- Market sentiment was bearish over the past 4 months as BTC confronted constant rejections from native highs

- Promoting strain has not abated and will power one other main southbound transfer

Bitcoin’s [BTC] 2024 halving occurred on 19 April. Since then, nevertheless, the promised bull run is but to materialize. At press time, the Crypto Fear and Greed Index had a studying of 46 – An indication of impartial sentiment.

On the weekly chart, Bitcoin continues to current a bearish construction, with BTC setting decrease highs and decrease lows since late Might. Insights into stablecoin flows strengthened the bearish view of the crypto-market over the approaching weeks.

Suspicions of a deeper worth correction

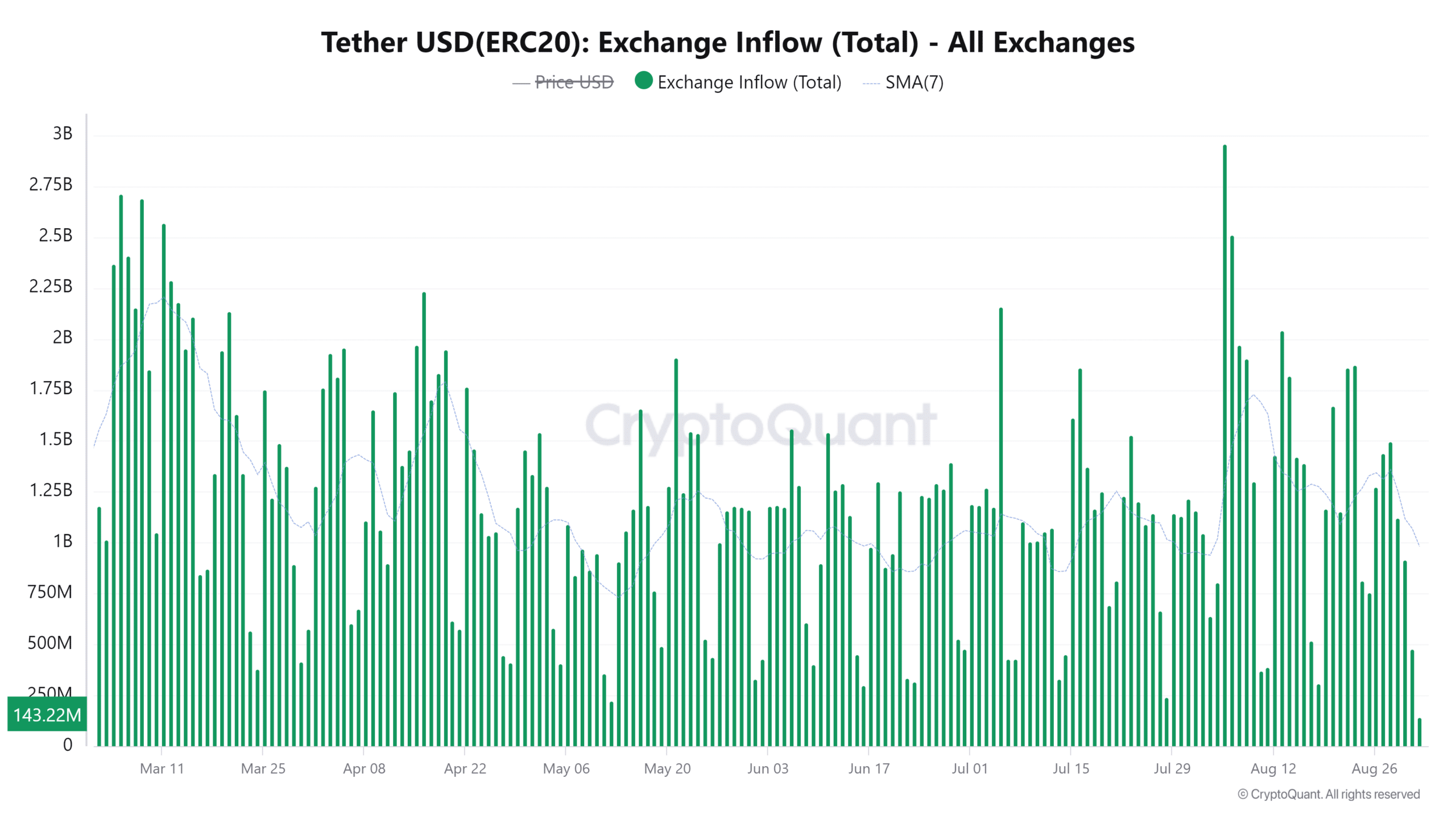

In a CryptoQuant Insights submit, fashionable analyst theKriptolik famous that there was a giant decline within the inflows of Tether [USDT] to exchanges. AMBCrypto regarded carefully on the charts and located that the stablecoin alternate inflows have been at a six-month low.

When Bitcoin and the broader crypto market expertise a big worth drop, stablecoin inflows are inclined to ramp up by a big quantity. That is indicative of consumers utilizing the dip so as to add to their crypto holdings.

The newest, sharp worth drop occurred on 5 August when Bitcoin fell from $58.3k to $49k – A 15.9% drop. On that day, the stablecoin inflows stood at $2.9 billion.

Due to this fact, the truth that we noticed unremarkable Tether alternate inflows when BTC fell beneath $60k could be interpreted as alarming information. It implied that sensible cash was ready for a a lot deeper worth drop earlier than coming into the market.

How low can the subsequent transfer go?

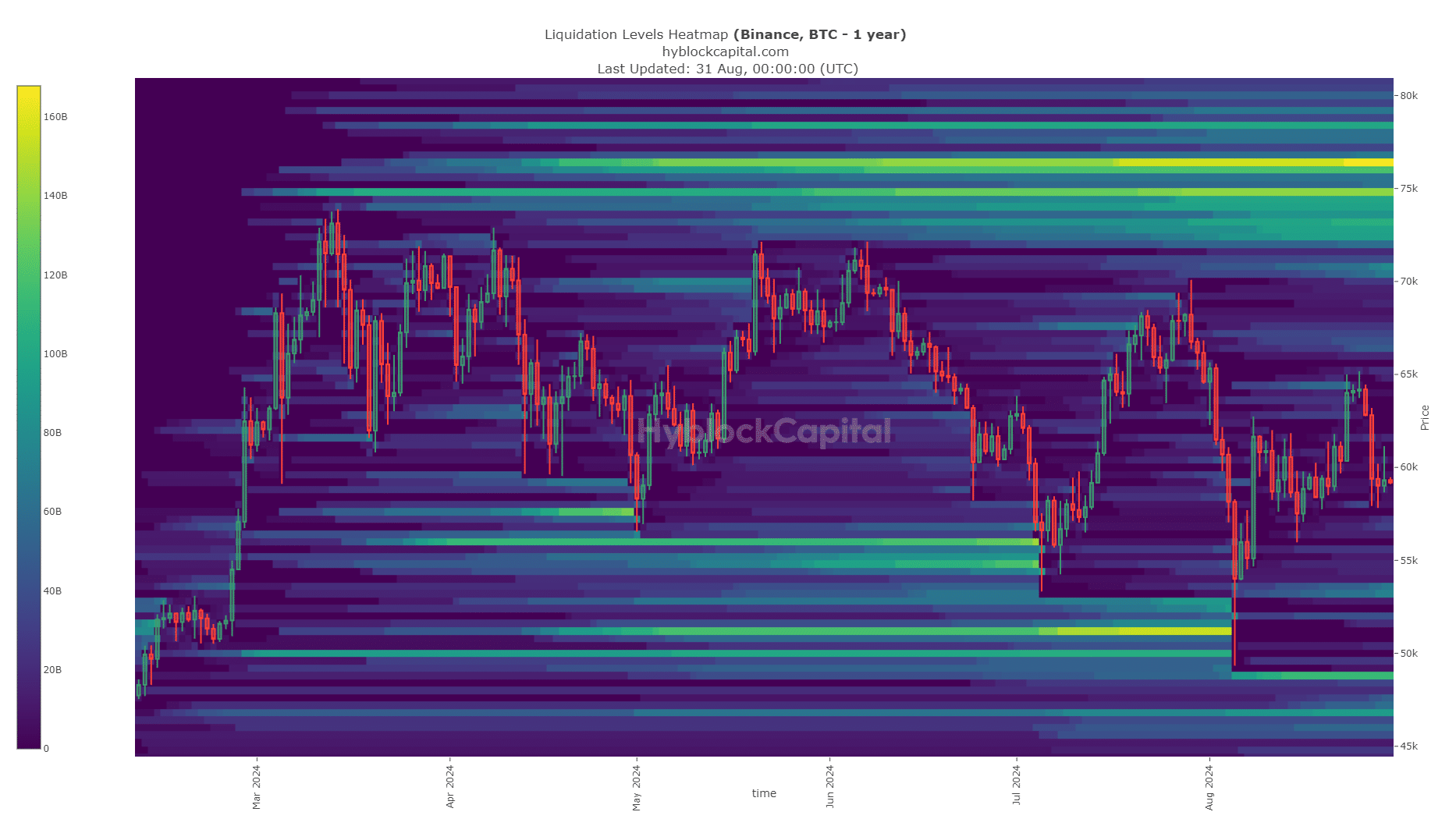

AMBCrypto’s evaluation of the liquidation heatmap revealed that the subsequent important magnetic zones for Bitcoin can be at $48.8k and $46.6k. Additionally, there gave the impression to be a pocket of liquidity at $53.6k. These ranges can be the targets for BTC in case of a worth drop beneath $56k.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

A latest report warned {that a} plunge beneath $56k might result in a a lot deeper correction. The bull-bear market cycle confirmed bearish dominance, and the findings from the Tether alternate flows strengthened this bearish view.