- U.S CPI information rose to 0.3%, barely beneath the anticipated 0.4% in April.

- Market noticed some reduction after April’s sluggish inflation studying, with BTC leaping by +5%

Threat-on markets, together with Bitcoin [BTC], noticed some reduction after United States’ CPI information revealed that inflation didn’t get a lot worse in April.

In keeping with the U.S Bureau of Labor Statistics (BLS), CPI (Shopper Worth Index) rose 0.3% in April, barely decrease than the anticipated 0.4%. CPI is a key information level for Fed price choices and tracks what customers pay for items and companies to gauge inflation.

The truth is, the studying advised that inflation cooled barely in April, giving the markets a much-needed breather after numerous muted worth motion.

Bitcoin swings, eyes the short-term provide at $65K

AMBCrypto lately lined how this week’s Fed calendar and bigger macro occasions might have an effect on BTC worth motion. The decrease studying from the CPI boosted risk-on markets, with BTC main the fray.

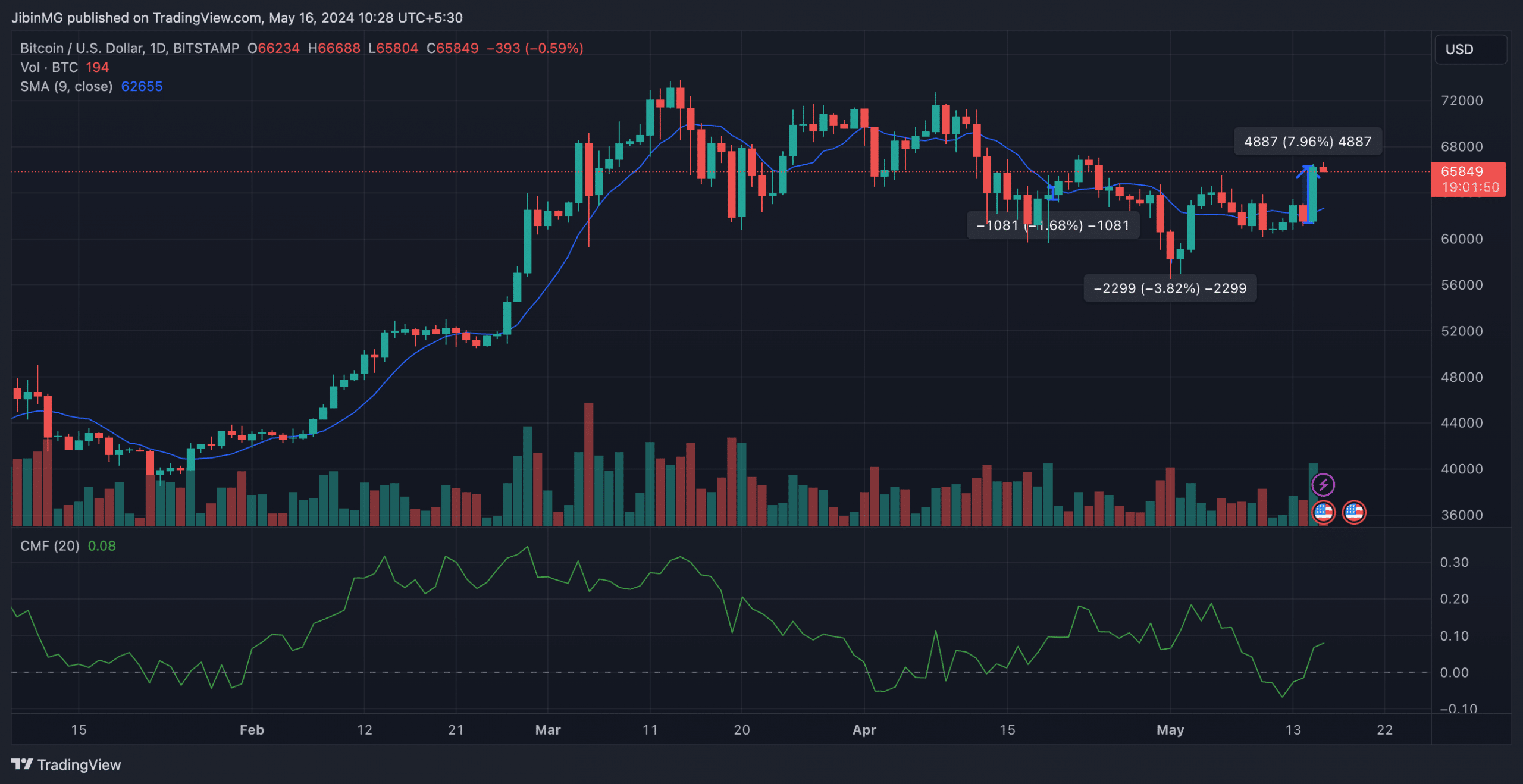

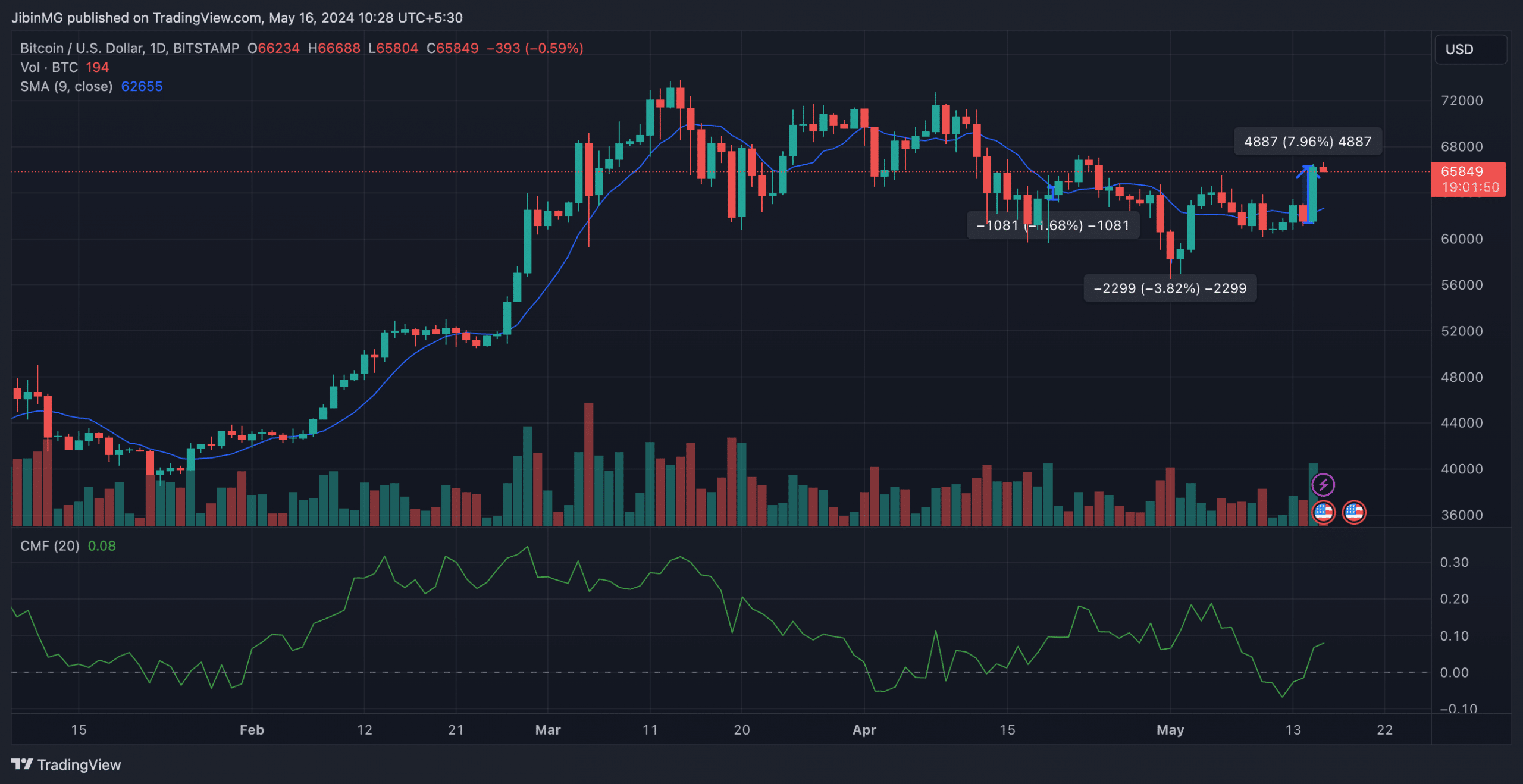

On the worth chart, the king coin rallied by over 5% and cleared its short-term spot provide (resistance) stage at $63k. On the time of writing, it was buying and selling at a worth nicely previous $65,000.

Supply: BTC/USD, TradingView

The aforementioned transfer might flip BTC’s market construction to bullish on the decrease timeframes (LTF), particularly on the 4H chart, if the candlestick closes above it. It’s price noting, nonetheless, that the market construction on greater timeframes stays bearish until BTC decisively closes above $66k.

Pseudonymous crypto-trader and analyst, Skew, shared the same projection after the CPI information was launched. After Bitcoin appreciated previous $63,000, the dealer famous,

“Spot provide round $65K now. Skinny spot books, so spot taker circulation can be important with a view to development with bullish pricing to this point in danger property”

Moreover, the dealer marked $63k and $63.5k as key worth ranges for a draw back transfer.

Wait and watch

Regardless of the marginally decrease CPI studying, the Fed might await a affirmation of sluggish inflation earlier than chopping rates of interest although.

Since BTC’s worth motion is fixated on Fed price expectations, a transparent worth path may be picked after June’s Fed assembly. Within the meantime, BTC might lengthen its choppiness inside the $60K—$70K vary till the following Fed price determination.