- BTC has fallen to the $62,000 value vary.

- Miners are feeling the warmth as income drops to report low.

Bitcoin [BTC] is experiencing a major part, mirrored within the fluctuating value traits and the financial situations impacting its miners.

Over the previous few days, there was a notable decline in miners’ income, which may very well be resulting from various factors.

Moreover, there was a lower within the reserves held by miners, doubtless resulting from them promoting off belongings to take care of operations or money out throughout unsure market situations.

Bitcoin miner income hits report low

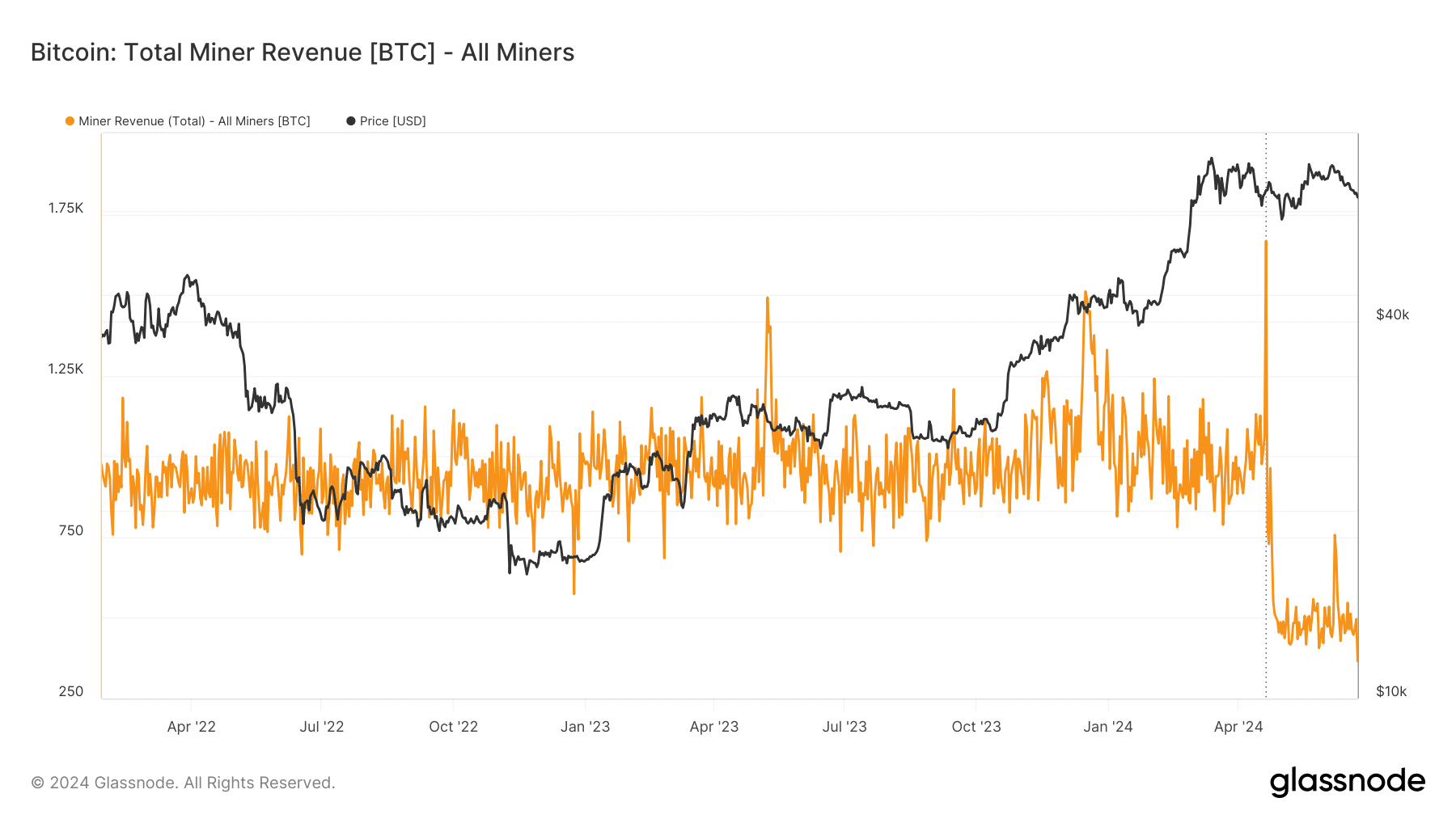

AMBCrypto’s evaluation of the Bitcoin miner income chart on Glassnode indicated a major decline in income during the last 24 hours.

At of the tip of the twenty third of June, the income was roughly 365 BTC. This translated to round $23 million, primarily based on the closing value of Bitcoin on that day.

Whereas at first look, this would possibly appear to be a considerable quantity, a deeper evaluation reveals that this determine represents a deviation from the norm.

Supply: Glassnode

A deeper evaluation of the Bitcoin miner income chart revealed that the latest figures signify a major drop from the same old income traits.

Historic knowledge from the chart confirmed that the final time revenues have been close to this low was in 2021. The chart confirmed that revenues have been round 388 BTC.

Nonetheless, the latest figures set a brand new report for the bottom income miners have skilled, surpassing the earlier report low set in 2021.

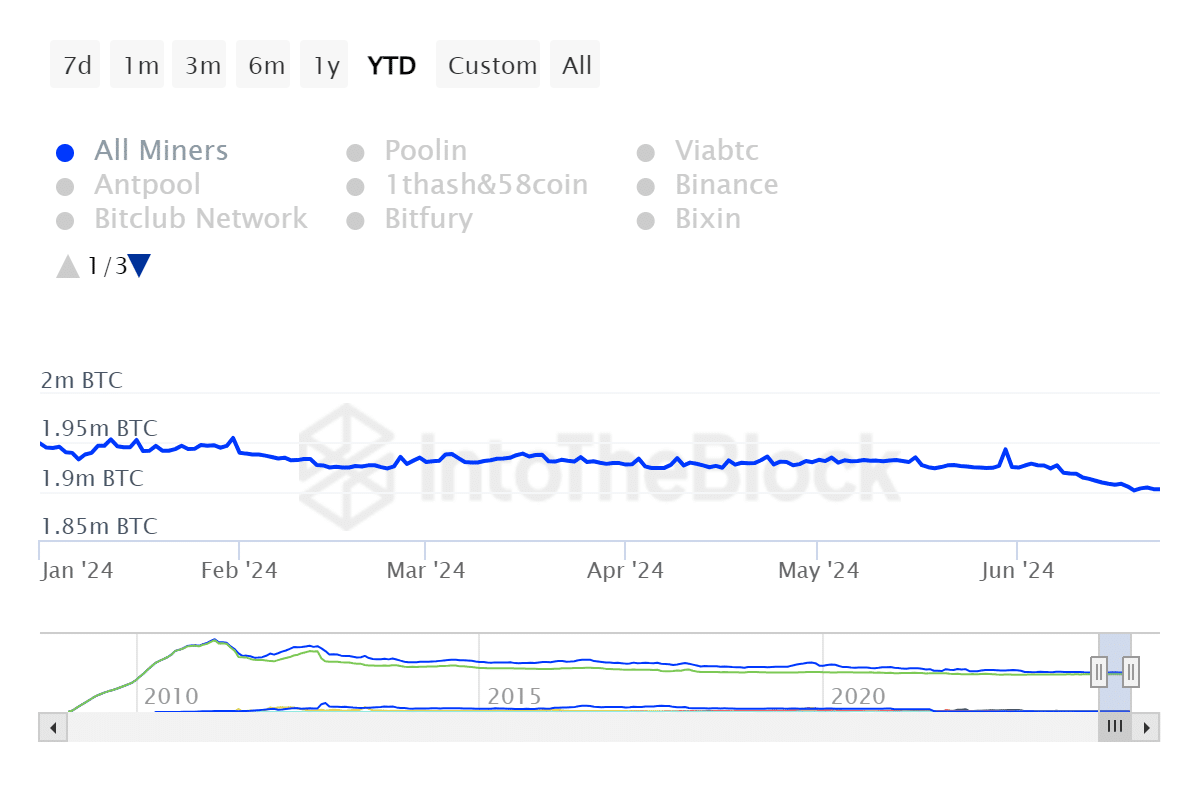

Bitcoin miner reserve follows the identical sample

The evaluation from Glassnode highlights that Bitcoin miner income has been experiencing a gradual decline, reflecting broader challenges throughout the mining sector.

This downturn in income, whereas sustaining across the $19 million stage, has proven some minor but vital declines.

Concurrently, the research of miner reserves signifies a discount. It means that miners have been compelled to unload their Bitcoin holdings to maintain operations or mitigate losses.

Supply: IntoTheBlock

This sell-off in reserves might be largely attributed to the mixture of latest Bitcoin halving occasions—which successfully scale back the reward for mining new blocks by half—and the present downtrend in Bitcoin’s market worth.

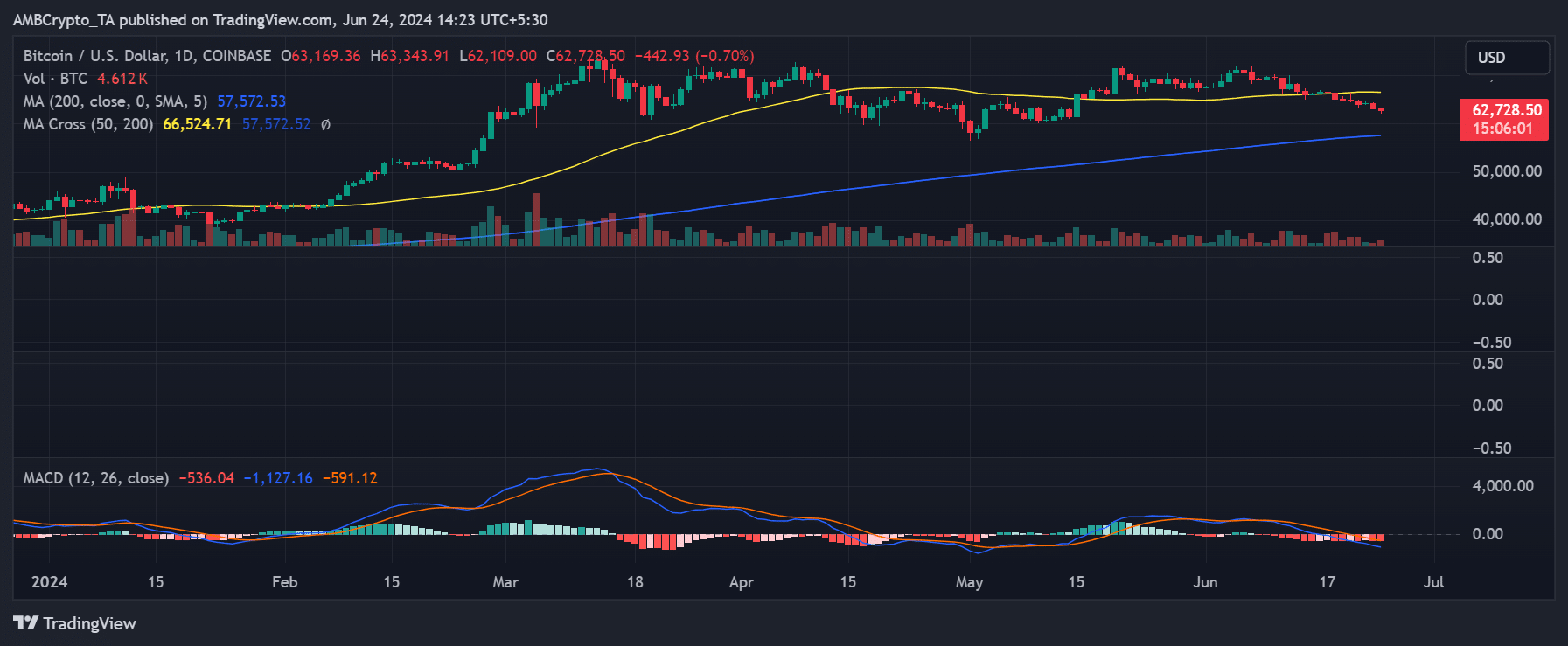

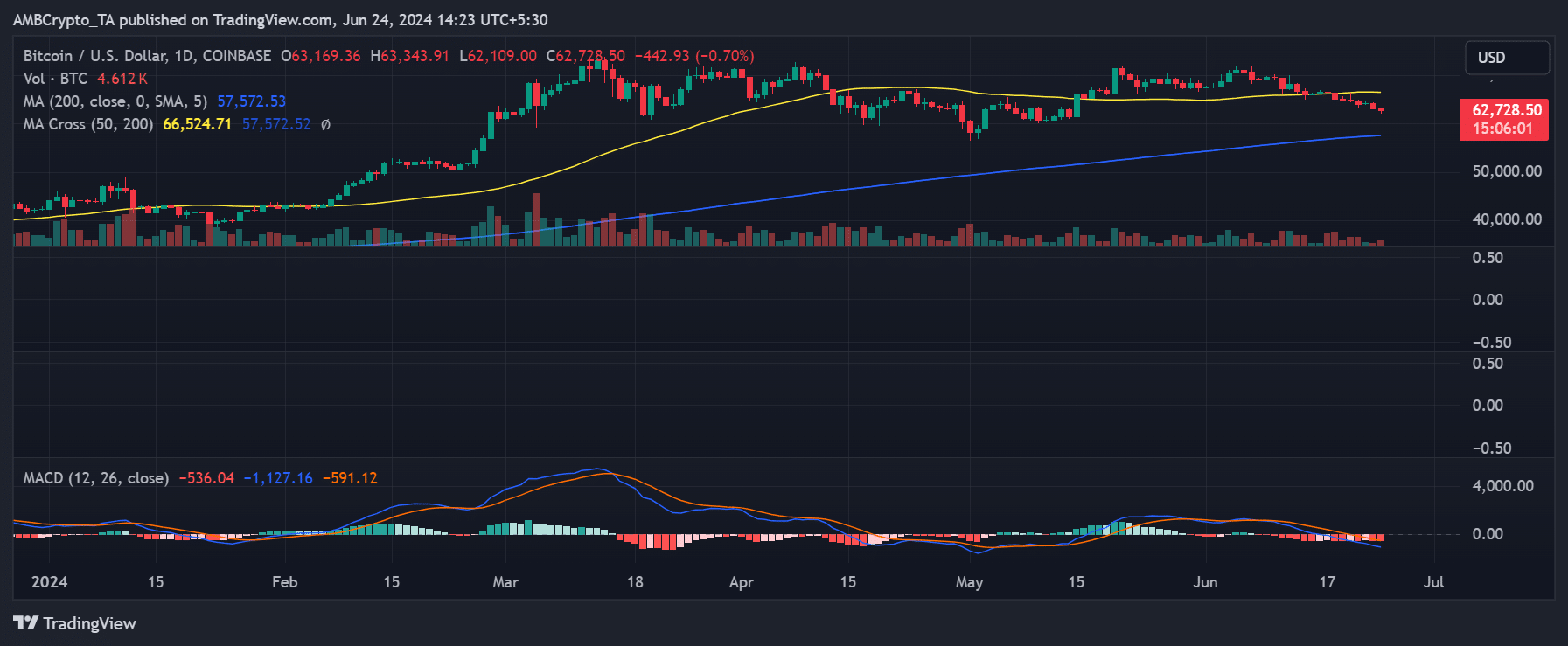

BTC continues to interrupt assist

Bitcoin’s value development indicated that it has been progressively breaking by way of numerous assist ranges. Furthermore, value ranges that beforehand acted as assist at the moment are turning into stronger resistance ranges.

Supply: TradingView

Notably, since Bitcoin dropped under the $66,000 vary, this value has turn into a major resistance stage.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

On the shut of buying and selling on the twenty third of June, BTC had fallen to round $63,171, marking a decline of roughly 1.6%.

As of this writing, it continued to face downward strain, buying and selling at about $62,880 after experiencing additional declines.