- Bitcoin doesn’t have sufficient demand within the quick time period to maintain a rally past $60k.

- Merchants can put together for a bearish reversal on Monday however ought to be careful for volatility.

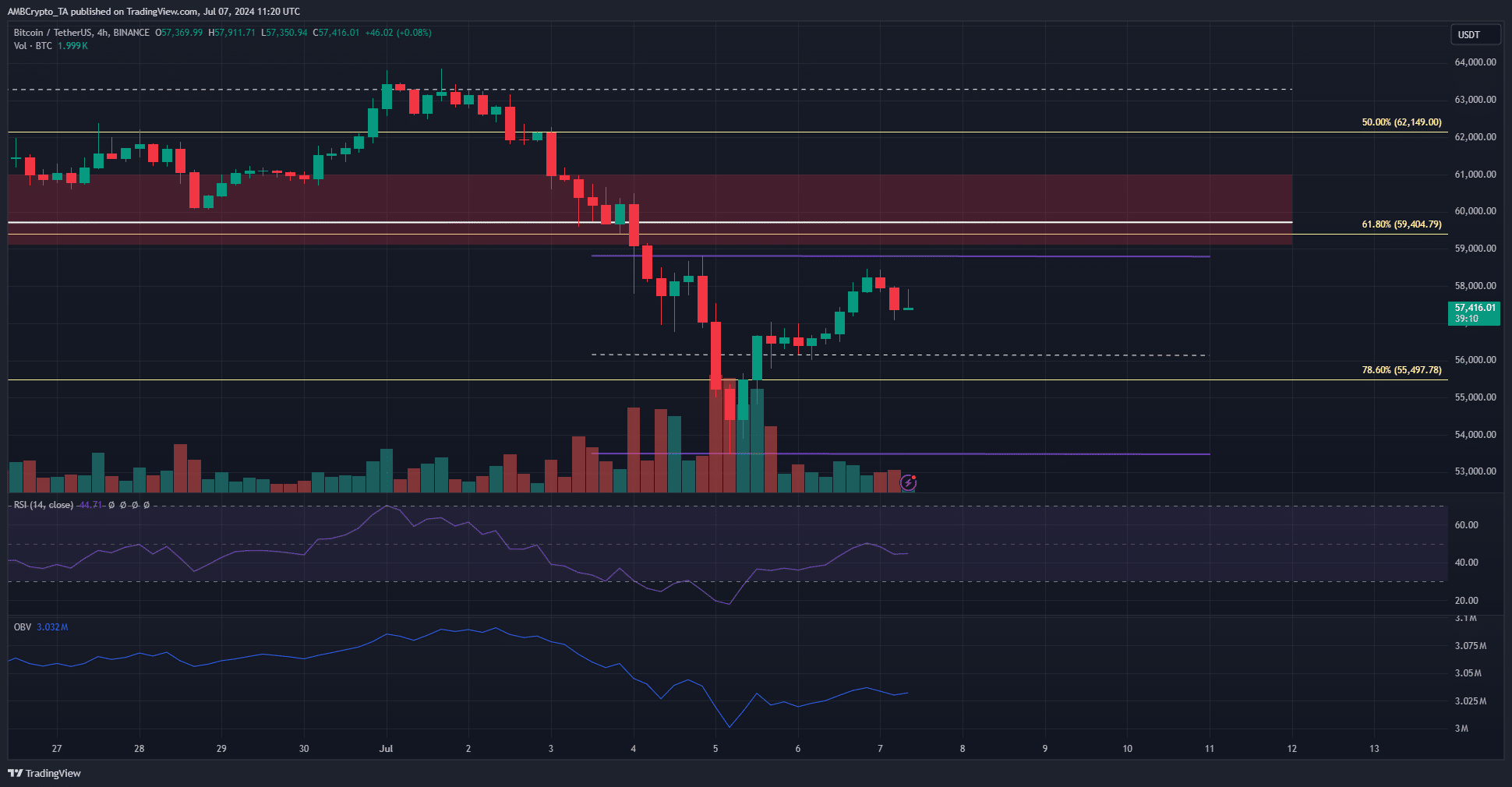

Bitcoin [BTC] fell by 16.2% between Monday, the first of July, and Friday, the fifth of July. After reaching the bottom level at $53.5k, BTC bounced by 9.33% over the following day and a half. The sharp downward worth transfer may see a short-term vary formation established.

AMBCrypto analyzed the liquidation charts and the value motion to grasp the place the costs may pattern over the following week. Whales had been accumulating BTC, however the sentiment was weak, and the coin motion onto exchanges was a priority.

Plotting the Bitcoin worth path for the following week

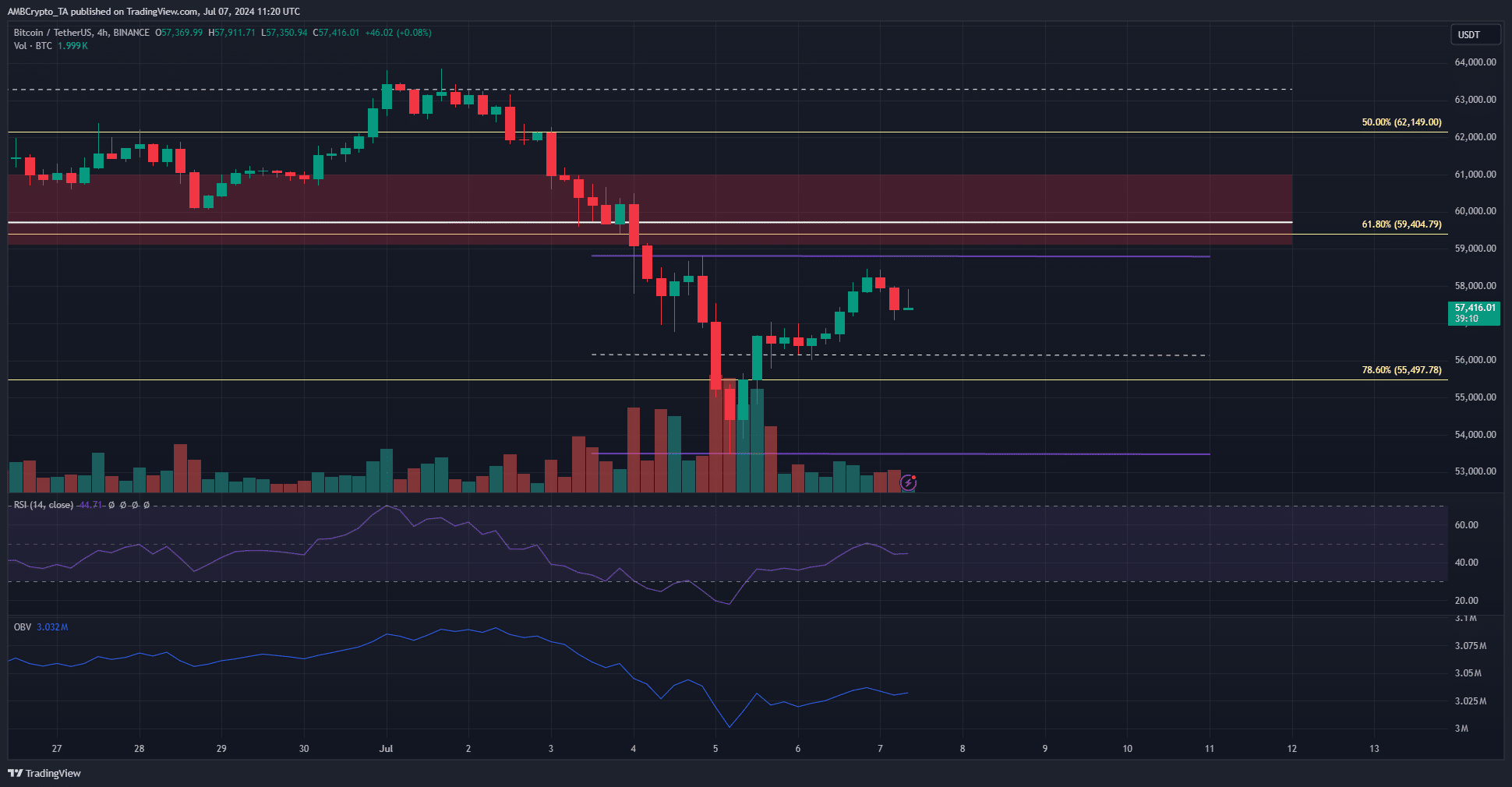

Supply: BTC/USDT on TradingView

The 4-hour chart confirmed a possible vary formation between $58.8k and $53.5k. The mid-range degree at $56.2k had served as assist on the fifth of July when costs tried to bounce greater.

The H4 RSI was at 44 and confronted rejection at impartial 50. Nevertheless, the RSI would possible go greater over the following day or two as a result of the vary highs beckons BTC costs to it.

The OBV, then again, remained in a downtrend, warning bulls to not take the bait supplied.

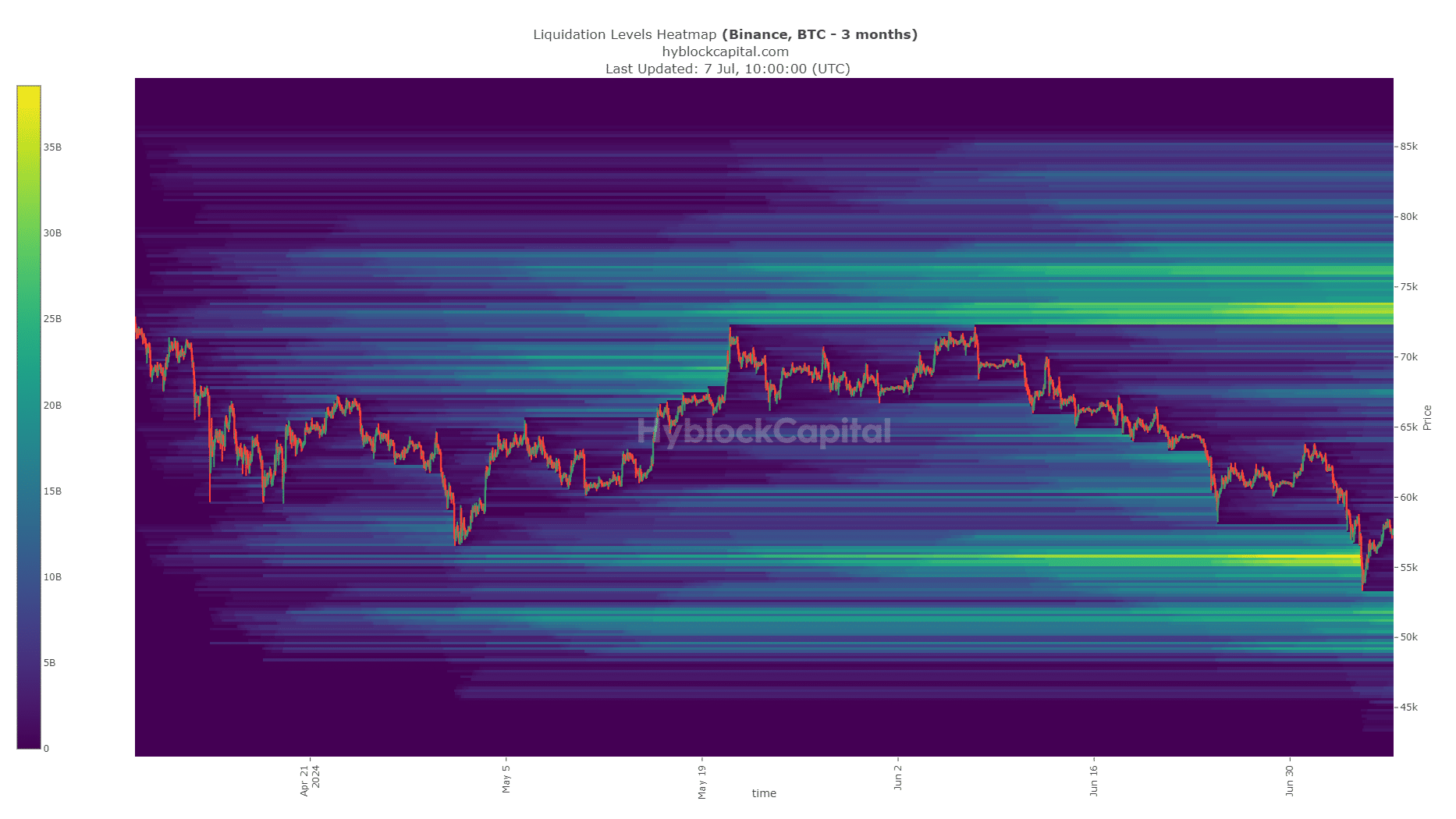

The liquidation heatmap of the previous three months confirmed that the $55.5k area had a excessive focus of liquidation ranges. This pool of liquidity was swept and within the coming weeks, BTC may search to run it northward to the $73k liquidity zone.

Within the quick time period, nonetheless, a right away reversal is unlikely. The bulls want time to collect their energy earlier than pushing greater. The vary formation outlined earlier is anticipated to final over the approaching week.

Outlining the important thing Bitcoin worth ranges

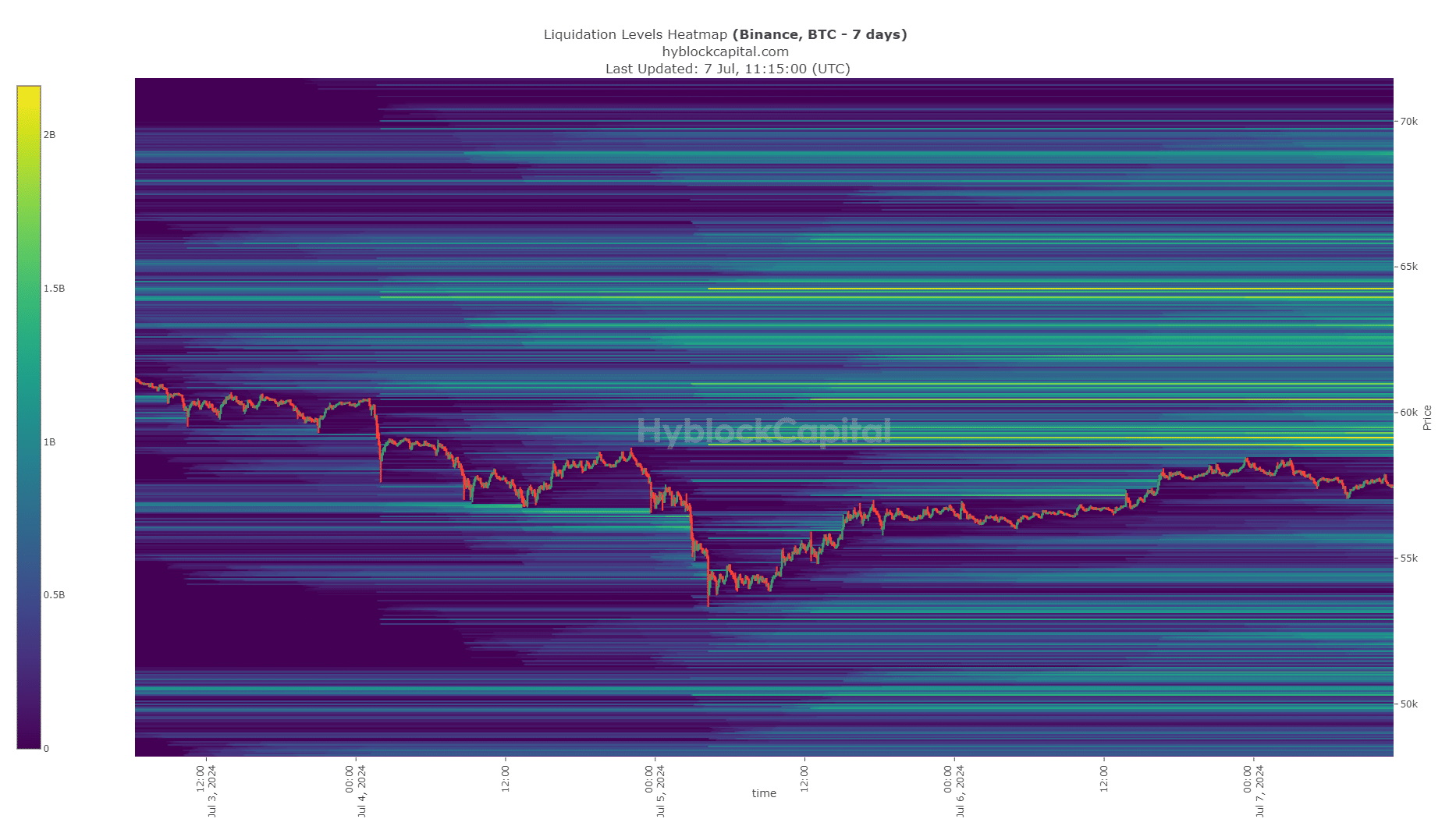

The 7-day liquidation heatmap confirmed that the $59k-$59.3k zone has bunched up liquidation ranges. This lined up nicely with the $58.8k vary highs.

The magnetic zone beneath $60k is probably going to attract Bitcoin costs to it.

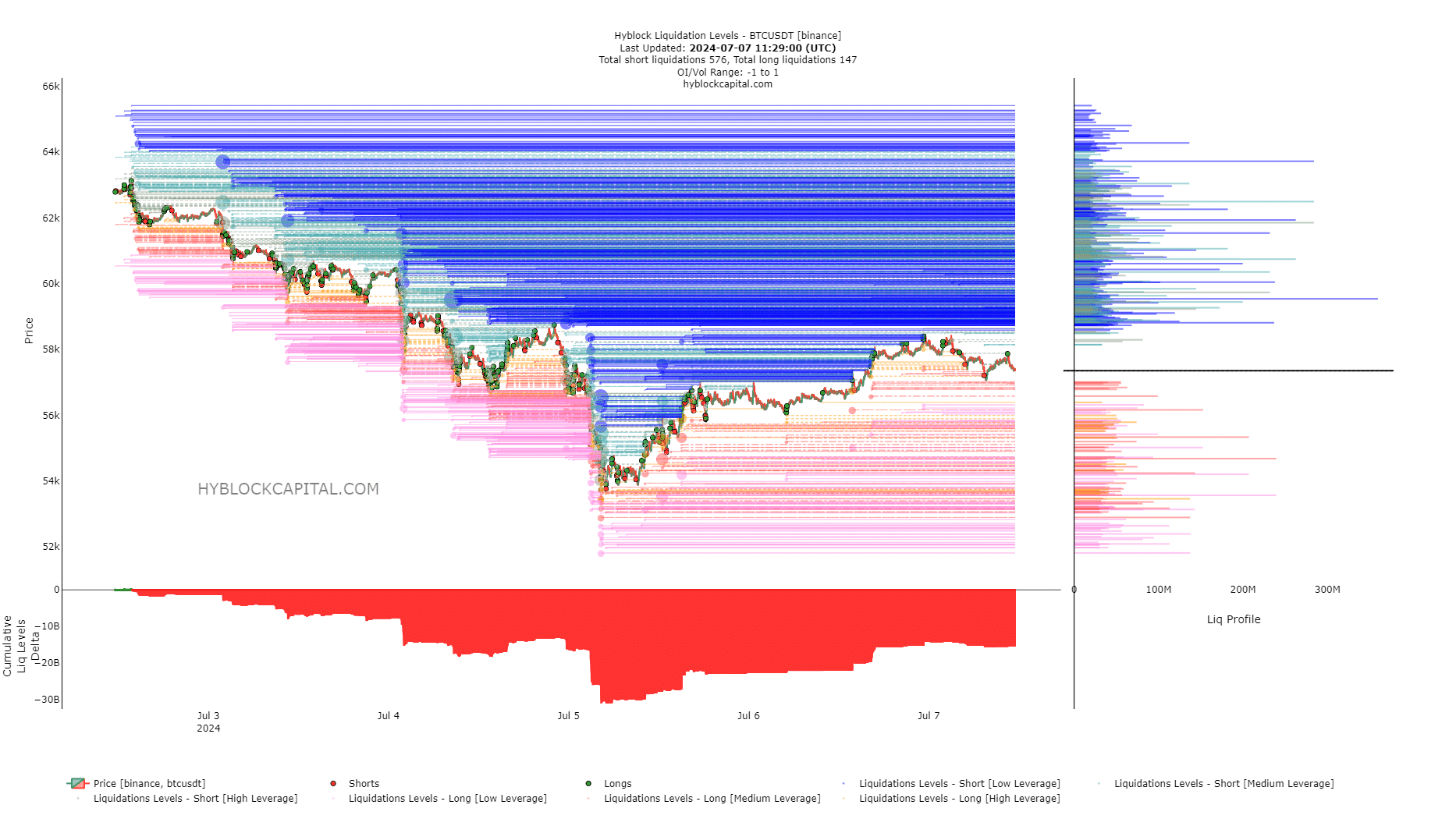

AMBCrypto additionally analyzed the liquidation ranges. They revealed that the cumulative liq ranges delta was nonetheless largely unfavourable however has withdrawn barely since its most on the fifth of July.

Subsequently, a transfer upward to hunt the overleveraged quick sellers may start on Monday, the eighth of July.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Whereas the king of crypto doesn’t have sufficient bullish sentiment or demand to gas a fast rally, merchants mustn’t ignore the potential of a breakout previous $60k.

As issues stand, a bearish reversal from the $59.2k space is anticipated, with volatility across the New York Open at 1 PM UTC on Monday one thing to watch out for.