism.

In his current blog post, Thielen claimed,

“Worth declines may speed up as help will get damaged and sellers scramble to seek out liquidity. Solely ill-informed merchants are prepared to purchase right here. Breaking this help may trigger a pointy decline to the low $50,000s.”

Thielen had the identical views just a few months in the past, whereby he had famous,

“Shopping for this dip continues to be too early. Technically, we nonetheless count on Bitcoin to commerce under 60,000 earlier than a extra significant rally try is began.”

It stays to be seen whether or not Bitcoin will defy Thielen’s prediction or validate it by dropping to $50K.

Bitcoin’s current market tendencies

In keeping with CoinMarketCap, at press time, BTC was buying and selling at $57,730.17, marking a 4% drop prior to now 24 hours.

Additionally, Spot Bitcoin Alternate Traded Funds (ETF) recorded an outflow of $20.5 million on the third of July.

Supply: Farside Traders

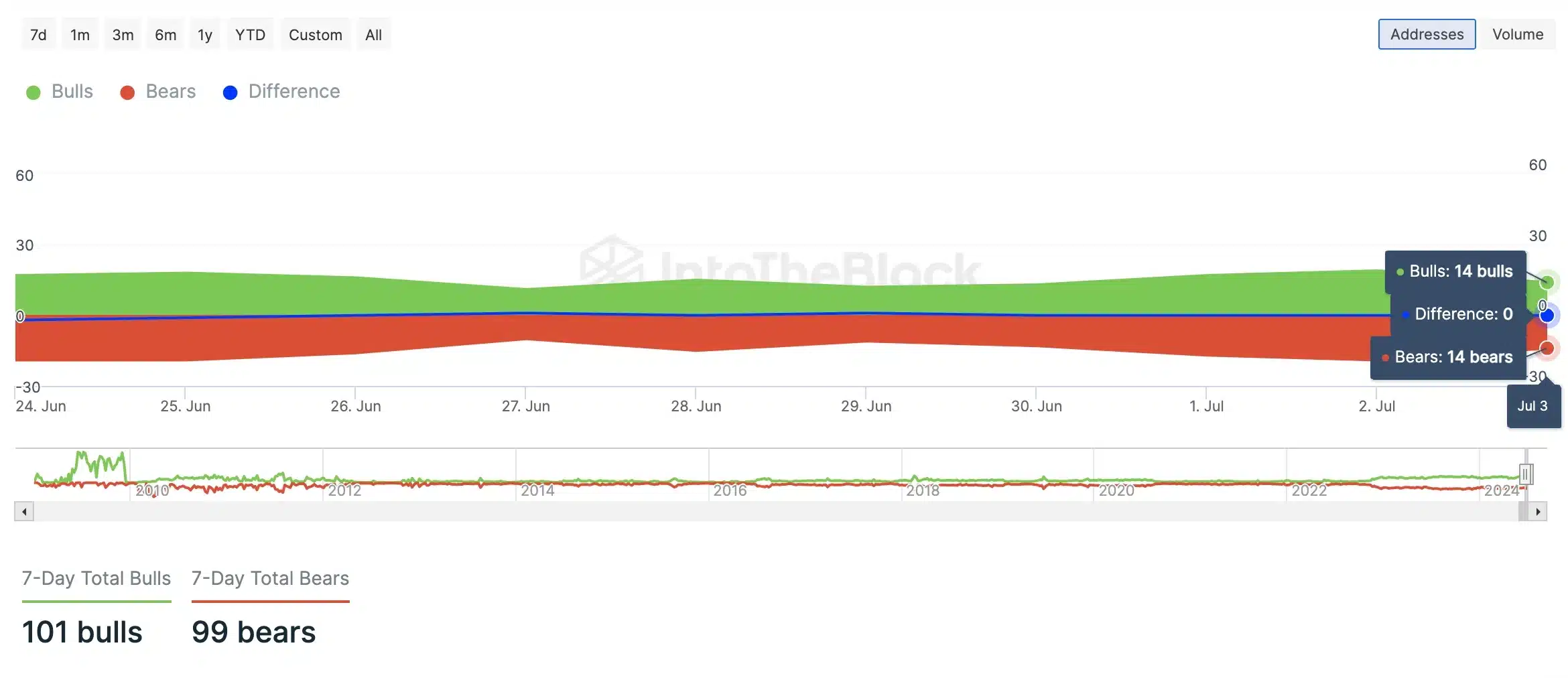

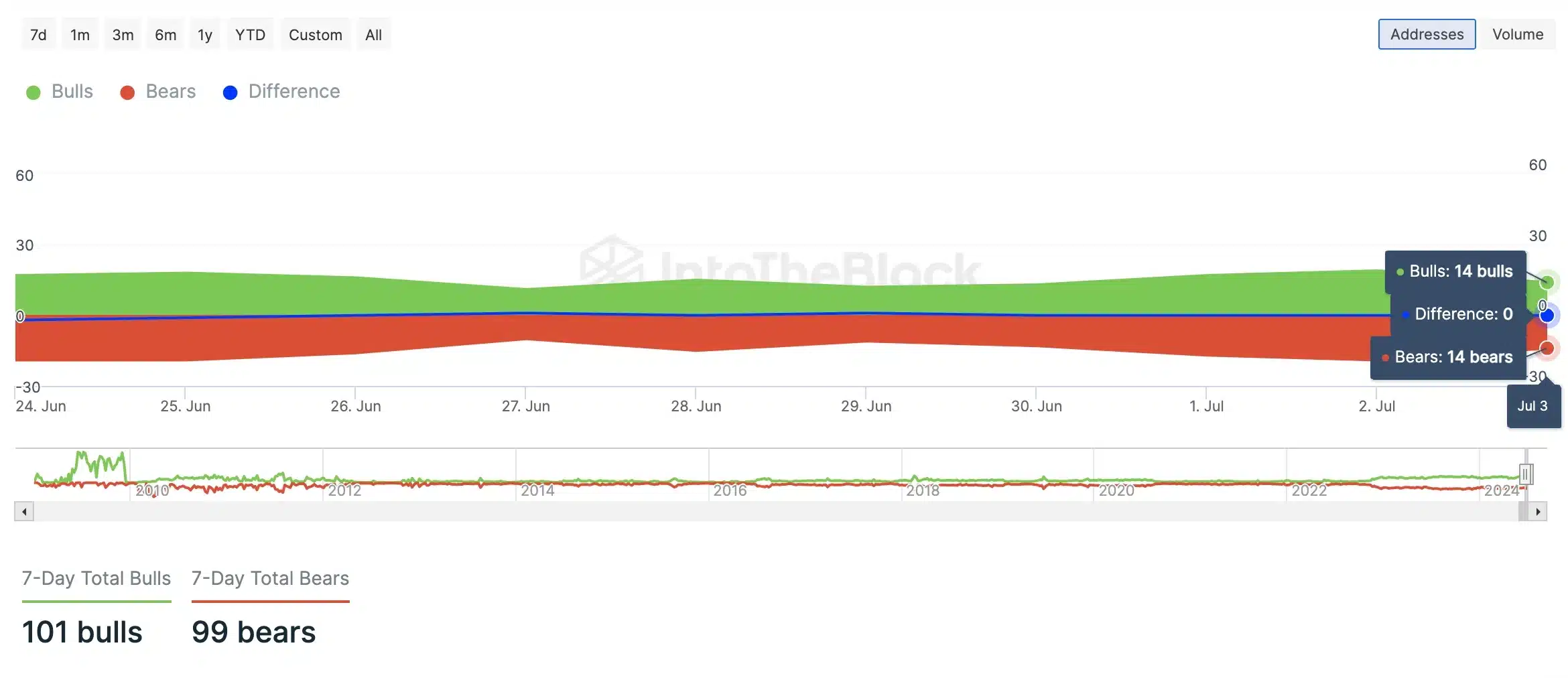

Nonetheless, IntoTheBlock’s Bears and Bulls information confirmed no clear dominance of both facet. As of the third of July, bulls and bears have been evenly matched, indicating no important shopping for or promoting stress.

Supply: IntoTheBlock

Actually, whereas inspecting the BTC ETF circulation information for July, we see that inflows have outpaced outflows inside simply three days of buying and selling.

On the first of July, BTC ETFs recorded inflows price $129.5 million, considerably larger than the mixed outflows of $34.2 million on 2nd and third July.

Notably, June noticed most outflows for BTC ETFs, however as Q3 started, there have been indicators of enchancment.