- BTC may hike to $67,269 within the first section of the projected upswing

- The liquidation ranges confirmed a bearish bias which will quickly be invalidated

Issues might need modified for Bitcoin [BTC] after the completion of its 4th halving. Nevertheless, when it comes to its value, the extra issues change, extra they continue to be the identical. AMBCrypto got here to this conclusion after monitoring its coin transfers to spinoff exchanges. In line with information from CryptoQuant, the variety of BTC despatched to spinoff exchanges has elevated considerably.

Particularly, we noticed that this has been the handwork of whales. Traditionally, when this occurs at a quick fee, it implies that whales are getting ready to open lengthy Bitcoin positions.

Supply: CryptoQuant

Large weapons have gotten aggressive

Pseudonymous on-chain analyst datascope additionally commented on the exercise. In line with datascope who shares his ideas on CryptoQuant,

“The rise in switch charges of Bitcoin from exchanges to spinoff exchanges is taken into account an necessary indicator. Current information signifies that these kinds of transfers have been a big issue within the rise of Bitcoin costs.”

Bitcoin’s value, at press time, was $63,572, Right here, it’s price noting that earlier than the halving, AMBCrypto had argued that the primary cryptocurrency may already be priced in.

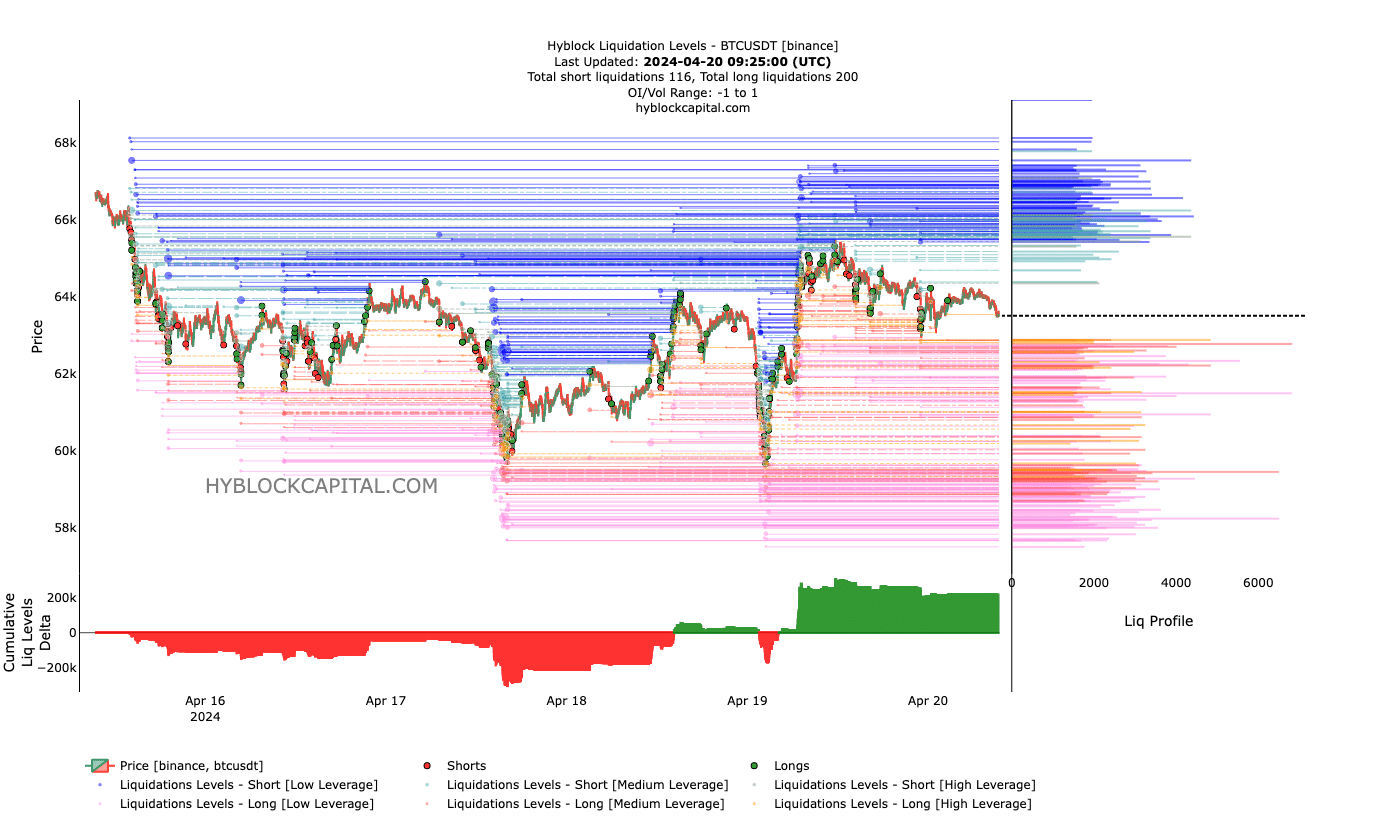

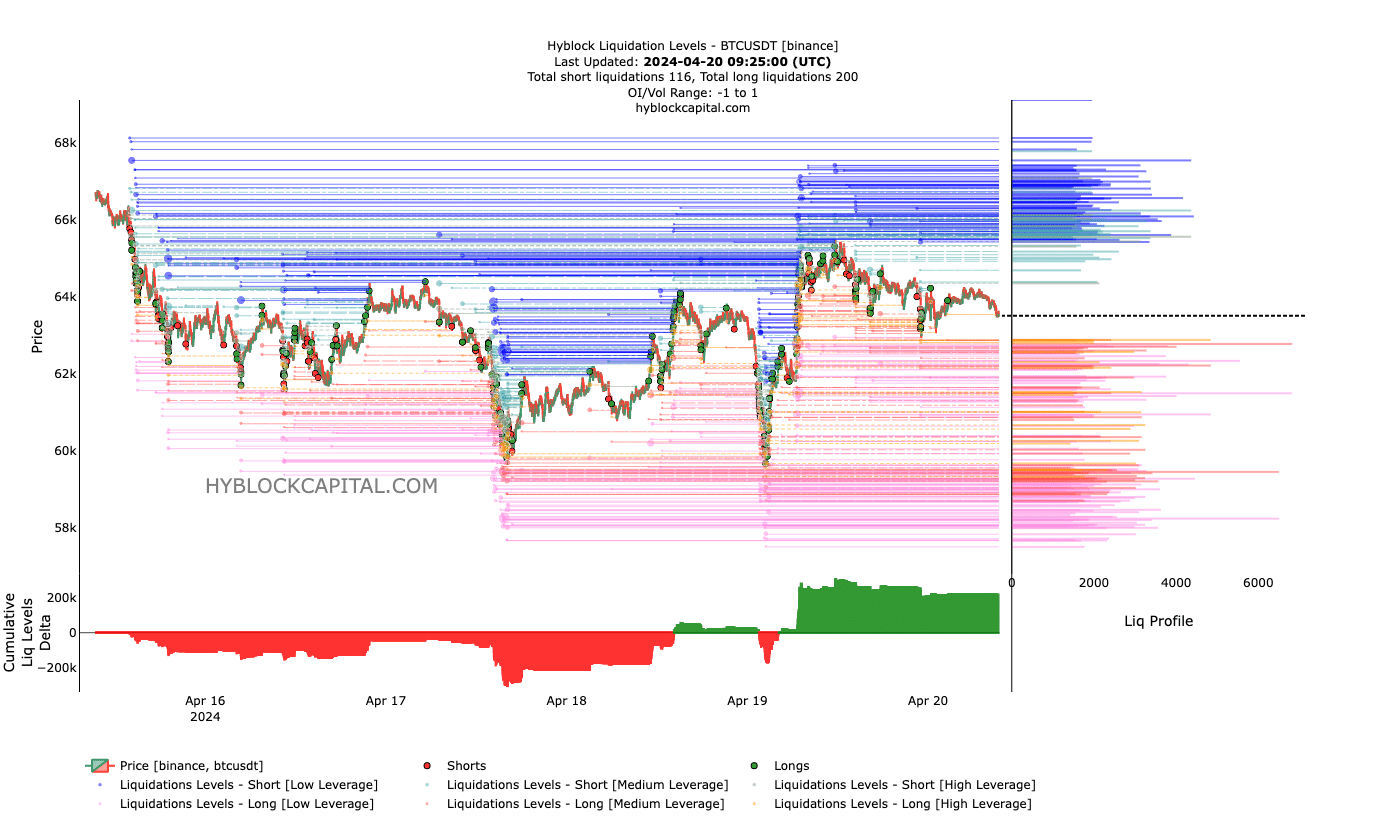

Nevertheless, the stalemate may change to the upside based mostly on our newest evaluation. The liquidation ranges are one indicator fueling this prediction.

Liquidation ranges revealed estimated value ranges the place a liquidation occasion may happen. For context, liquidation occurs when an alternate forcefully closes a dealer’s place. That is both as a result of an inadequate margin steadiness or a high-leveraged guess that went in the wrong way.

At press time, a cluster of liquidity appeared from $65,434 to $67,269, suggesting that Bitcoin’s value may goal these ranges within the brief time period.

One other factor we seen was that there was aggressive shopping for because the drop beneath $64,000. If the shopping for strain will increase, longs with low leverage is perhaps rewarded quickly.

Bears gained’t survive what’s coming

Lastly, we thought of the Cumulative Liquidation Ranges Delta (CLLD). On the time of writing, the CLLD was constructive. Unfavorable values of the CLLD point out extra brief liquidations.

Quite the opposite, a constructive studying implies that there have been extra lengthy liquidations. Nevertheless, this indicator additionally has some impact on the value.

Supply: Hyblock

From the indications above, it may be seen that the CLLD revealed a bearish bias. Nevertheless, whales’ getting into their orders with the present liquidity may reverse the sign.

On this state of affairs, the value may fall and set off some cease losses. And but, as soon as part of the liquidity has been flushed out, the value may start to make its method again up.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Ought to this be the case shifting on, Bitcoin may rally, and hitting $75,000 could possibly be an possibility within the mid-term. Within the brief time period, nonetheless, BTC may drop decrease than $63,000 earlier than the pump begins a lot later.