- Bitcoin surged above $64,000 following the U.S. Fed price reduce however fell to $63,786 at press time.

- Bitcoin’s MVRV ratio signaled undervaluation, with additional upward momentum wanted for a sustained rally.

Ever since america introduced its newest rate of interest reduce, Bitcoin [BTC] skilled a gradual rebound in worth.

The cryptocurrency surged to a peak of over $64,000 on the twenty third of September, gaining 8.5% in worth during the last week.

Nonetheless, following this surge, Bitcoin retraced barely to $63,786 at press time—nonetheless up 0.2% prior to now 24 hours.

The asset’s current efficiency has captured the eye of analysts, particularly given its resistance and help ranges, which appear to recommend an upcoming shift in momentum.

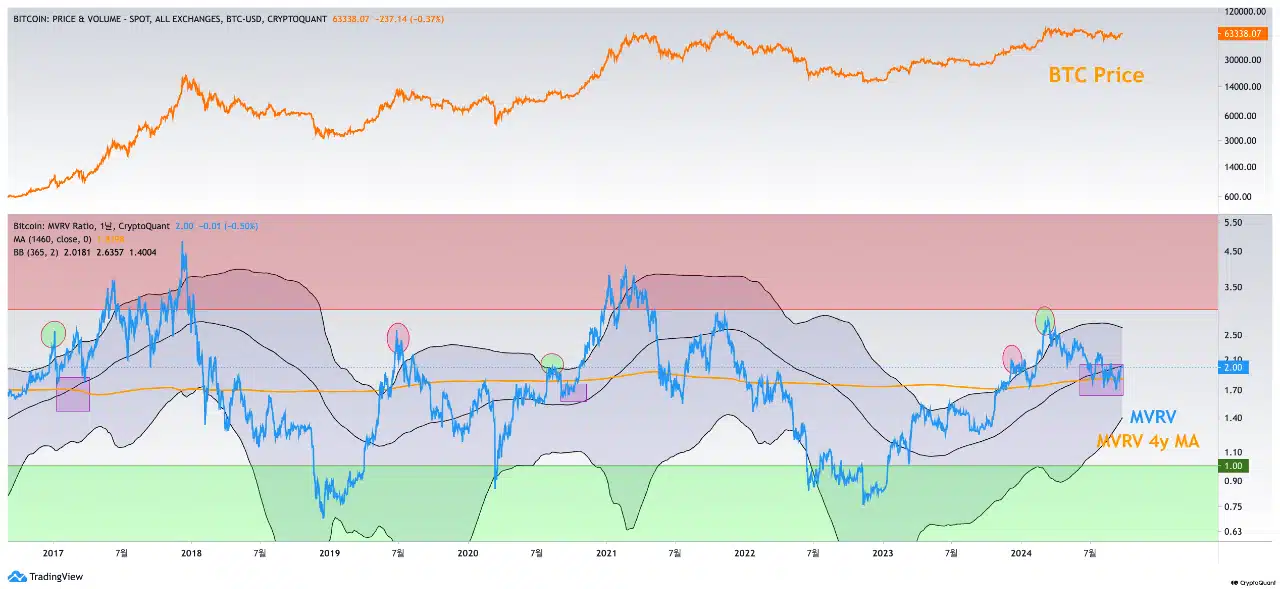

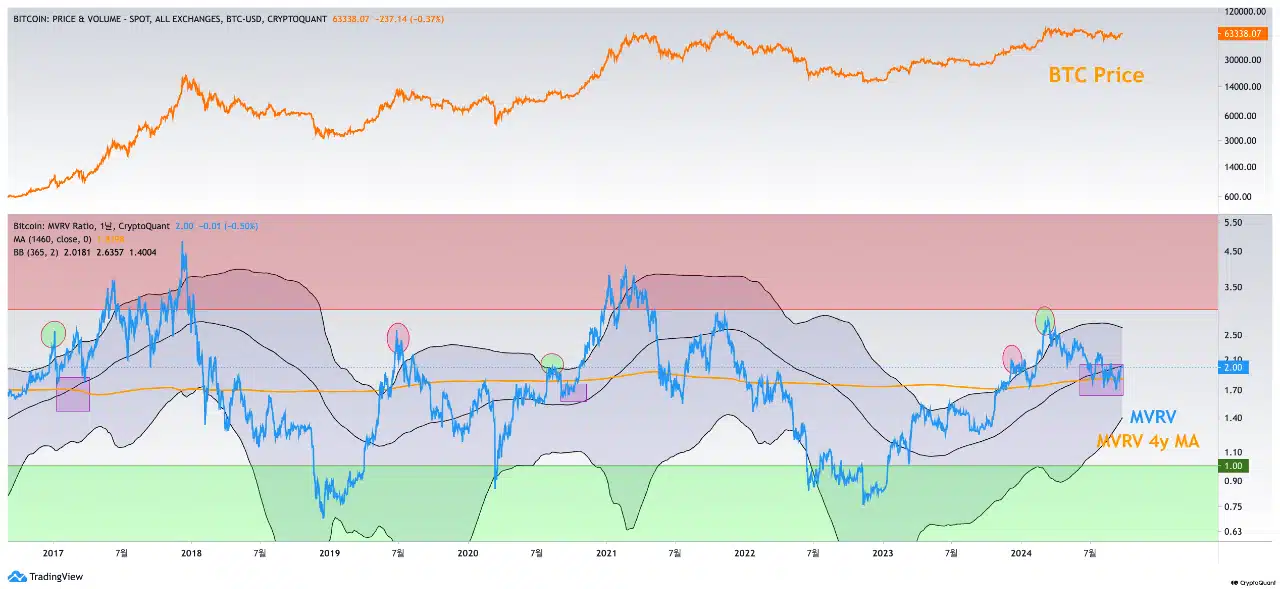

One such analyst, working underneath the pseudonym CoinLupin on the CryptoQuant platform, pointed to Bitcoin’s Market Worth to Realized Worth (MVRV) ratio as a key indicator of the potential course of the market.

The MVRV ratio compares Bitcoin’s market worth to its realized worth, serving to merchants perceive whether or not the asset is overvalued or undervalued at a given cut-off date.

Key indicator for Bitcoin’s development

In a current evaluation, CoinLupin defined that Bitcoin’s 1-year and 4-year MVRV averages have traditionally served as crucial resistance or help ranges throughout varied market traits.

In keeping with the analyst,

“The general market move tends to observe the same sample.”

CoinLupin highlighted that the MVRV ratio, significantly throughout the restoration phases in 2023, supplied worthwhile perception into Bitcoin’s worth fluctuations.

Supply: CryptoQuant

The present market situation reveals a deviation from previous traits.

After a quick interval of “overheating” throughout the current restoration, the value correction for Bitcoin was milder than anticipated, and the consolidation interval has lasted longer than anticipated.

This prolonged interval of consolidation has induced Bitcoin’s MVRV ratio to dip under each its 1-year and 4-year averages.

Whereas this could possibly be a sign of the market being undervalued, the analyst prompt that for Bitcoin to regain robust bullish momentum, the MVRV ratio should rise above its 1-year common.

This might set off a brand new bullish part, resulting in potential positive aspects within the coming weeks.

Open Curiosity and Energetic Addresses

Past the MVRV ratio, different key metrics are additionally price analyzing to find out Bitcoin’s future worth motion.

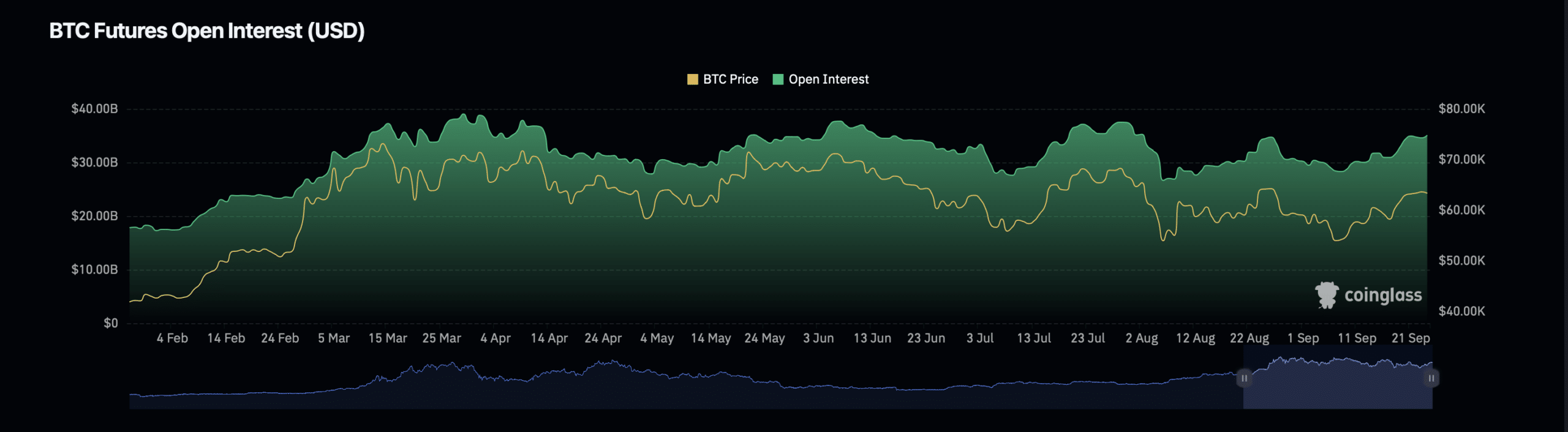

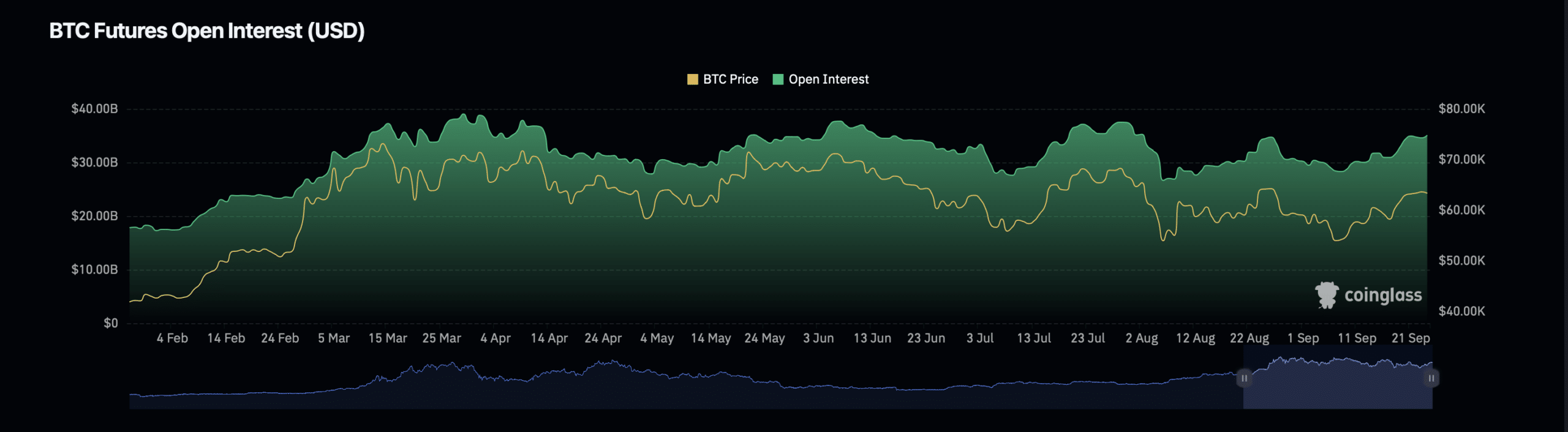

In keeping with data from Coinglass, Bitcoin’s Open Curiosity—an indicator of the variety of open Futures contracts on the asset—has fallen by 0.85% to a present valuation of $34.78 billion.

Supply: Coinglass

This decline in Open Curiosity prompt that market individuals could also be closing positions, doubtlessly signaling warning or uncertainty amongst merchants.

Moreover, Bitcoin’s Open Curiosity quantity, which tracks the full worth of energetic contracts, has plunged by 20.86% to $45.77 billion.

A pointy lower in Open Curiosity typically signifies lowered participation out there, which might dampen worth motion.

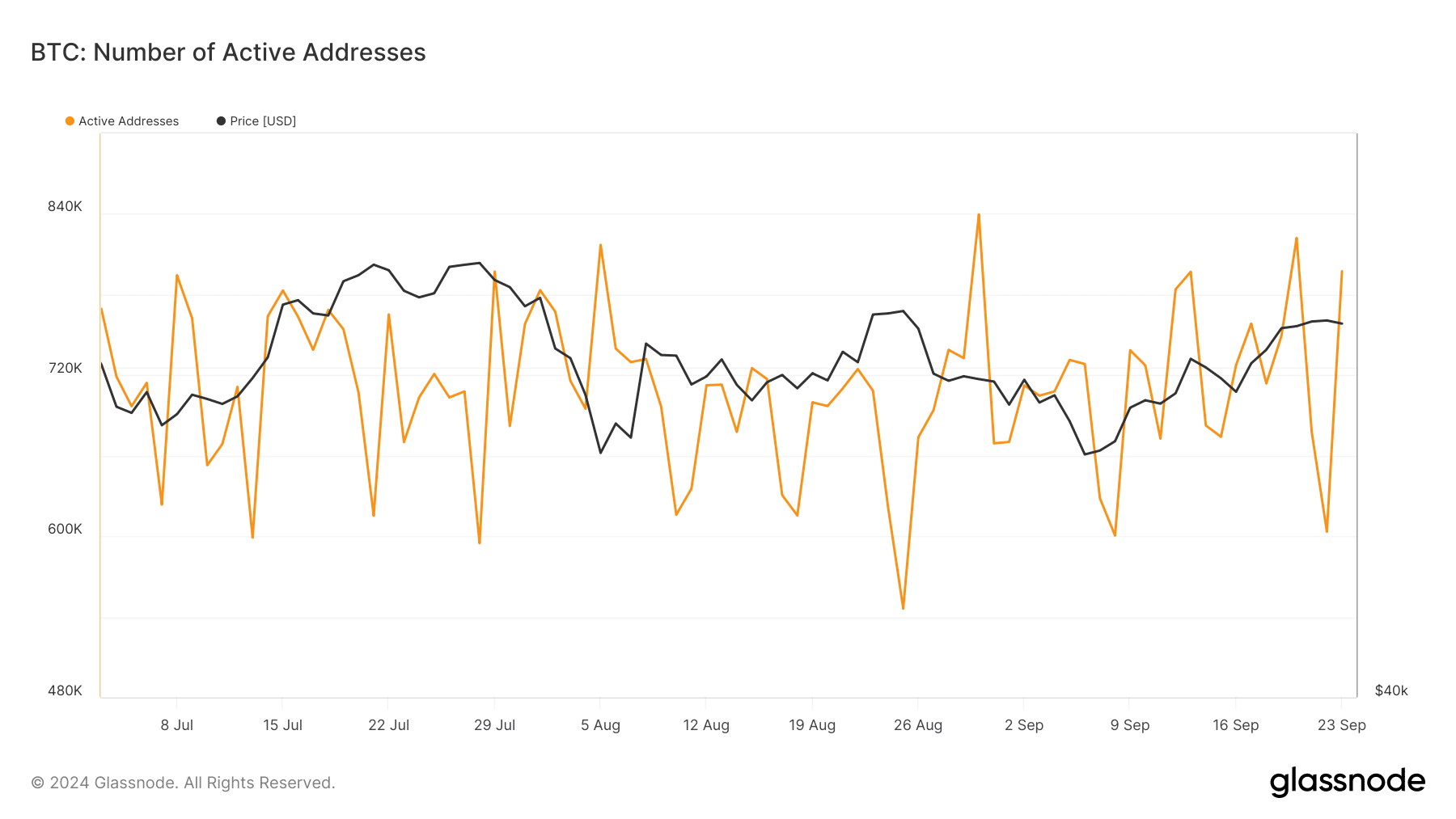

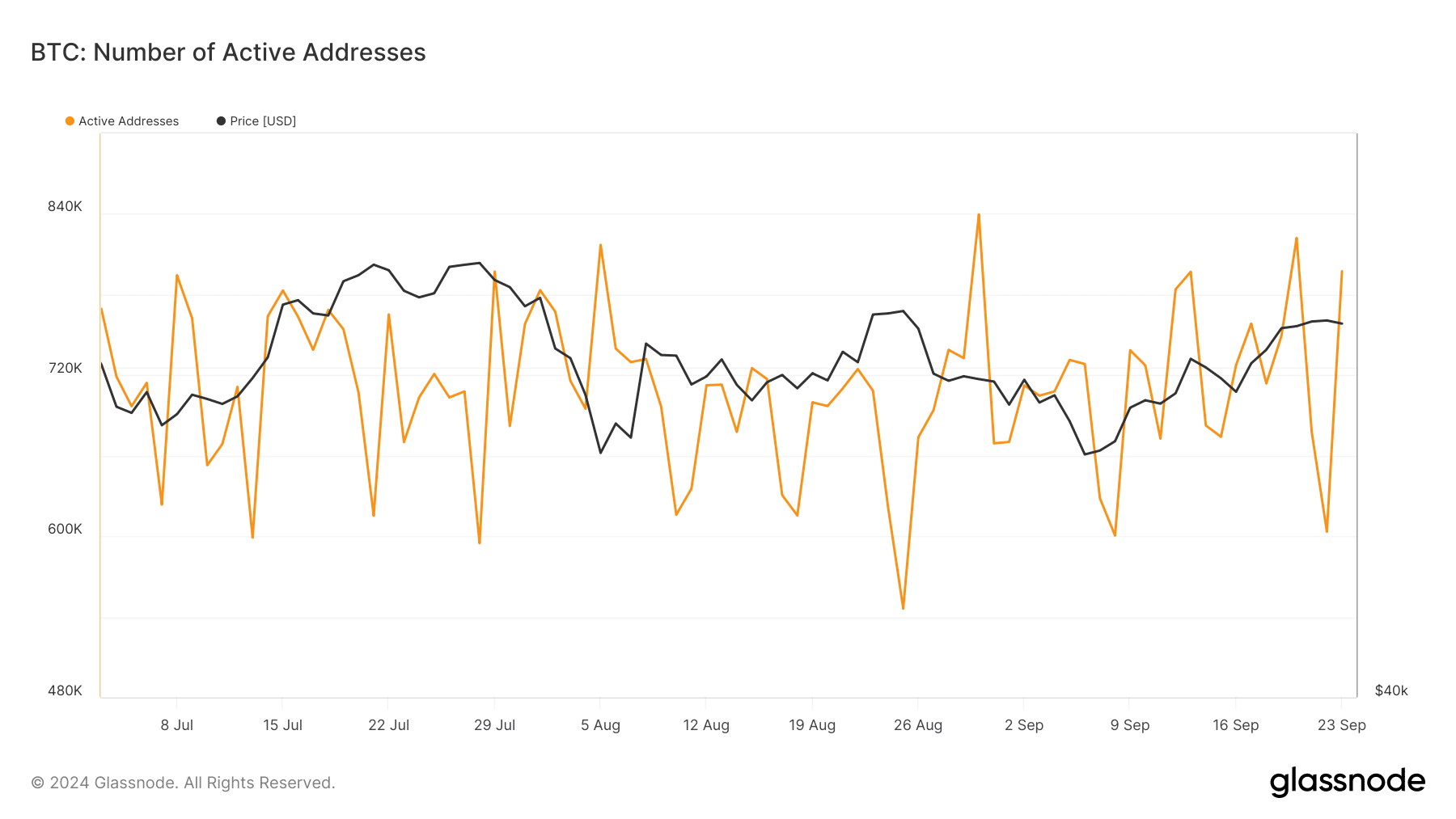

However, data from Glassnode revealed a optimistic improvement in Bitcoin’s energetic addresses, which noticed a major restoration after a steep drop earlier this month.

Bitcoin energetic addresses

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The variety of energetic addresses—an indicator of community exercise—has rebounded from 600,000 to 797,000 as of at present.

This uptick in energetic addresses might point out renewed curiosity in Bitcoin and will doubtlessly sign stronger worth motion forward, particularly as extra individuals interact with the community.