- Inflows into new ETFs negated outflows from GBTC.

- Bitcoin nonetheless encountered promoting stress from long-term holders.

In a exceptional turnaround, Bitcoin [BTC] spot exchange-traded funds (ETFs) within the U.S. attracted substantial inflows on Tuesday, following a disappointing efficiency final week.

A powerful internet constructive day

In response to AMBCrypto’s evaluation of SoSo Value knowledge, about 6,000 BTCs, value $418 million, flew into these funding avenues on a internet foundation, marking the strongest wave of inflows because the 14th of March.

With the newest inflow, the full worth of Bitcoins backing the spot ETFs hit $57.2 billion, constituting 4.20% of the crypto’s complete market cap.

Supply: SoSo Worth

Constancy’s spot ETF (FBTC) led the inflows chart, amassing $279.10 million value of Bitcoins, adopted by BlackRock’s IBIT fund with inflows of $162 million.

The overall inflows from the 9 newly-launched ETFs helped in negating $212 million in outflows from incumbent issuer Grayscale Bitcoin Trust (GBTC).

Final week, Grayscale outflows had exceeded inflows, leading to 5 straight internet destructive days.

On an interesting notice, the gathered quantity by new ETFs included all newly mined Bitcoins on the day, the equal of Grayscale’s outflows, and a further 5,092 cash from different sellers, enterprise capital agency HODL15Capital noted.

Bitcoin fails to carry

Regardless of a powerful wave of inflows, Bitcoin stayed rooted across the $70,000 degree, in line with CoinMarketCap, implying that appreciable promoting was nonetheless happening.

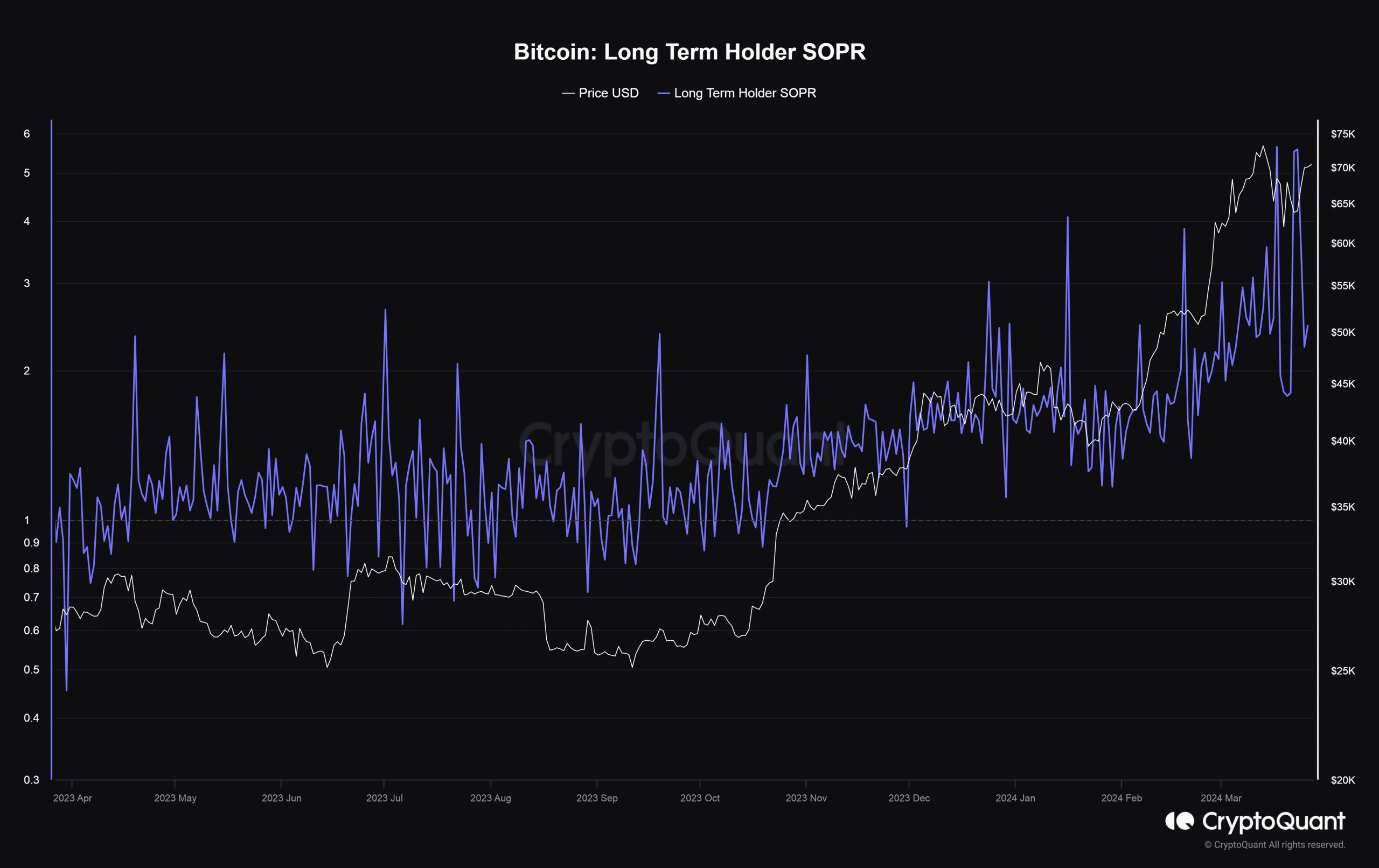

A variety of these sell-offs might be attributed to long-term holders of the coin. As per AMBCrypto’s scrutiny of CryptoQuant knowledge, this cohort has been more and more promoting their holdings for revenue recently.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Whereas occasions like this stem the asset’s rise, they carry beforehand inactive cash into the liquid provide. This might doubtlessly result in extra demand and volatility.

A sentiment of “excessive greed” prevailed available in the market, as per the newest replace from Bitcoin’s Fear and Greed Index. This might result in sustained shopping for stress within the coming days, inflicting Bitcoin to go additional north.