- Hayes put a purchase name for BTC in anticipation of US greenback liquidity as Japanese banking disaster worsens.

- Nonetheless, one other analyst means that BTC headwinds will solely finish if the miner disaster ends.

Japan’s banking disaster is reportedly getting ready to exploding and will inject US ‘greenback liquidity’ and increase Bitcoin [BTC] and the general crypto market.

In a brand new weblog post on twentieth June, BitMEX founder Arthur Hayes, seen the potential affect of the Japanese banking disaster as a ‘pillar’ for the sector.

‘That is simply one other pillar of the crypto bull market.’

In line with Hayes, the fifth-largest Japanese financial institution, Norinchukin is already underneath pressure and plans to promote $63 billion of its US and European bonds.

The BitMEX founder added that the US could also be compelled to intervene to salvage the disaster, which may drive a ‘stealth greenback liquidity’ injection.

How will Bitcoin profit?

Per Hayes, the Norinchukin’s US Treasury (UST) sell-off may tip different mega banks to comply with go well with.

‘All of the Japanese megabanks will comply with within the footsteps of Nochu (Norinchukin) and dump their UST portfolio to make the ache go away. Which means $450 billion price of USTs will hit the market rapidly.

Nonetheless, per Hayes, the US won’t enable the above situation as a result of ‘yields would spike increased,’ making the federal authorities extraordinarily costly to fund.

In response, the US may persuade the Financial institution of Japan (BoJ) to make use of a repurchase facility program to ‘take up the UST provide.’ In return, the US will hand over ‘freshly printed US {dollars}’ to the BoJ, spiking greenback liquidity.

The chief additionally famous {that a} comparable state of affairs occurred in This autumn 2023, and ‘it was off to the races for all danger property, crypto included.’ Moreover, the US banking disaster in March 2023 tipped BTC to surge +200% after a bailout was introduced, Hayes expounded.

To the BitMEX founder, the November US election was one other play that might pressure the US to intervene within the Japanese banking disaster.

‘In an election 12 months, the very last thing the ruling Democrats want is a large rise in UST yields, which have an effect on main issues their median voter financially cares about’

In consequence, the following US liquidity injection was more likely to come from the Japanese disaster, which was a boon for crypto buyers. If that’s the case, Hayes nudged buyers to ‘purchase the f**king dip.’

BTC dilemma

Regardless of the above macro purchase sign for BTC from Japan woes, the Bitcoin miner disaster was not over to verify the purchase name.

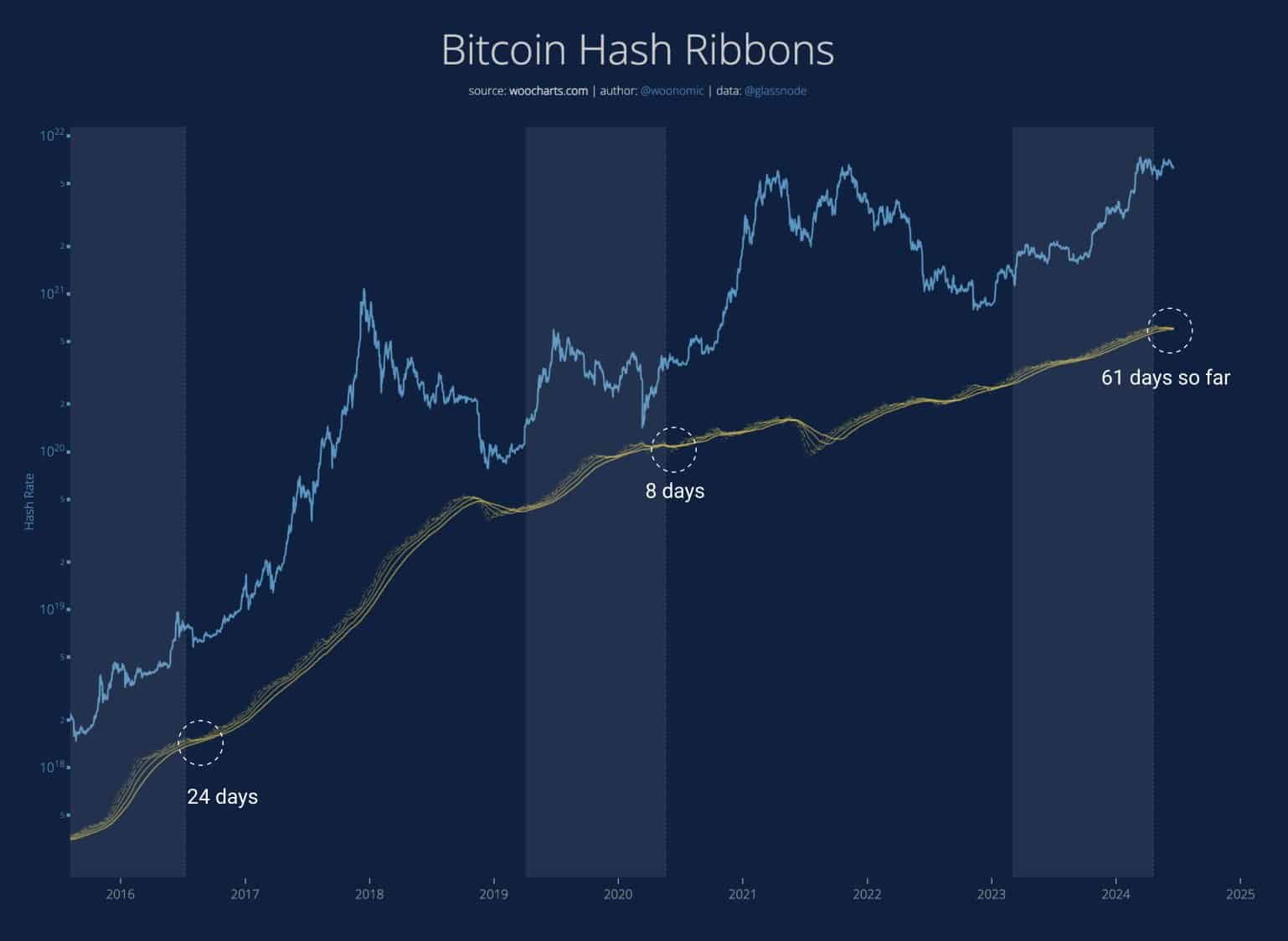

In line with Willy Woo, a famend BTC analyst, the BTC miner crisis was taking longer, and BTC will solely enhance over.

‘When does #Bitcoin get better? It’s when weak miners die and hash fee recovers.’

Supply: Willy Woo