- Bitcoin’s value dropped by over 6% within the final seven days.

- Just a few metrics hinted at a market backside, however indicators steered in any other case.

Bitcoin [BTC] witnessed a substantial value correction final week, sparking worry amongst traders. However issues may take a U-turn quickly, as there have been possibilities of a pattern reversal. This appeared to be the case as BTC was mimicking its 2017 value pattern.

Bitcoin’s historic pattern

Traders didn’t make a revenue final week as BTC’s chart remained purple. In accordance with CoinMarketCap, BTC was down by greater than 6% within the final seven days, pushing its value as soon as once more below the $67k mark.

On the time of writing, BTC was buying and selling at $66,896.42 with a market capitalization of over $1.32 trillion.

In the meantime, Milkybull, a preferred crypto analyst, not too long ago posted a tweet highlighting an fascinating improvement. As per the tweet, BTC was mimicking a pattern that it adopted again in 2017 earlier than starting a bull rally.

The tweet revealed that BTC’s value was about to succeed in a market backside, after which, if historical past repeats itself, BTC’s value may kickstart a bull rally. Moreover, an indicator was additionally exhibiting a bullish divergence, similar to in 2017.

There was much more excellent news. AMBCrypto’s evaluation of Glassnode’s knowledge additionally revealed a bullish indicator.

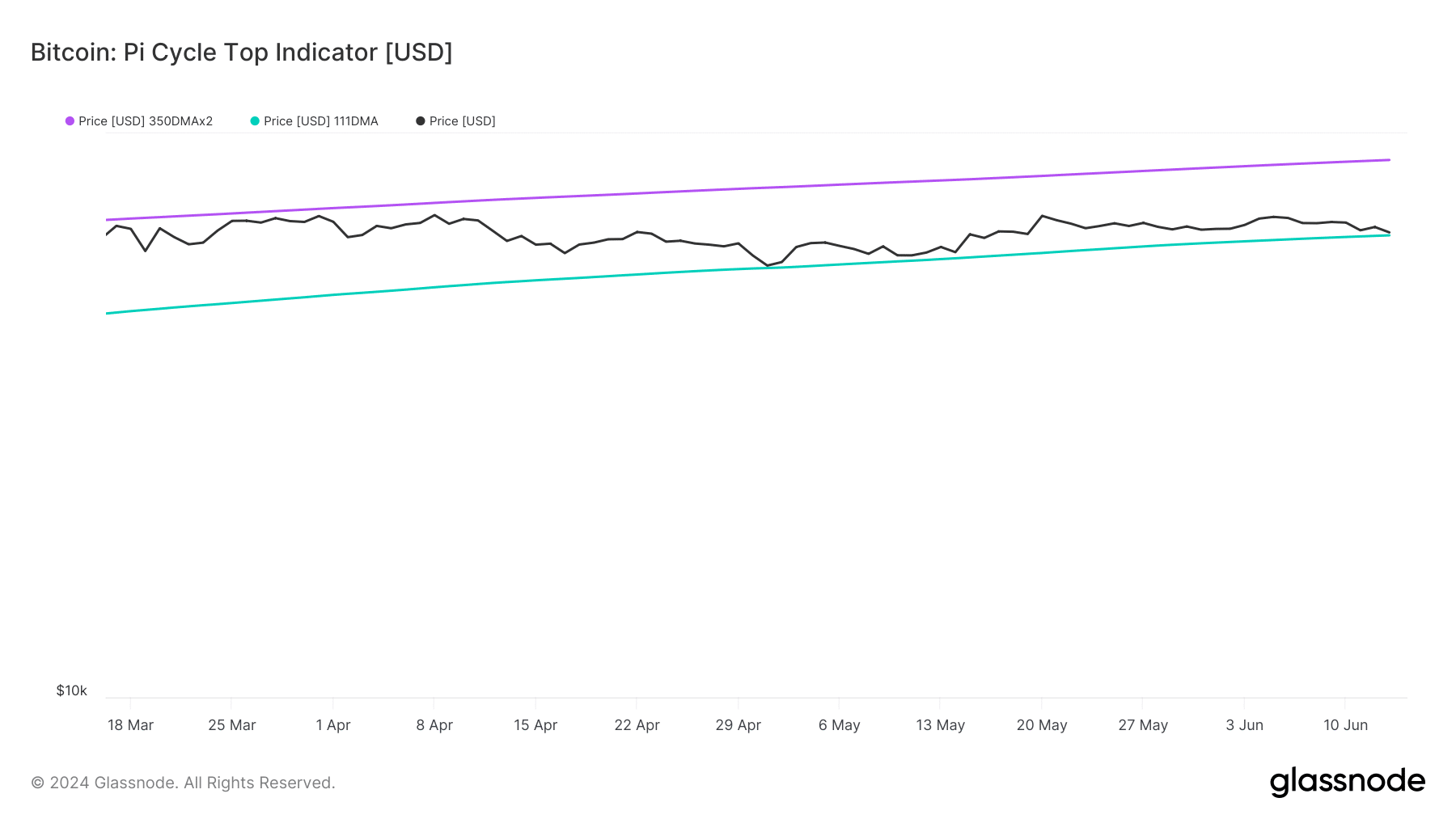

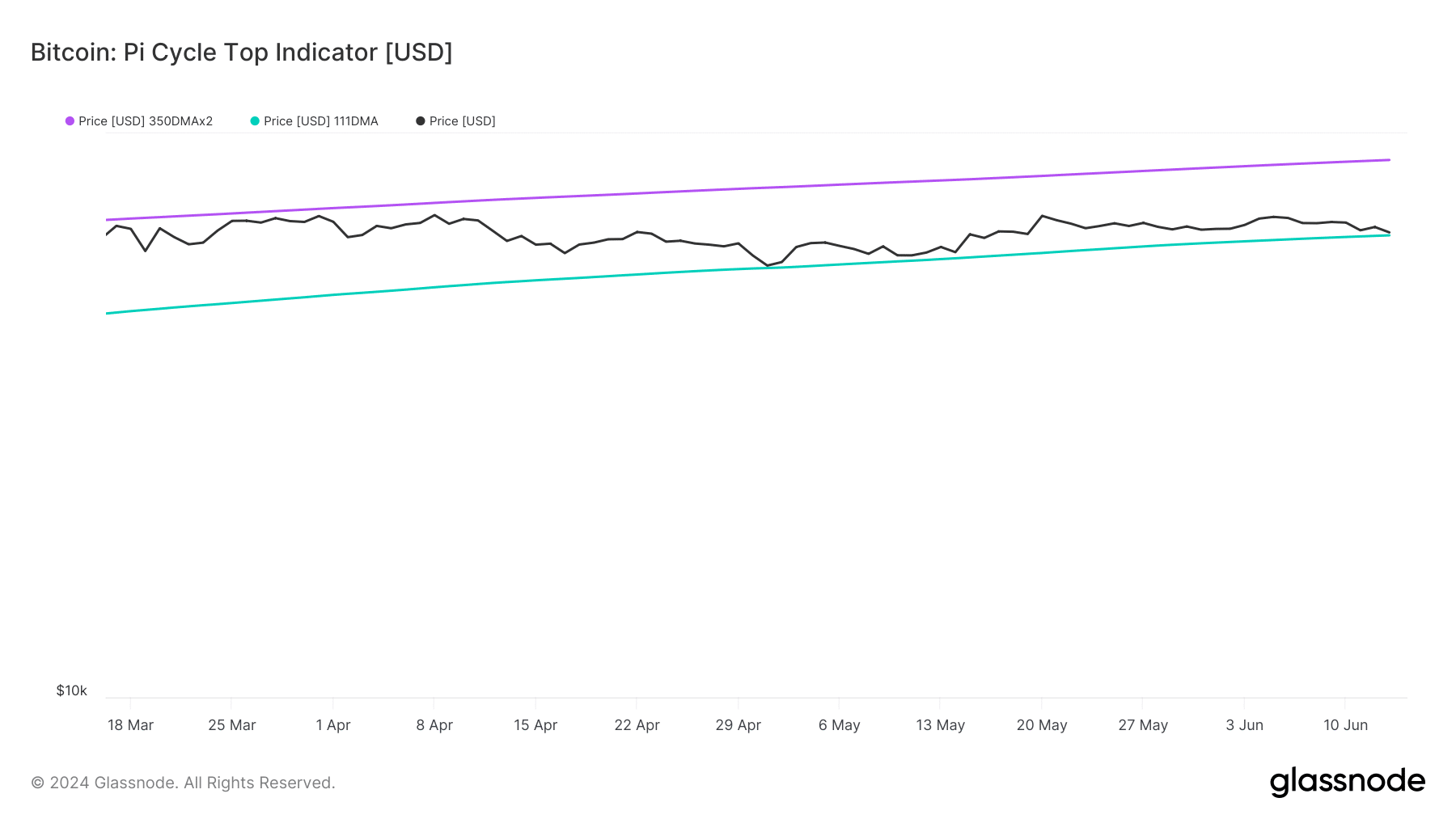

In accordance with BTC’s Pi Cycle Prime indicator, Bitcoin’s value was resting at its market backside, and if a pattern reversal occurs, then it’d contact $89k quickly.

Supply: Glassnode

Is BTC getting ready for a rally?

AMBCrypto then checked CryptoQuant’s data to see whether or not metrics additionally hinted at a value improve. BTC’s change reserve was dropping, which means that promoting strain on BTC was low.

Supply: CryptoQuant

Its Binary CDD was additionally inexperienced, which means that long-term holders’ actions within the final seven days had been decrease than common. They’ve a motive to carry their cash. Nonetheless, the remainder of the metrics seemed bearish.

As an example, BTC’s aSORP steered that extra traders are promoting at a revenue, which could trigger additional bother for BTC’s already bearish value motion.

On prime of that, BTC’s fear and greed index had a worth of 63% at press time, which means that the market was in a “greed” part. At any time when the metric reaches this degree, it signifies that the possibilities of a value decline are excessive.

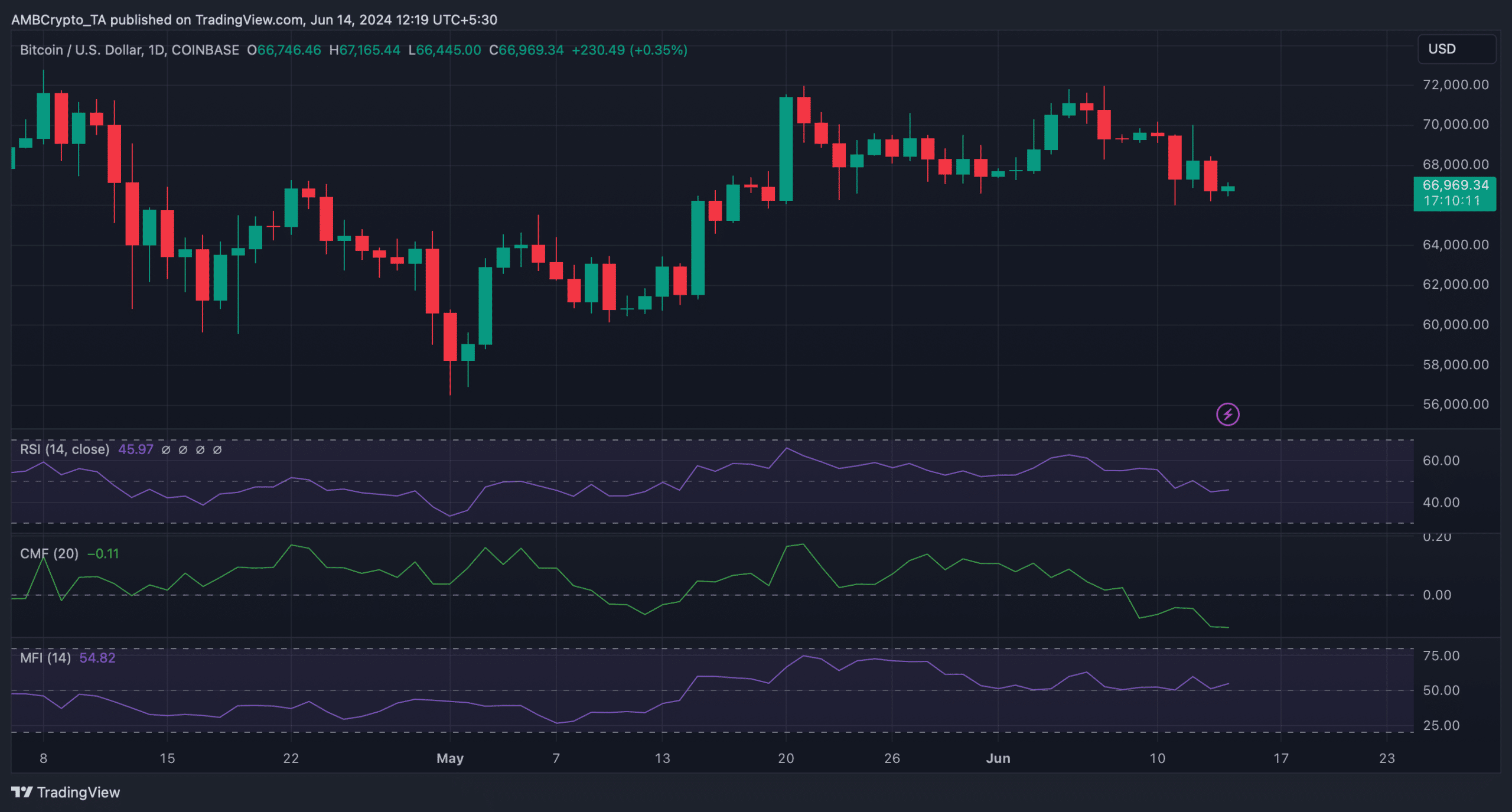

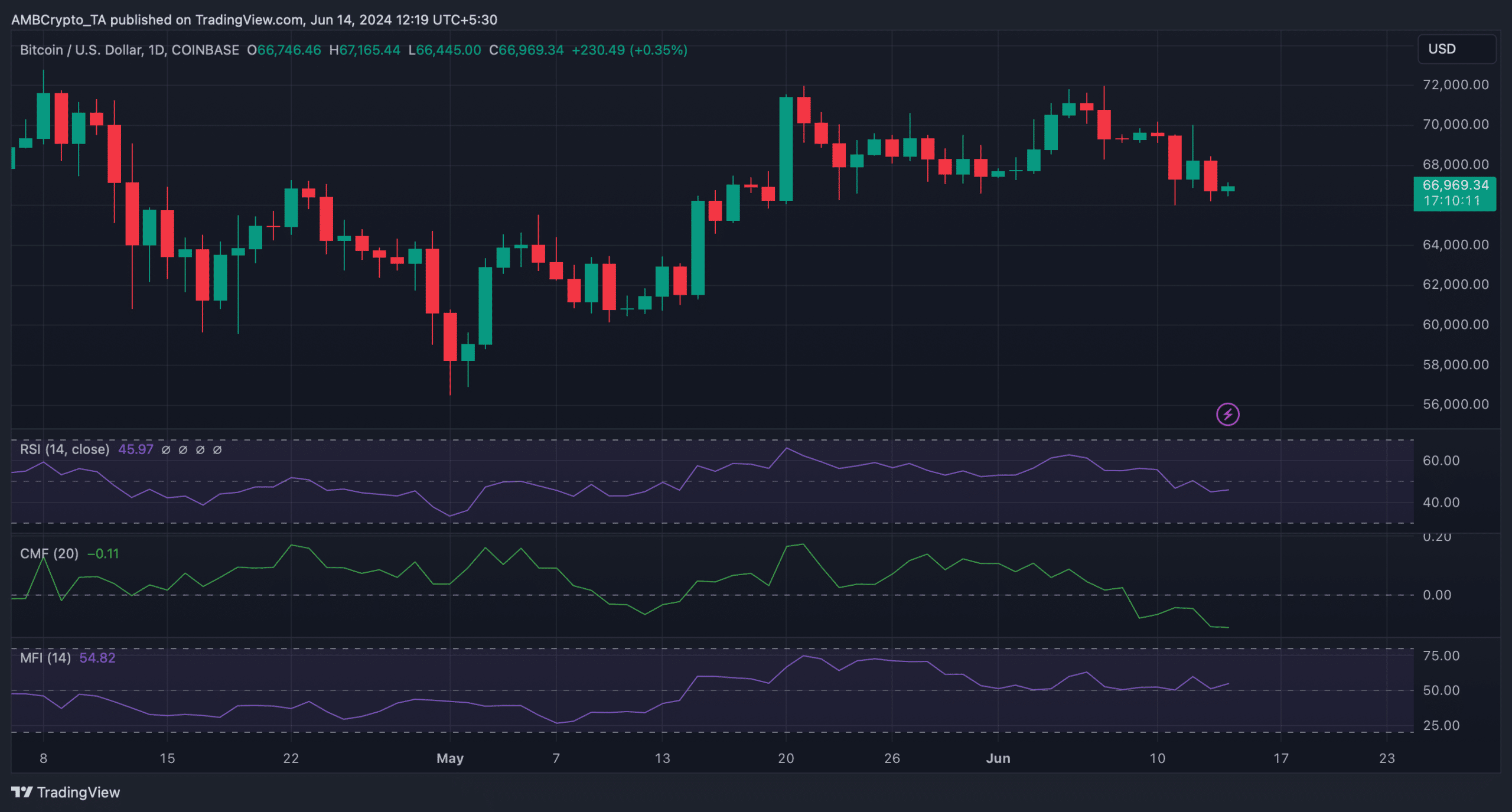

Just a few of the market indicators additionally seemed fairly bearish. For instance, its Chaikin Cash Stream (CMF) had registered a pointy downtick.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Moreover, the Relative Power Index (RSI) was additionally resting below the impartial mark, indicating an extra value decline.

Nonetheless, the Cash Stream Index (MFI) supported the bulls because it moved northwards from the impartial mark.

Supply: TradingView