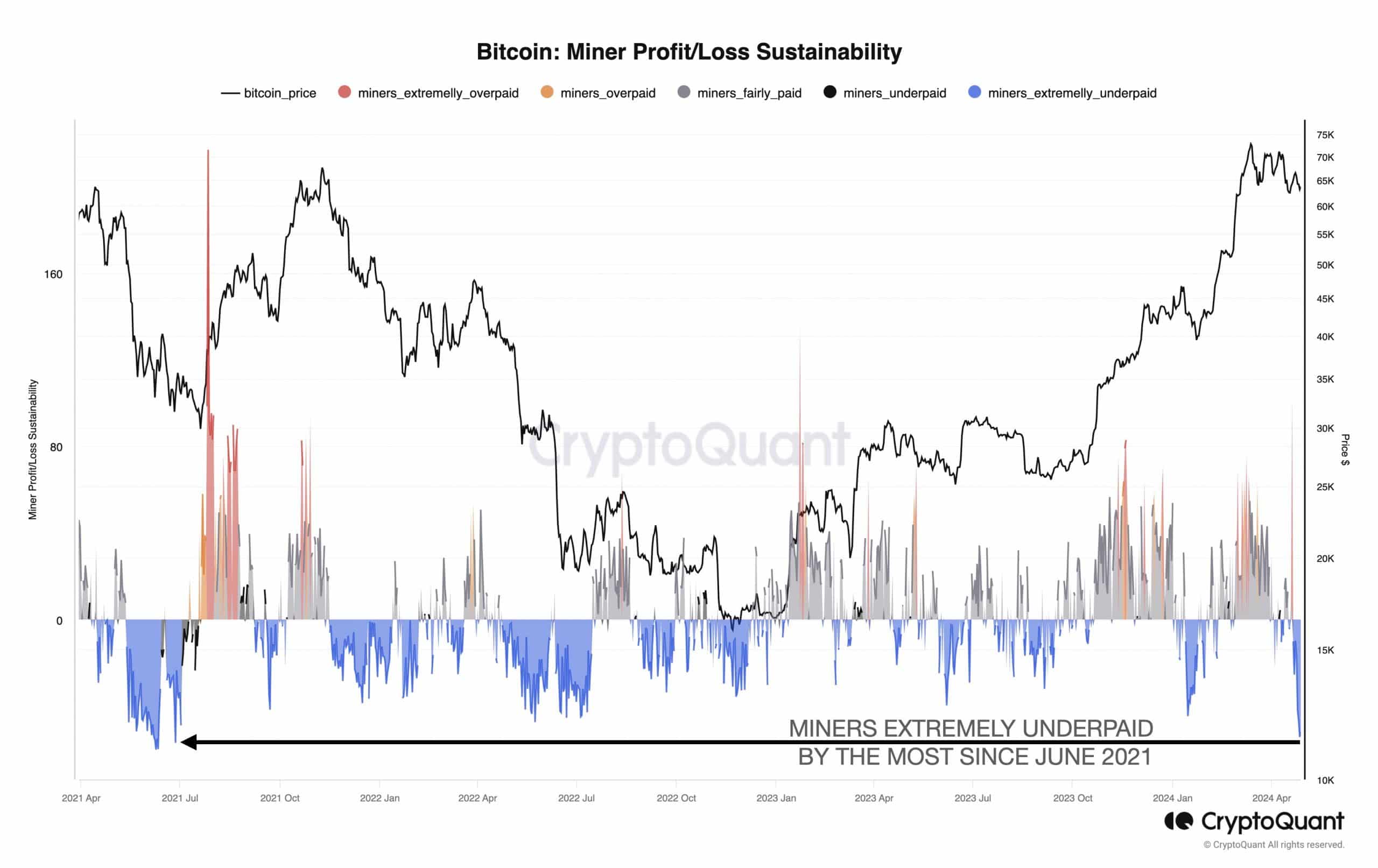

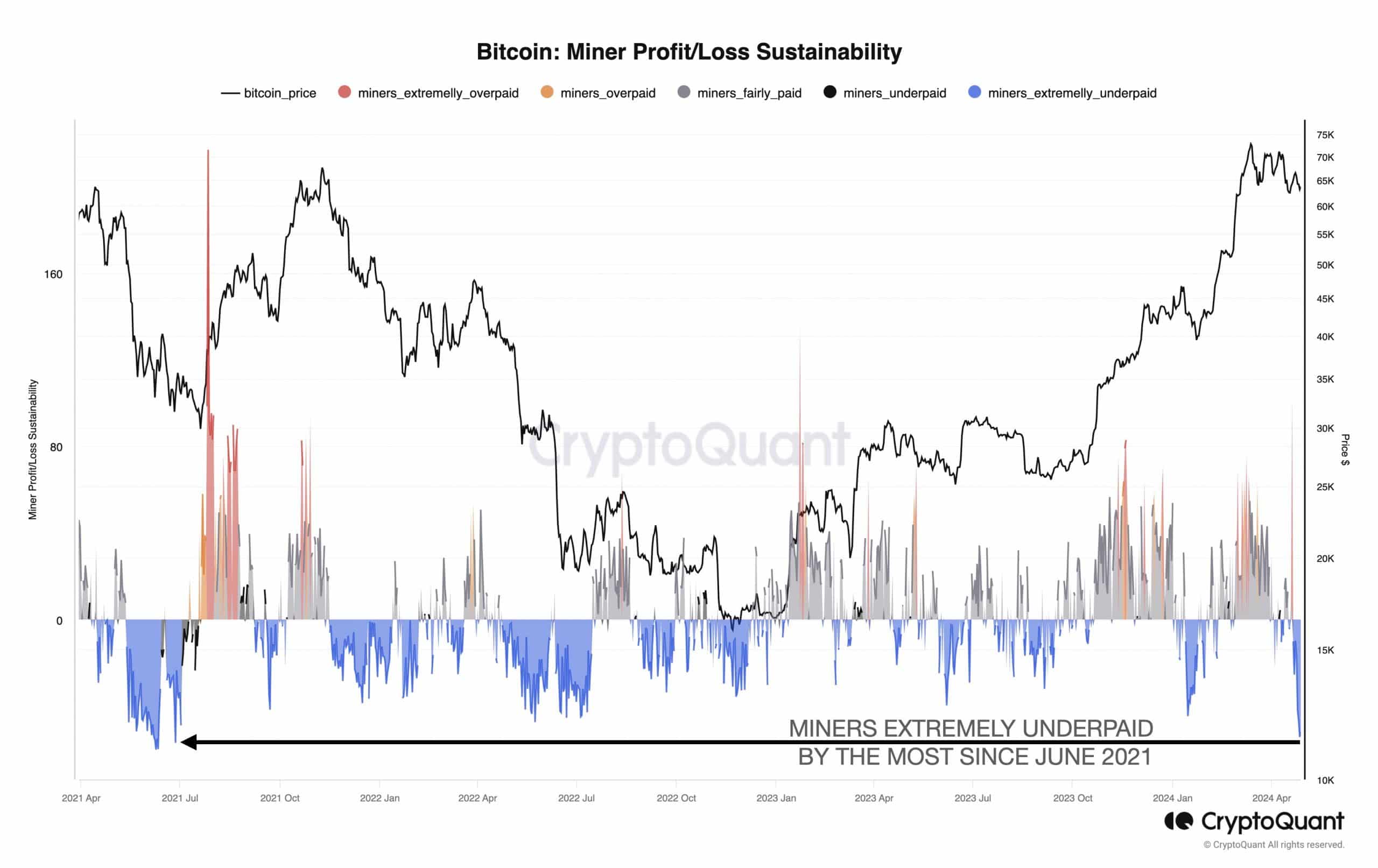

- Miner revenue/loss sustainability sank to lows not seen since June 2021.

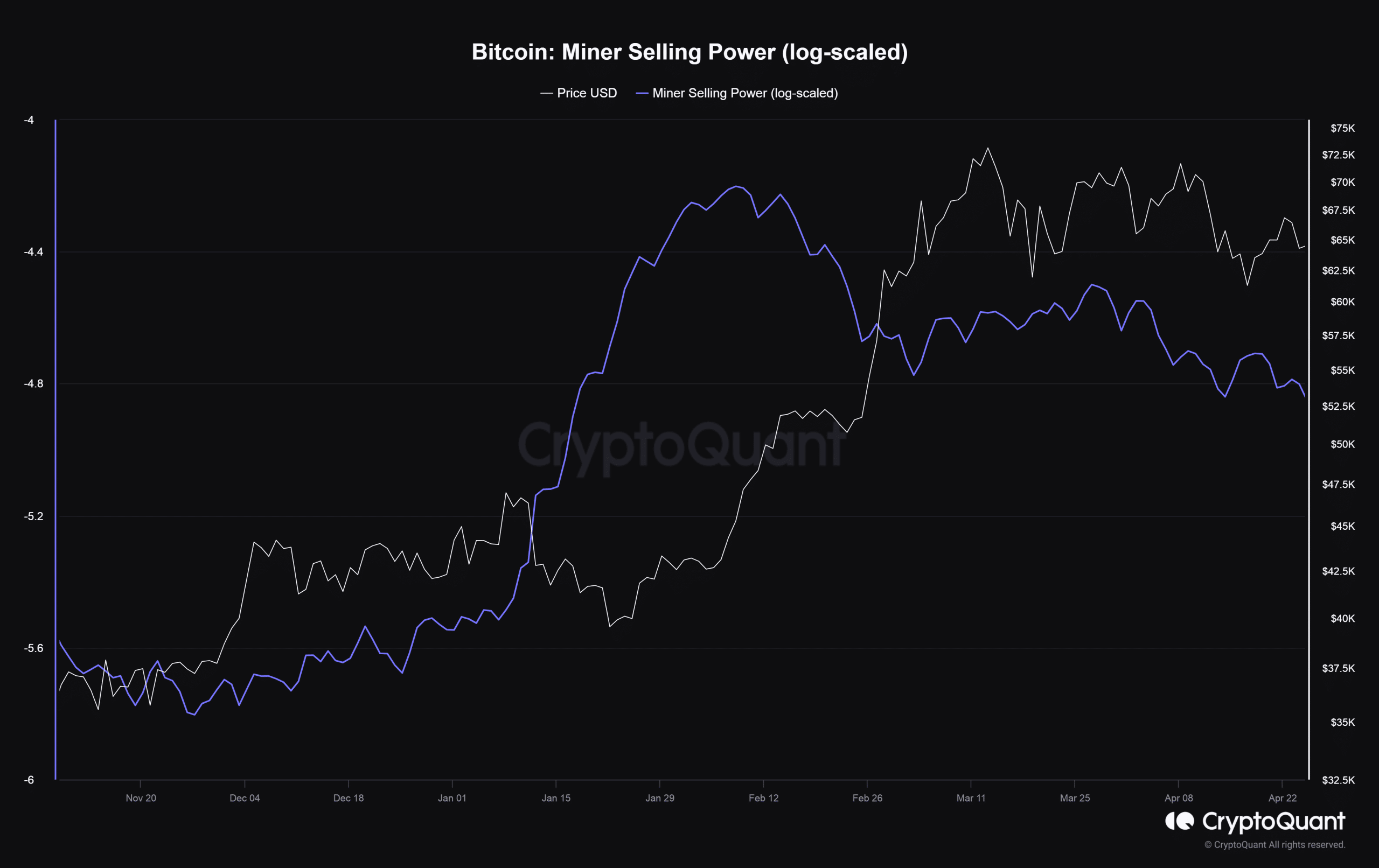

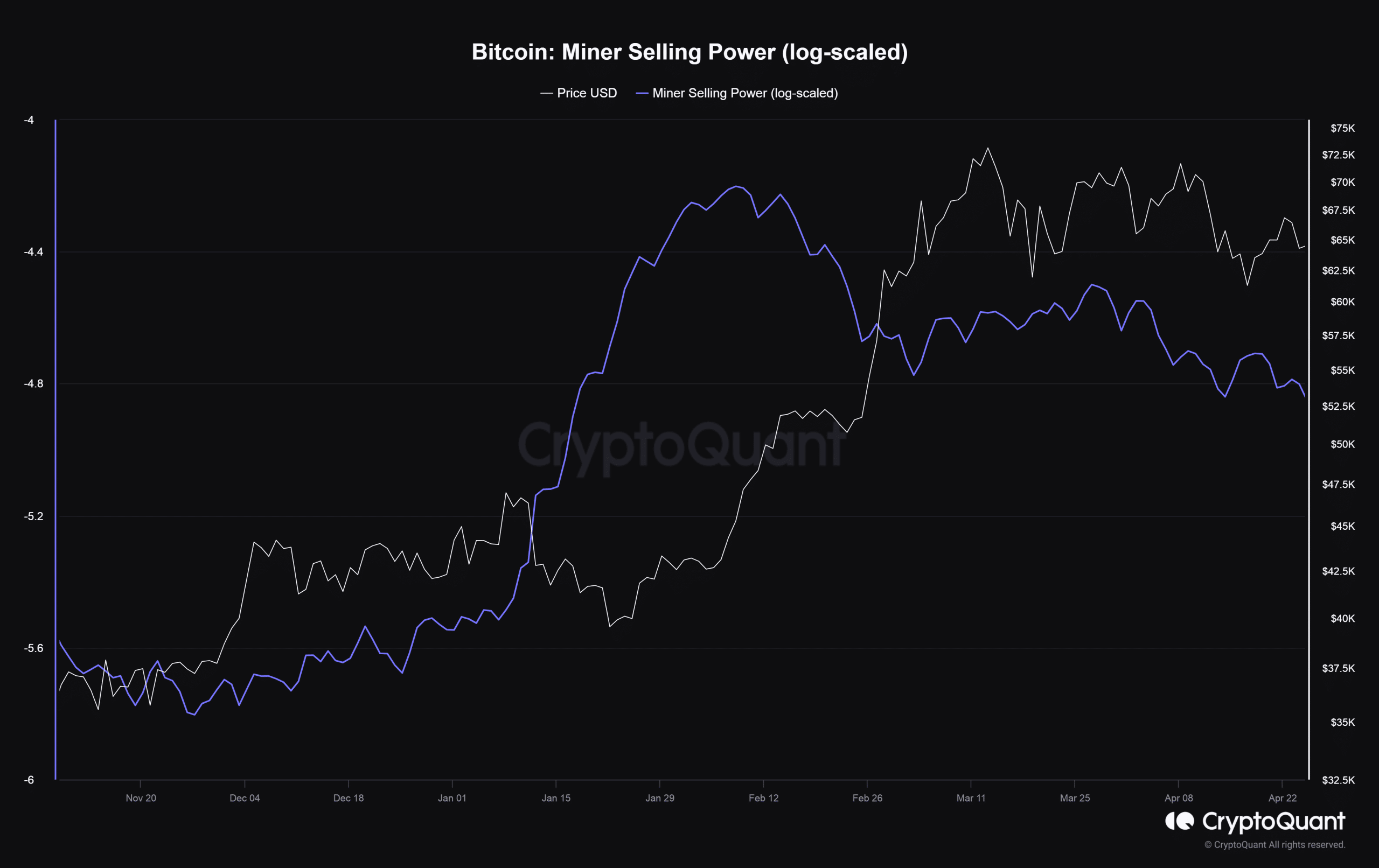

- Because of the dip in profitability, promoting strain from miners dipped additional.

Bitcoin [BTC] miners’ earnings have been dealt a giant blow for the reason that halving earlier this month, creating ache for the trade crucial for the sleek functioning of the world’s largest digital asset.

Miners face losses

In an X submit dated twenty ninth April, Julio Moreno, Head of Analysis at on-chain analytics agency CryptoQuant revealed that miner revenue/loss sustainability has sunk to lows not seen since June 2021.

Supply: CryptoQuant

For the curious, the aforementioned metric measures the expansion of block rewards – a crucial income stream for miners – in opposition to the expansion in mining issue, which is an indicator of their prices. The sharp dip indicated that miners had been “extraordinarily underpaid” on the time of writing.

Furthermore, relative to the worth of Bitcoin, day by day miner revenues had been considerably low, further information confirmed.

The latest halving slashed the block rewards from 6.25 BTC to three.125 BTC per block, resulting in a scenario the place miners must double their mining investments simply to break-even.

Whereas massive miners with deep pockets would possibly discover it simpler to climate the storm, the small miners would ultimately bow out.

Promoting strain dips

Because of the dip in profitability, most miners have resisted the urge to promote their Bitcoins and generate money. As per AMBCrypto’s evaluation of CryptoQuant information, the promoting strain from miners has dropped additional since halving.

Supply: CryptoQuant

The lowered promote strain was additionally obvious within the decrease variety of cash transferred to exchanges. For the reason that halving, 7-day shifting common of miner to exchange flows tanked 70%.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

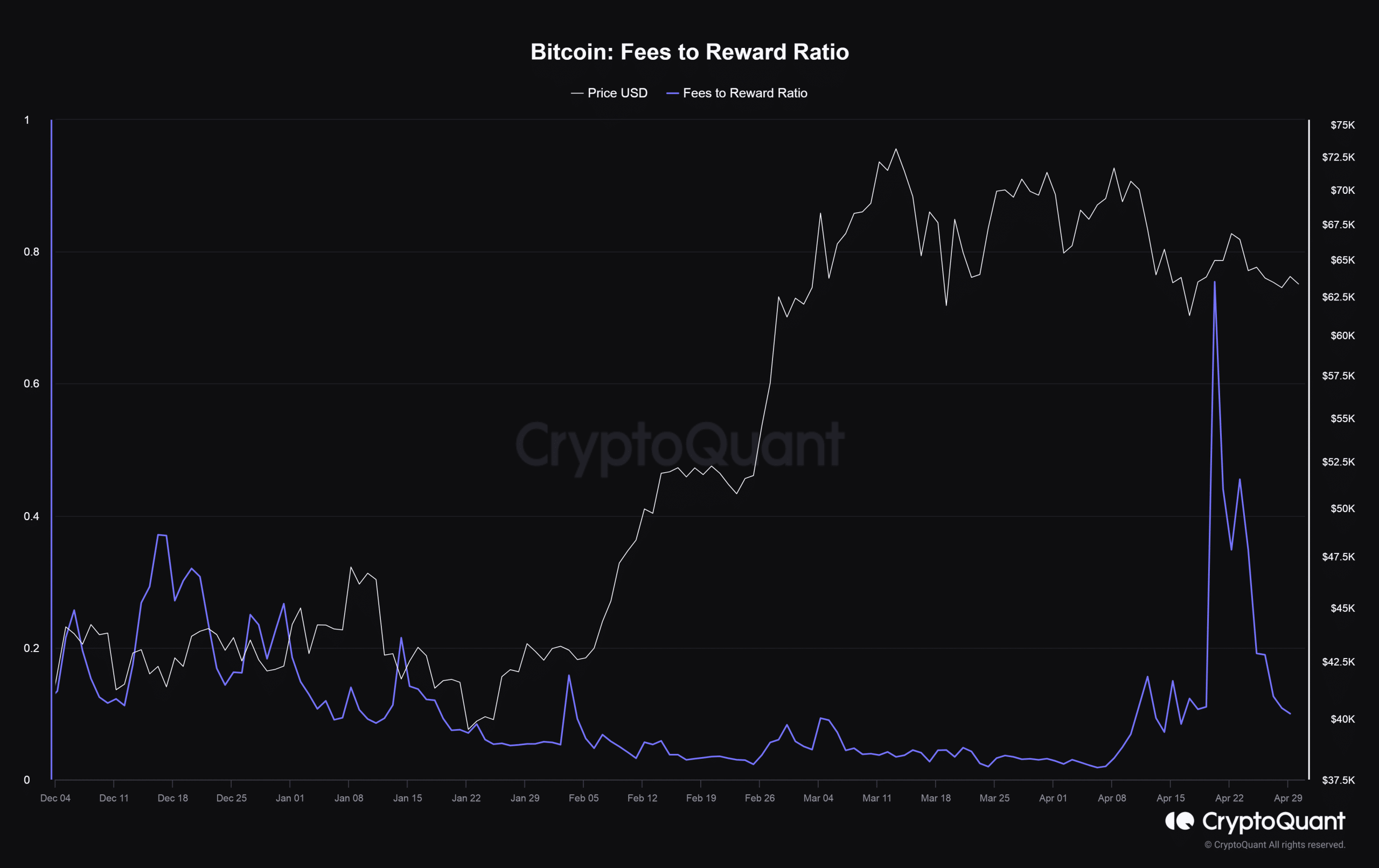

Charges not coming to the rescue

Miners had been additionally hit by a pointy fall in transaction charges for the reason that halving day frenzy.

The share of payment in whole block rewards fell progressively from 75% on the twentieth of April to 9% on the twenty ninth of April.

Supply: CryptoQuant