- Bitcoin might attain the $60,500 degree if its every day candle closes above the $58,500 degree.

- Veteran dealer Peter Brandt suggests a purchase sign in Bitcoin for the quick time period.

In the previous few days, the general cryptocurrency market has been very risky and experiencing steady ups and downs.

Amid this difficult scenario, Michael Saylor, the founder and chairman of MicroStrategy, and the veteran dealer Peter Brandt took bullish stances on Bitcoin [BTC].

Michael Saylor and Peter Brandt put up on X

On seventh July, 2024, Michael Saylor made a post on X stating that

“Bitcoin is engineered to maintain profitable.”

This put up from MicroStrategy’s chairman highlights that Bitcoin is designed to succeed and change into extra precious over time regardless of something occurring available in the market.

Together with the tweet, he additionally shared a picture that showcased BTC’s efficiency over the 12 months, evaluating it to different asset courses together with Gold and silver.

Individually, a distinguished veteran dealer Peter Brandt additionally made a post on X stating that he discovered a bullish sample in BTC, which he known as “Foot Shot.” He additionally added that it is a purchase sign for the quick time period.

Each these tweets by business giants gained large consideration from traders and merchants on this difficult scenario and is perhaps influencing the feelings of the bulls.

Bitcoin technical evaluation and key ranges

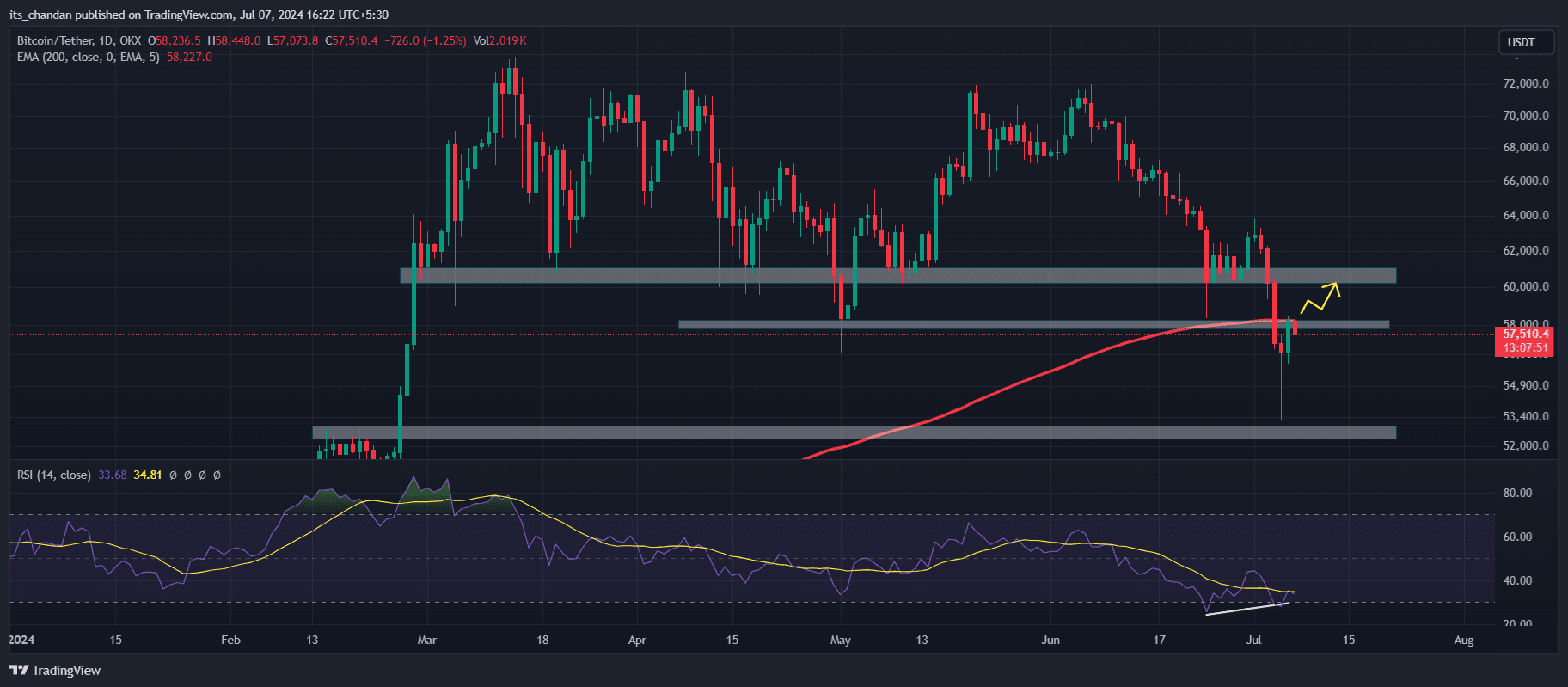

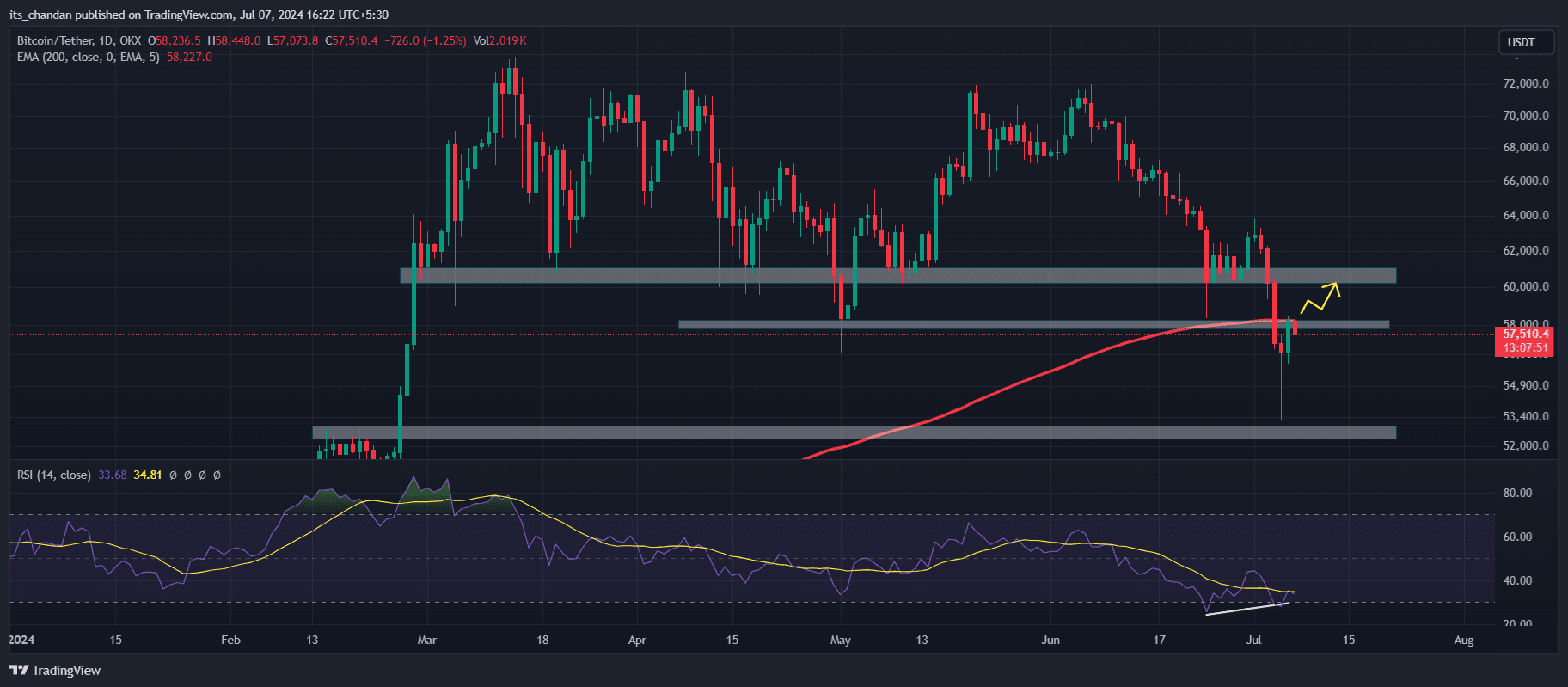

In accordance with technical evaluation, Bitcoin is at present trying bearish and going through resistance from the 200 Exponential Shifting Common (EMA) close to the $58,000 degree.

This 200 EMA might create a hurdle for BTC till it offers a candle closing above the $58,500 degree.

Supply: TradingView

Regardless of robust resistance, the Relative Energy Index (RSI) is in an oversold space and forming a bullish divergence, which alerts a possible signal of restoration.

There’s a excessive likelihood that BTC will attain the $60,500 degree if it offers a every day candle closing above the $58,000 degree.

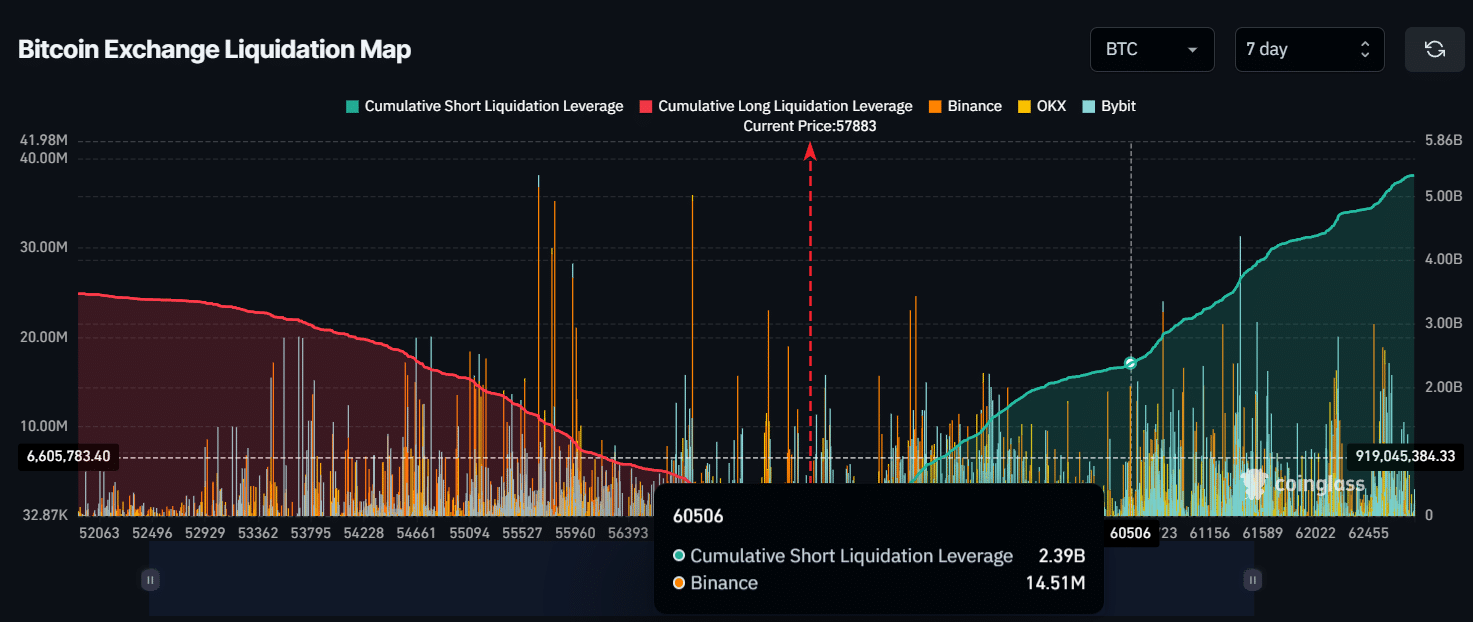

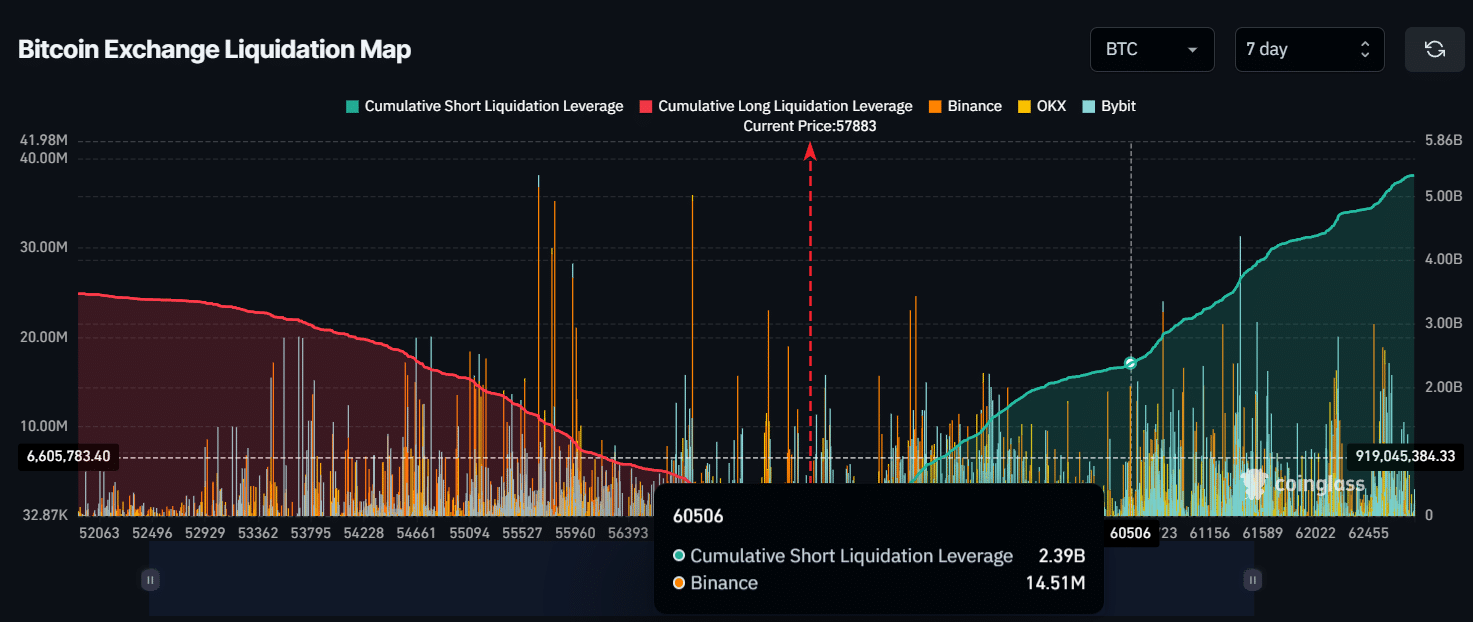

In accordance with an on-chain analytic agency CoinGlass, if BTC reaches the $60,500 degree, practically $2.4 billion of quick place might be liquidated.

In the meantime, the open curiosity (OI) of Bitcoin has surged by 1.4% within the final 24 hours as per CoinGlass information. This surge in OI alerts slight investor and dealer curiosity in Bitcoin.

Supply: CoinGlass

BTC price-performance evaluation

As of writing, BTC is buying and selling close to the $57,800 degree and it skilled a 2% upside momentum within the final 24 hours.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nevertheless, the buying and selling quantity dropped by 37% in the identical interval, signaling a lower in investor and dealer participation over the past 24 hours.

If we have a look at the efficiency of BTC over an extended interval, within the final 7 days it’s down by 6%. Whereas, within the final 30 days, BTC has misplaced over 20% of its worth, dropping from $71,300 to $57,800 degree.