- A number of on-chain metrics recommended that BTC’s charts would quickly flip inexperienced.

- Market indicators additionally hinted at a worth improve.

Bitcoin [BTC] has been struggling of late because the bulls have did not take management of the market. Nonetheless, this sluggish worth motion hasn’t demotivated traders to carry at the very least 1 BTC.

The intent of traders holding 1 BTC clearly signifies that they anticipate the king of cryptos’ worth to rise.

Demand for BTC is rising

CoinMarketCap’s data revealed that Bitcoin traders had a horrible month final month because the coin’s worth dropped by greater than 8%.

In reality, within the final seven days, the coin has witnessed a 4% worth correction. On the time of writing, BTC was buying and selling at $61,611.07 with a market capitalization of over $1.2 trillion.

Regardless of the most recent worth corrections, it was optimistic to see over 85% of BTC traders nonetheless in revenue, as per IntoTheBlock’s data. One other attention-grabbing piece of knowledge was revealed by a latest tweet from IntoTheBlock.

As per the tweet, there have been greater than 1 million addresses that have been holding 1 BTC. This was a transparent long-term pattern, as increasingly more individuals goal to attain whole-coiner standing.

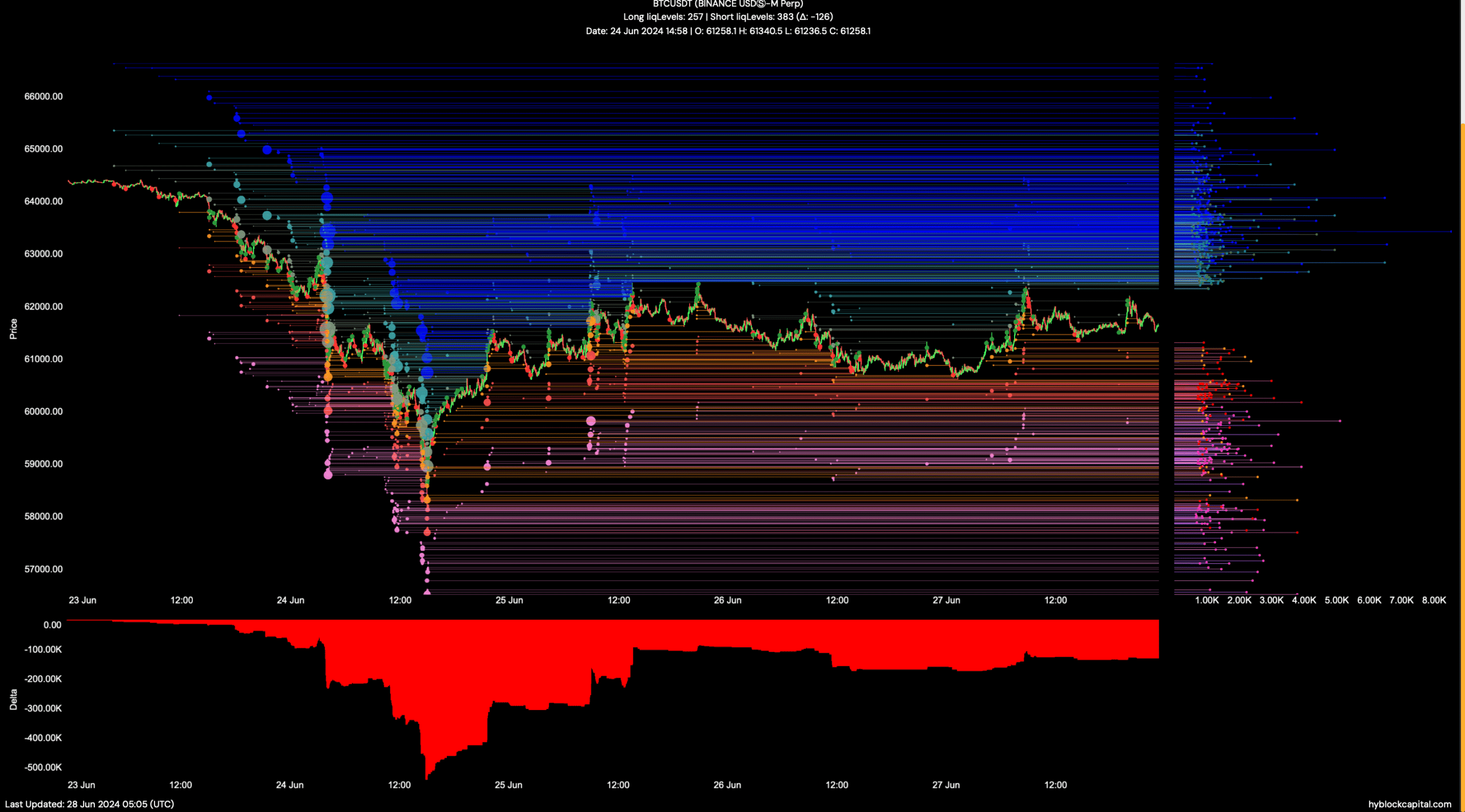

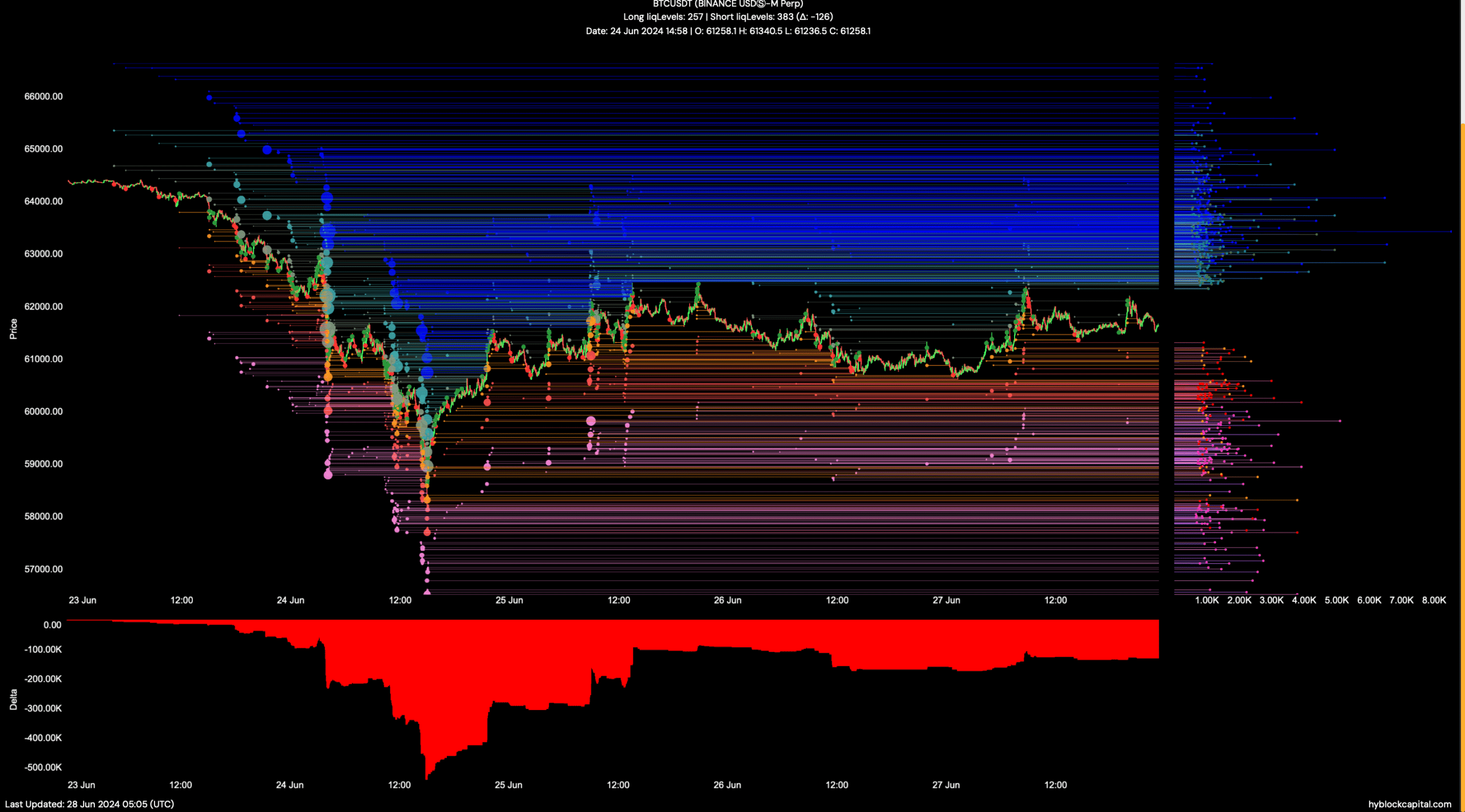

Other than this, AMBCrypto’s evaluation of Hyblock Capital’s information additionally revealed that traders have been prepared to carry BTC. As per our evaluation, BTC’s cumulative liquidation information has declined sharply after touching -500k just a few days in the past. This meant that traders have been anticipating the coin’s worth to rise once more quickly.

Supply: Hyblock Capital

Bitcoin is displaying indicators of restoration

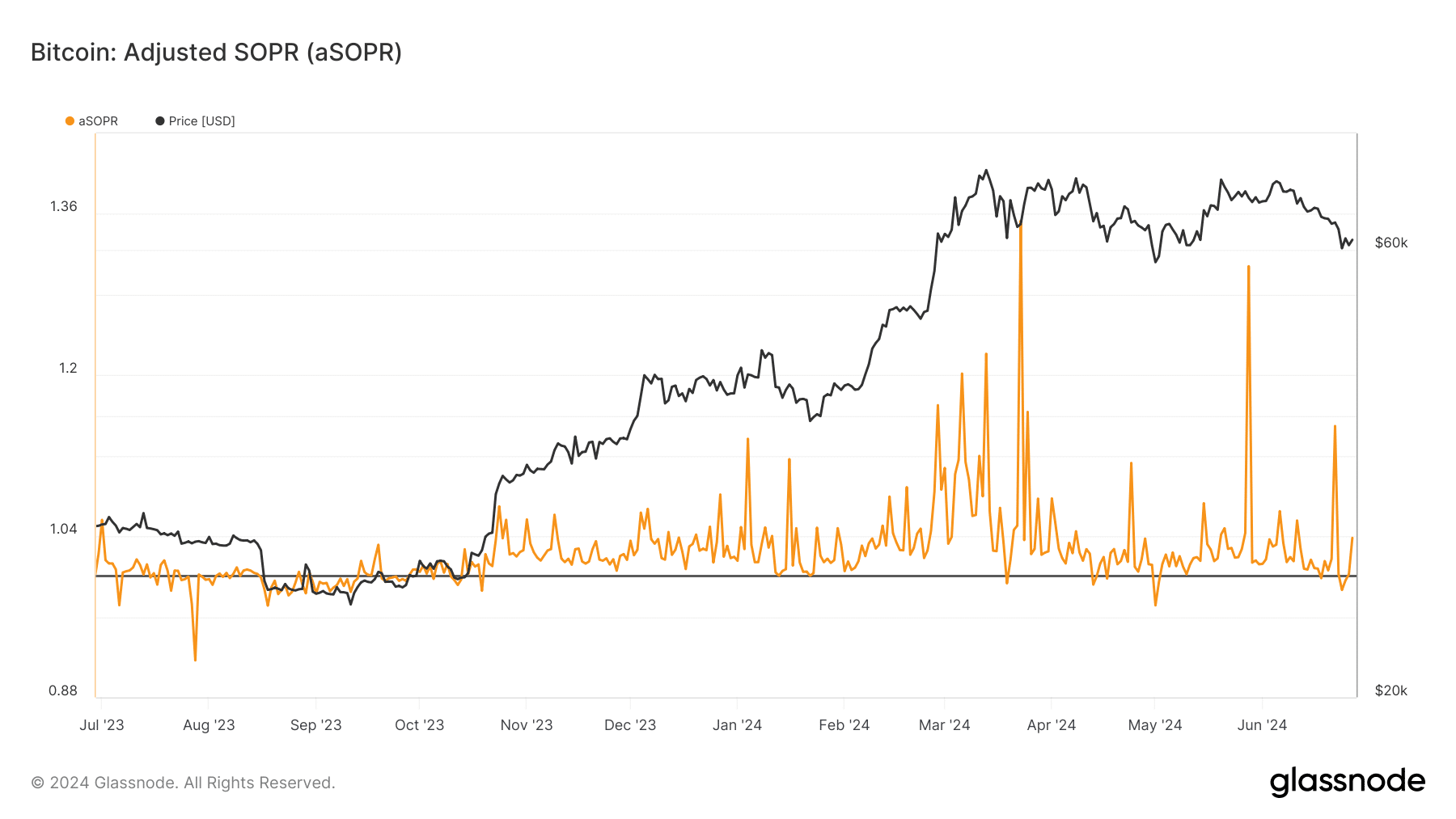

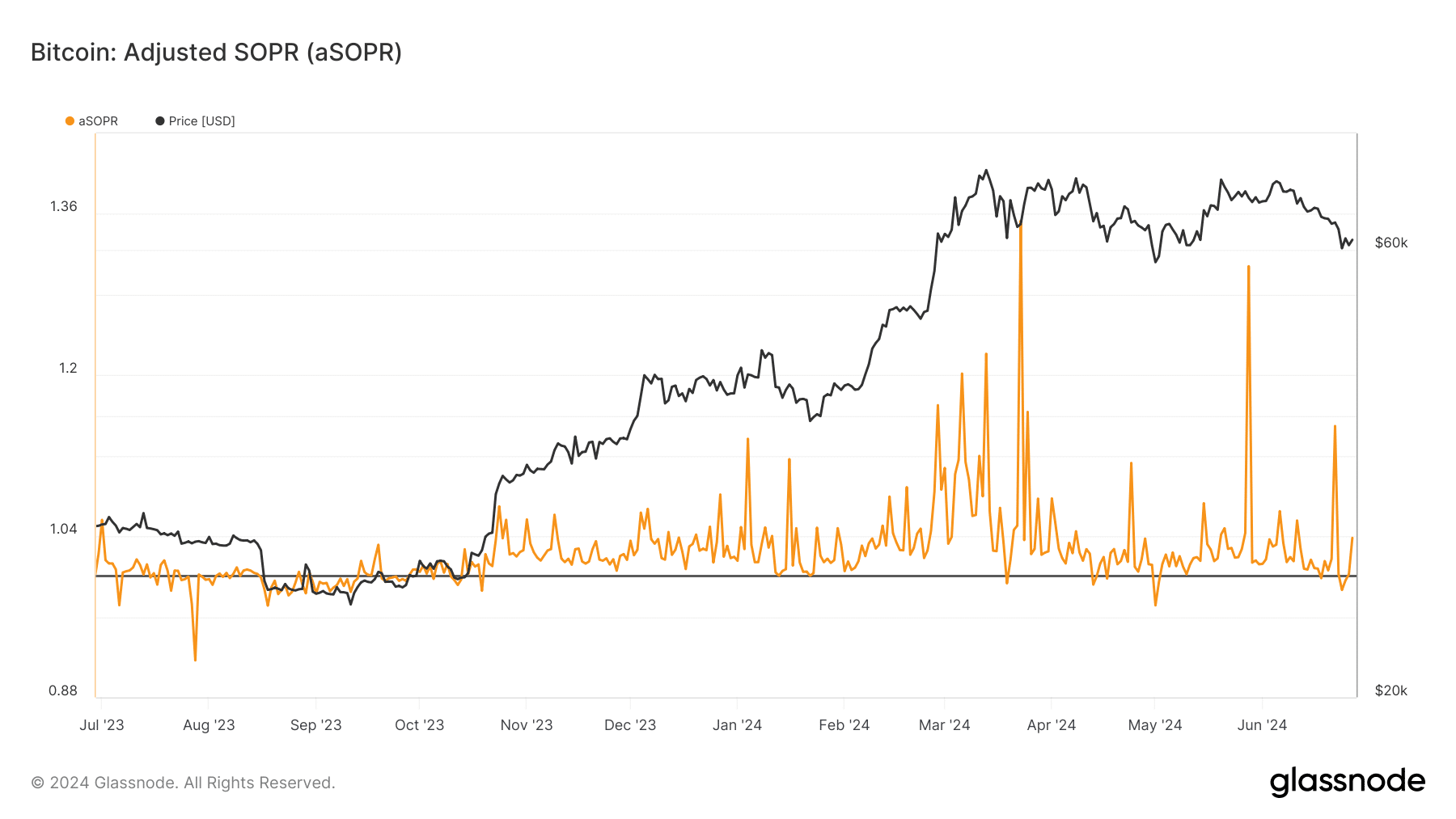

Traders’ confidence may need simply began to repay as BTC’s worth moved up marginally within the final 24 hours. BTC’s aSORP had fallen beneath the 1.0 threshold on the twenty fifth of June.

Each time that occurs, it signifies a potential bull rally.

Supply: Glassnode

AMBCrypto’s evaluation of CryptoQuant’s data additionally identified fairly just a few bullish metrics. As an example, BTC’s Relative Energy Index (RSI) was in an oversold place. This would possibly assist improve shopping for stress and, in flip, push its worth up.

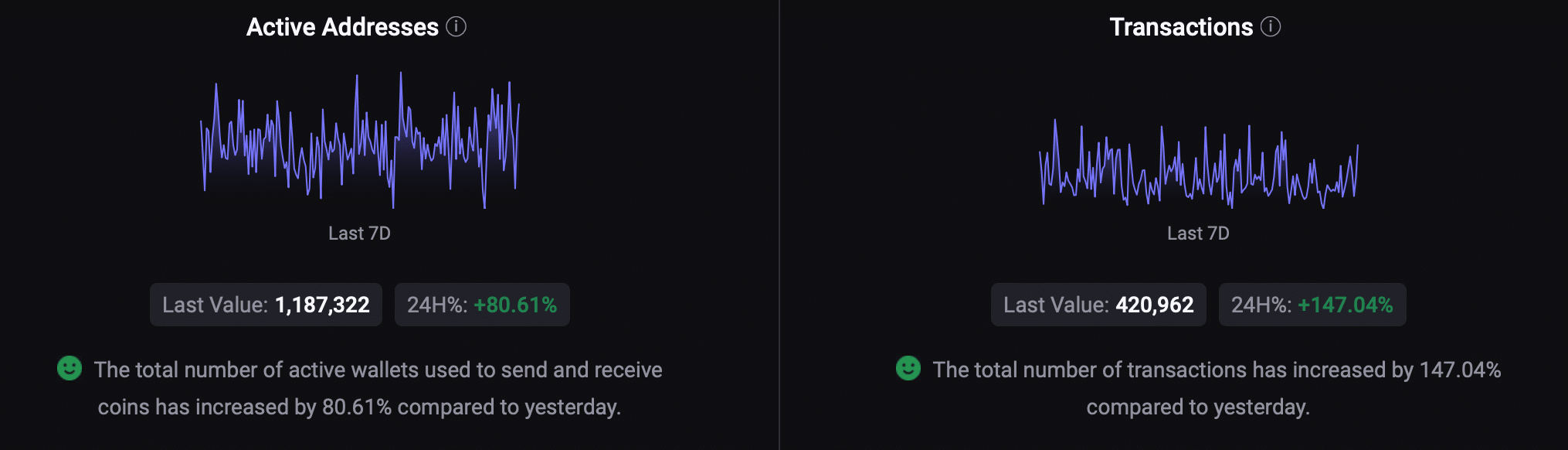

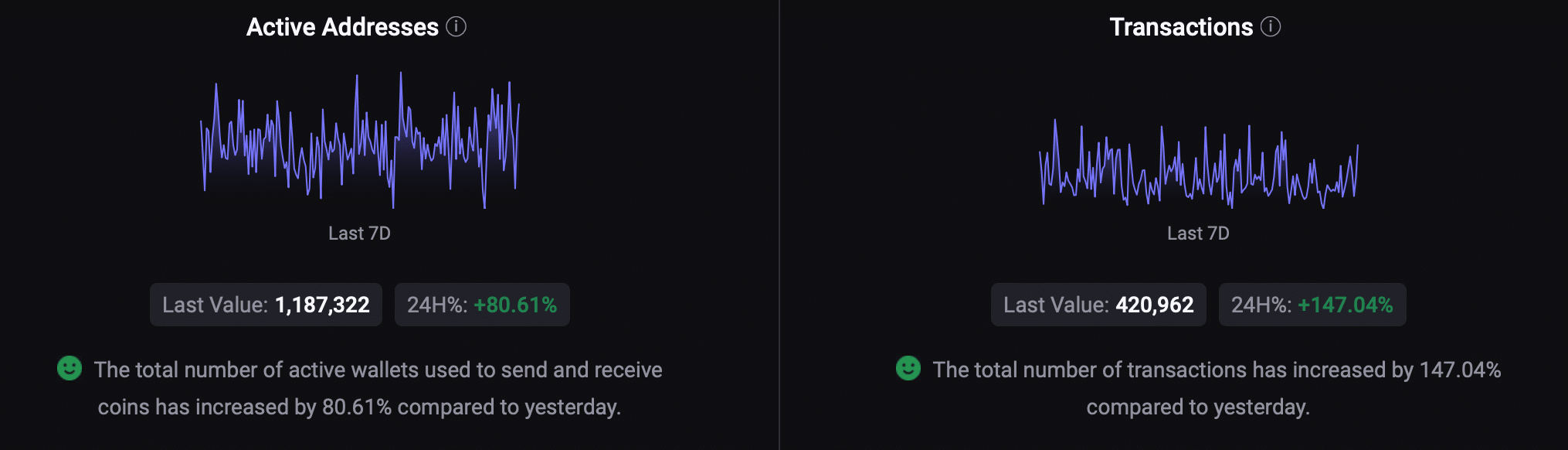

The opposite bullish metrics have been energetic addresses and the variety of transactions, as each of them elevated within the final 24 hours.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

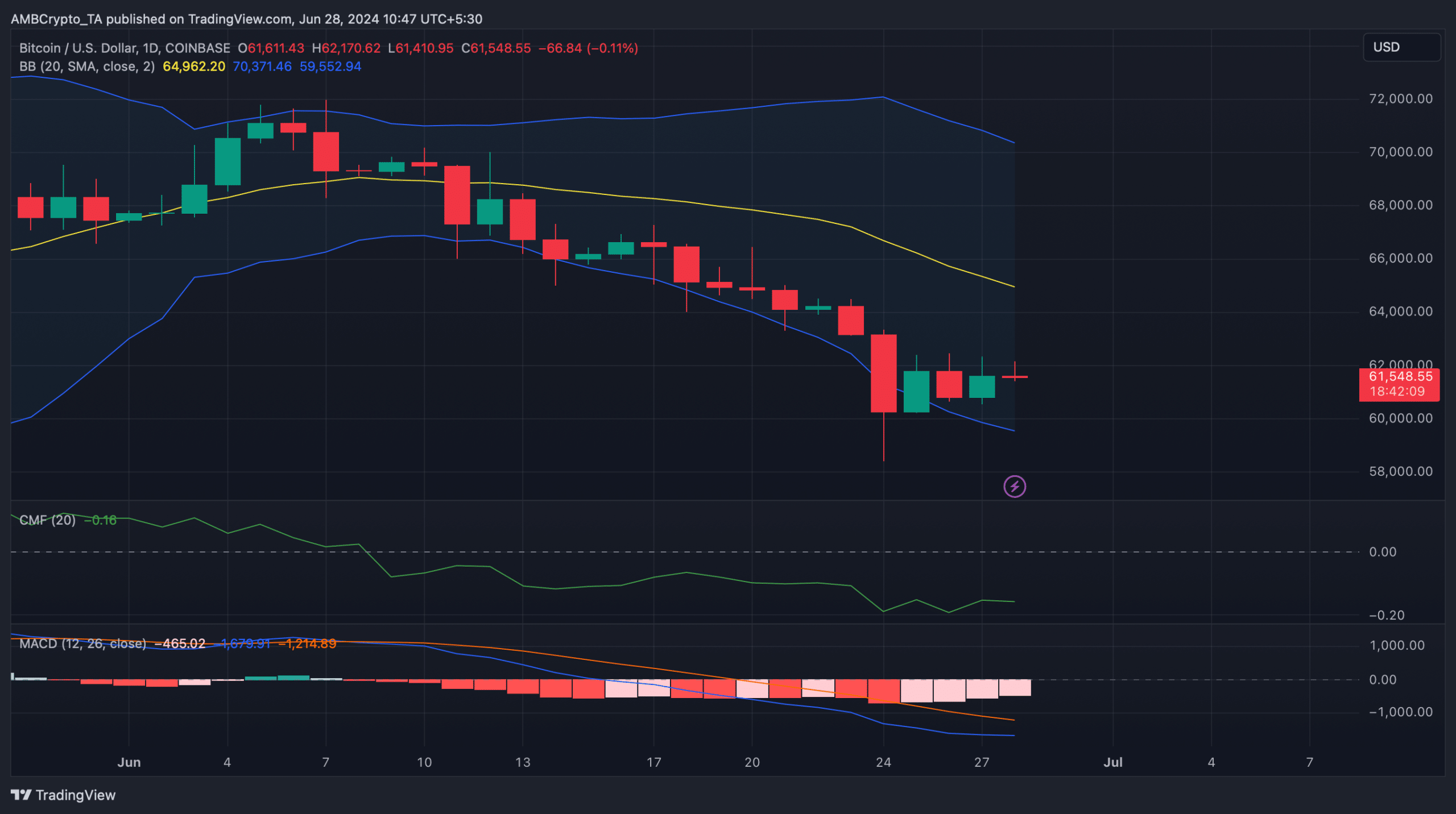

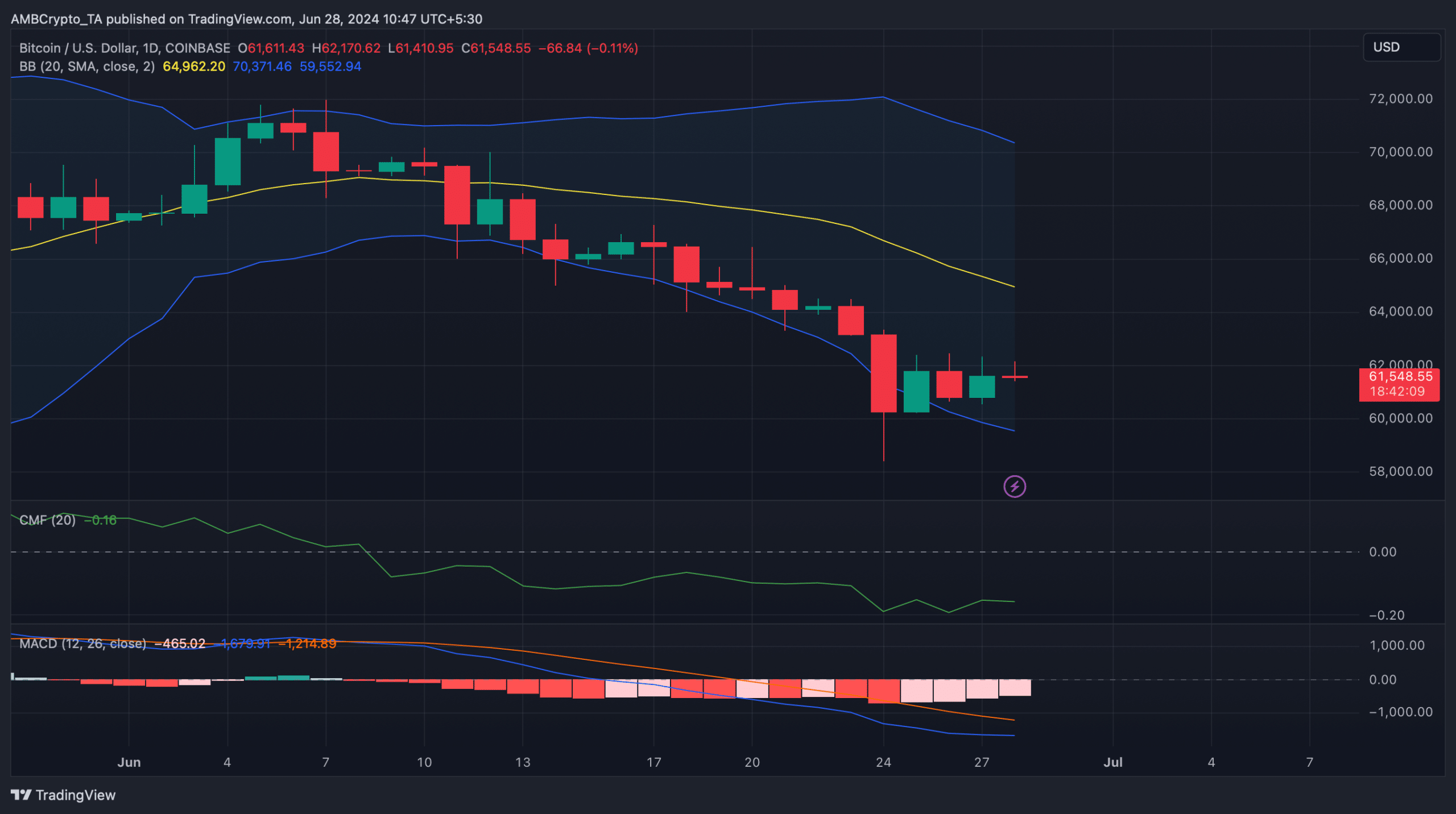

We then deliberate to take a look at Bitcoin’s every day chart to raised perceive whether or not it was about to start a bull rally. We discovered that BTC’s worth began to rebound after touching the decrease restrict of the Bollinger Bands. This typically ends in bull rallies.

The MACD additionally displayed the potential of a bullish crossover within the coming days. Nonetheless, the Chaikin Cash Circulate (CMF) remained bearish because it was resting properly under the impartial mark.

Supply: TradingView