- Crypto funding merchandise noticed outflows value $206 million.

- LTC and LINK outperformed Bitcoin due to the halving and rate of interest hypothesis.

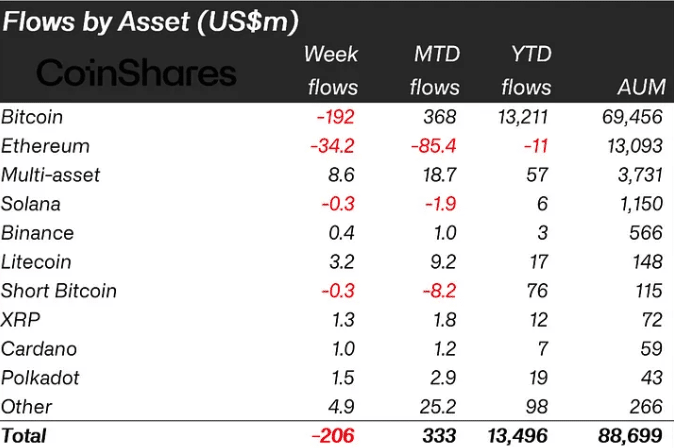

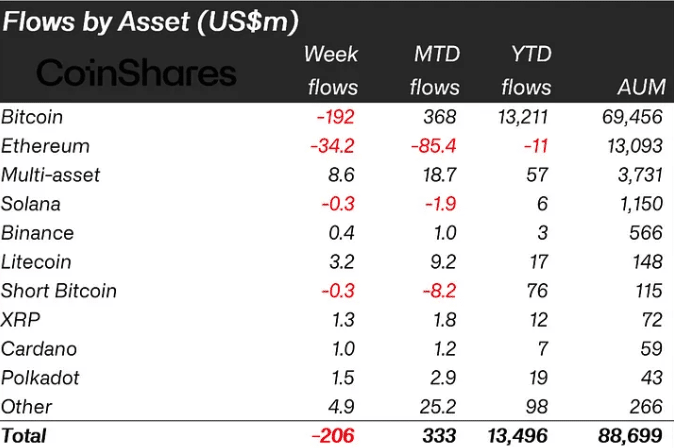

A complete of $206 million flowed out of crypto funding merchandise final week, CoinShares revealed. Based on the report, Bitcoin [BTC] outflows have been value $192 million whereas Ethereum [ETH] was $34.2 million.

Nevertheless, many altcoins together with Litecoin [LTC] and Chainlink [LINK] registered substantial inflows throughout the similar timeframe.

Buyers fear about BTC’s future

From AMBCrypto’s evaluation, Litecoin had $3.2 million in inflows. Chainlink, alternatively, recorded $1.7 million. Moreover, there have been causes the overall funding had extra outflows than inflows.

First off, the report famous that buyers have been frightened concerning the impact the fourth Bitcoin halving which occurred on nineteenth April, would have on miners.

Supply: CoinShares

As such, they thought it was higher to remain off BTC and possibly return when the market settle. In current articles, AMBCrypto reported how miners have been promoting off their cash since their rewards have been halved.

Subsequently, it was not stunning that the outflows elevated for the second consecutive week. Another excuse Litecoin and Chainlink topped Bitcoin might be due to rates of interest.

Just lately, there was hypothesis that the Fed will preserve rates of interest at a excessive level. Due to this, investor starvation for riskier property has been diminishing. CoinShares noted that,

“The information suggests urge for food from ETP/ETF buyers continues to wane, probably off the again of expectations that the FED is more likely to preserve rates of interest at these excessive ranges for longer than anticipated.”

LINK could stay on prime however LTC…

If the sentiment doesn’t change, BTC, in addition to ETH may proceed to face additional disinterest. For Litecoin and Chainlink, their respective value efficiency may have performed an element within the surge in inflows.

At press time, LTC modified fingers at $84.89. This was a 3.97% enhance within the final seven days. LINK additionally had the same efficiency as its value jumped by 6.18%.

Should you examine the performances with these of ETH and BTC, you’ll observe that the highest two cryptocurrencies lagged. Ought to the costs proceed to remain unimpressive, the brand new week’s stream may also be damaging.

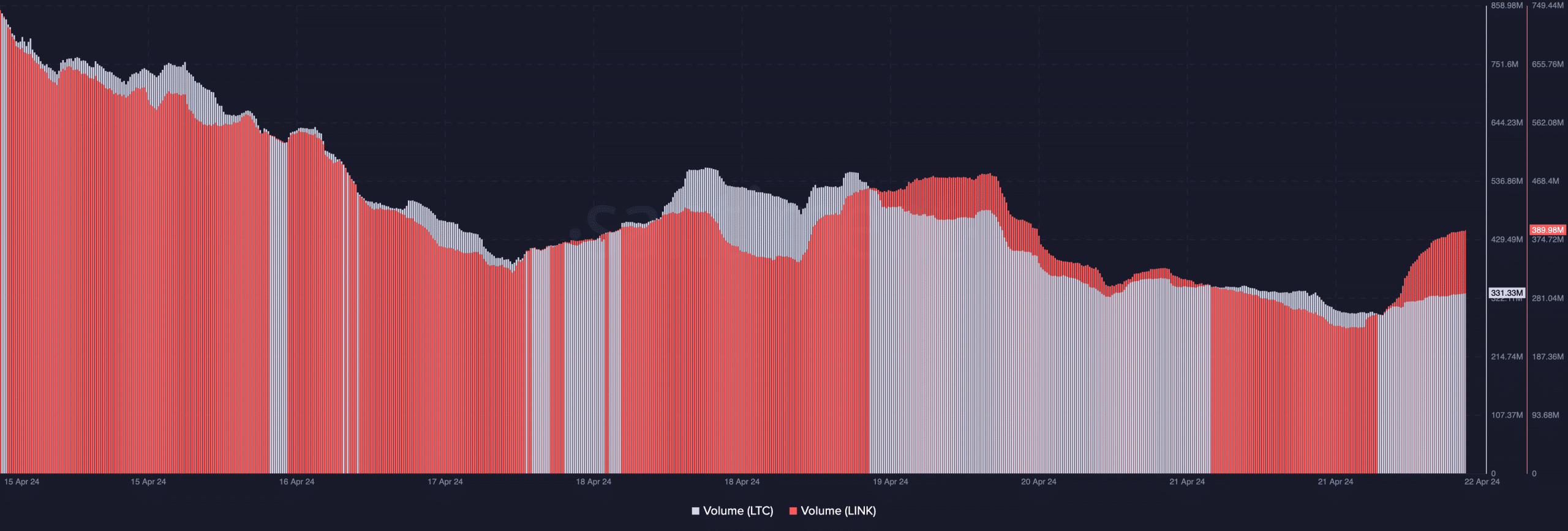

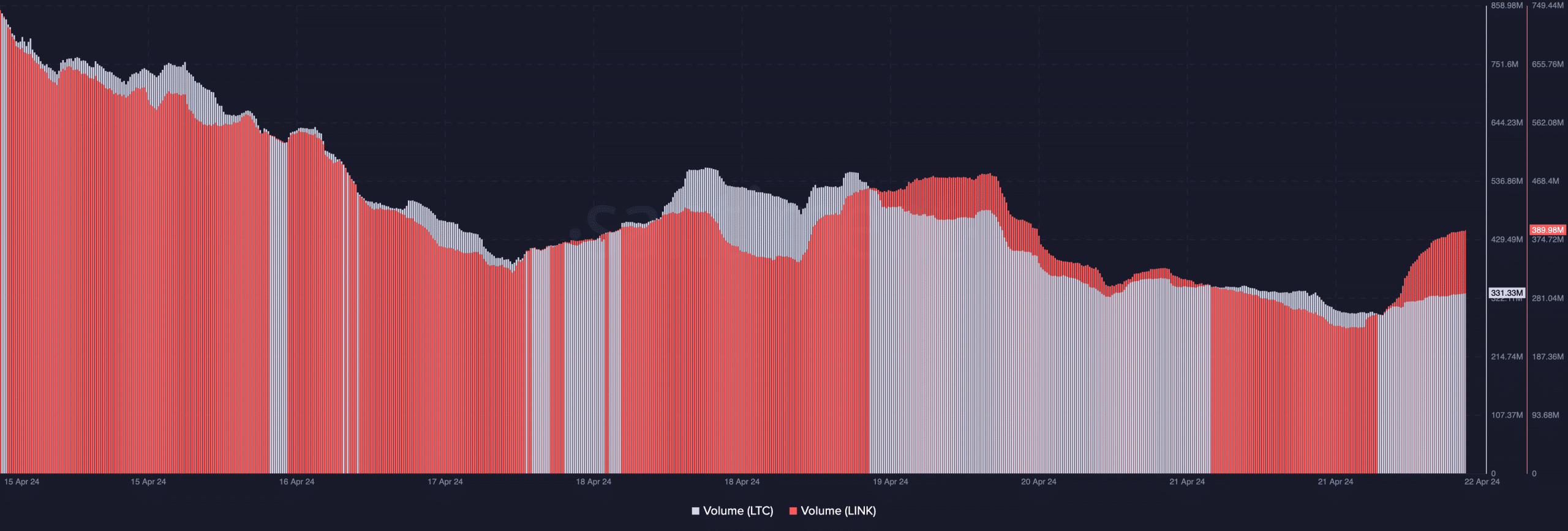

In the meantime, we checked out Chainlink’s and Litecoin’s quantity to ascertain interest within the cryptocurrencies. Based on knowledge AMBCrypto obtained from Santiment, each volumes dropped from the heights they have been seven days in the past.

Nevertheless, there have been slight will increase within the final 24 hours. For LINK, the hike may set off an additional uptrend for its value because it additionally elevated within the final 24 hours.

Supply: Santiment

However LTC may not take pleasure in that profit because the rising quantity may function power for the downtrend the worth skilled. If this stays the case all week lengthy, Chainlink could be a part of the highest inflows once more.

In a associated improvement, CoinShares defined that the concern of buyers may quickly begin enjoying out. Based on the analysis staff, Bitcoin miners may shift their focus from the coin to AI.

Is your portfolio inexperienced? Verify the Litecoin Revenue Calculator

The report, which was published on nineteenth April, talked about that the explanation for the prediction was that the halved rewards may not maintain miners’ bills. Therefore,

“We anticipate a shift in direction of AI in energy-secure places because of its potential for larger revenues, with corporations like BitDigital, Hive and Hut 8 already producing revenue from AI.”