The Bitcoin value is buying and selling at $27,100 on the time of writing, marking a 60% decline from its all-time excessive of $69,000 in 2021. Because the anticipation for the subsequent bull market builds, questions come up concerning Bitcoin’s potential future costs.

Whereas most predictions are speculative, one analyst has devised a mannequin leveraging historic information to forecast potential tops and bottoms in Bitcoin’s value over time.

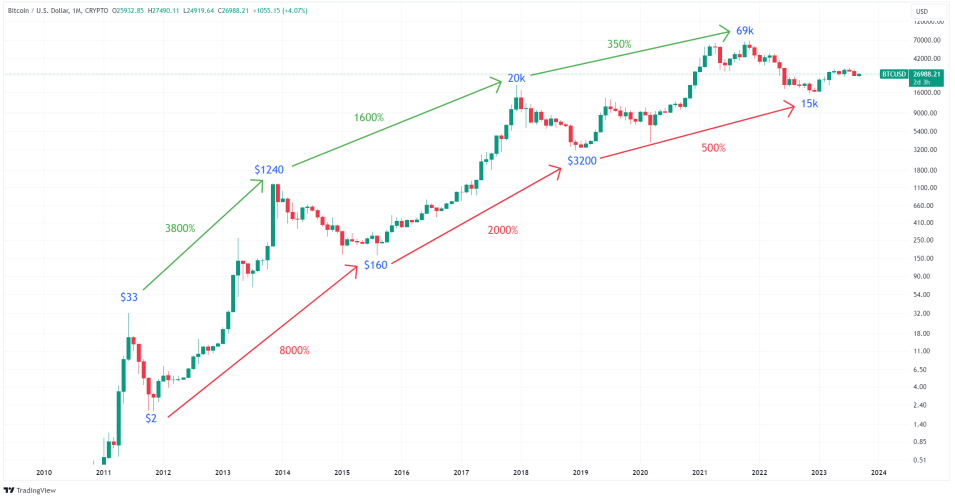

Bitcoin Worth In Earlier Cycles

Bitcoin's costs adjustments since 2011. Supply: BTCUSDT on TradingView

Since its inception, Bitcoin has demonstrated exceptional development, rewarding early long-term buyers considerably. This value development is observable in measuring Bitcoin’s costs from the lows to the highs and between the highs of successive bull markets.

In 2011, the height was $33, adopted by a peak of $1240 in 2013, reflecting a 3800% improve between peaks. The next peaks in 2017 and 2021 have been $20,000 and $69,000, representing will increase of 1,600% and 350%, respectively. Comparable ranges of improve are additionally noticed when analyzing the lows of various cycles.

Notably, the relative development between cycles has diminished, presumably as a result of improve in Bitcoin’s market capitalization, requiring extra substantial capital to affect its value. This diminishing development aligns with a mathematical sample often called logarithmic regression.

Logarithmic Regression

An analyst has devised numerous logarithmic curves on the Bitcoin chart to forecast Bitcoin’s potential tops and bottoms, using time as the one enter. Such fashions can assist buyers by providing an easy option to see potential market traits and make proactive plans within the unpredictable world of cryptocurrency.

Chart of Bitcoin's value in a channel of logistic regression curves. Supply: @BawdyAnarchist_ on X

Bitcoin’s tops and bottoms sometimes manifest each 4 years, enabling the prediction of potential Bitcoin costs in upcoming cycles based mostly on the logarithmic regression mannequin.

Bitcoin Worth Projections

- 2025-2026: Bitcoin value could peak within the third or fourth quarter of 2025 between $190,000-$200,000, earlier than bottoming out round $70,000 the next 12 months.

- 2029-2030: Bitcoin value could attain a prime of $420,000 to $440,000 and backside out the next 12 months at round $230,000.

- 2033-2034: Bitcoin value could peak between $750,000-$800,000 and backside out round $700,000 the next 12 months.

By the late 2030s, the mannequin begins to interrupt down as predicted tops begin falling beneath the anticipated bottoms, probably indicating a stabilization in Bitcoin’s value publish its peak of $750,000-$800,000

Closing ideas

Whereas fashions like this provide insightful projections of Bitcoin’s potential future costs, it’s vital to acknowledge their limitations and the necessity for periodic updates with contemporary information factors. Quite a few exterior elements, together with however not restricted to regulatory adjustments, technological developments, and macroeconomic circumstances, might considerably affect the mannequin’s accuracy.

Furthermore, the unprecedented nature of Bitcoin’s trajectory, having by no means endured a recessionary setting, implies a possible susceptibility to extra substantial crashes than fashions may predict. Predictions needs to be cautiously thought-about with broader market analyses and traits as with every monetary mannequin.

Funding Disclaimer: The content material offered on this article is for informational and academic functions solely. It shouldn’t be thought-about funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding selections. Buying and selling and investing contain substantial monetary threat. Previous efficiency is just not indicative of future outcomes. No content material on this web site is a advice or solicitation to purchase or promote securities or cryptocurrencies.

Featured picture from ShutterStock, Charts from TradingView.com