- The coin’s open curiosity hit the very best level since March, suggesting that BTC might break previous $73,750.

- Alternate withdrawal elevated whereas the funding price was constructive, reinforcing the bullish bias.

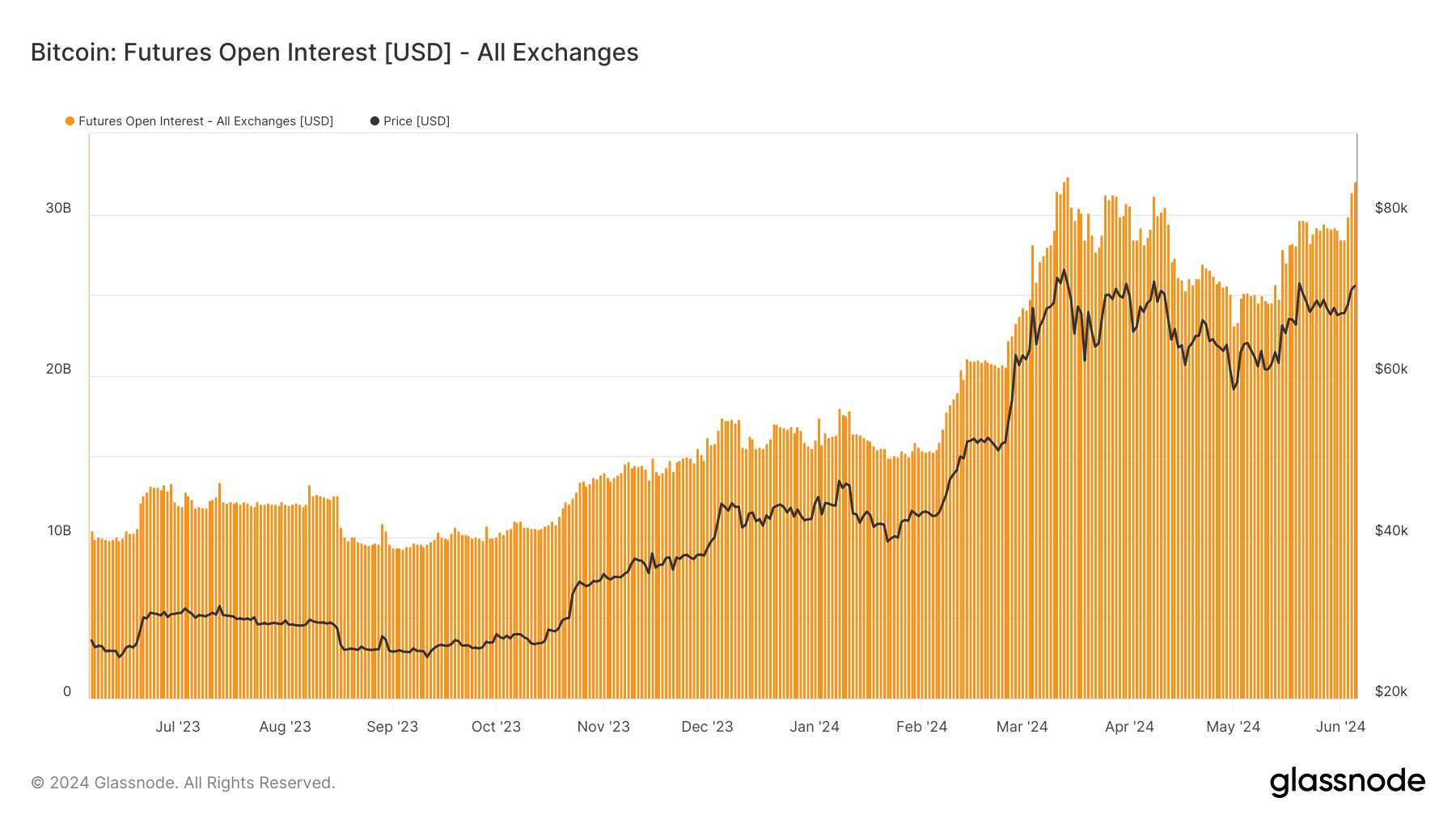

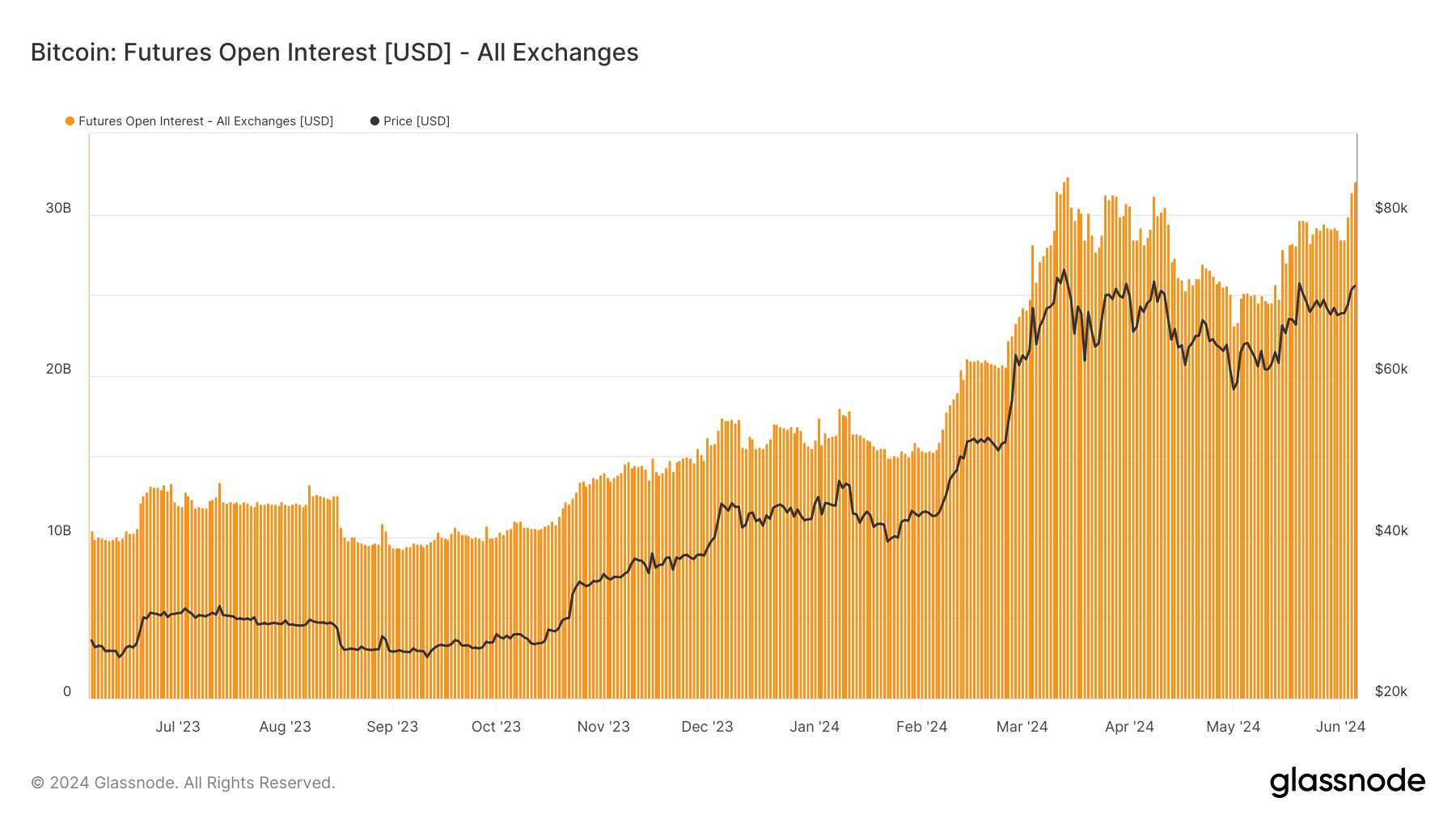

For the primary time because it hit its all-time excessive of $73,570, Bitcoin [BTC] Open Curiosity has hit a brand new excessive. Particularly, the Open Curiosity was $37.66 billion, in accordance with data from Glassnode.

Open Curiosity (OI) is the worth of excellent contracts within the derivatives market. If the OI decreases, it means merchants are more and more closing their positions, and this might result in a worth lower.

Nonetheless, a rise in OI like Bitcoin has performed just lately is an indication that new cash is getting into the market. If sustained, this might again BTC’s uptrend and result in a better worth.

Supply: Glassnode

BTC goals increased, backed by alternate move

As of this writing, BTC modified palms at $71,200. This represented a 3.89% soar within the final seven days. With rising curiosity within the token, there’s a excessive likelihood that it might surpass its all-time excessive and presumably attain $80,000.

Regardless of the bullish prediction, you will need to take a look at the spot buying and selling exercise on exchanges as this might additionally have an effect on the worth motion.

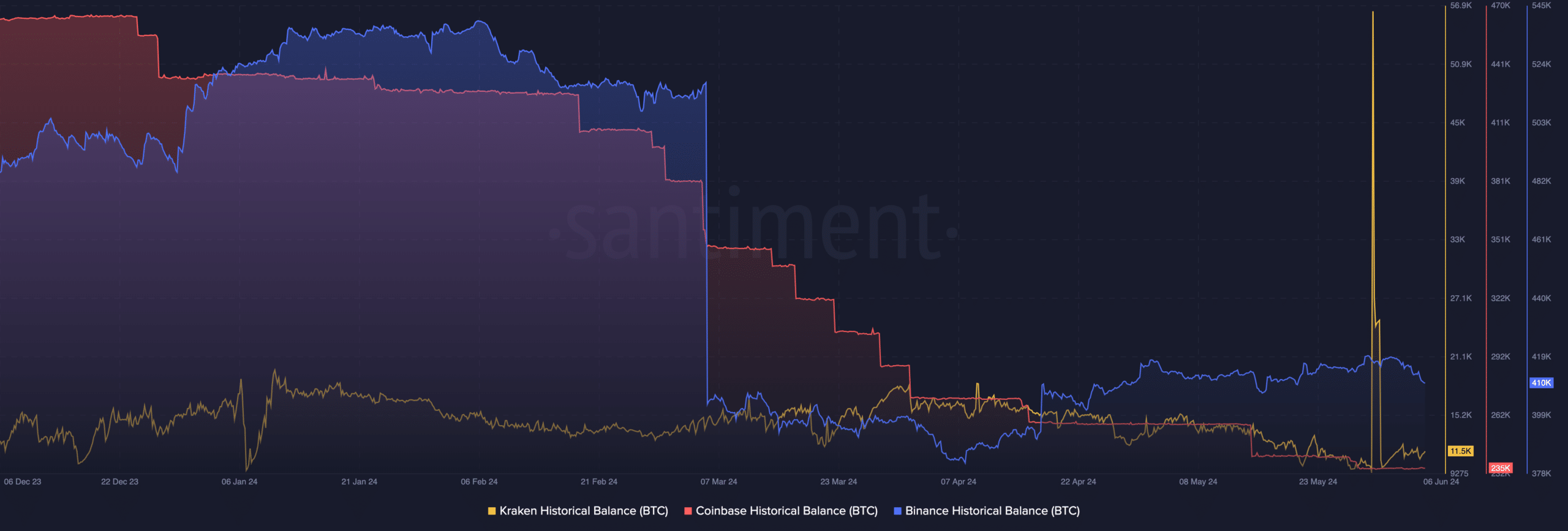

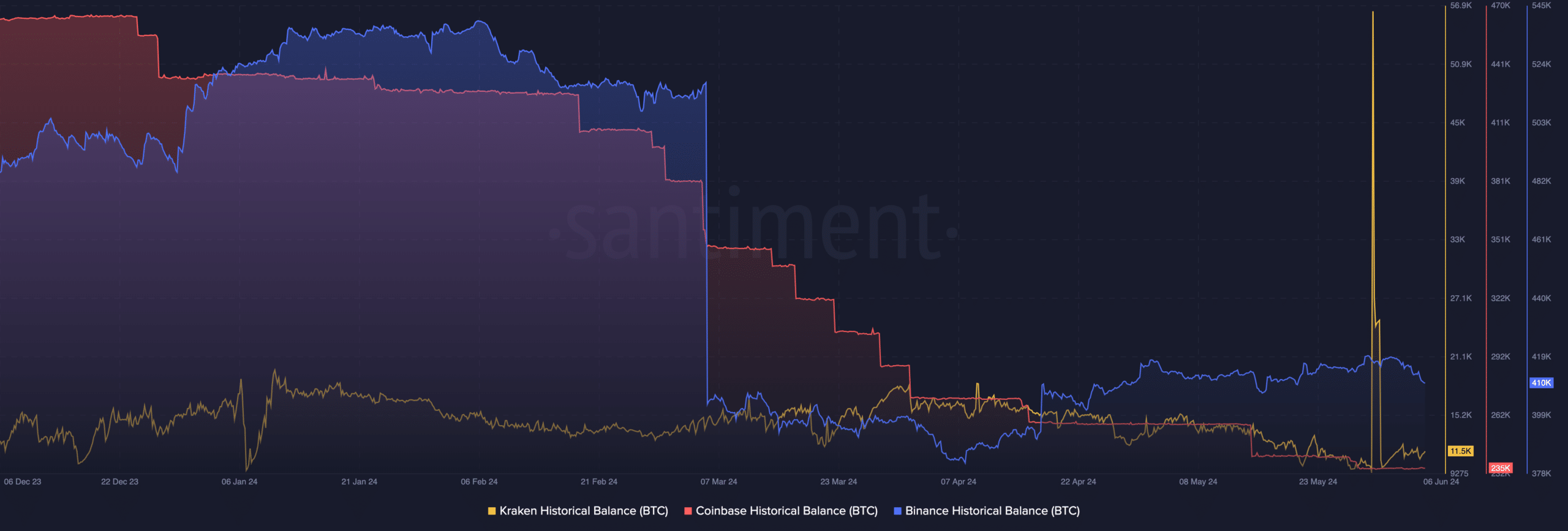

One of many methods to do that is by trying on the provide on exchanges and the provision out of it. As well as, the stability held by among the prime exchanges might give an concept.

As an illustration, AMBCrypto found that Binance and Coinbase’s historic stability was down, indicating that customers had been withdrawing their BTC from the platforms. Nonetheless, Kraken recorded a surge in BTC purchases on the thirtieth of Could earlier than the current decline.

It appeared that many holders had been shopping for extra cash on exchanges and withdrawing them for the long run. If this continues to be the case, Bitcoin may evade promoting strain, and the worth might hit an all-time excessive earlier than the tip of June.

Supply: Santiment

Merchants proceed to guess on a rally

Then again, the prediction might be invalidated if provide on exchanges begins to rise. It’s because a rise within the provide would imply that traders are prepared to guide earnings. If this occurs, BTC may lose maintain of $70,000.

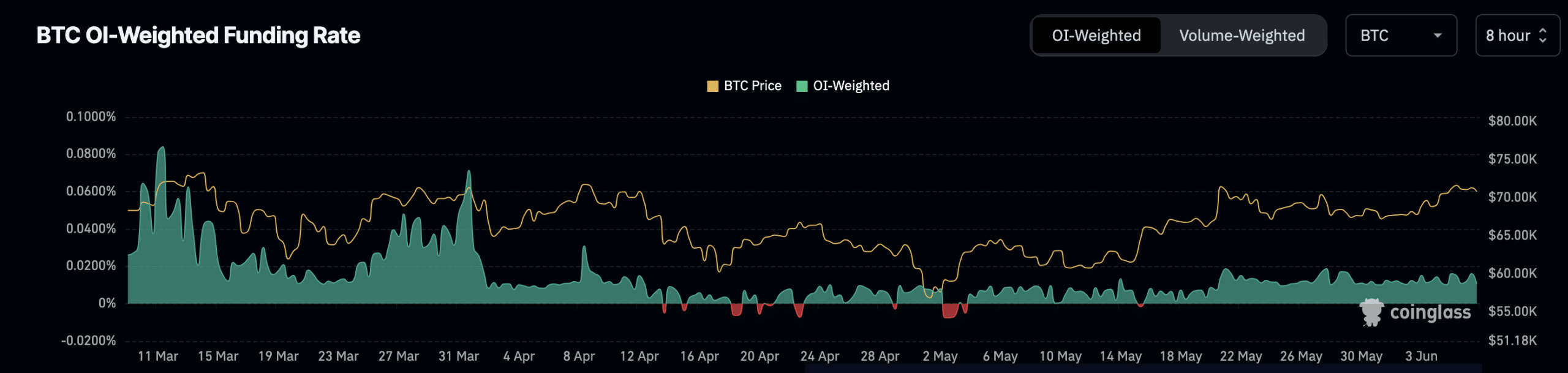

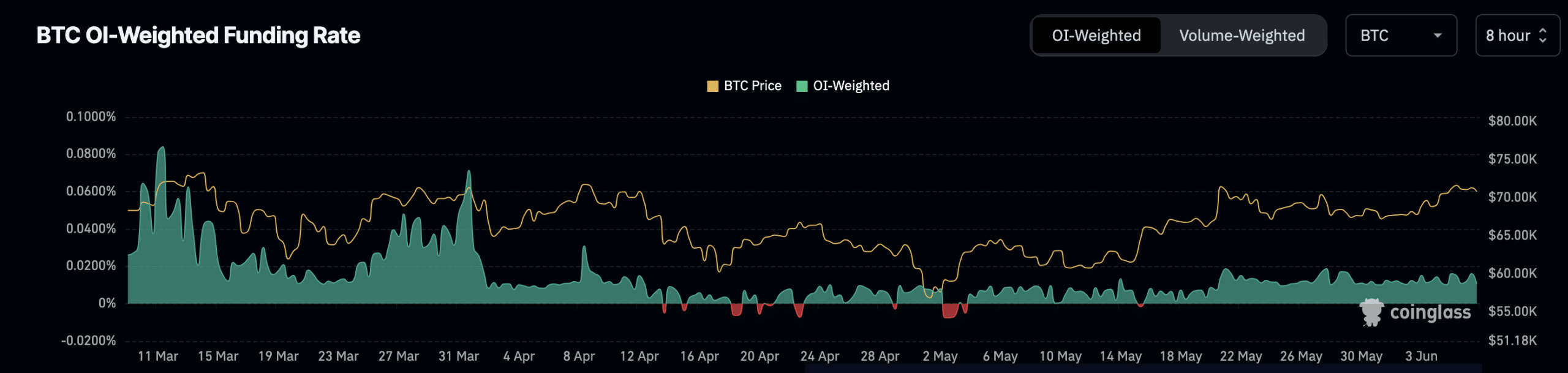

Nonetheless, merchants appear to not share the point of view of worth lower. This was primarily based on the Funding Price information obtained from Coinglass.

In accordance with the derivatives data portal, Bitcoin’s Funding Rate was positive. If the studying of the metric is damaging, it implies that shorts are paying longs a charge to maintain their place open.

On this occasion, the broader sentiment is bearish.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Nonetheless, the constructive studying of the metric indicated that longs are dominant, and predict BTC’s worth to extend. Ought to Bitcoin rise to $74,000 as it’s being talked about, merchants with lengthy positions can be rewarded.

This might additionally give strategy to $80,000 supplied bears fail to nuke the uptrend.