- BTC has remained bullish regardless of latest fluctuations.

- Extra lengthy positions have been liquidated within the present buying and selling session.

Bitcoin [BTC] started the brand new month with notable value fluctuations, sparking diverse market reactions.

Regardless of ending the earlier buying and selling session on a worthwhile be aware, it skilled important liquidation volumes prompted by its value volatility.

Lengthy liquidations dominate

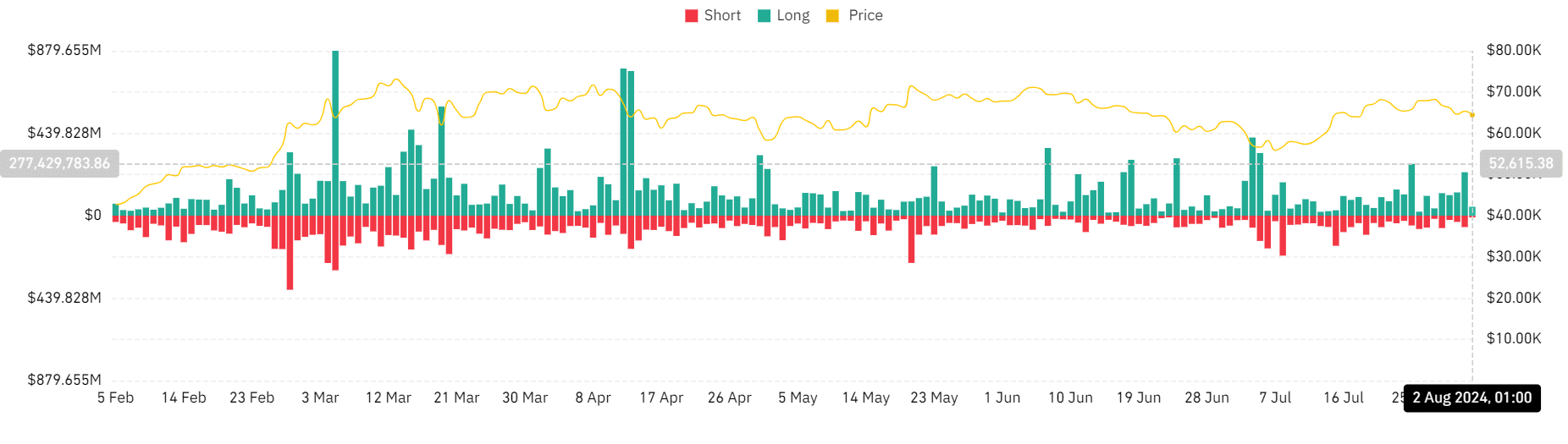

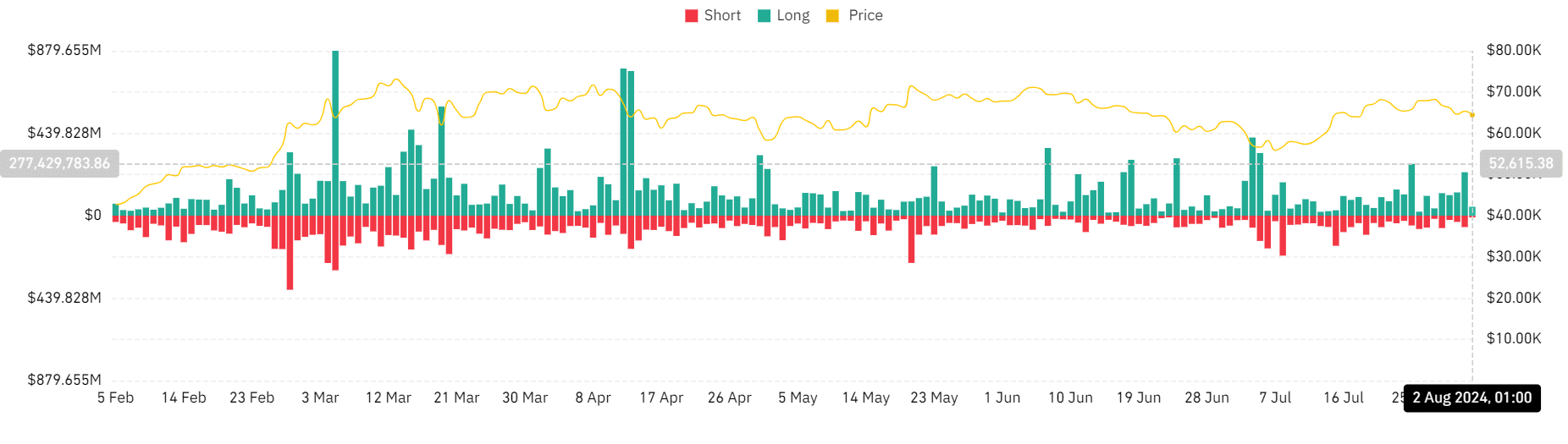

Evaluation of the Bitcoin liquidations chart on Coinglass revealed that the primary day of the month witnessed liquidations exceeding $280 million.

A deeper look into the info confirmed that lengthy liquidations accounted for many of this quantity, recording over $231.6 million. In distinction, quick liquidations had been considerably decrease, round $60.8 million.

Additional evaluation indicated that this spike in lengthy liquidations on the first of August was not an remoted incident; BTC had been experiencing a dominance of lengthy liquidations within the days main as much as this occasion.

This pattern means that many merchants had been overly optimistic about BTC’s value actions. This led to the next quantity of lengthy positions being liquidated when the market turned towards them.

Supply: Coinglass

The prevalence of lengthy liquidations highlighted a interval of bullish sentiment that was abruptly challenged, inflicting substantial monetary repercussions for these holding leveraged lengthy positions.

The disparity between lengthy and quick liquidation volumes underscores the volatility BTC has witnessed in the previous couple of days.

Understanding the trigger

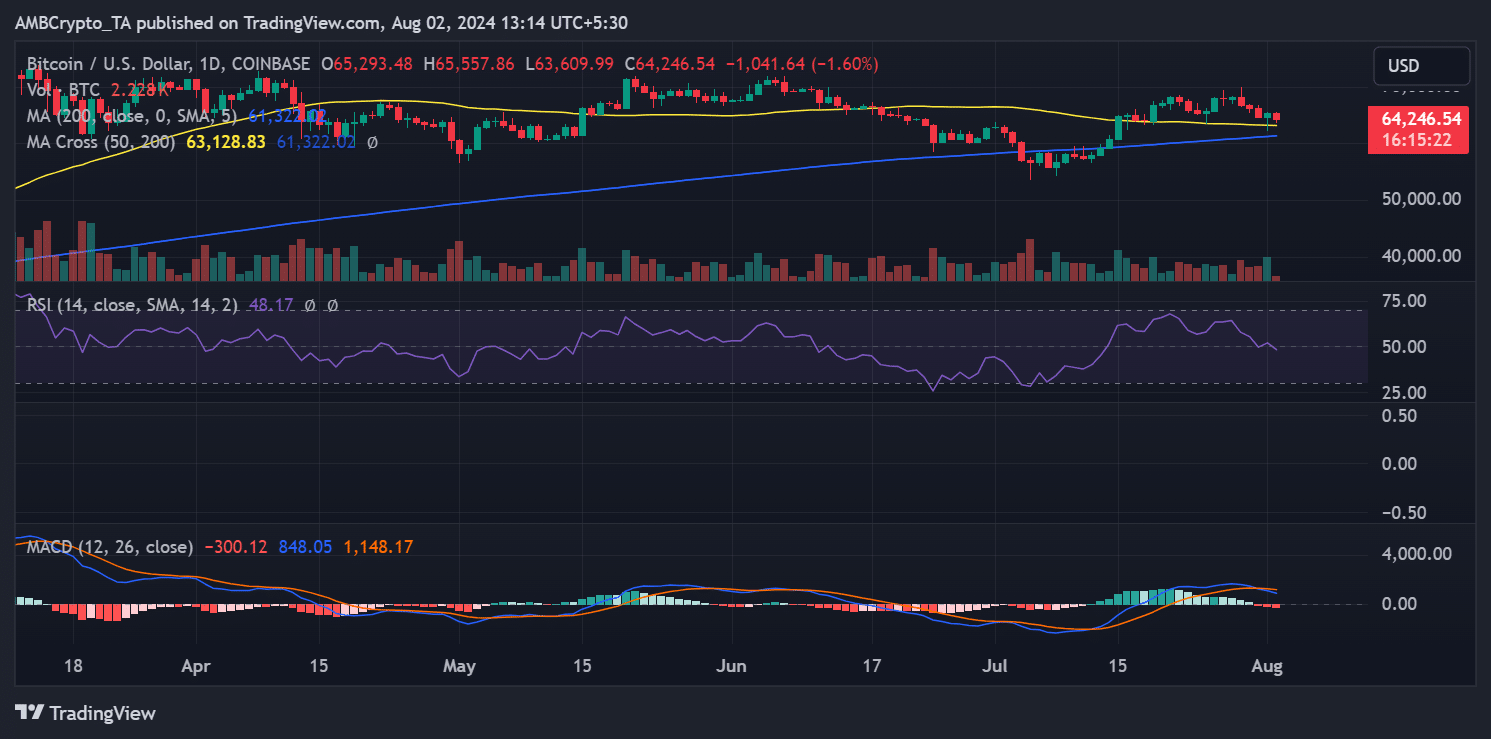

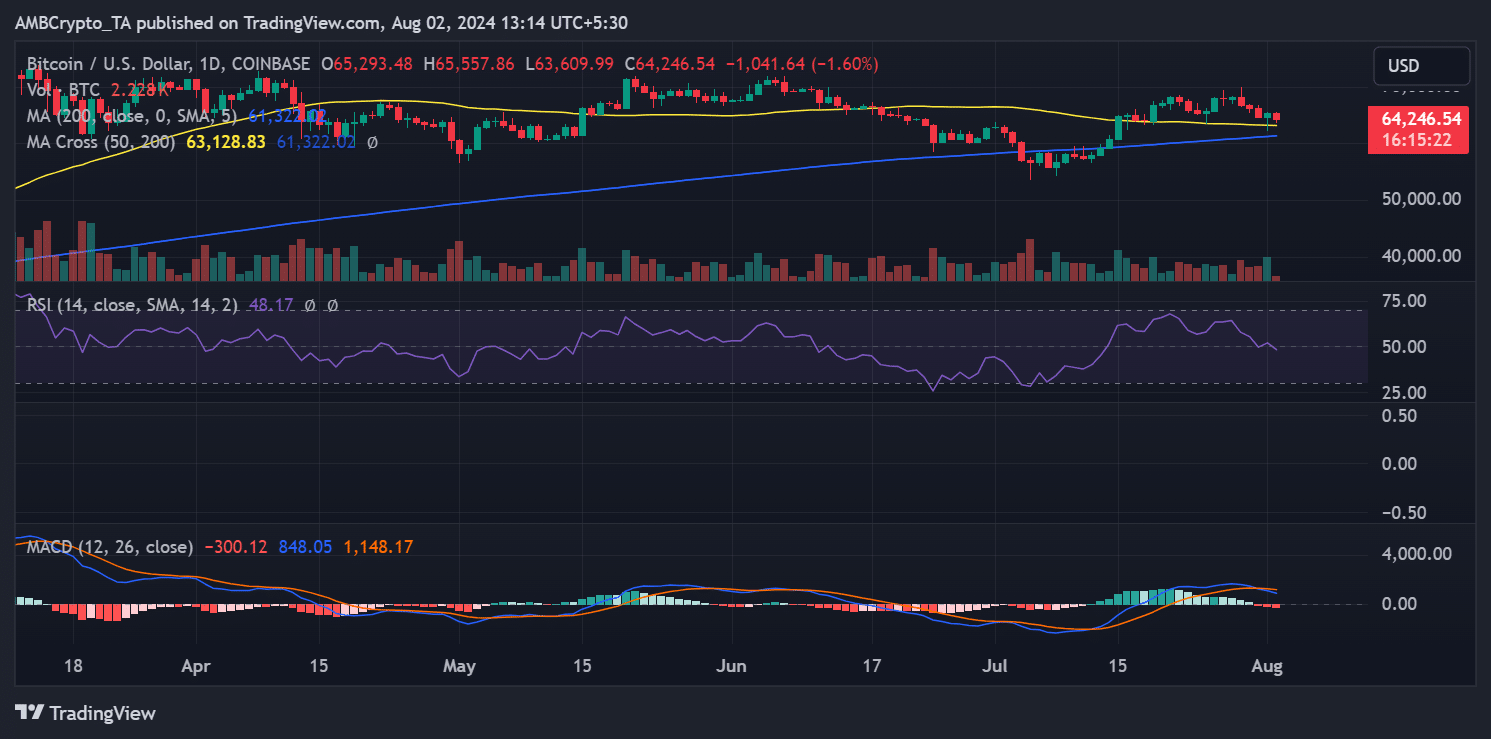

AMBCrypto’s evaluation of Bitcoin on a each day timeframe chart revealed that it ended the earlier buying and selling session with an over 1% improve.

Nonetheless, lengthy liquidations dominated because of important intraday volatility regardless of this acquire somewhat than the session’s closing value.

In response to AMBCrypto’s evaluation, Bitcoin started buying and selling at roughly $64,609 however subsequently declined to round $62,212. This sharp drop triggered the substantial lengthy liquidation quantity noticed.

By the tip of the day, Bitcoin had recovered and traded at about $65,288.

Supply: TradingView

As of this writing, Bitcoin had declined by over 1% and was buying and selling at round $64,254. If this pattern continues, one other day of lengthy liquidation dominance is probably going.

Bitcoin sees high-volume exercise

Bitcoin’s quantity pattern on Santiment indicated a good buying and selling quantity. The chart revealed that the best quantity within the earlier buying and selling session reached round $41 billion.

As of this writing, the quantity was already over $38 billion.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Regardless of the present value pattern favoring sellers, there may be potential for a shift if consumers can take management of the market.

Such a shift may alter the continued liquidation pattern, probably decreasing the dominance of lengthy liquidations and stabilizing the value motion.