- Bitcoin rallied to $64,000, however the U.S. market’s absence raises considerations concerning the rally’s sustainability.

- Metrics present a decline in Bitcoin’s Open Curiosity and retail exercise, signaling potential warning for buyers.

The worldwide crypto market has skilled a big increase prior to now few days, with an increase of over $60 billion in valuation.

This enhance comes as Bitcoin’s value surged as soon as once more to the $64,000 mark, reigniting optimism amongst buyers.

Whereas this rally has grabbed the eye of many, some analysts are questioning the sustainability of this development, noting sure uncommon tendencies behind the scenes.

Market pushed by Asian capital, not U.S. patrons?

A CryptoQuant analyst, utilizing the pseudonym BQYoutube, has not too long ago highlighted a important remark on the CryptoQuant QuickTake platform.

In a post titled “We’re going up. However Coinbase Ain’t Shopping for,” the analyst identified that the U.S. market, represented by Coinbase, has not been taking part within the current rally.

BQYoutube famous that whereas Bitcoin’s value was climbing, Coinbase Premium, a metric that tracks the distinction between Bitcoin costs on Coinbase and different exchanges, has been falling into adverse territory.

This drop within the Coinbase Premium signifies that the U.S. market won’t be as enthusiastic concerning the rally, probably weakening the general bullish sentiment.

Supply: CryptoQuant

One of many key causes behind Bitcoin’s current rally could possibly be attributed to capital flows from Asia, in response to BQYoutube. The analyst prompt that the China charge lower and influx of Asian capital could be driving costs upward.

Nonetheless, this rally lacks full assist with out important U.S. participation.

The U.S. market has historically performed a vital position in sustaining long-term Bitcoin value rallies, and its absence may sign potential vulnerabilities within the present value motion.

BQYoutube cautioned that the rally could possibly be dangerous if the U.S. market stays disengaged, as sustained value momentum usually depends on broader international participation.

Retail curiosity in Bitcoin rebounds barely

Other than these observations, it’s important to have a look at Bitcoin’s key on-chain metrics to know the broader image.

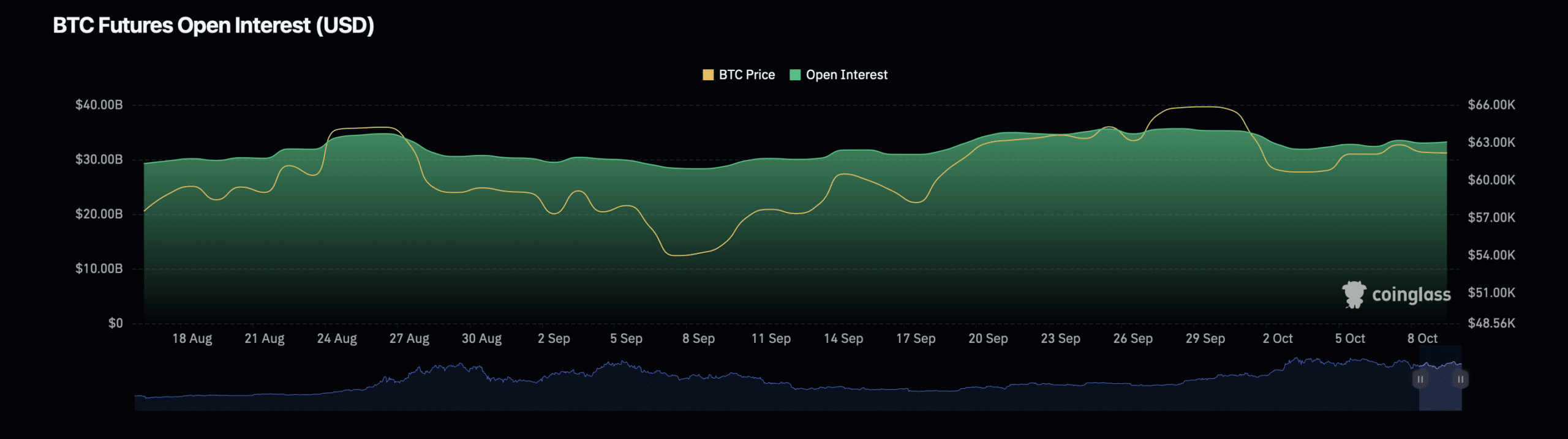

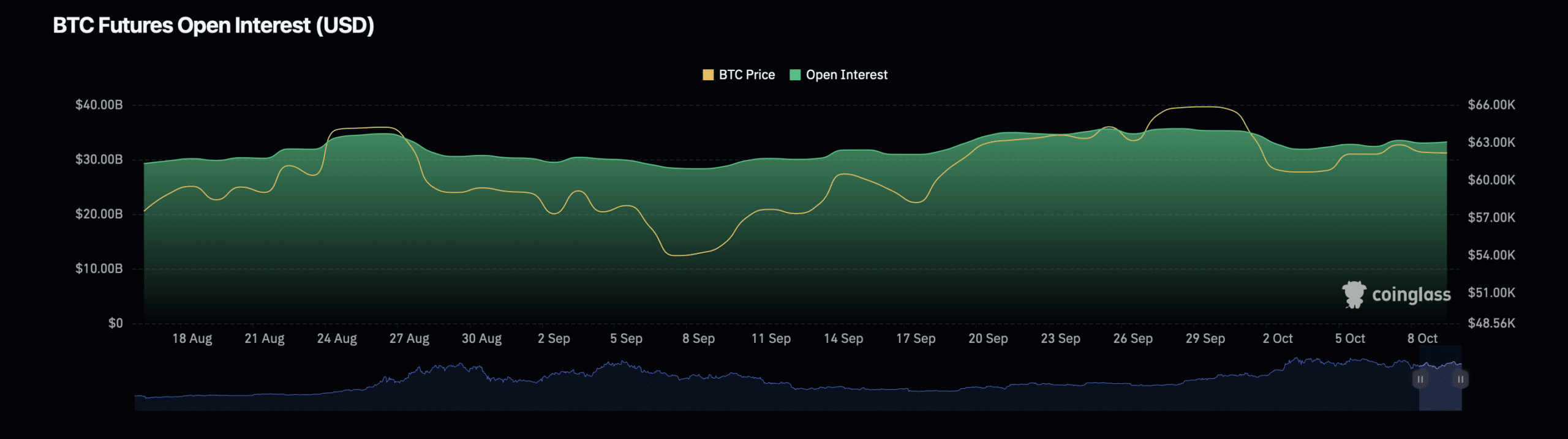

Data from Coinglass reveals a decline in Bitcoin’s Open Curiosity, which refers back to the complete variety of excellent by-product contracts.

Supply: Coinglass

This metric has dropped by 0.83%, bringing its worth to $33.25 billion.

Equally, Bitcoin’s Open Curiosity quantity, which displays the overall variety of trades, has additionally seen a pointy decline of 31.04%, standing at $45.49 billion at press time.

These declines might point out that merchants had been much less optimistic concerning the asset’s future motion within the quick time period.

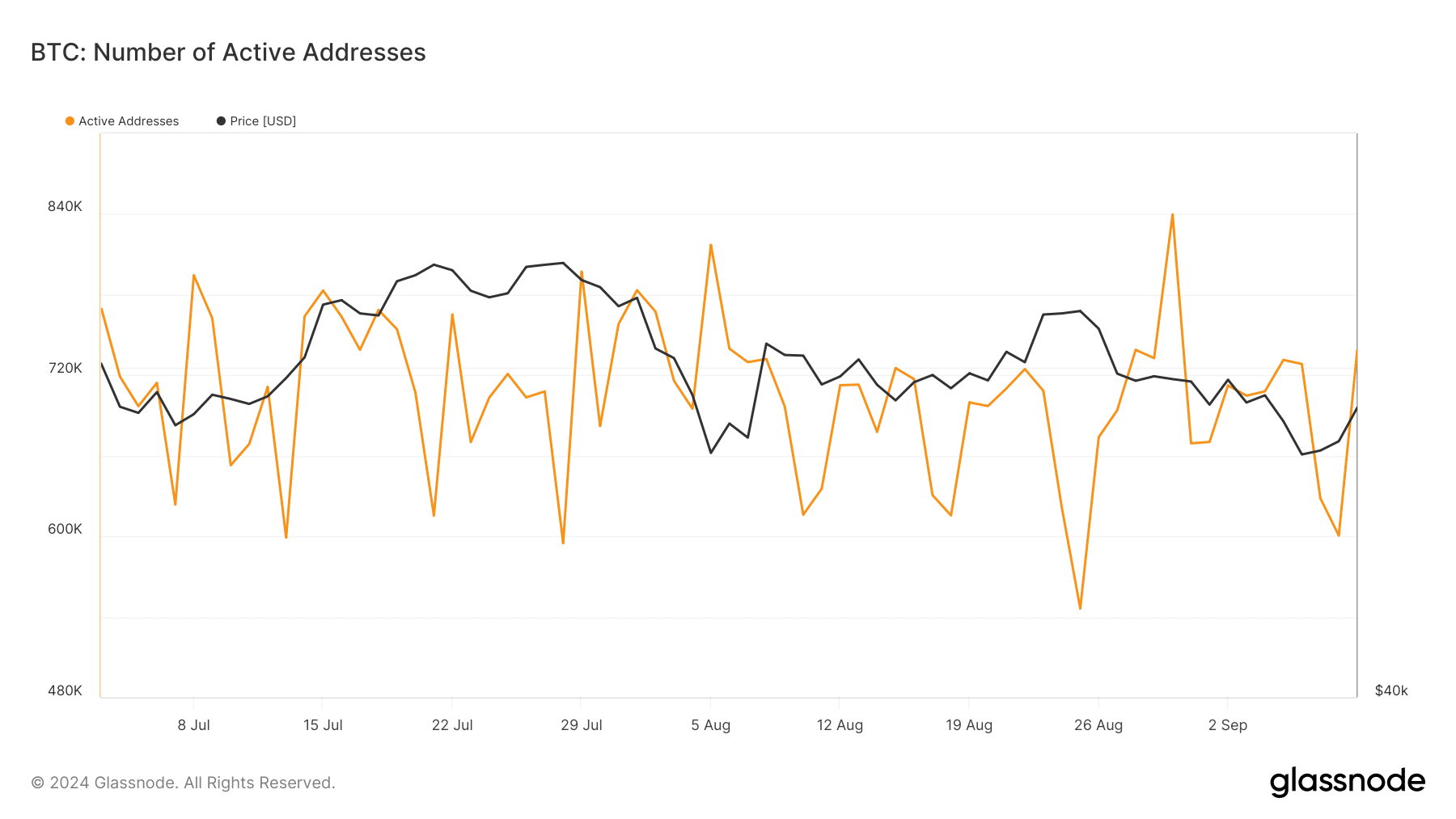

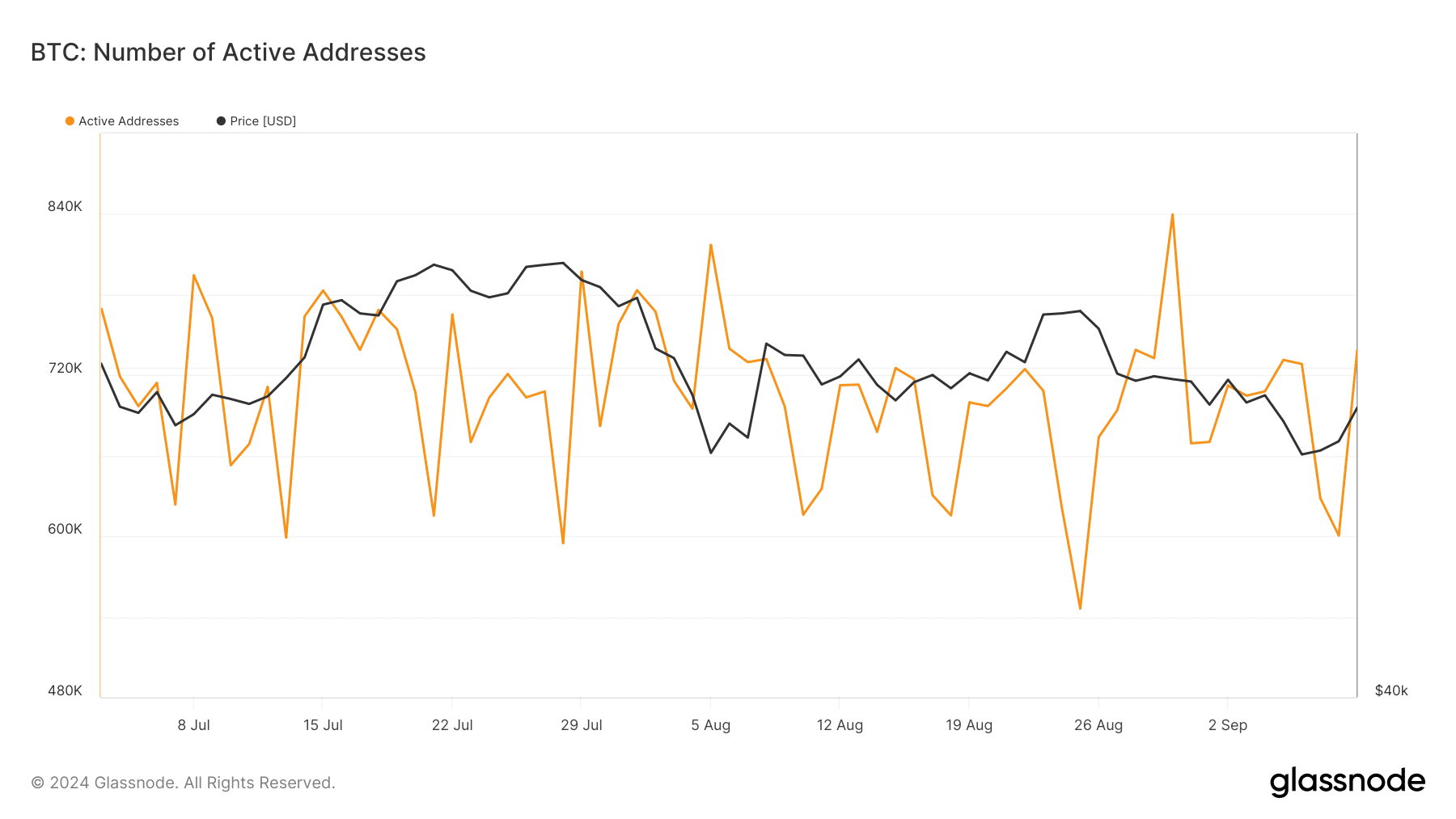

One other important metric to watch is Bitcoin’s energetic addresses, which function a key indicator of retail curiosity.

Information from Glassnode revealed a considerable drop in energetic Bitcoin addresses over the previous few months, significantly after peaking at 839,000 on the thirtieth of August.

Supply: Glassnode

This drop noticed energetic addresses plunge to round 600,000 by the tip of September, reflecting a decline in retail curiosity.

Nonetheless, current information prompt a minor restoration, with energetic addresses climbing again above 700,000 in current days.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Notably, whereas the present rally has sparked pleasure, the shortage of U.S. participation and declining open curiosity could current challenges for Bitcoin’s short-term prospects.

Nonetheless, the rebound in retail curiosity might sign renewed confidence out there.