- BTC’s value moved marginally within the final 24 hours.

- Market indicators hinted at a couple of extra slow-moving days.

Traders might need been anxious about the previous couple of days, as Bitcoin’s [BTC] value witnessed a number of corrections.

Nonetheless, they need to not lose hope, as this would possibly simply be one more re-testing part, which may finish with one other bull rally.

What historical past suggests

The final week didn’t witness excessive volatility by way of BTC’s value motion, because the king of cryptos’ worth moved marginally. The same development was additionally famous within the final 24 hours.

In response to CoinMarketCap, on the time of writing, BTC was buying and selling at $64,796.66 with a market capitalization of over $1.27 trillion.

Nonetheless, there have been possibilities for the coin’s value to show unstable over the times to comply with. Moustache, a preferred crypto analyst, lately posted a tweet mentioning how BTC was in a “re-testing” part.

If historical past is to be thought of, BTC would possibly quickly start a bull rally, because the coin turned bullish when its value entered an analogous sample again in 2017 and 2020.

Due to this fact, AMBCrypto checked Bitcoin’s metrics to see the probabilities of the coin truly kick-starting a bull rally.

Metrics look bearish although

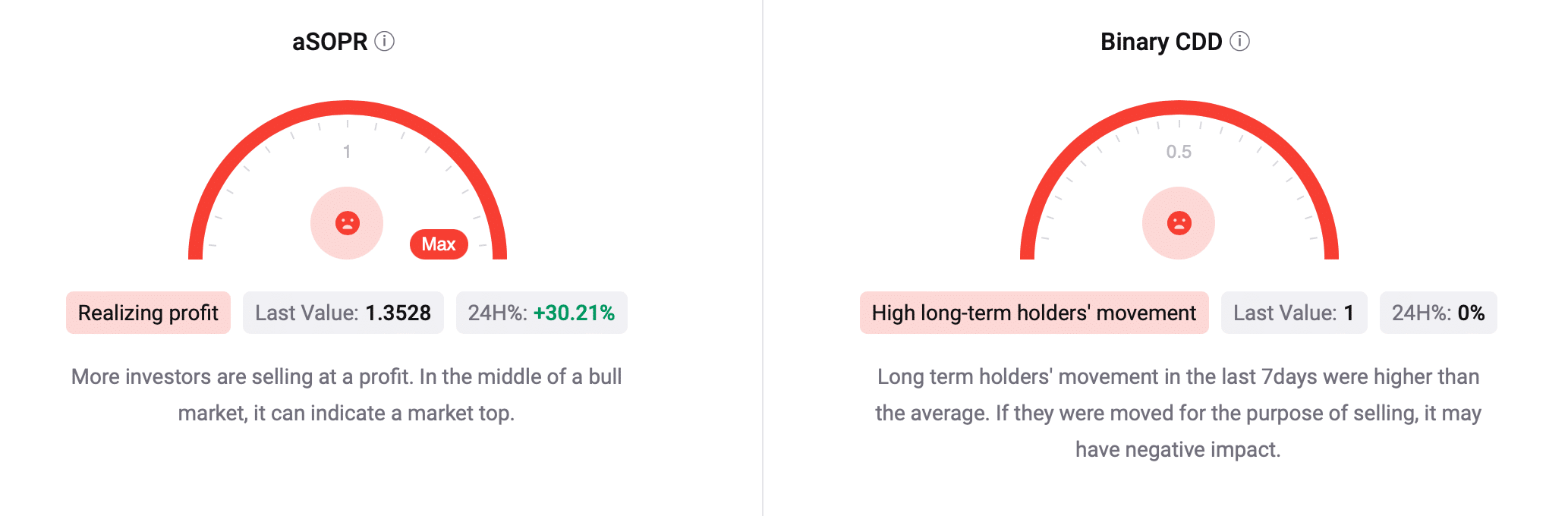

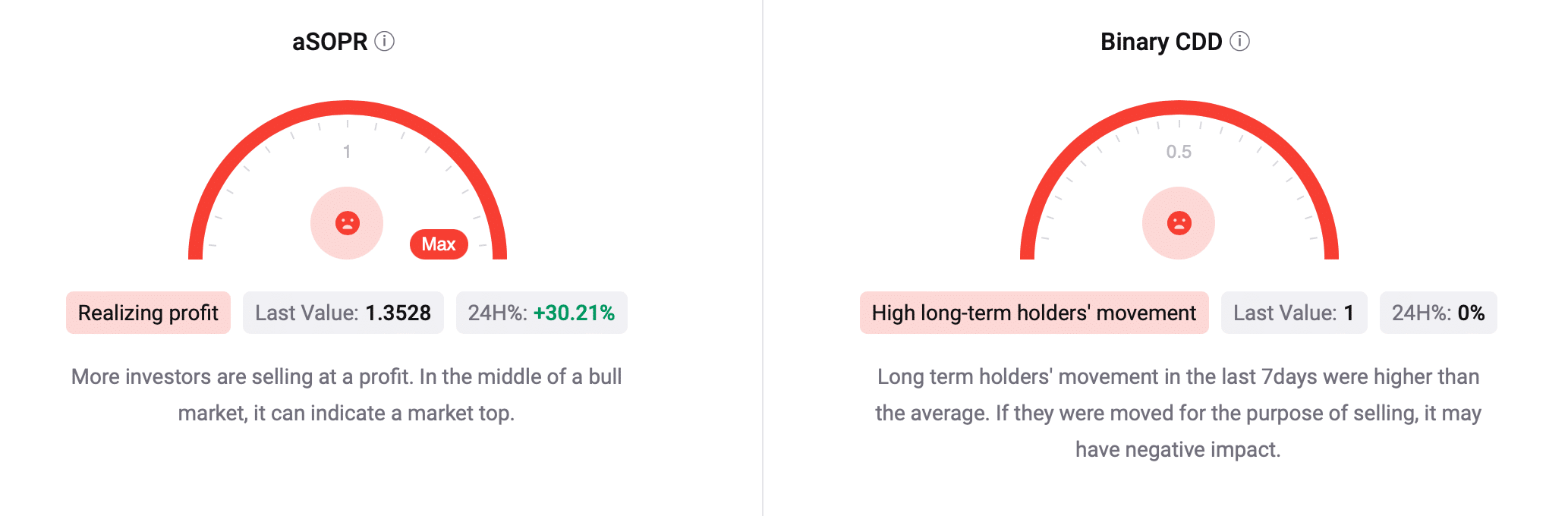

Regardless of a historic bull sample, Bitcoin’s on-chain metrics continued to look bearish. For instance, it’s aSOPR was pink, as per our evaluation of CryptoQuant’s data.

This meant that extra buyers had been promoting at a revenue. In the midst of a bull market, it may point out a market prime.

Its Binary CDD adopted an analogous development, which means that long-term holders’ actions within the final seven days had been increased than common. In the event that they had been moved for the aim of promoting, it could have a unfavourable impression.

Supply: CryptoQuant

Nonetheless, different metrics informed a unique story. Bitcoin’s alternate reserve was dropping at press time, indicating that promoting stress on the coin was low.

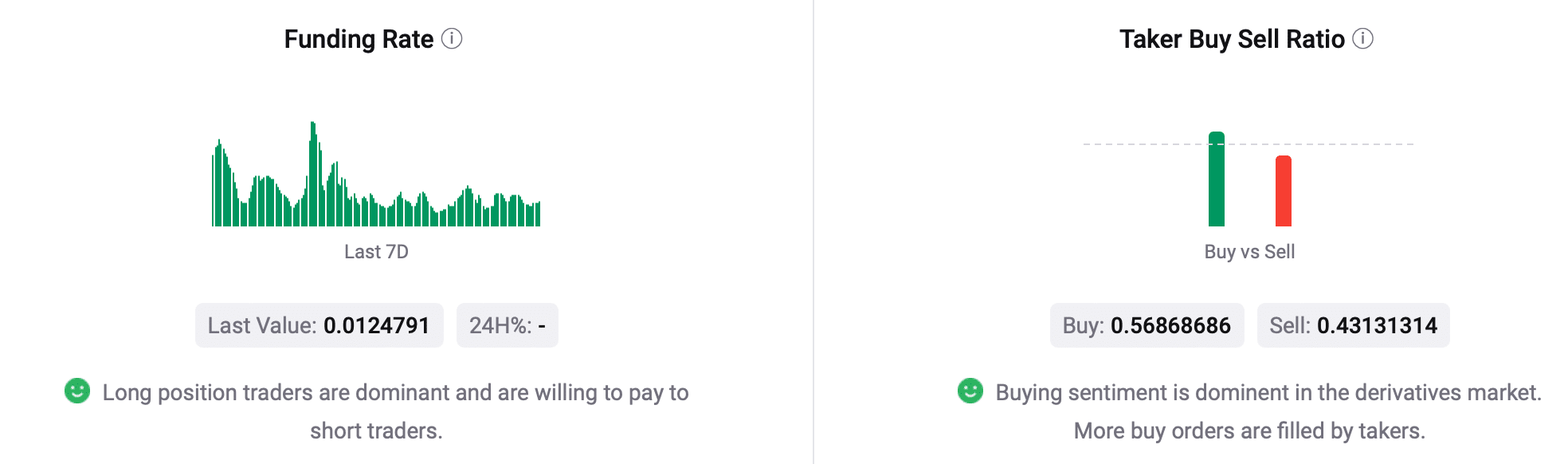

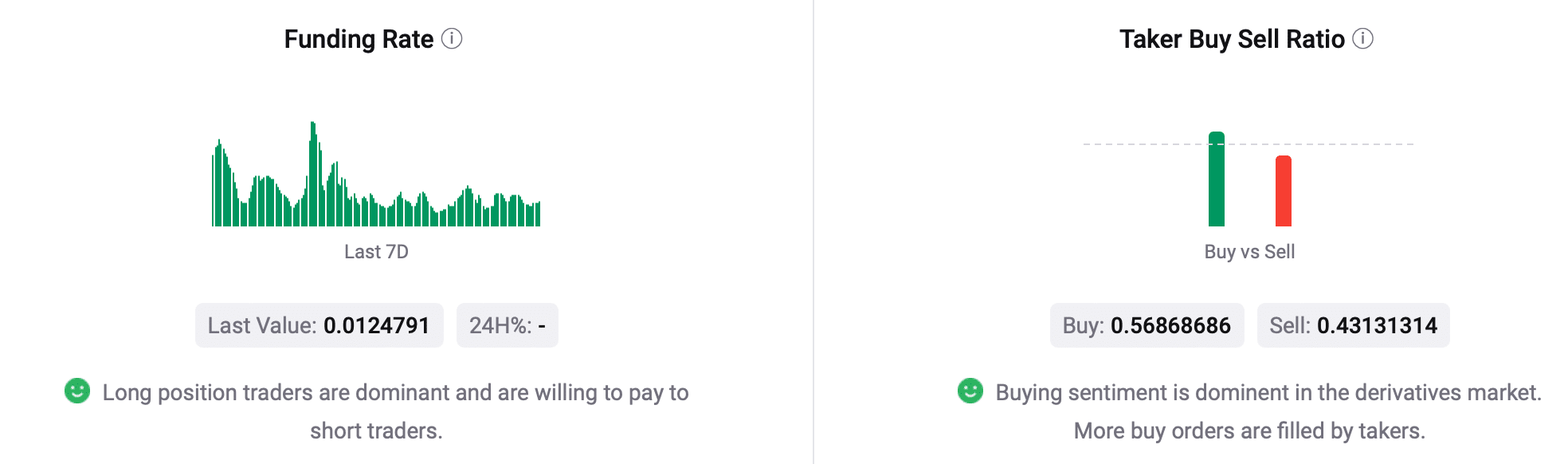

Moreover, its Funding Charge and Taker Purchase Promote Ratio was within the inexperienced, suggesting that purchasing sentiment was dominant within the derivatives market.

Supply: CryptoQuant

AMBCrypto then checked BTC’s every day chart to search out out which path the coin was headed.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Our evaluation of TradingView’s chart urged that buyers would possibly as nicely witness a couple of extra slow-moving days, because the Relative Energy Index (RSI) moved sideways close to the impartial zone.

The Cash Stream Index (MFI) additionally adopted an analogous development, indicating that probabilities of much less unstable value motion had been excessive.

Supply: TradingView