- Market observers provide combined indicators on the Fed’s macro outlook impression on BTC and crypto.

- BTC dropped to $67K after the Fed’s choice and threatened to publish extra losses.

Bitcoin [BTC] struggled to carry above $67K after the Fed determined to keep up the present 5.25% to five.5% rate of interest for the seventh time.

Nonetheless, the Fed’s financial projection and ahead steerage in the course of the assembly have stirred divergent macro views on the impression on danger belongings like BTC.

A JPMorgan commentary stated that the Fed’s ‘financial outlook remained unsure.’ This was based mostly on the potential of just one minimize by the top of 2024, not like the three cuts forecasted within the March assembly.

Is BTC going through macro danger in Q3?

The uncertainty was additional cemented by Fed’s chair Jerome Powell’s ‘insecurity’ in latest inflation knowledge. The chair famous,

“It’s in all probability going to take longer to get the arrogance that we have to loosen coverage.’

On his half, Quinn Thompson, founder and CIO of crypto hedge fund Lekker Capital, considered the Fed’s outlook as a danger to crypto belongings. Forecasting an identical liquidity crunch that hit BTC earlier than US tax season in April, the chief said,

‘I imagine the ‘liquidity air pocket’ that started on the finish of Q1 previous to tax season continues to be with us till there may be both one other month or so of higher inflation knowledge to strengthen the present disinflationary development’

Increasing on the potential danger for crypto belongings, the hedge fund govt added,

‘I believe there may be severe cascade danger in crypto, and particularly, count on most altcoins to be taken out again. The market appears to have misplaced any capability to bounce.’

Additional casting doubt on BTC prospects in summer season, Thompson said that the king coin has failed to collect sufficient power to interrupt above its all-time excessive.

Nonetheless, different market observers, like crypto buying and selling agency QCP Capital, acknowledged the Fed’s ambiguity however remained bullish for the remainder of 2024. In a latest Telegram replace, the agency noted,

‘We keep a structurally bullish outlook for the rest of the 12 months, pushed by the anticipated ETH ETF S-1 approval and potential price cuts in September and on the year-end.’

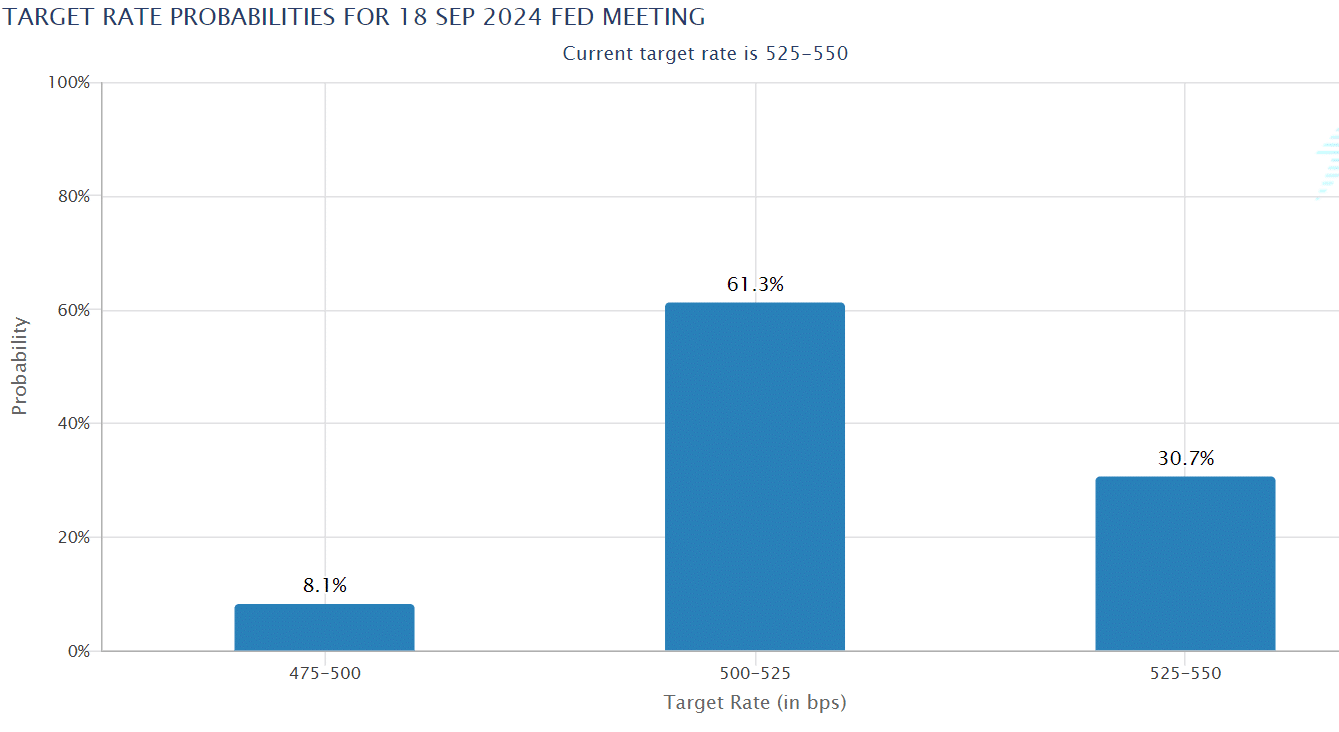

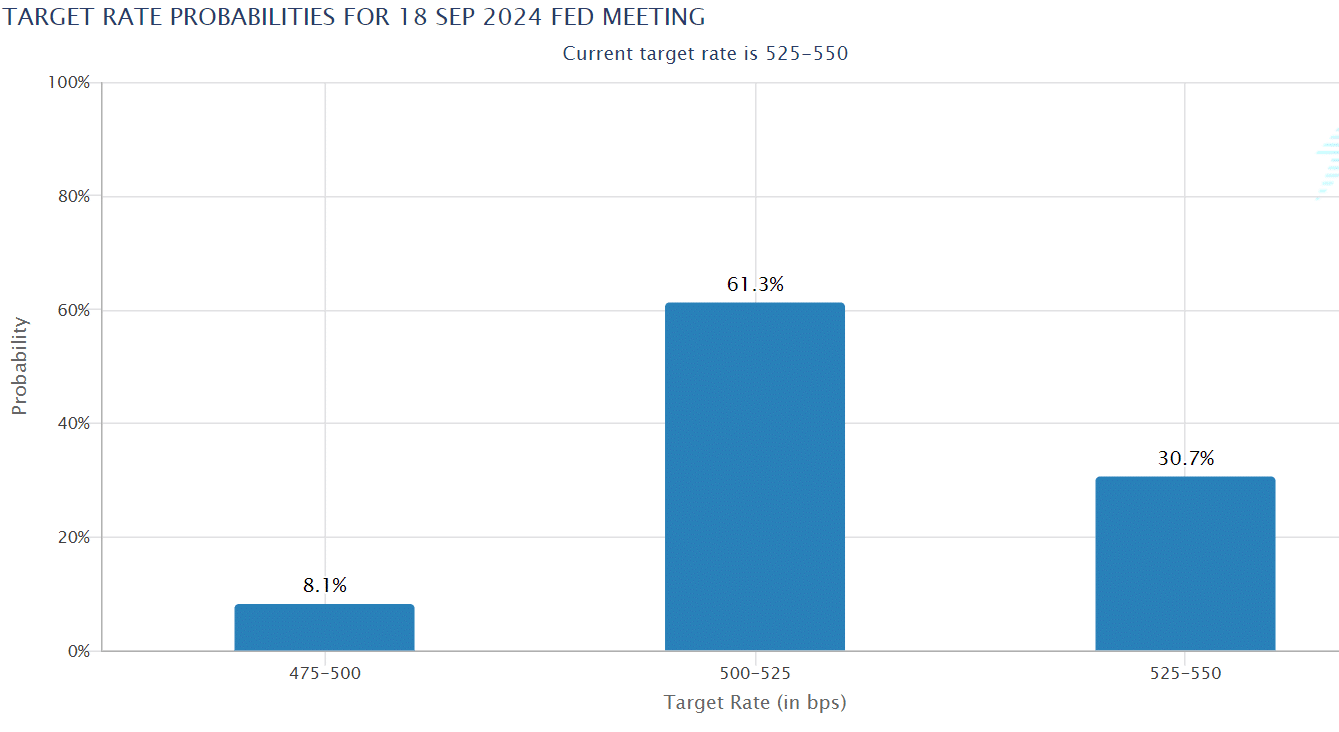

As of press time, the odds of the September price minimize have been up +60% in opposition to 30% for holding present charges unchanged.

Supply: CME

One other macro analyst, TedTalksMacro, shared the constructive outlook and considered the Might US CPI print as ‘disinflationary’ and short-term bullish for crypto.

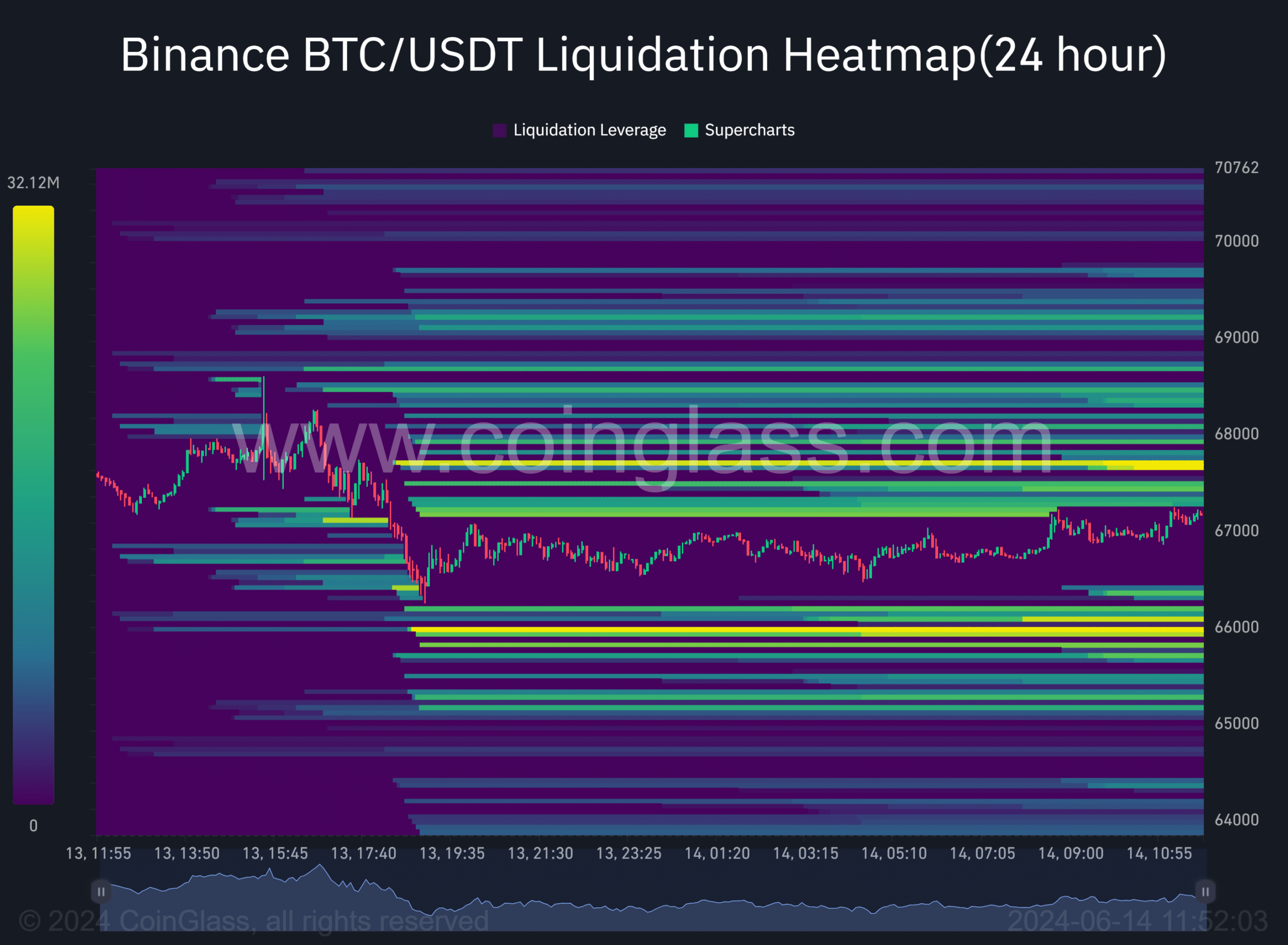

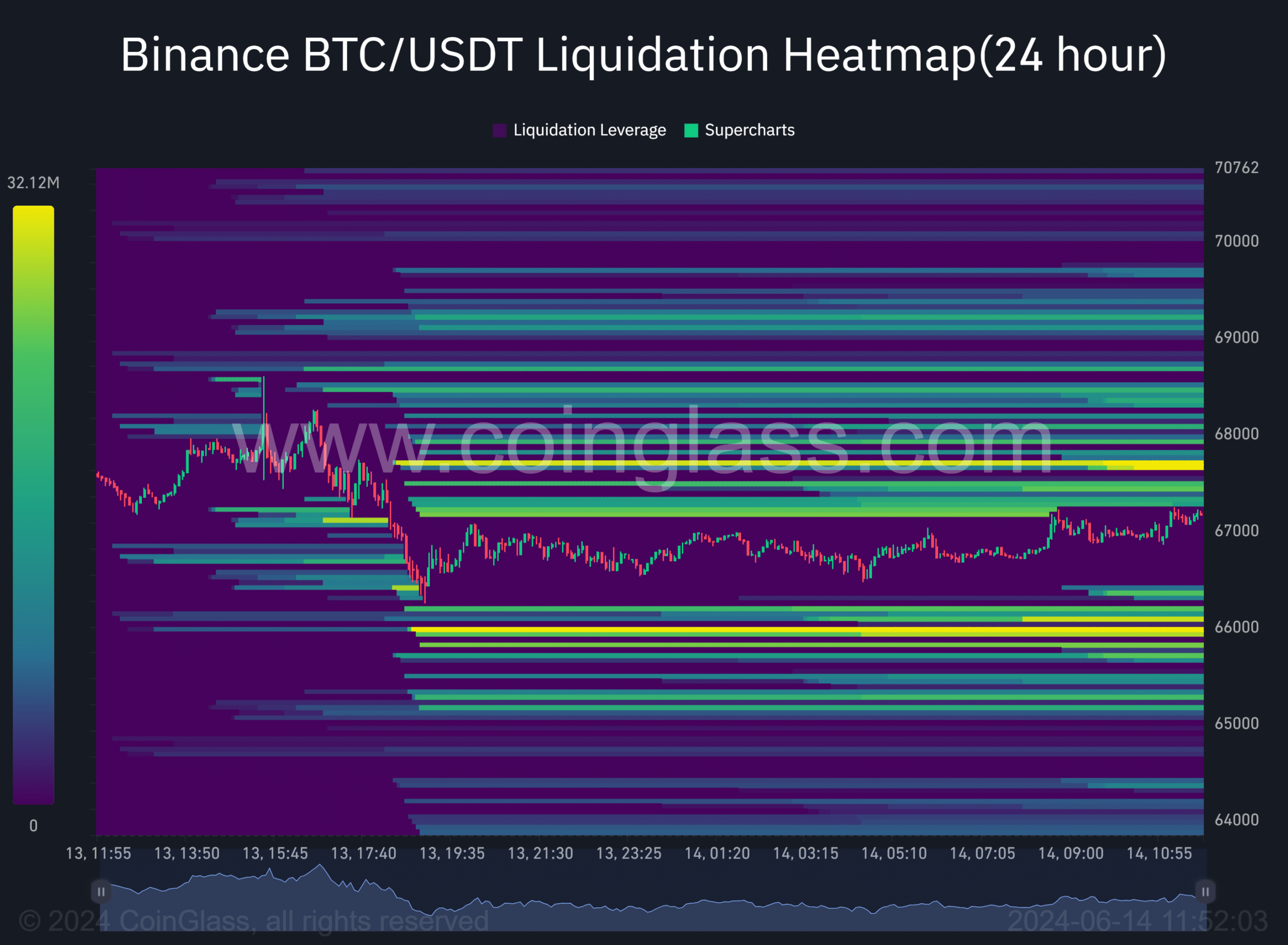

Within the meantime, the each day liquidation charts confirmed appreciable liquidity clusters at $66K and $68K (marked orange) as of press time.

Sometimes, worth motion targets these liquidity areas, and it steered {that a} retest of the $66K and $68K ranges was possible within the brief time period.

Supply: Coinglass