- Bitcoin miners may promote as decreased mining rewards and transaction charges decrease revenues.

- A possible sell-off by miners may dramatically influence the cryptocurrency market.

Bitcoin [BTC] continues to carry vital worth, buying and selling above $60,000 regardless of a 2.3% lower over the previous day.

This resilience in value comes amid a difficult interval for Bitcoin miners, whose revenues have plummeted following the newest halving occasion, in keeping with data from Kaiko.

Pressures on Bitcoin miners intensify

Bitcoin miners are going through growing strain to promote their holdings on account of diminishing revenues.

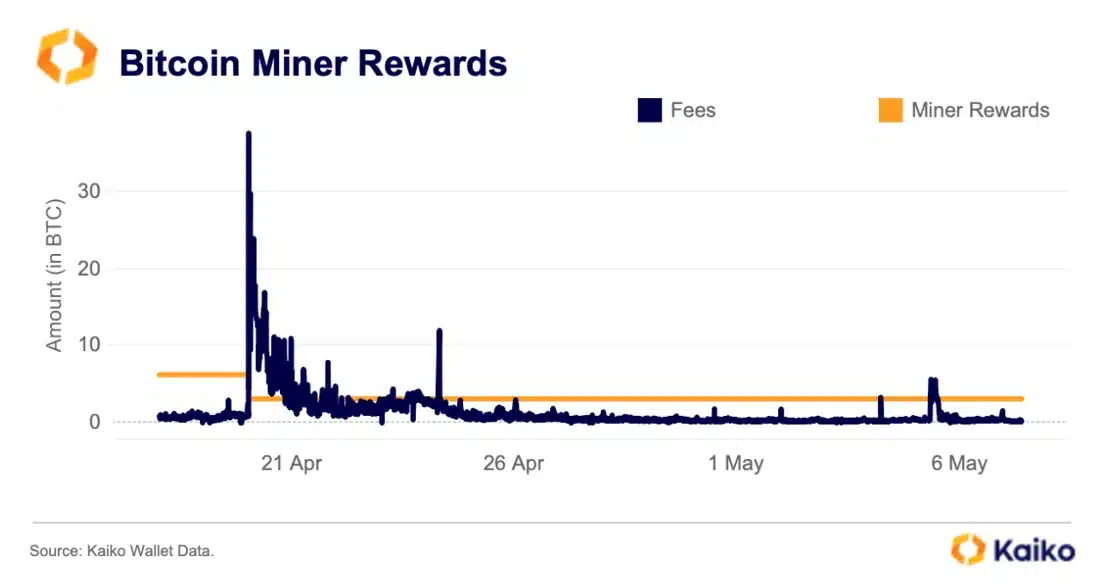

The latest halving, which diminished mining rewards from 6.25 BTC to three.125 BTC, has considerably impacted their earnings.

This drop in income is compounded by falling transaction charges, which haven’t recovered because the preliminary surge following the halving.

Supply: Kaiko

Kaiko’s report highlights that miners’ twin earnings streams—mining rewards and transaction charges—are yielding decrease returns.

That is forcing miners to think about offloading their BTC to cowl operational prices. Kaiko analysts famous,

“The halving has sometimes been a promoting occasion for Bitcoin miners as the method of making new blocks incurs vital prices, forcing miners to promote to cowl prices.”

Supply: Kaiko

The potential for a Bitcoin sell-off by miners may have profound results on the cryptocurrency market, particularly given the present low liquidity.

Mining giants like Marathon Digital, which holds over $1.1 billion in Bitcoin, may set off vital market actions in the event that they resolve to promote even a small portion of their holdings.

Kaiko’s report explains.

“Bitcoin miners sometimes classify their BTC holdings as present belongings as a consequence of their capability to liquidate these holdings to fund working bills.”

With main gamers like Marathon Digital and Riot Platforms holding substantial quantities of Bitcoin, any pressured gross sales may result in notable market impacts.

Bitcoin’s community exercise declines

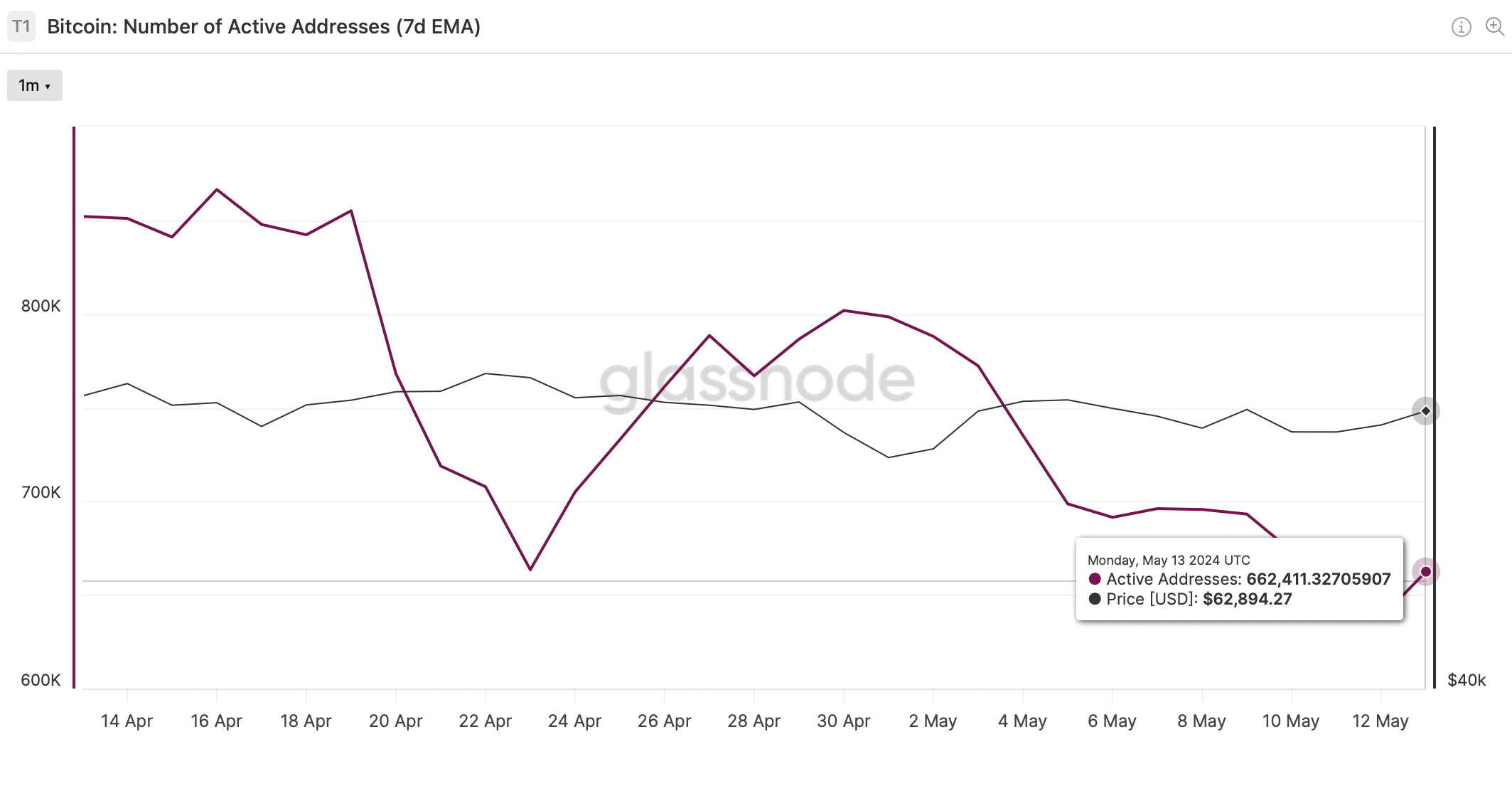

In the meantime, Bitcoin’s community exercise is exhibiting indicators of slowing down.

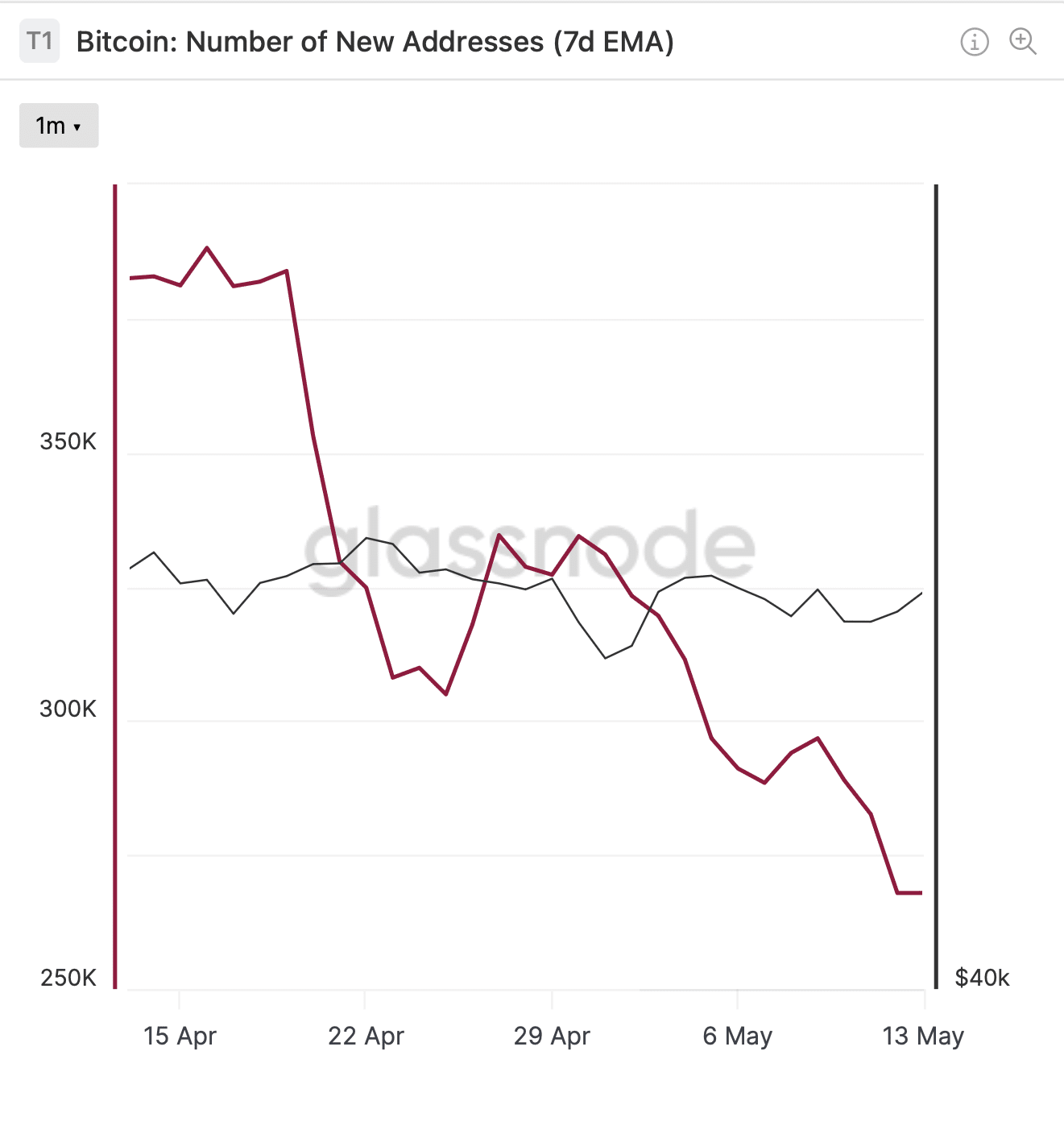

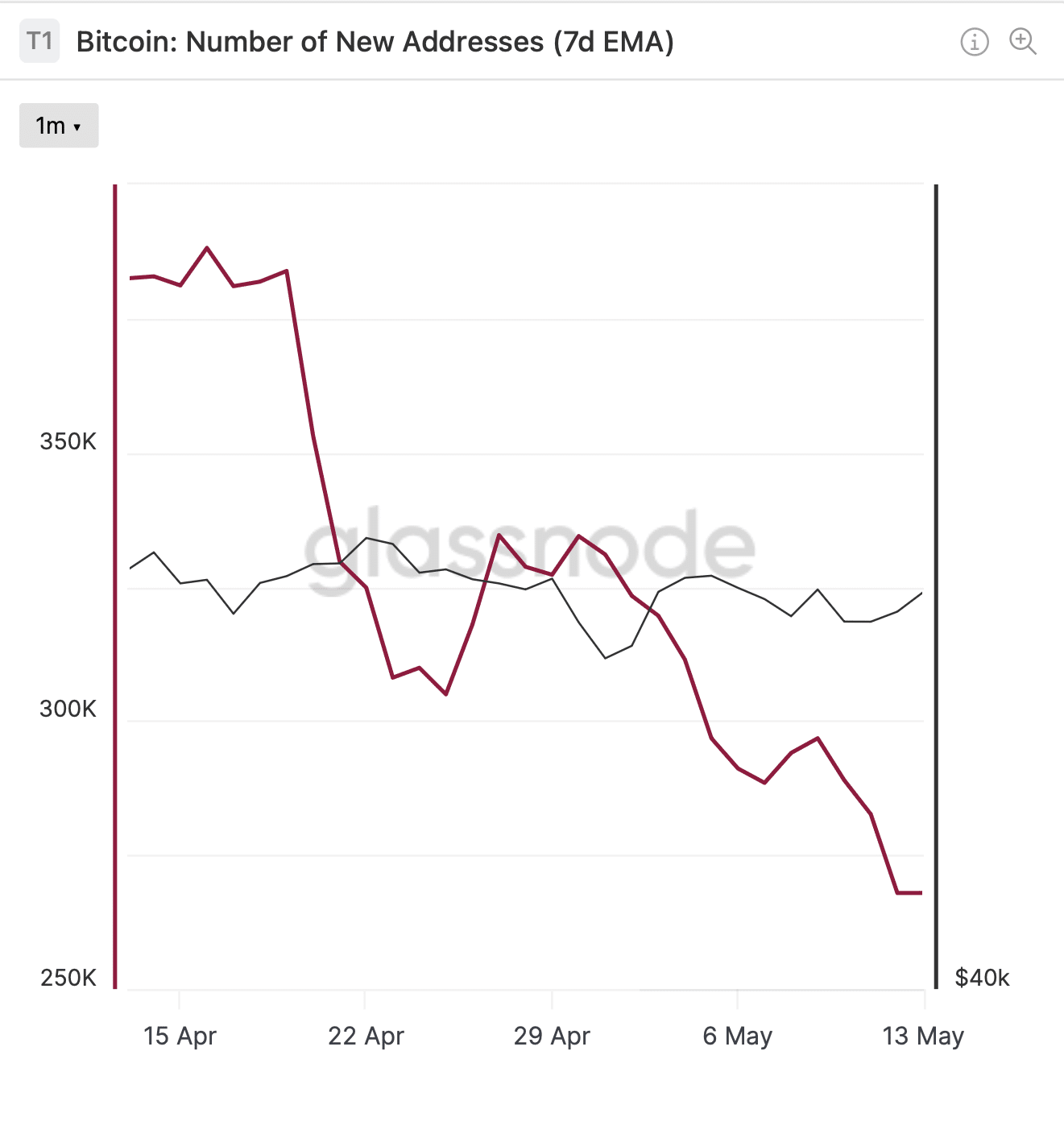

Glassnode’s data reveals that the variety of lively Bitcoin addresses (7d EMA) has fallen from over 800,000 to beneath 700,000 in latest weeks.

Supply: Glassnode

Equally, the variety of new addresses (7d EMA) has decreased from round 388,158 to 267,925, indicating a potential decline in consumer engagement and curiosity.

Supply: Glassnode

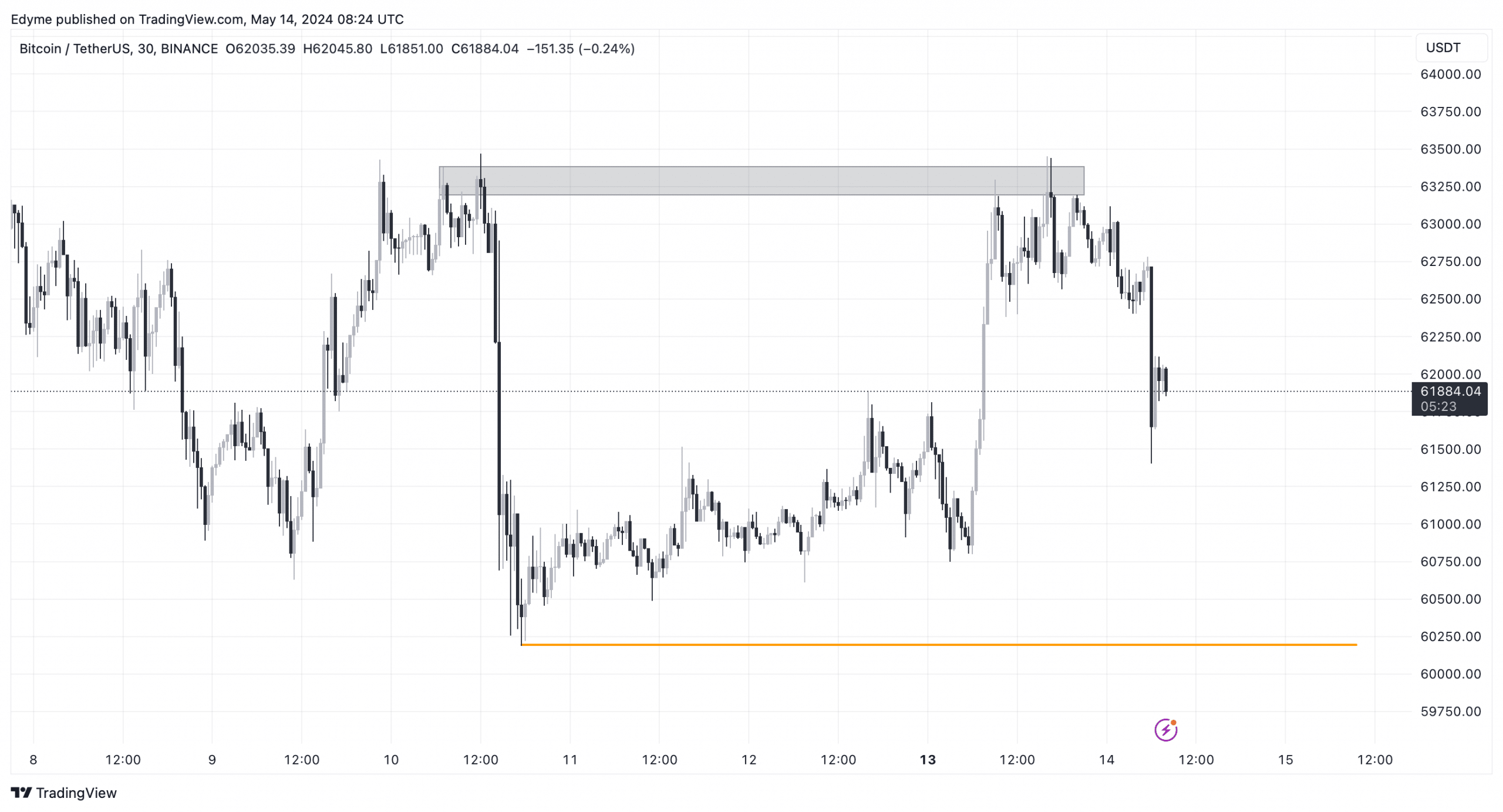

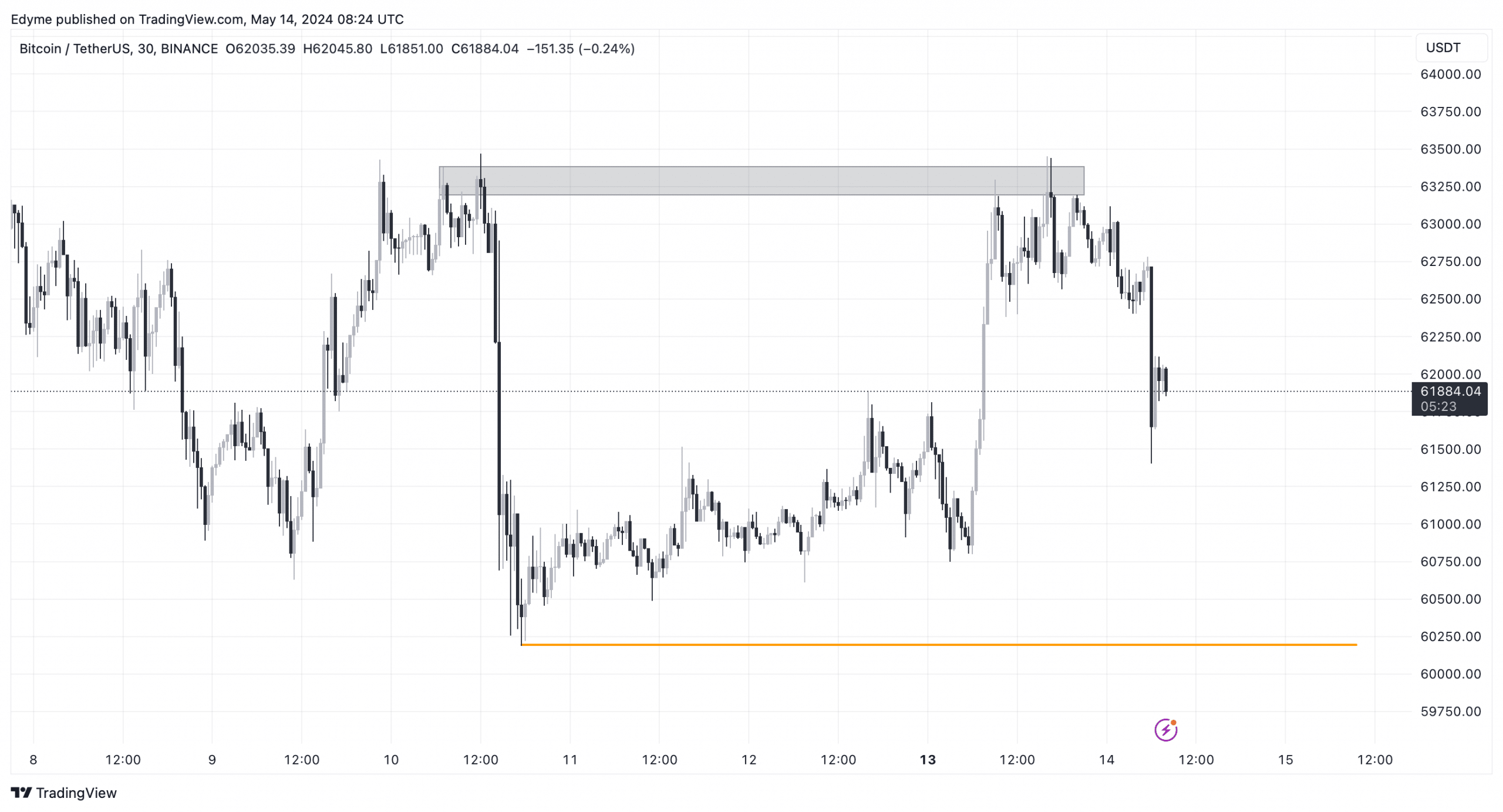

Brief-term technical evaluation instructed that Bitcoin took out liquidity on the 30-minute chart on the 14th of Could.

This instructed that the asset may proceed to retract in the direction of the $60,000 vary—a swing low—earlier than any vital upward motion happens.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The potential decline, coupled with pressures on miners, may set the stage for a risky interval within the Bitcoin market.

Supply: TradingView

In the meantime, AMBCrytpo has not too long ago reported that crypto analyst Ali Martinez has projected that if Bitcoin can reclaim $64,290 as a assist stage, there may very well be a pathway to a bullish rise towards $76,610.