- Hut 8 Corp has secured a PPA for a website in West Texas, having access to 205 MW of energy capability.

- Regardless of a number of efforts, Bitcoin miner’s each day revenues have dropped by 63% post-halving.

Hut 8, a Canadian Bitcoin [BTC] mining agency, has just lately concluded an settlement to increase its operational capabilities in Texas.

On ninth July, Hut 8 Corp. disclosed securing an influence buy settlement (PPA) for a West Texas website, offering it unique entry to 205 megawatts of energy capability and accompanying land.

Hut 8 new initiative

This marks the primary deal from Hut 8’s plan to safe 1,100 megawatts of vitality capability, considerably boosting its BTC mining operations.

Remarking on the identical, Asher Genoot, CEO of Hut 8 stated,

“That is the primary time a big knowledge middle load has been permitted beneath the advanced regulatory framework on this explicit market.”

Key benefits

The brand new PPA supplies Hut 8 with a number of key benefits. The primary is proximity to a wind farm and connection to the Electrical Reliability Council of Texas (ERCOT) grid.

This might allow Hut 8 to leverage a few of North America’s best wholesale energy costs.

Moreover, the positioning infrastructure contains an current operational substation, simplifying the method of connecting to the ability grid and decreasing setup time.

Most significantly, the positioning is well-suited for numerous high-density computing duties, together with Bitcoin mining and synthetic intelligence (AI) purposes.

Expressing on the identical, Genoot famous,

“This transaction exemplifies Hut 8’s differentiated strategy to securing new vitality capability by mutually accretive partnerships.”

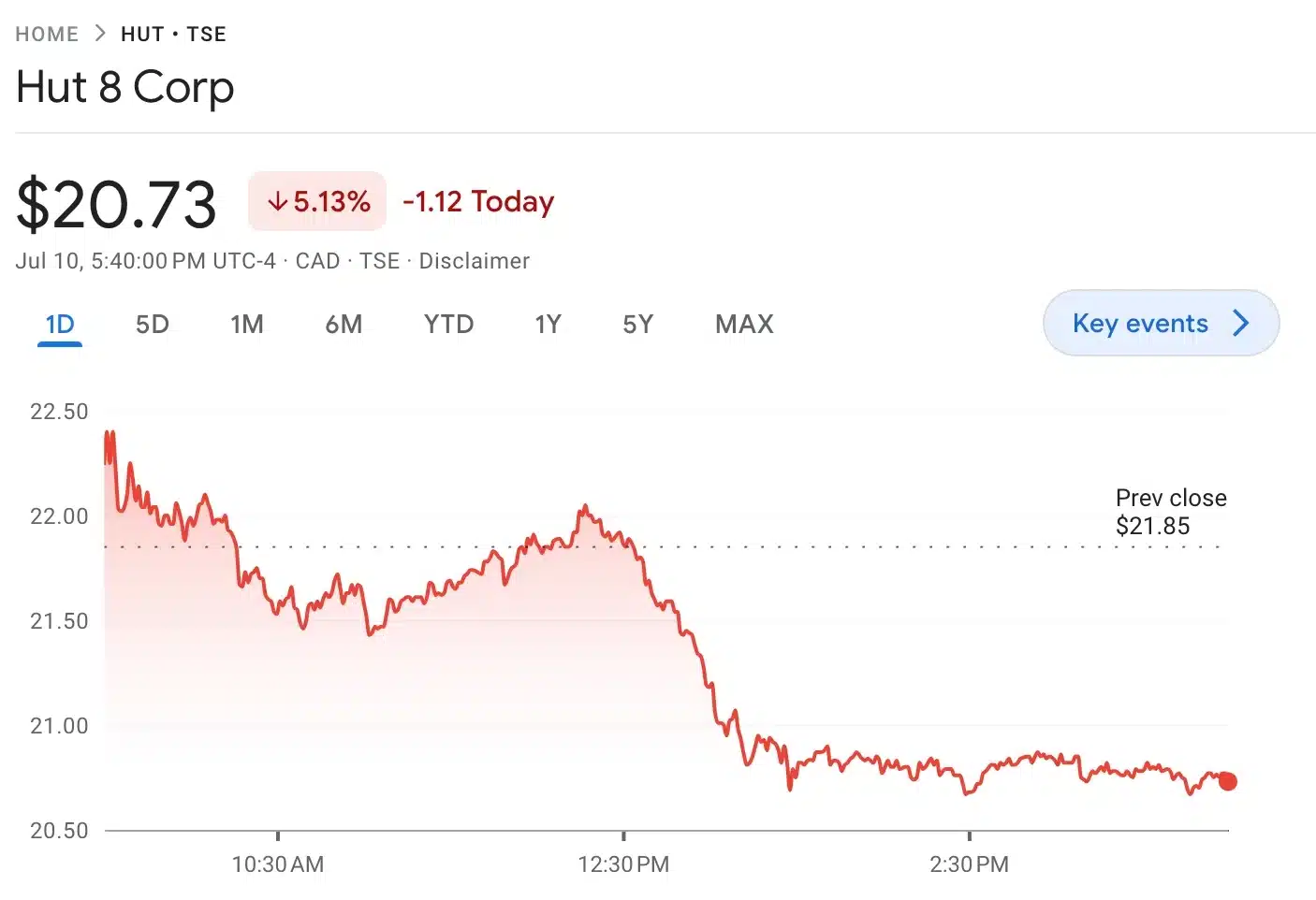

Following the announcement, Hut 8 shares initially rose by 1.54%, reaching $17.75. Nevertheless, this enhance was short-lived, as the newest replace reveals the inventory worth was down by 5.13% on the time of writing, now standing at $20.73.

Supply: Google Finance

Affect of Bitcoin halving on miners

That being stated, following the latest Bitcoin halving, the business has undergone important modifications. Miners are diversifying their income streams, rising their hashrate, and pursuing mergers, acquisitions, and partnerships to keep up profitability.

As an illustration, CleanSpark acquired 5 mining services in Georgia, considerably boosting their processing energy. Mining companies corresponding to Marathon Digital, CleanSpark, and Riot Platforms collectively secured $2 billion in fairness financing.

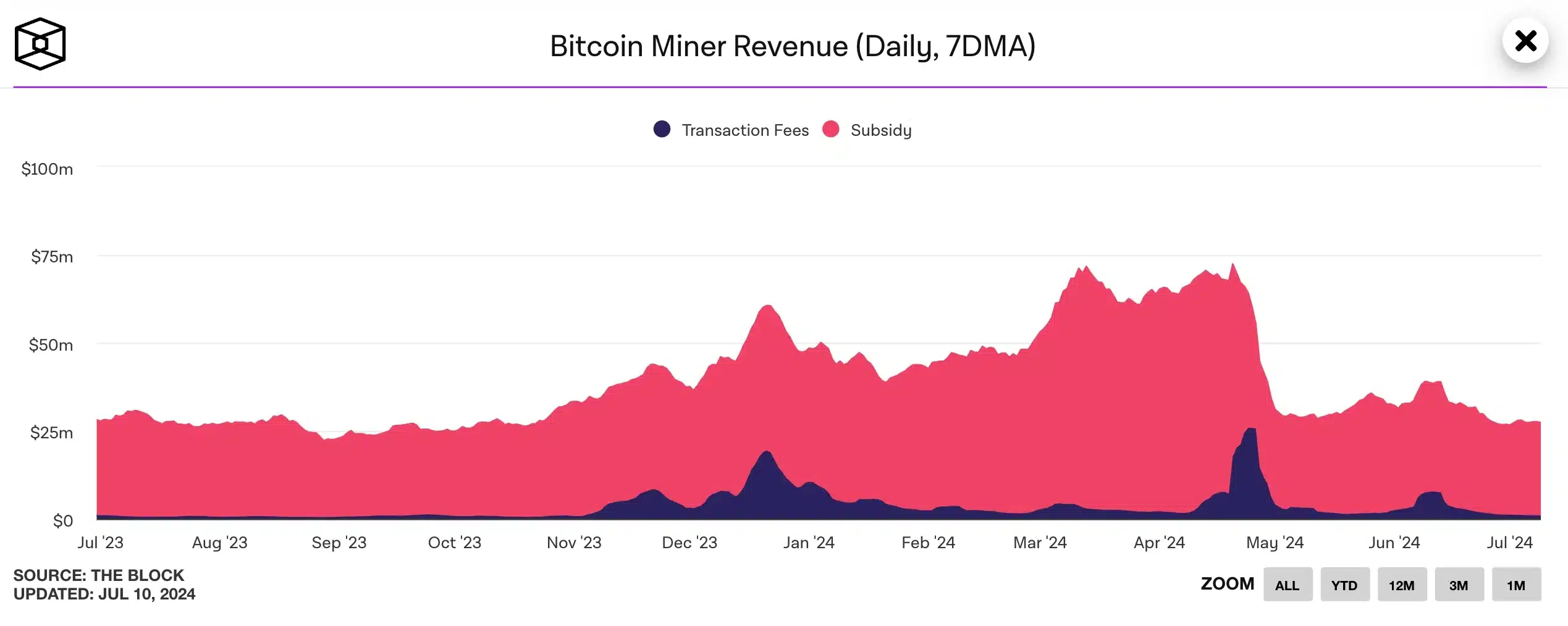

Regardless of these efforts, miners’ each day revenues have dropped by 63% for the reason that halving.

AMBCrypto’s evaluation of IntoTheBlock knowledge confirmed this, exhibiting whole BTC miner income (7DMA) at $27.29 million, a steep decline from the $72.35 million recorded on twentieth April, only a day after the fourth Bitcoin halving occasion.

Supply: IntoTheBlock