- Bitcoin miners confronted promoting stress as revenues declined.

- Inflows for Bitcoin ETFs grew considerably.

Bitcoin [BTC] has remained stagnant on the $62,000 worth degree for fairly a while. Nonetheless, issues might take a flip for the more severe for the king coin going ahead.

Miners face the warmth

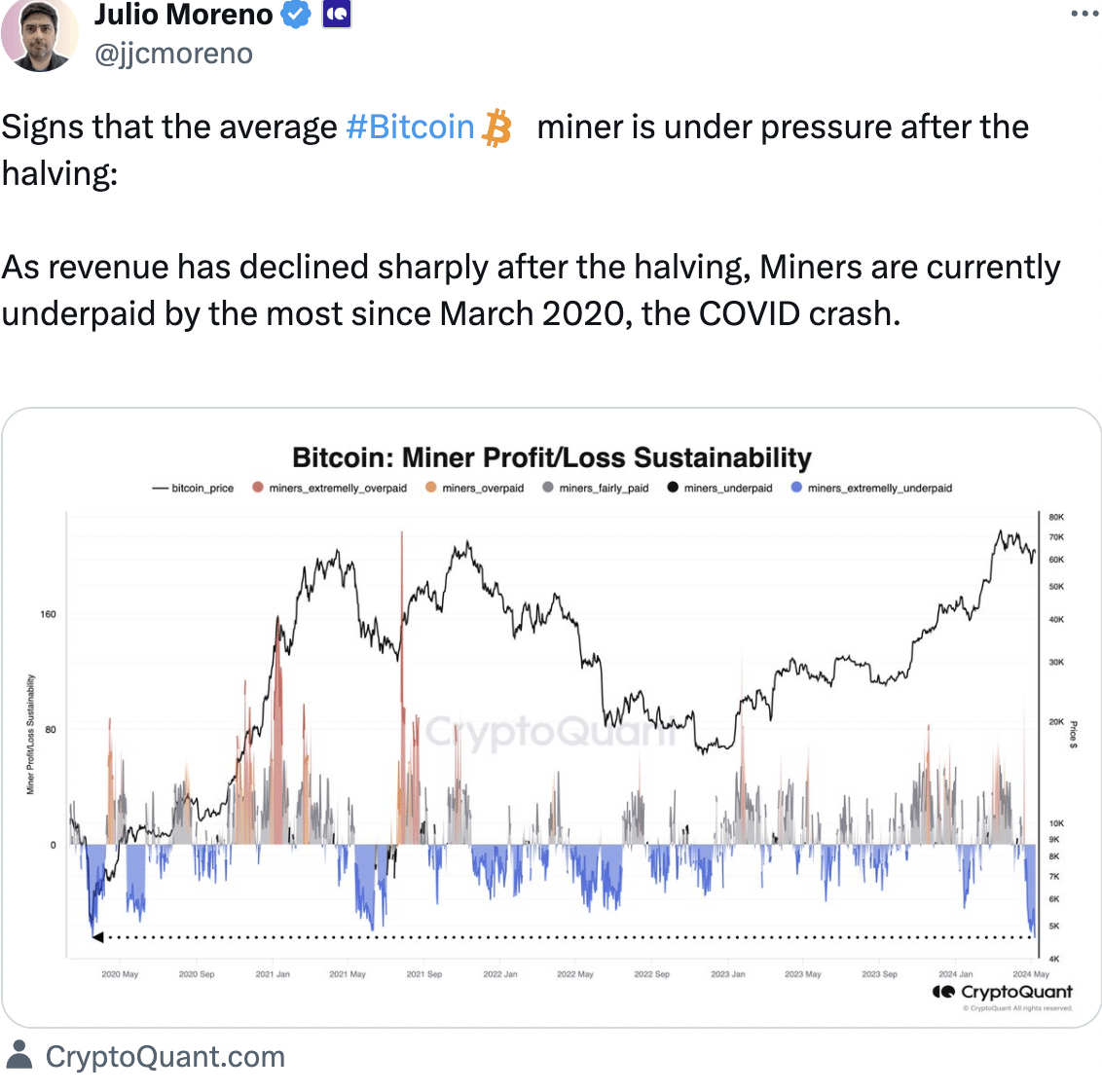

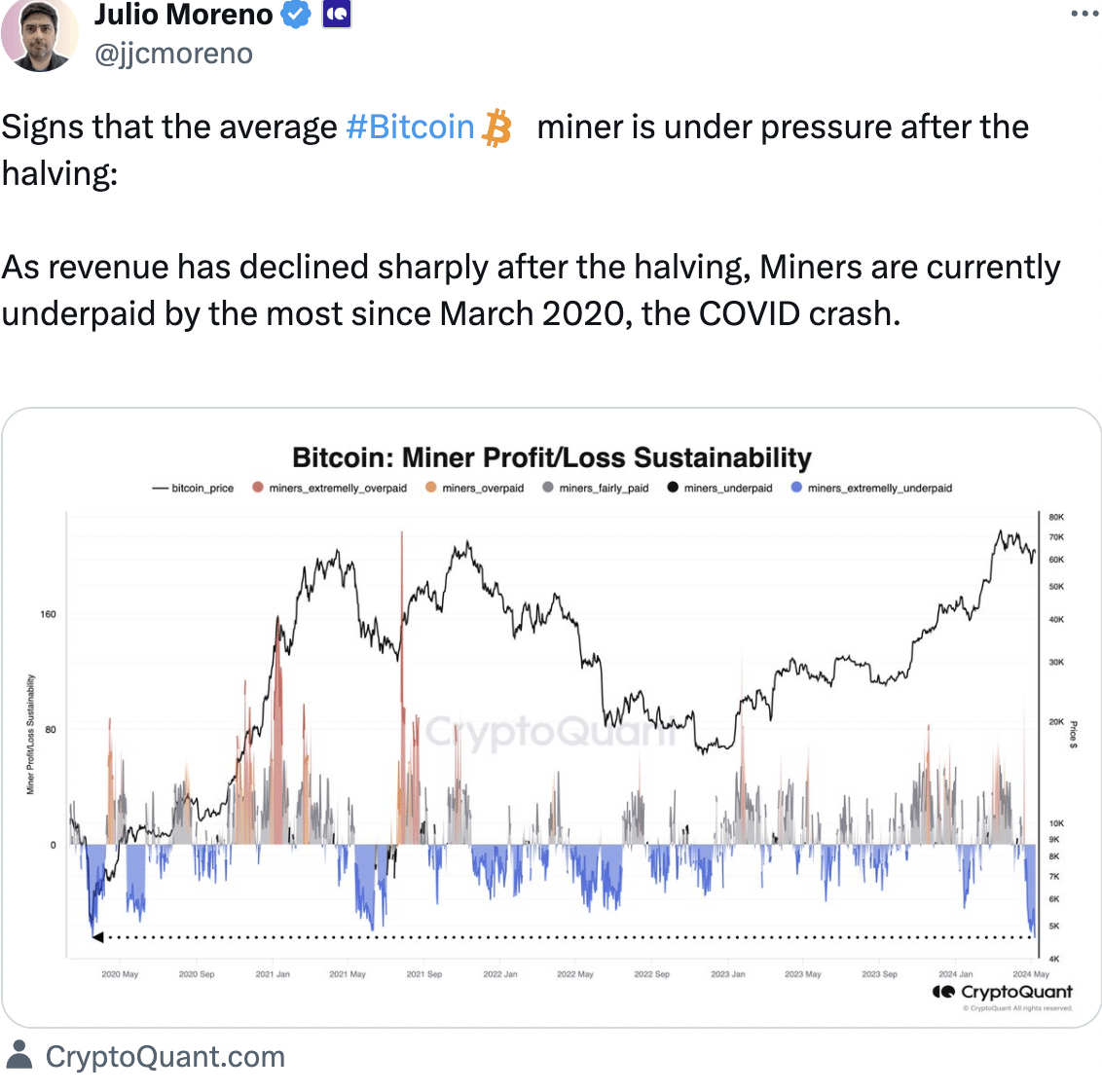

In keeping with latest knowledge, there have been clear indications that the common Bitcoin miner is feeling the pressure post-halving.

With a big drop in income for the reason that halving, miners are at the moment dealing with essentially the most difficult situations they’ve encountered since March 2020, in the course of the COVID-19 crash.

This stress is obvious within the declining hashrate, which has prompted the community to endure its fourth adverse issue adjustment of the yr.

The most recent adjustment, standing at -5.6%, marks the most important adverse change since November 2022, following the FTX collapse.

If issues proceed to worsen, miners will probably be compelled to promote their BTC holdings to stay worthwhile.

Supply: X

Inflows on the rise

Despite the fact that the state of BTC appears to be like dire as a result of state of miners, issues seemed higher for Bitcoin on Wall Avenue.

Latest knowledge revealed that US Spot Bitcoin ETFs skilled a complete internet influx of $11.78 billion, with a every day internet influx of $12 million recorded on the eighth of Could.

Amongst these ETFs, Bitwise’s BITB stood out as the only ETF with a internet influx, whereas each Blackrock’s IBIT and Grayscale’s GBTC noticed no internet move throughout the identical interval.

Furthermore, the Grayscale Bitcoin Belief ETF (GBTC) registered zero internet move on the eighth of Could and recorded a complete internet outflow of $17.5 billion.

In Asia, the most recent statistics point out that HK Spot Bitcoin ETFs have garnered a complete internet influx of $273.6 million since their launch on the thirtieth of April, with a every day internet influx of $6.3 million reported on the eighth of Could.

Then again, HK Spot Ether ETFs noticed a complete internet influx of $50.6 million since their launch on the thirtieth of April, however they skilled a every day internet outflow of $1.9 million on the eighth of Could.

Supply: X

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

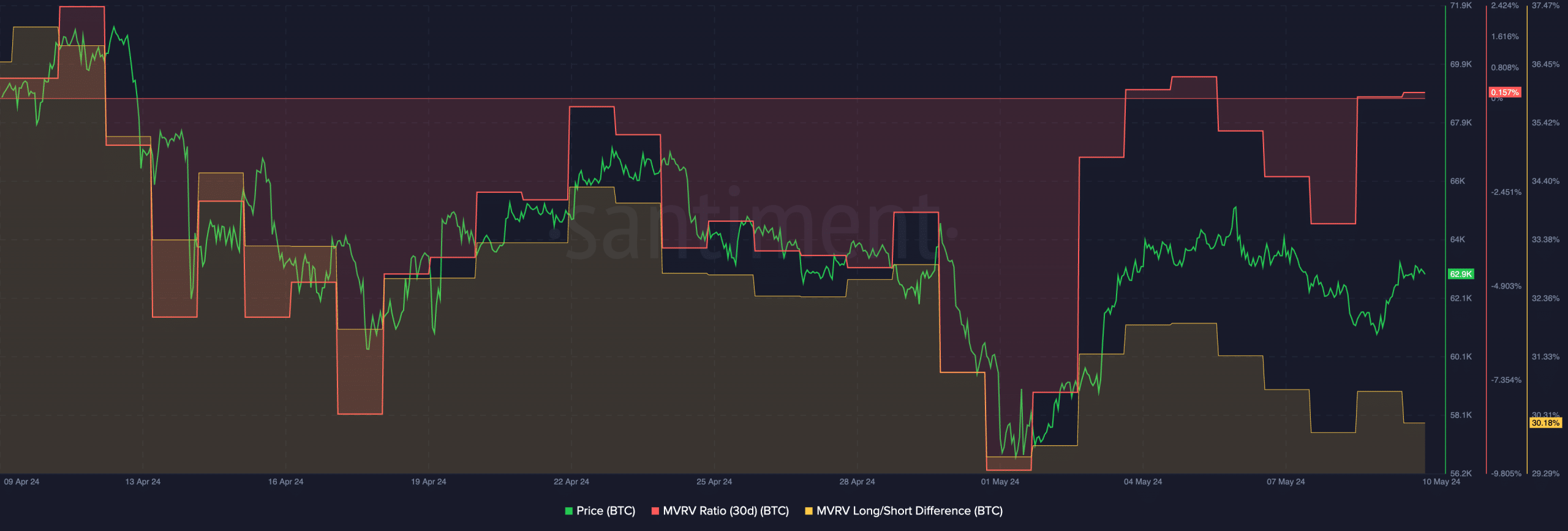

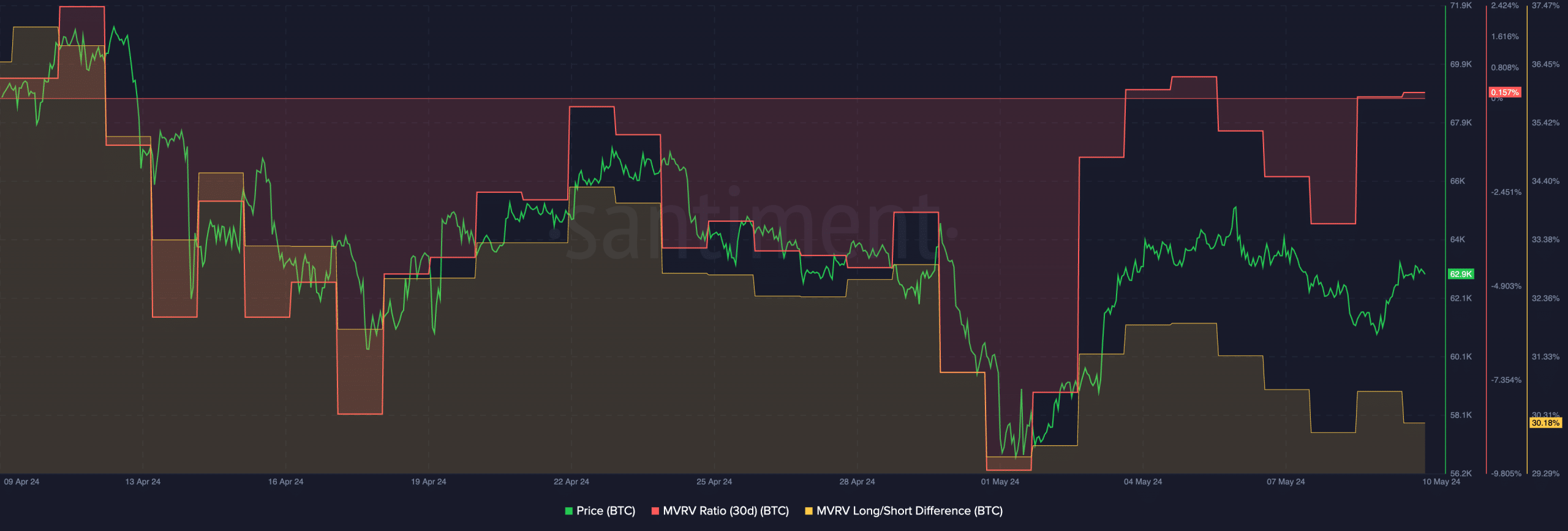

At press time, BTC was buying and selling at $62,945.16 and its worth had grown by 3.40% within the final 24 hours. The MVRV ratio for BTC had grown as a result of surge in worth.

This meant that the majority addresses holding BTC had turned worthwhile. As profitability for addresses will increase, so does the inducement for holders to promote and take pleasure in profit-taking.

Supply: Santiment