- Marathon’s hash price surged 78%, however Bitcoin manufacturing fell by 30%.

- Regardless of increased income, earnings missed forecasts as a result of rising prices and technical points.

Following its current acquisition of $100 million in Bitcoin [BTC], Marathon Digital Holdings [MARA], the biggest BTC mining agency, reported its second-quarter earnings, which fell in need of Wall Road projections.

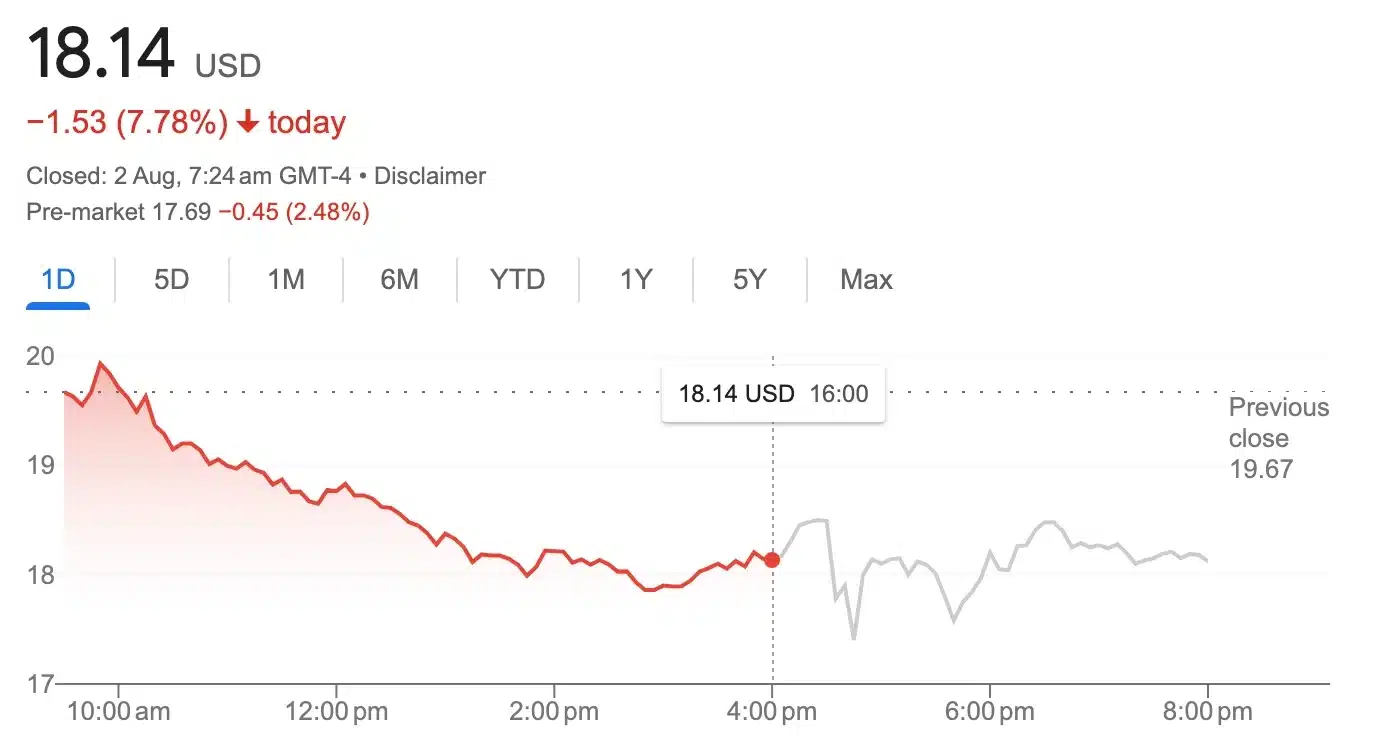

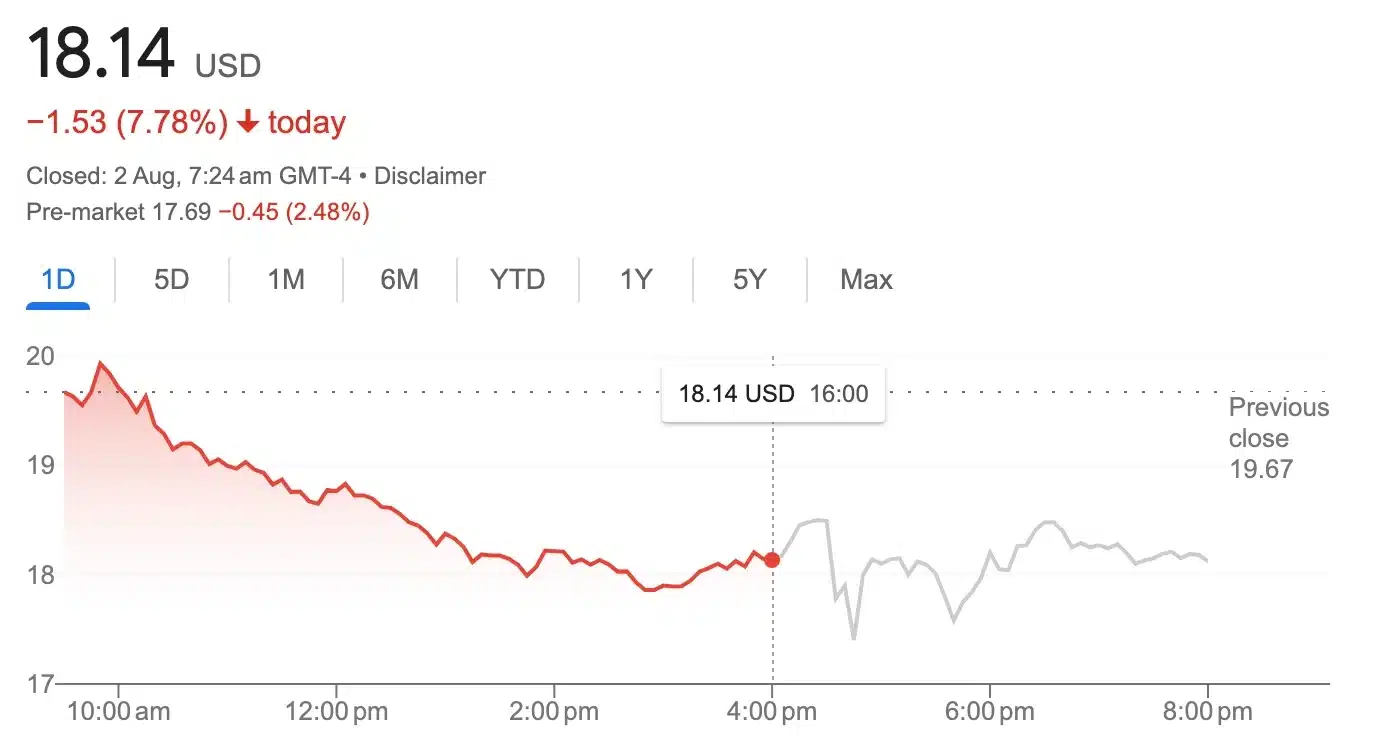

This led to an 8% drop in its share worth.

Marathon Digital Q2 outcomes

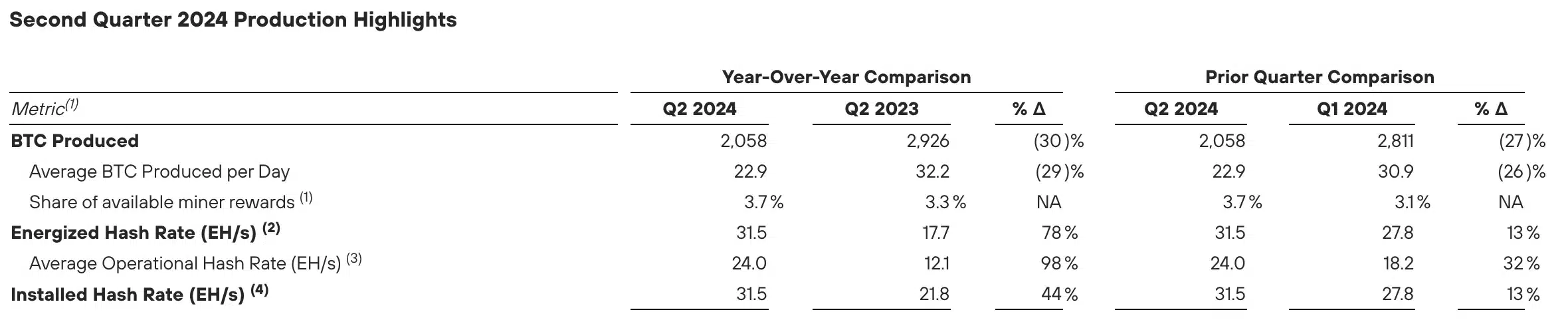

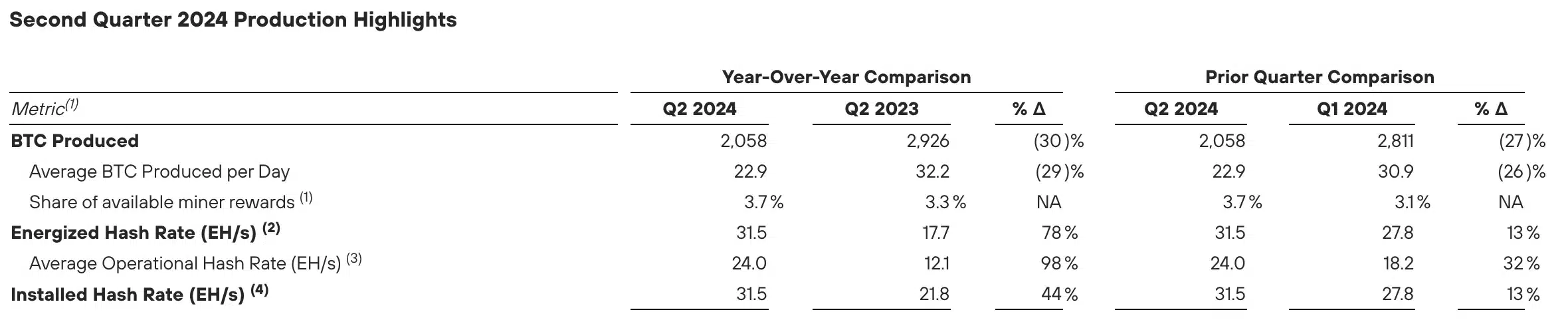

The corporate’s press release highlighted a notable 78% improve in hash price, reaching 31.5 EH/s in Q2 2024 in comparison with 17.7 EH/s in Q2 2023.

Regardless of this development in computing energy, Marathon Digital’s Bitcoin manufacturing decreased by 30%, with 2,058 BTC mined in Q2 2024, down from 2,941 BTC the earlier yr.

Nevertheless, by way of income, the agency famous,

“Revenues elevated 78% to $145.1 million in Q2 2024 from $81.8 million in Q2 2023.”

Surprisingly, Yahoo Finance data revealed that this determine was roughly 9% under the anticipated $157.9 million forecast by analysts.

As of the most recent replace, the corporate’s inventory had dropped 7.78%, buying and selling at $18.14.

Supply: Google Finance

What occurred to this point?

That being stated, throughout the quarter, Marathon Digital confronted monetary pressures as a result of elevated operational prices following the Bitcoin halving occasion in April.

To handle these prices, the corporate offered over half of its mined BTC.

Regardless of a big improve within the common worth of Bitcoin mining in comparison with the earlier yr, Marathon’s day by day BTC manufacturing decreased by 9.3 BTC.

Supply: ir.mara.com

This implies that, though the worth of Bitcoin was increased, operational challenges and rising prices impacted their general mining output and monetary technique.

Execs weighing in

Remarking on the identical, Fred Thiel, MARA’s chairman and chief govt officer, stated,

“In the course of the second quarter of 2024, our BTC manufacturing was impacted by surprising gear failures and transmission line upkeep on the Ellendale website operated by Utilized Digital, elevated world hash price, and the April halving occasion.”

He additional added,

“Nevertheless, I’m happy to report that transformer points on the Ellendale website have been mitigated and remediated post-quarter finish, and our hash price restoration effort is full.”

In accordance with Thiel, the corporate has reached an all-time excessive put in hash price of 31.5 exahash within the second quarter and continues to focus on 50 exahash of energized hash price by the top of 2024 with extra development in 2025.

What lies forward?

As Marathon Digital adjusts to increased prices and technical points, its skill to innovate whereas managing these challenges shall be essential.

Henceforth, the corporate’s future success will rely upon how properly it balances these components within the evolving crypto market.