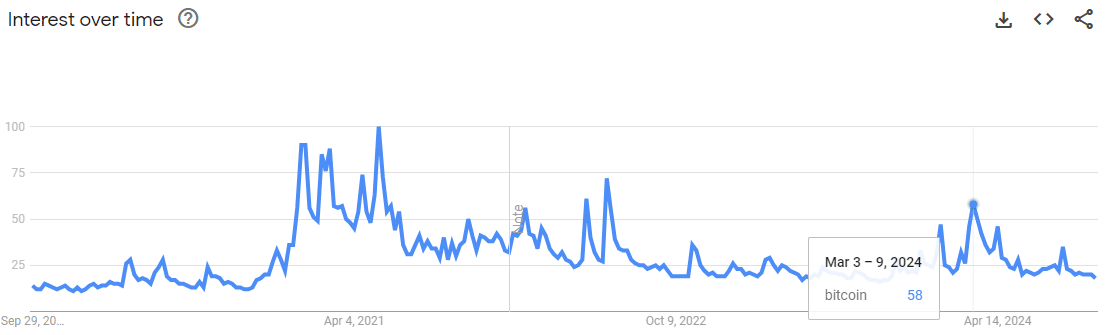

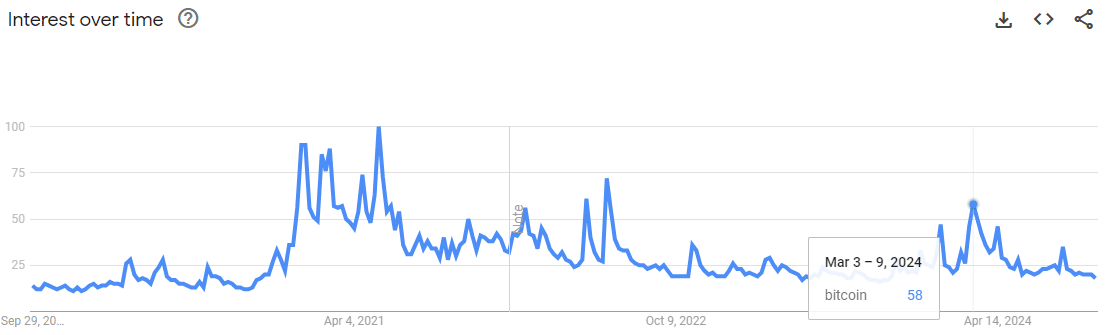

- Bitcoin recognition is a small fraction of what it was in March 2024.

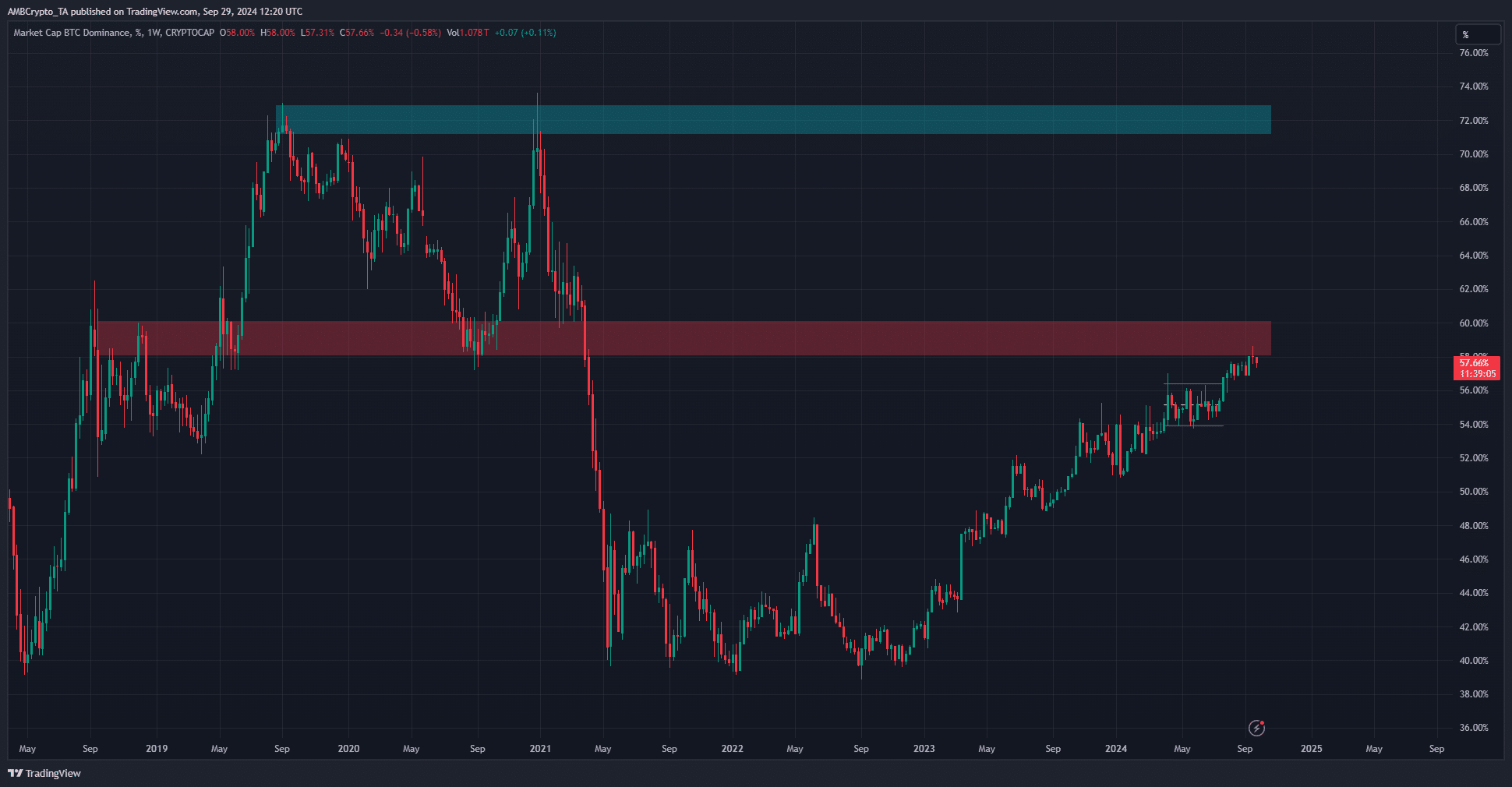

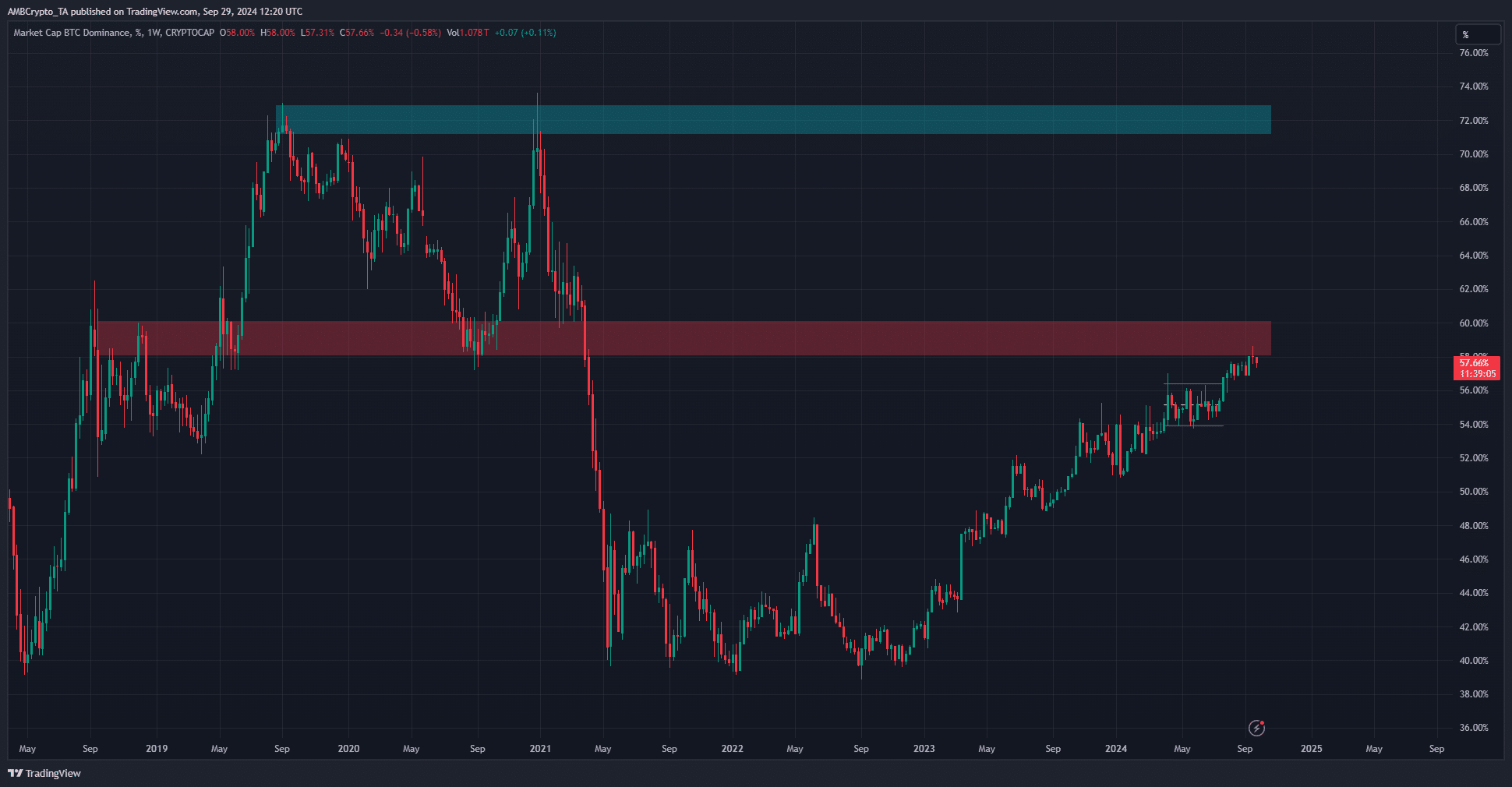

- The market capitalization charts gave bullish indicators for the long-term.

Bitcoin [BTC] market sentiment was beginning to flip bullish. The Crypto Worry and Greed Index stood at 63 to indicate greed was predominant out there after BTC raced previous the $64k resistance zone.

In a post on X, person Alex Becker famous that regardless of the thrill inside the crypto neighborhood, the curiosity from the broader market was minimal. It was solely a fraction of the frenzy seen through the 2020 run.

Supply: Google Developments

A take a look at the recognition of the time period “Bitcoin” on Google Developments underlines this level. It reached the zenith of its recognition within the first half of 2021. The rally from final October to March 2024 noticed BTC recognition attain a rating of 58.

In distinction, the rating it set final week was 20. This meant that Bitcoin searches are solely a 3rd of what they had been earlier this 12 months, even because the king of crypto trades simply 11% under its all-time excessive.

AMBCrypto took a more in-depth take a look at different charts to grasp what this implies for the broader crypto market.

Bitcoin Dominance is vital for understanding capital circulation

Supply: BTC.D on TradingView

At press time, the whole crypto market capitalization was $2.3 trillion. The Bitcoin Dominance, or BTC’s share of the whole market cap, stood at 57.66%. The weekly chart outlined the 60% space as a resistance zone.

The BTC.D chart typically has an inverse correlation with how effectively alts carry out. A fall in BTC.D implies that the altcoin market cap is rising quicker than BTC’s, which might be a constructive growth for the alt market.

Nonetheless, evaluating with the 2020 cycle, we see that it could be perfect if Bitcoin can embark on a long-term uptrend to attract capital to the crypto market. As soon as it does, this capital can “rotate” into different altcoin sectors, which merchants and traders can revenue from.

Lengthy-term traders can use this dominance chart to grasp whether or not Bitcoin or the altcoins are the market’s focus at any given time.

One other constructive signal for alt season

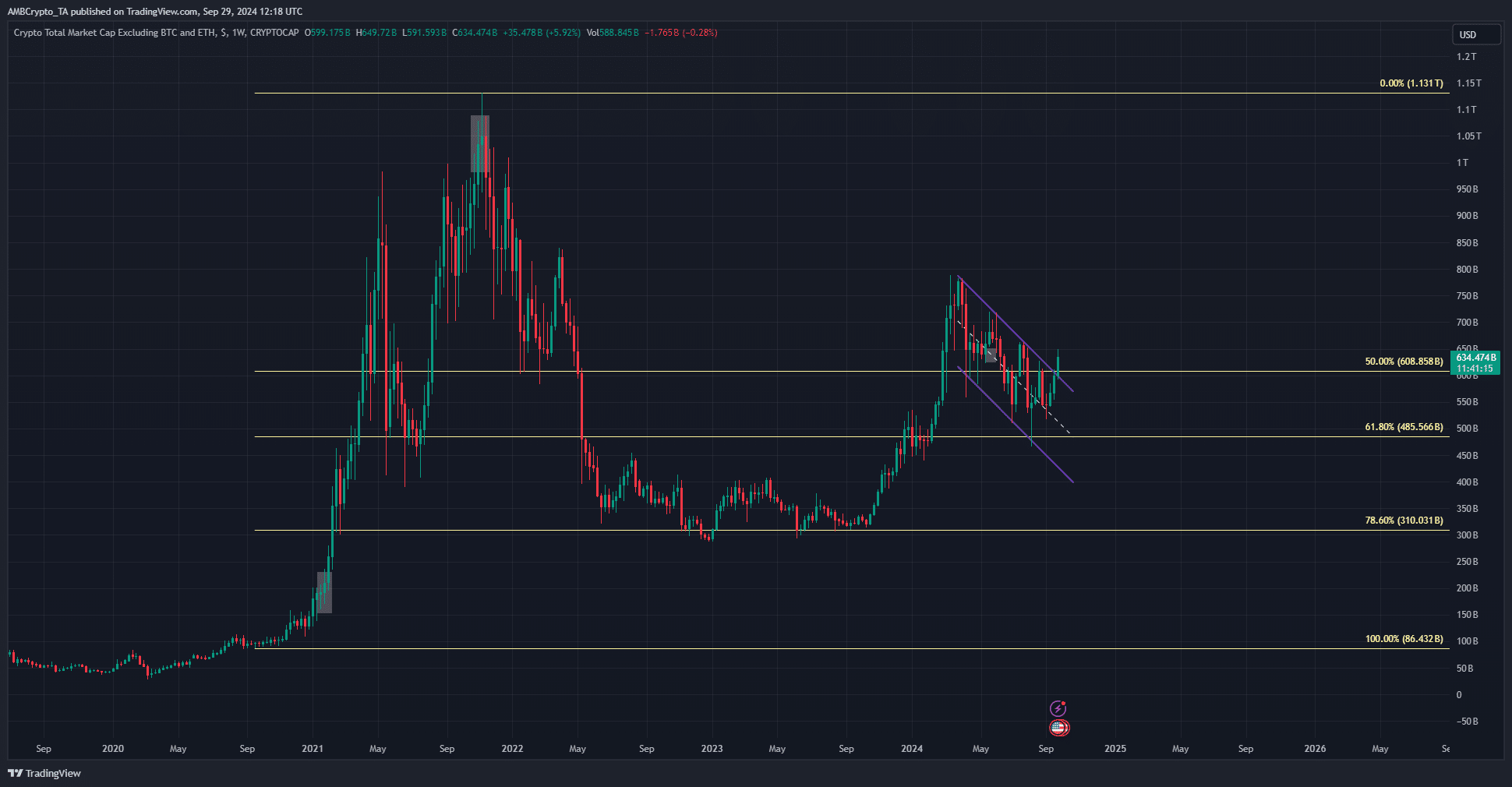

Supply: TOTAL3 on TradingView

The market capitalization of the highest crypto belongings excluding Bitcoin and Ethereum [ETH] are represented on the chart above. It broke out previous a descending channel formation.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In doing so, it additionally breached the 50% Fibonacci retracement stage from the 2020 bull run.

This set the stage up properly for a powerful efficiency from the altcoins within the coming months. From a technical perspective and historic developments, the one approach for the crypto market to go is upward over the following 3-6 months.