- Bitcoin has a bullish construction after flipping $67k to help.

- The dearth of quantity may minimize quick an uptrend.

Bitcoin [BTC] has gained shut to three.6% from the lows of Friday the thirty first of Might. Again then, the king of crypto was buying and selling simply above the $67k help degree and confirmed little bullish momentum.

This might need begun to vary. Nonetheless, the buying and selling quantity was unconvincing, and bulls wanted to do far more to drive a convincing breakout. Is the market prepared for a rally, or will we see an prolonged consolidation?

Resolving the conflicting quantity indicators

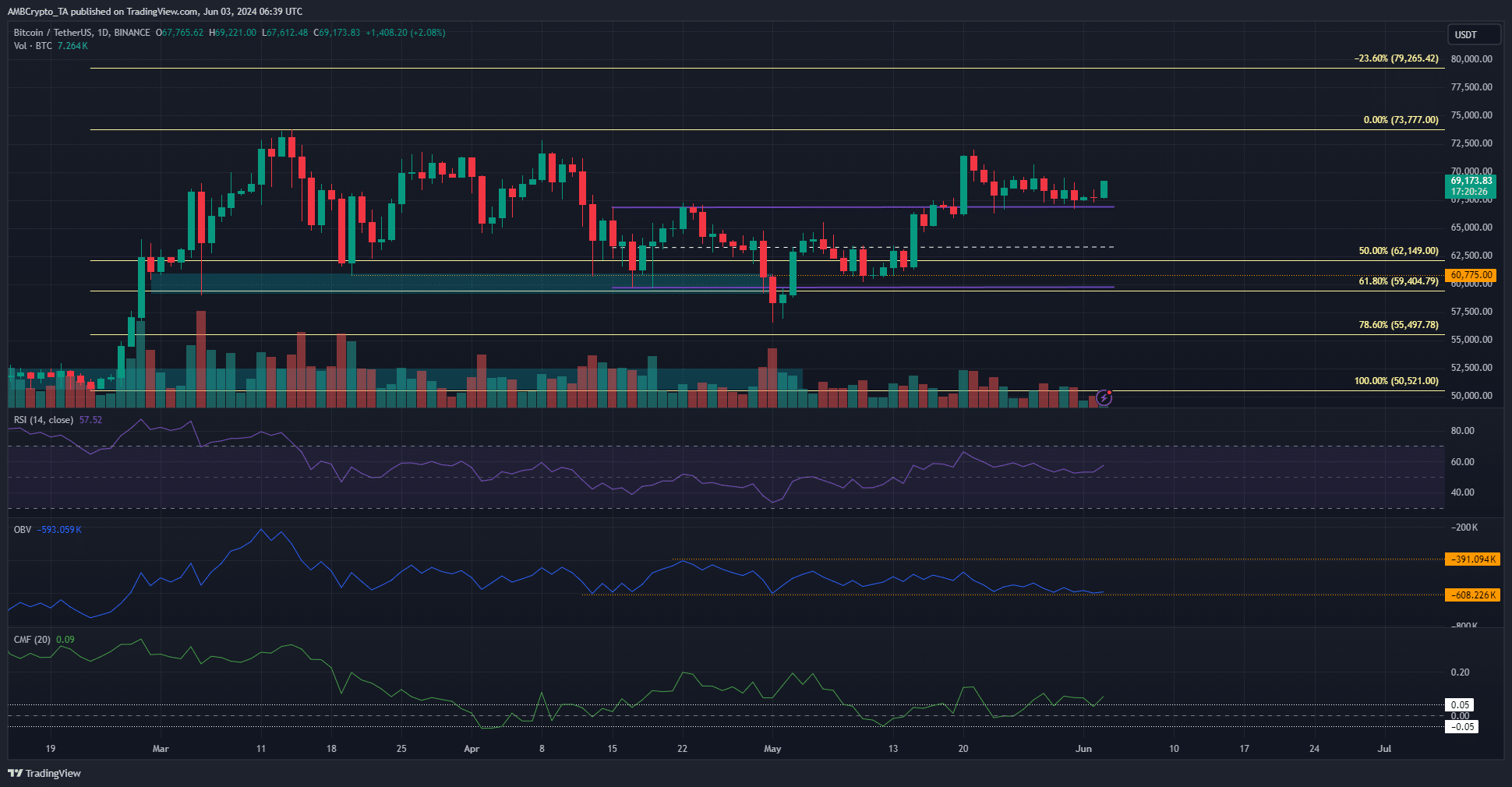

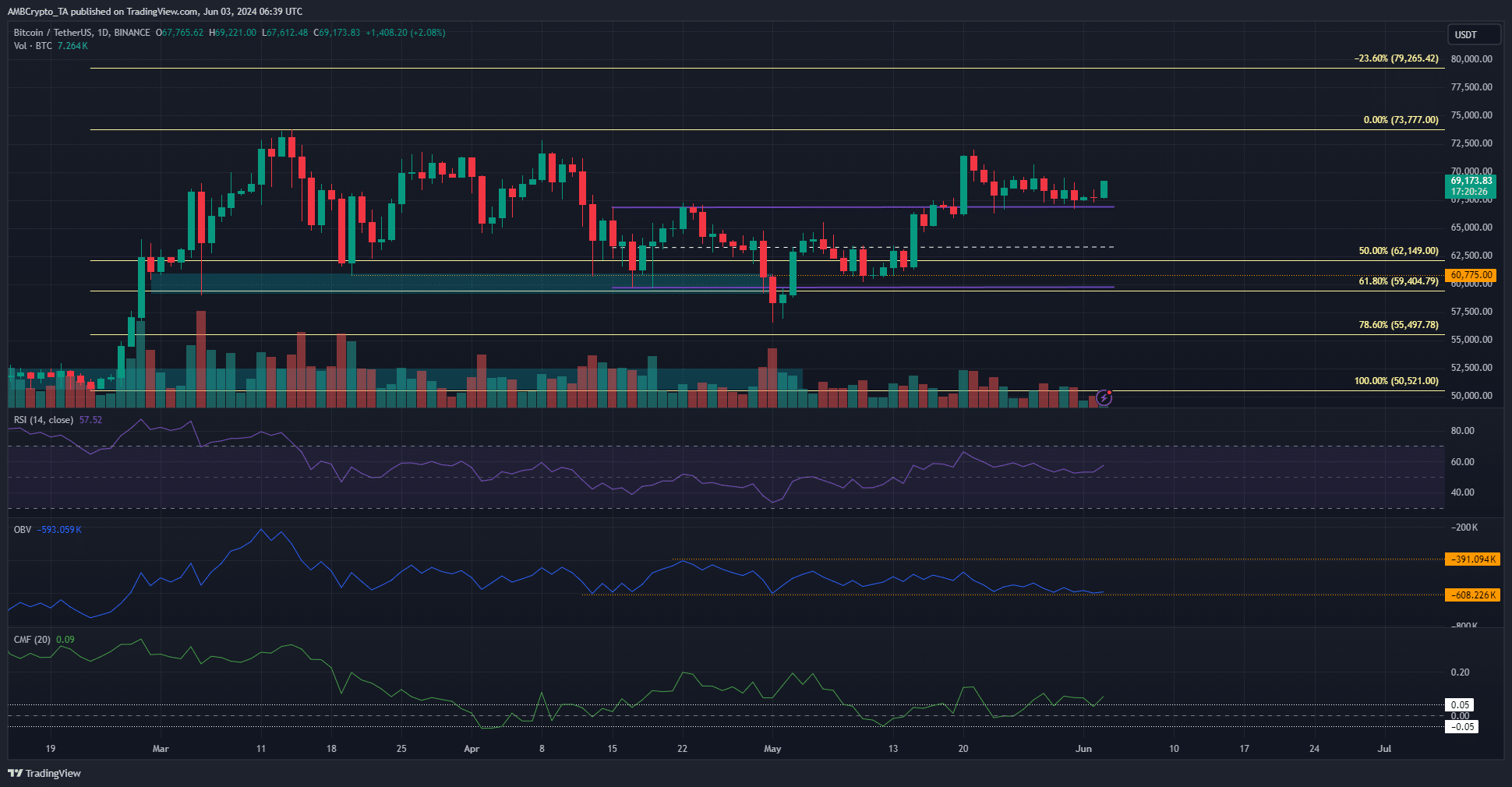

Supply: BTC/USDT on TradingView

The late February rally noticed a retracement to $59k in mid-April. This degree was solely the 61.8% retracement degree and since then BTC has recovered effectively. The RSI on the day by day chart climbed above impartial 50 to sign a shift in momentum.

Nonetheless, regardless of the value’s vary breakout, the OBV was resolutely inside a variety. It was on the lows from April, which was a regarding growth.

It indicated that the latest beneficial properties had been more likely to be worn out rapidly as a result of lack of shopping for stress.

Conversely, the CMF jumped above +0.05 to spotlight important capital inflows. The quantity indicators opposed one another’s findings.

Total, whereas the bullish bias was stronger, the shortage of buying and selling quantity prior to now two weeks weakened Bitcoin value prediction’s bullish arguments.

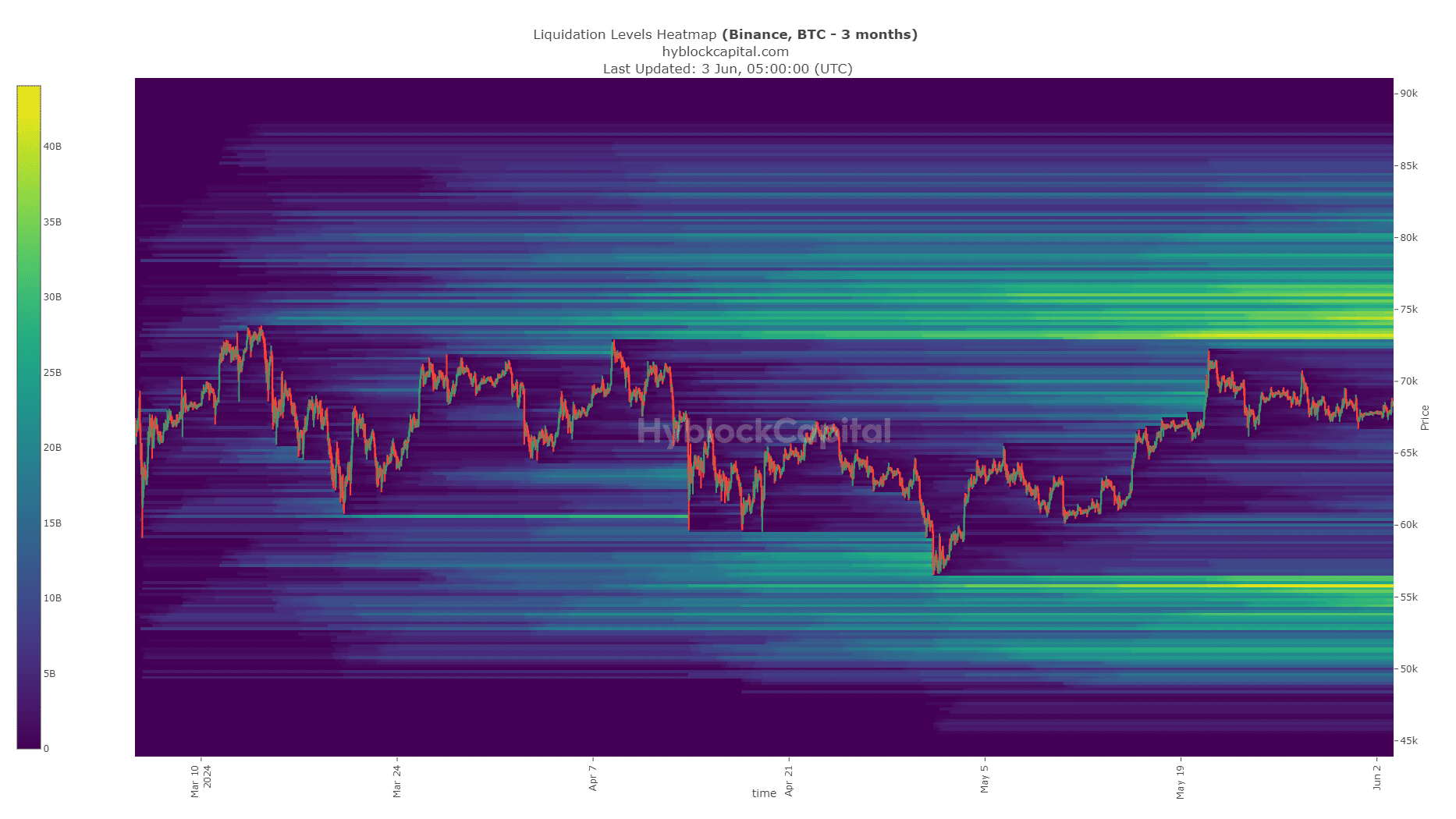

The liquidation cluster may pull BTC towards $75k

The big cluster of liquidation ranges at $73k-$75.2k is more likely to act as a powerful magnetic zone for Bitcoin costs. To the south the $65.6k area was additionally a area of curiosity.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The dearth of buying and selling quantity meant the Bitcoin value prediction is consolidation across the $70k area for this week, and even longer.

Till the quantity expands and costs can breach the $73.5k area, merchants and buyers can count on a variety formation to take maintain.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.