- Bitcoin value hit $71,000, main the market to hit a concern and greed index of 76.

- The liquidation heatmap pinpointed $76.900 as the following goal for BTC.

Bitcoin’s [BTC] value hit $71,000 for the primary time in virtually 40 days, bringing optimism again to the market. The worth enhance aligned with AMBCrypto’s latest evaluation which defined how the bull run was not over.

Past the metrics talked about in that article, there have been different causes BTC recovered. First on the register had been the ETFs. For these unfamiliar, a Bitcoin ETF will not be the identical as BTC.

It, nevertheless, means that an investor has publicity to Bitcoin. As such, if the worth of the cryptocurrency will increase, then the ETF Internet Asset Worth (NAV), which represents the worth of every share, would additionally enhance.

The heavyweights are again

Within the first quarter of 2024, billions of {dollars} flowed into Bitcoin ETFs, prompting the worth to achieve an all-time excessive earlier than the halving. Nonetheless, the issuers failed to draw the king of capital they as soon as had in the course of the first a part of the second quarter.

In consequence, BTC slumped, slipping under $59,00 at one level. Nonetheless, that situation has modified for the higher. As of the twentieth of Might, the full netflow into Bitcoin ETFs was $235 million.

This meant that ARK, BlackRock, Constancy, and Grayscale had registered inflows for 4 straight days. If sustained, Bitcoin’s value might be in line to rise previous $73,000 earlier than the top of Might.

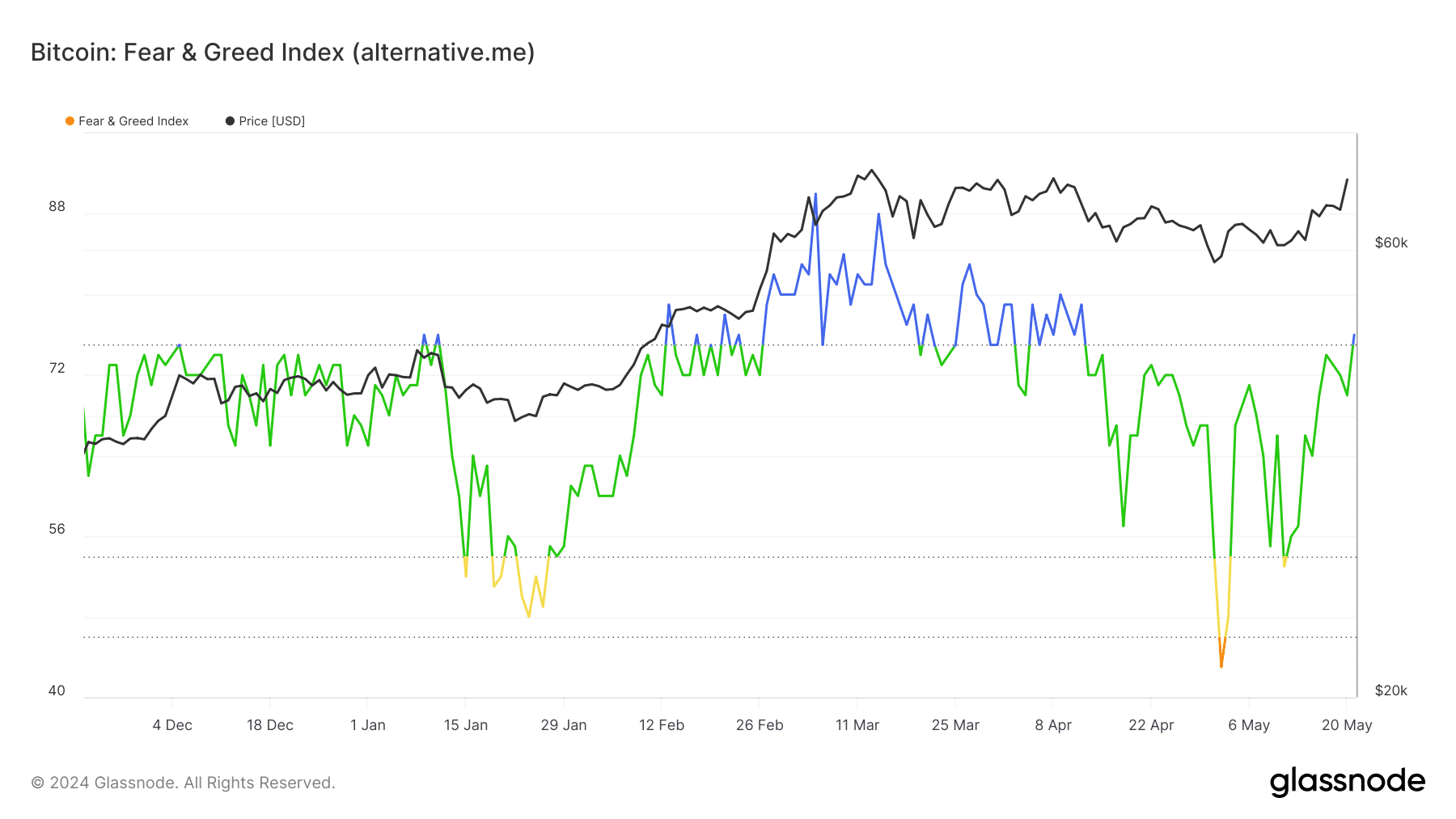

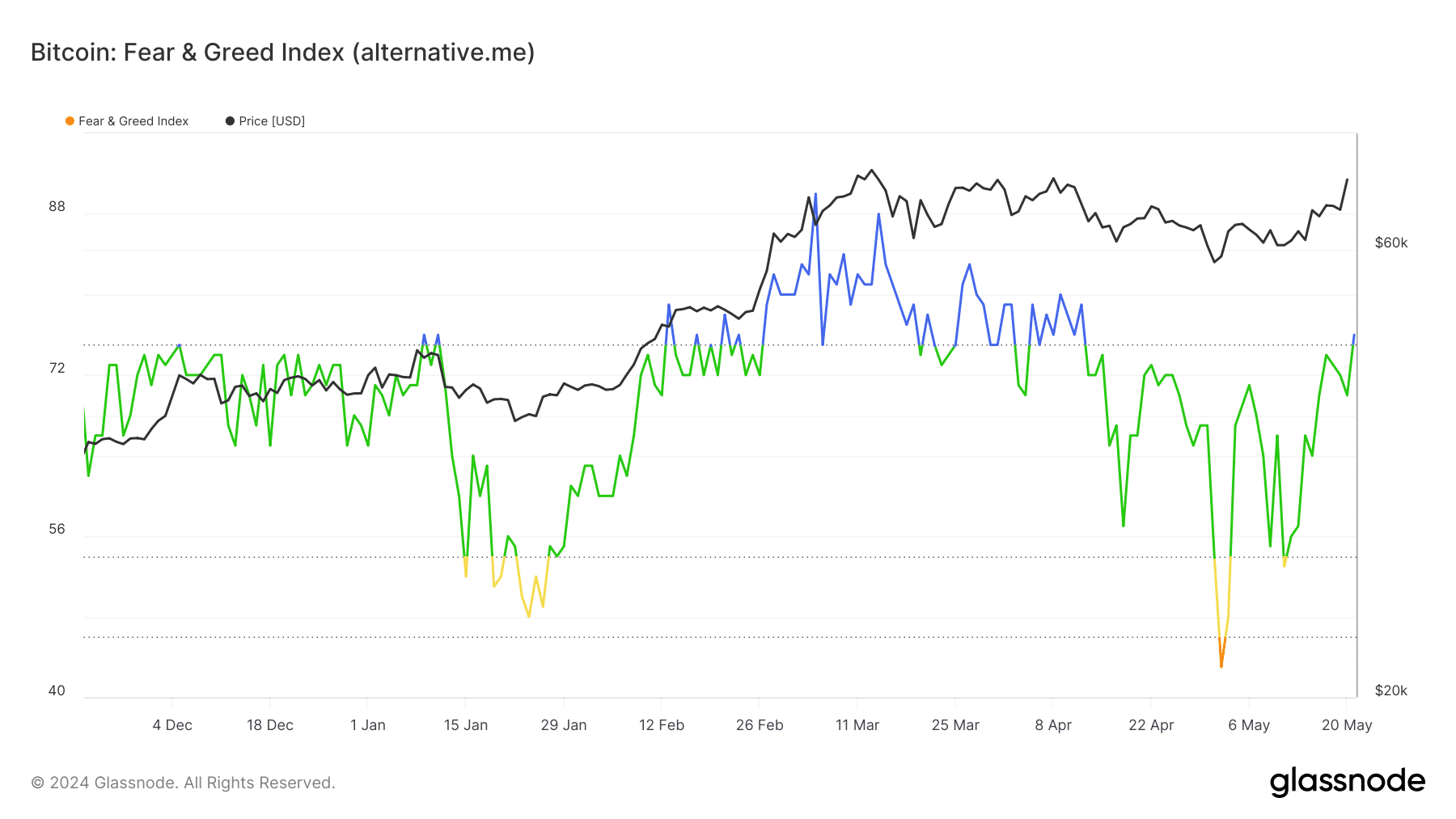

Other than this information, AMBCrypto appeared on the concern and greed index. Based on Glassnode, Bitcoin’s concern and greed index returned to 76— an 8.57% enhance within the final 24 hours.

Supply: Glassnode

This studying, represented by the colour inexperienced, implies the market was within the grasping area. The final time BTC rallied to a brand new excessive, the metric hit 90— an especially grasping (blue) area.

Liquidations pour in: What’s subsequent for BTC?

Because it stands, Bitcoin was not at a degree the place constructive investor sentiment was exaggerated. With this place, the coin value may nonetheless recognize, and rising near $75,000 might be doable in a number of days.

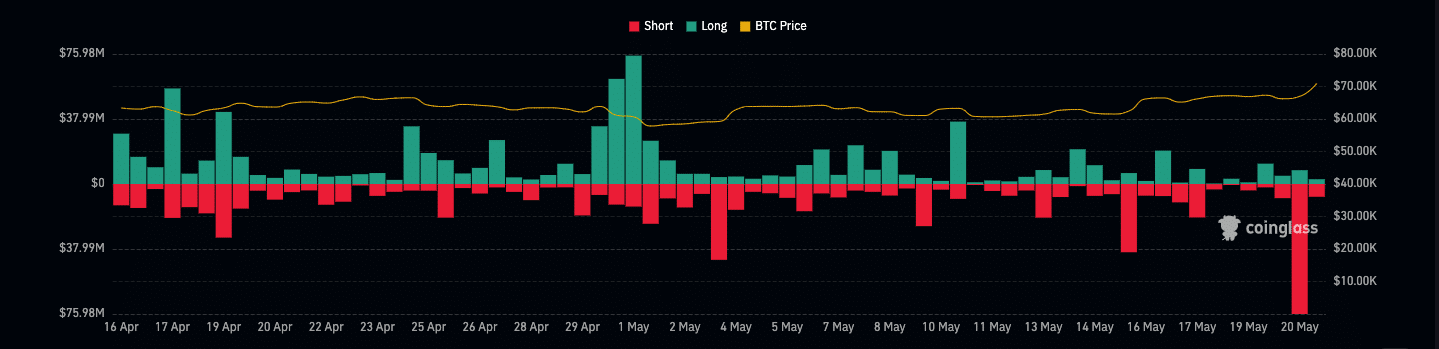

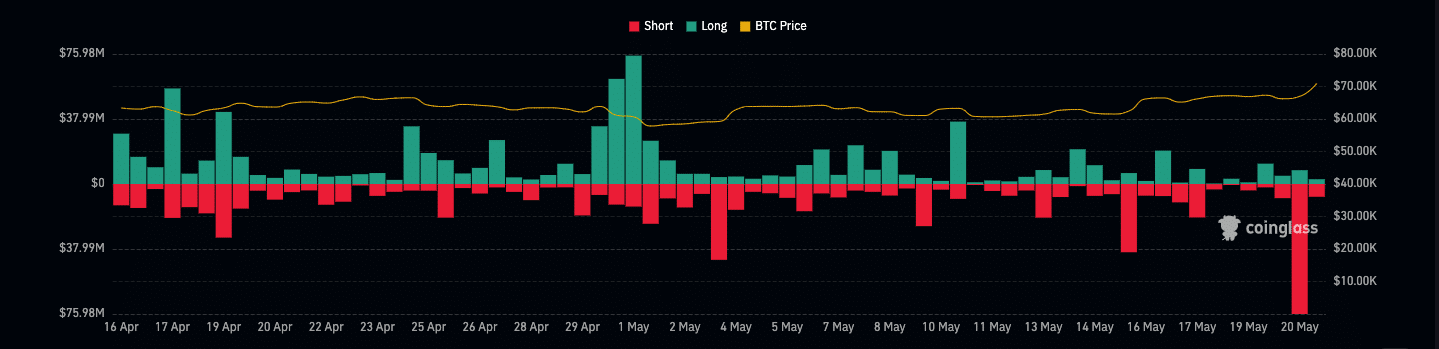

Moreover, it’s noteworthy to say that $96.87 million value of BTC contracts had been liquidated within the final 24 hours. Based on Coinglass, brief liquidations accounted for nearly $80 million whereas the remainder had been longs.

Supply: Coinglass

For context, shorts are merchants betting on the worth of an asset to lower. Longs, alternatively, place bets on a value enhance.

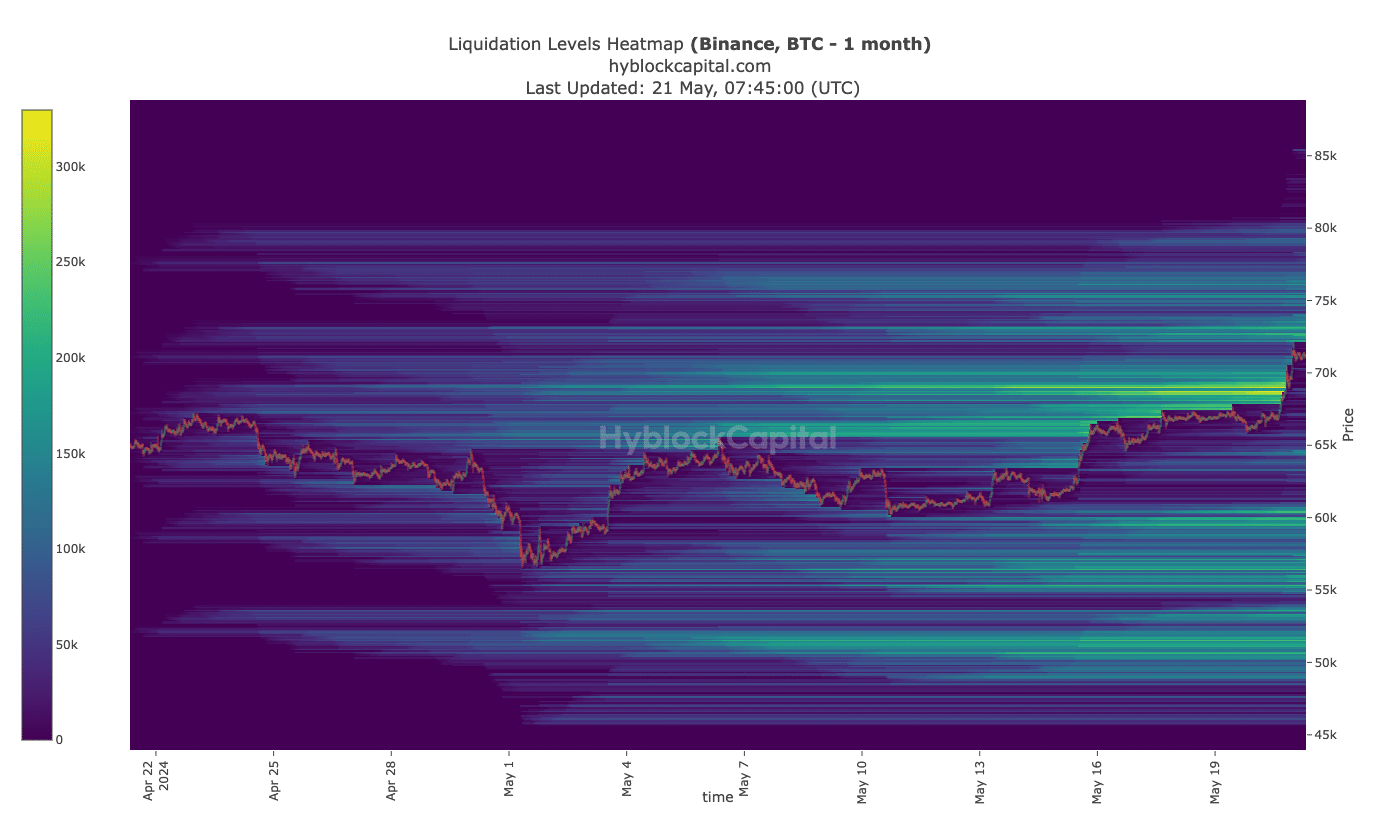

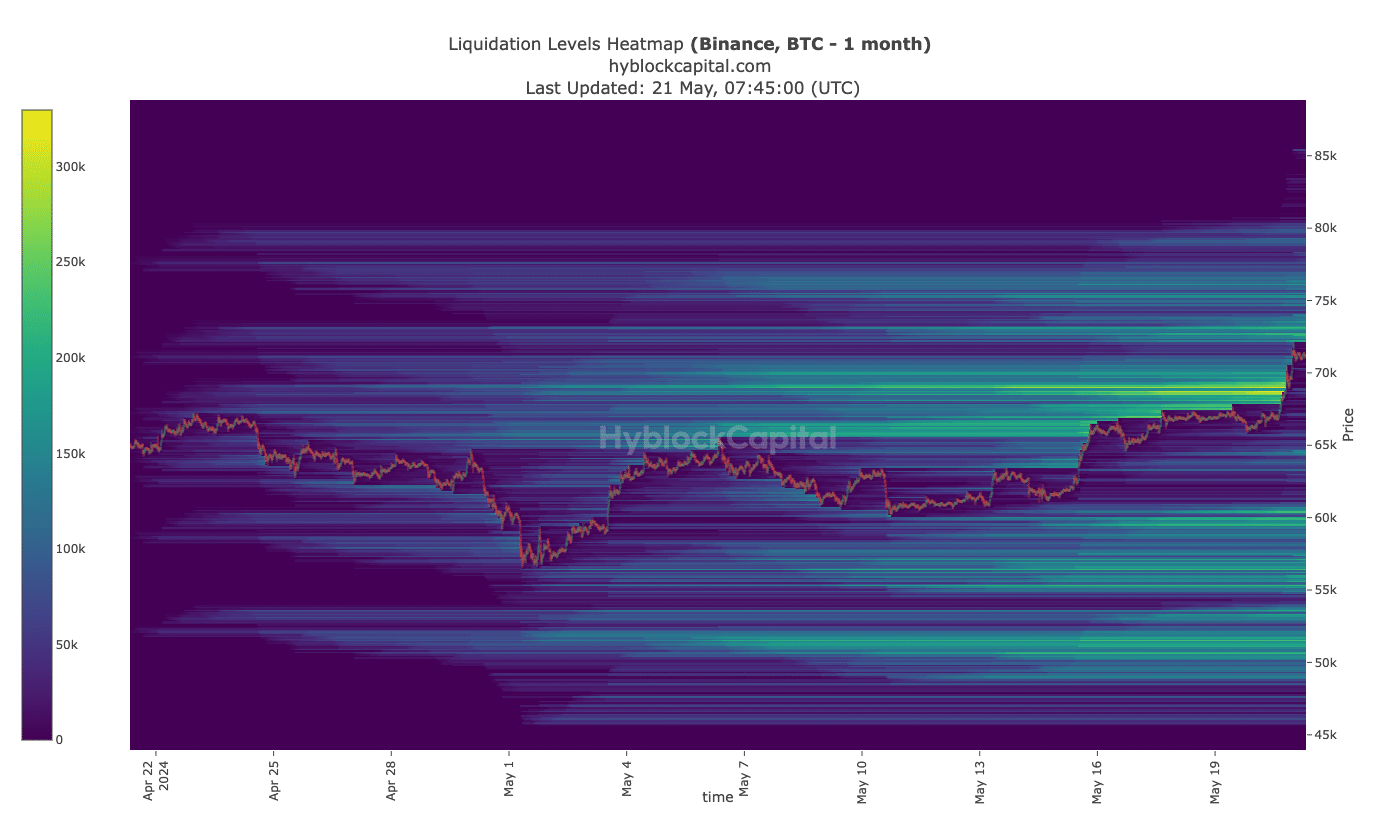

As well as, AMBCrypto analyzed the liquidation heatmap to verify the following degree for Bitcoin’s value to hit. Liquidation heatmap helps merchants to establish areas of excessive liquidity.

Supply: Hyblock

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

If liquidity is concentrated in a area, value may transfer towards the purpose whereas giant liquidations may happen. Based on information from Hyblock, excessive liquidity existed from $73,300 and above.

Subsequently, Bitcoin may squeeze previous its all-time excessive, and a goal of $76,900 might be the following peak it hits.