- Bitcoin mining might assist bulls begin one other main rally, based on this evaluation.

- Miner reserves soared to 6-week highs regardless of latest market FUD.

Now that Bitcoin [BTC] is buying and selling beneath $60,000 as soon as extra, many is perhaps questioning whether or not it is a perfect time to purchase, particularly now that it has demonstrated some weak spot above that key value level.

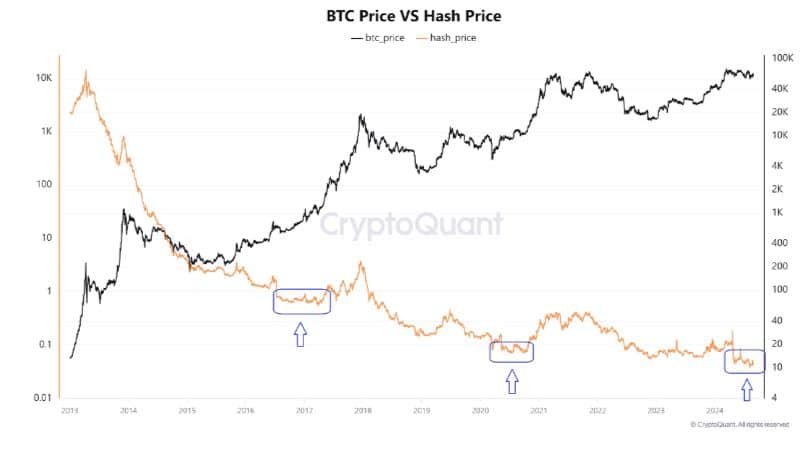

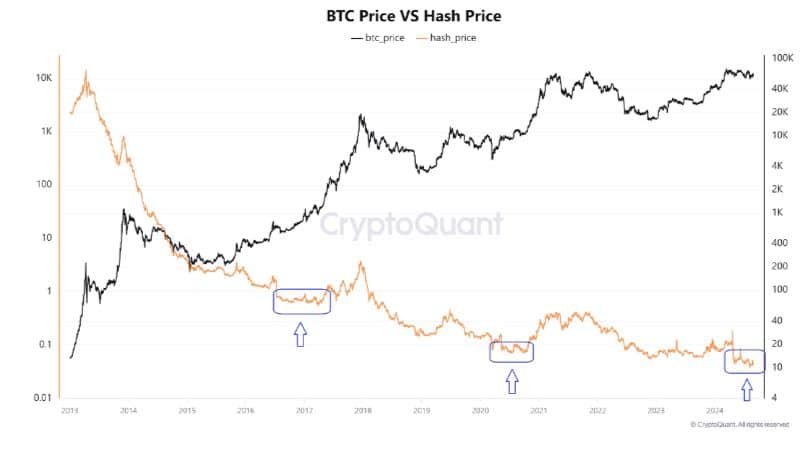

Bitcoin is presently in a purchase alternative, based on CryptoQuant analyst Woominkyu. The analyst made a bullish case for the cryptocurrency utilizing the Bitcoin hash value, which showcased miner profitability.

Woominkyu’s evaluation instructed that the hash value can be utilized as a bullish sign. A comparability with Bitcoin lows instructed that the hash value, on the backside of its pattern, might sign bullish alternatives forward.

Supply: CryptoQuant

The Bitcoin hash value lately dropped to its lowest historic ranges. This coincided with BTC’s latest draw back, particularly at the beginning of August.

If this evaluation holds true, then it means that Bitcoin might already be to start with levels of its subsequent main rally. It additionally means that the latest pullbacks is perhaps the very best accumulation alternatives at discounted ranges.

In the meantime, decentralized mining pool operator Loka Mining plans to introduce new measures that might stop or ease miner capitulation.

In keeping with its CEO Andy Fajar Handika, the corporate will finance progress and short-term wants utilizing ahead mining contracts.

The objective is reportedly to offset a few of the pressures that miners face as a consequence of declining block rewards and excessive working prices.

How Bitcoin mining impacts demand

Bitcoin has thus far demonstrated wholesome demand beneath the $60,000 value stage. Different miner associated stats additionally level to a positive sentiment for a doubtlessly bullish end result.

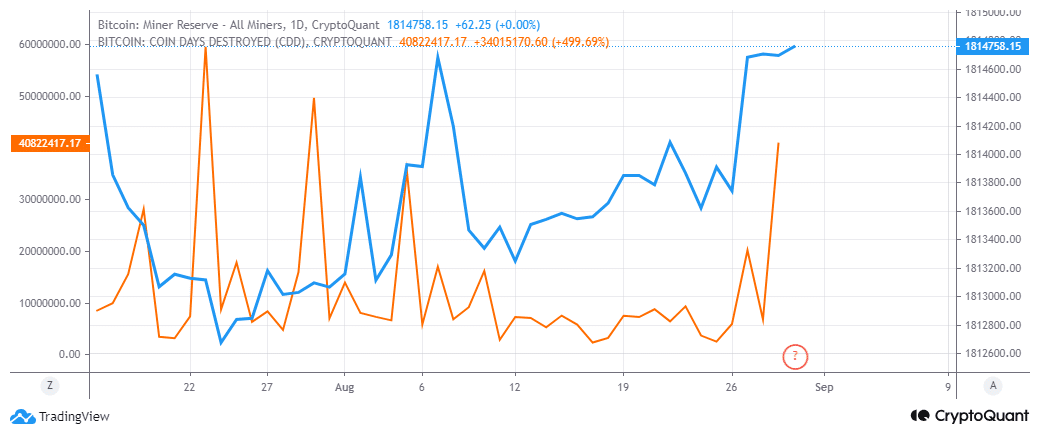

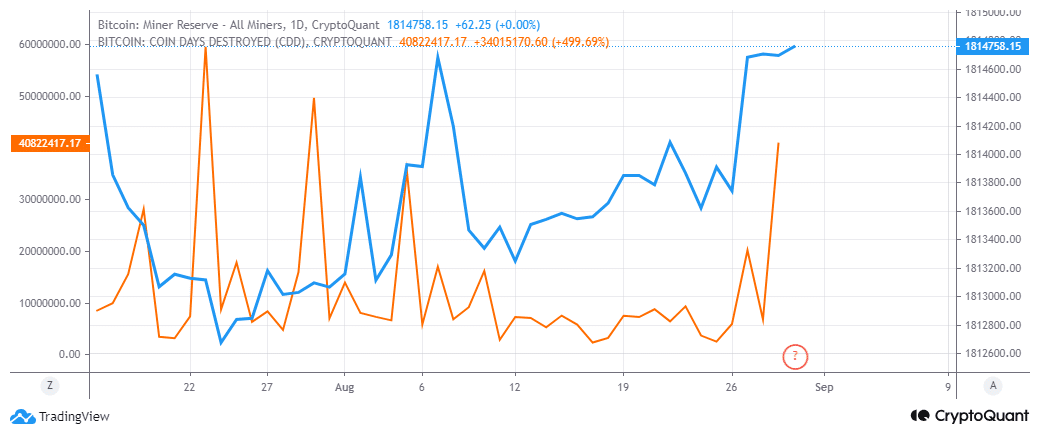

For instance, miner reserves had been at their highest ranges within the final six weeks.

Supply: CryptoQuant

The surging miner reserves means that miners have been HODLing their cash in anticipation of upper costs. We additionally noticed the best spike in coin days destroyed in August.

The second-highest spike throughout the month was on the peak of the dip that occurred at the beginning of the month.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Earlier spikes within the coin days destroyed indicator had been noticed earlier than a significant value transfer. This means that Bitcoin could possibly be on the verge of one other extremely risky transfer, both to the upside or draw back.

Nevertheless, the above observations recommend {that a} larger likelihood of a bullish end result. However, merchants ought to transfer cautiously contemplating that there’s nonetheless a good stage of uncertainty out there.