- Bitcoin has a bearish short-term outlook with its collection of decrease highs previously month

- The drop to $56.5k meant the liquidity under it will seemingly be examined quickly

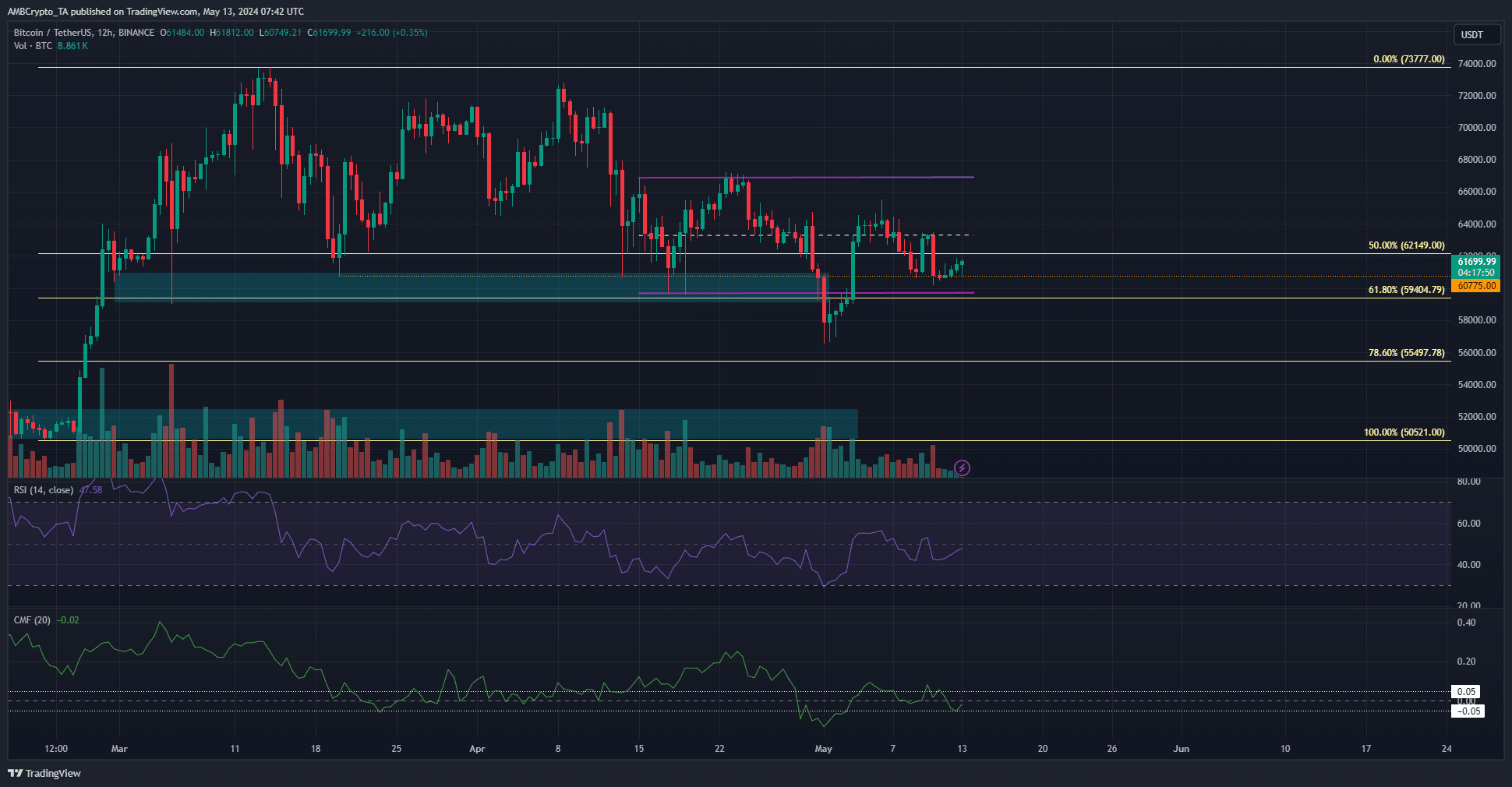

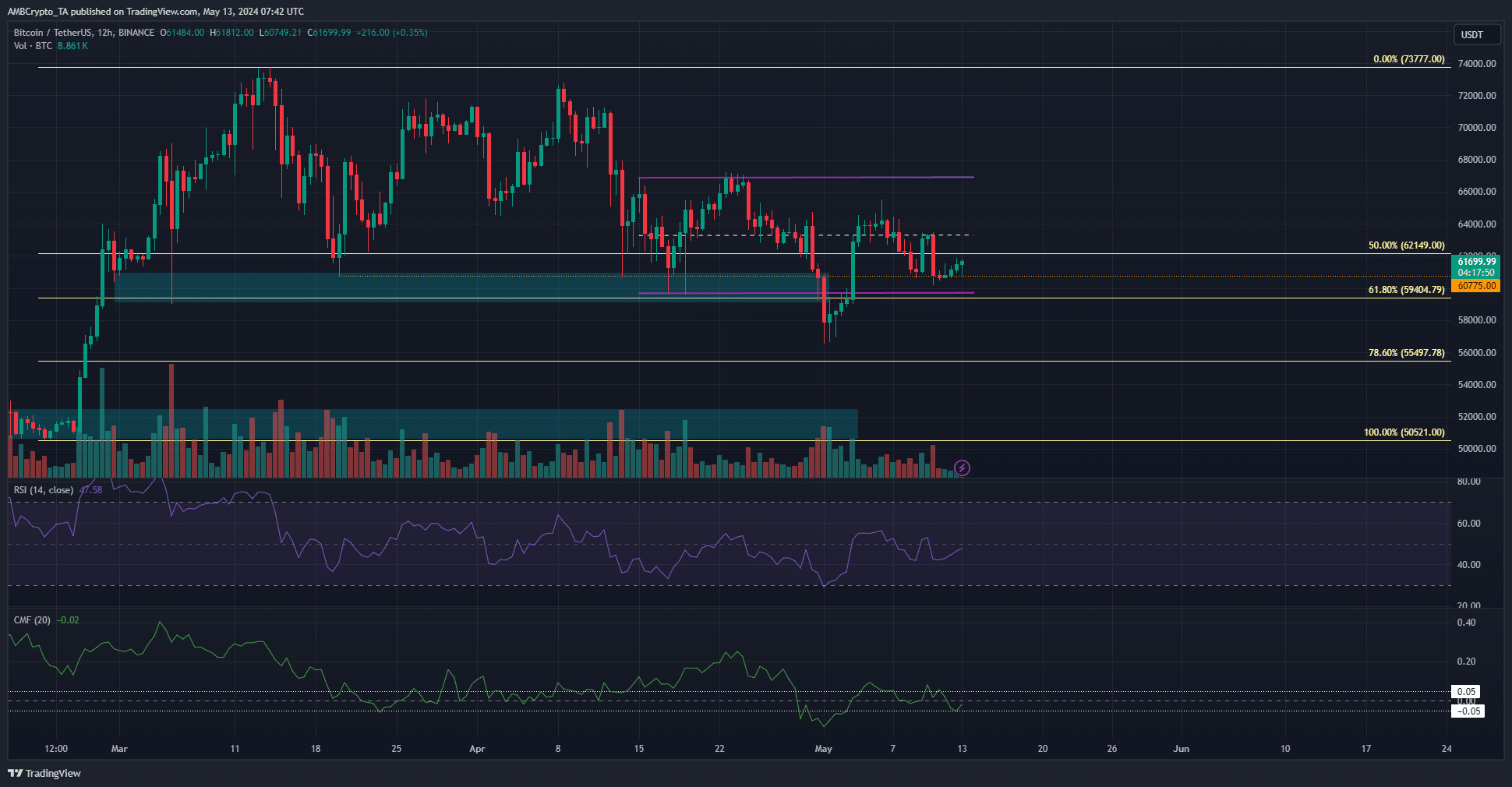

Bitcoin [BTC] clung to the $60.7k assist stage over the weekend, however its short-term bearish expectation held weight.

A latest AMBCrypto liquidity evaluation confirmed the place a value reversal might happen for this week’s value motion.

Information of two dormant wallets, inactive for almost 11 years, waking as much as promote BTC price $60.9 million might spook market members. The report additionally highlighted a drop in key on-chain Bitcoin metrics.

The capital inflows for BTC confirmed indecisiveness

Supply: BTC/USDT on TradingView

The vary formation was breached conclusively on the first of Could, when Bitcoin dropped like a rock to $56.5k. Regardless that it bounced to $65.5k per week later, its decrease timeframe market construction was bearish.

AMBCrypto’s Bitcoin value prediction leans towards a drop to the $56k mark and probably decrease. At press time, it possessed regular downward momentum, signaled by the RSI’s studying of 47.

The worth has fashioned decrease highs since mid-April.

The 78.6% HTF Fibonacci retracement stage at $55.5k could be revisited earlier than the underside is in. It’s unclear how issues would unfold, however merchants and traders must be ready for this state of affairs.

The spot CVD disagreed with the CMF indicator’s findings

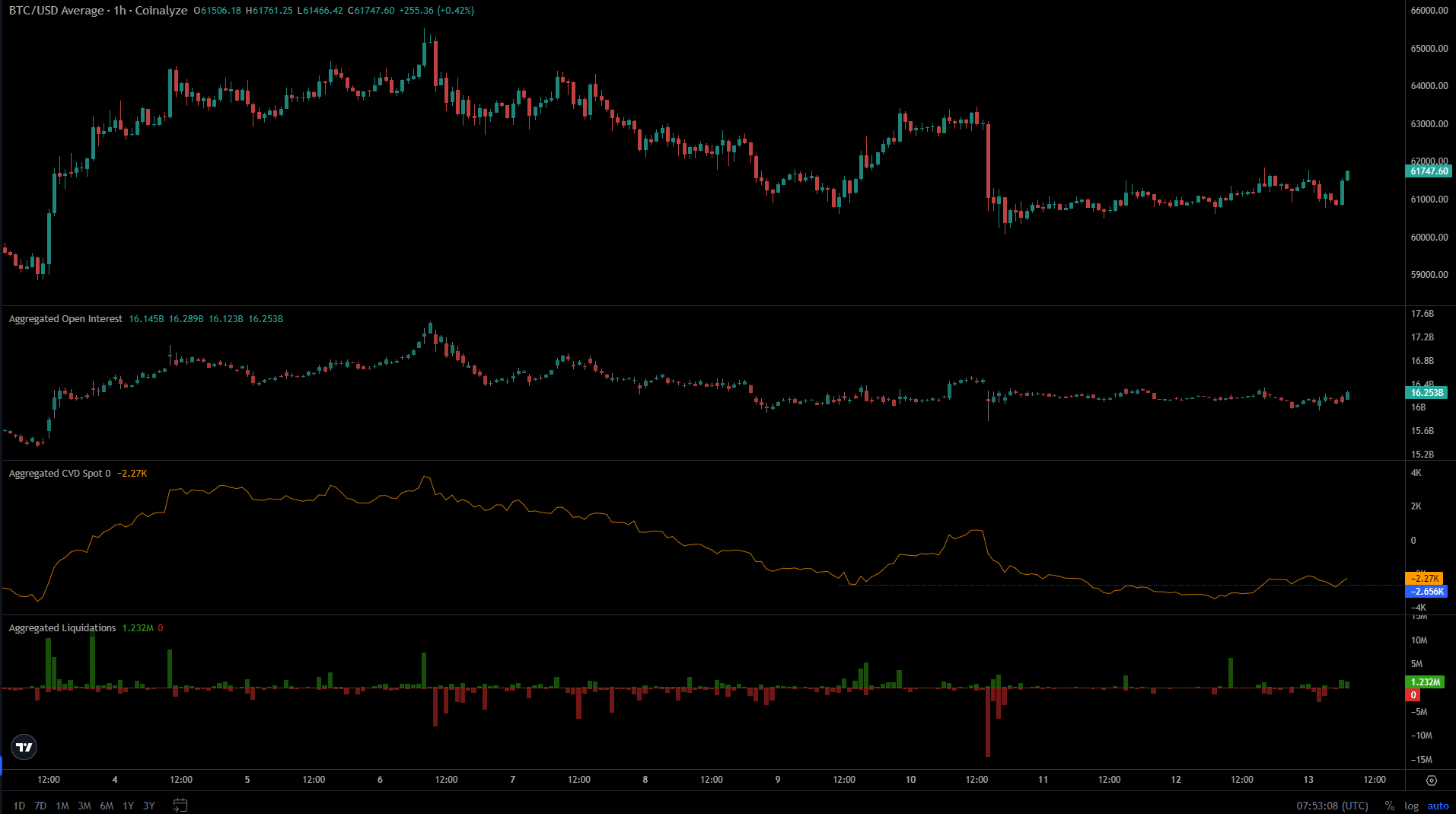

Capital influx and bullish conviction are vital for an asset to development upward. The Open Curiosity chart has been passive and lackluster over the previous week as Bitcoin additionally struggled to kind a development.

Nevertheless, the spot CVD started to climb larger, and reclaimed a former short-term assist stage.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This indicated shopping for stress within the spot markets. Moreover, the previous two days noticed brief positions liquidated.

This pressured market purchase orders of the liquidated place and, if the development continues, might see Bitcoin bounce larger.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.