- Analyst Max Keiser forecasted Bitcoin’s rise to $220,000 because of a supply-demand shock.

- Present information indicated rising short-term bearish strain.

Amid fluctuating market situations, Bitcoin [BTC] traded at $61,512 at press time, marking a 1.4% lower up to now 24 hours however sustaining a 6.8% improve over the week.

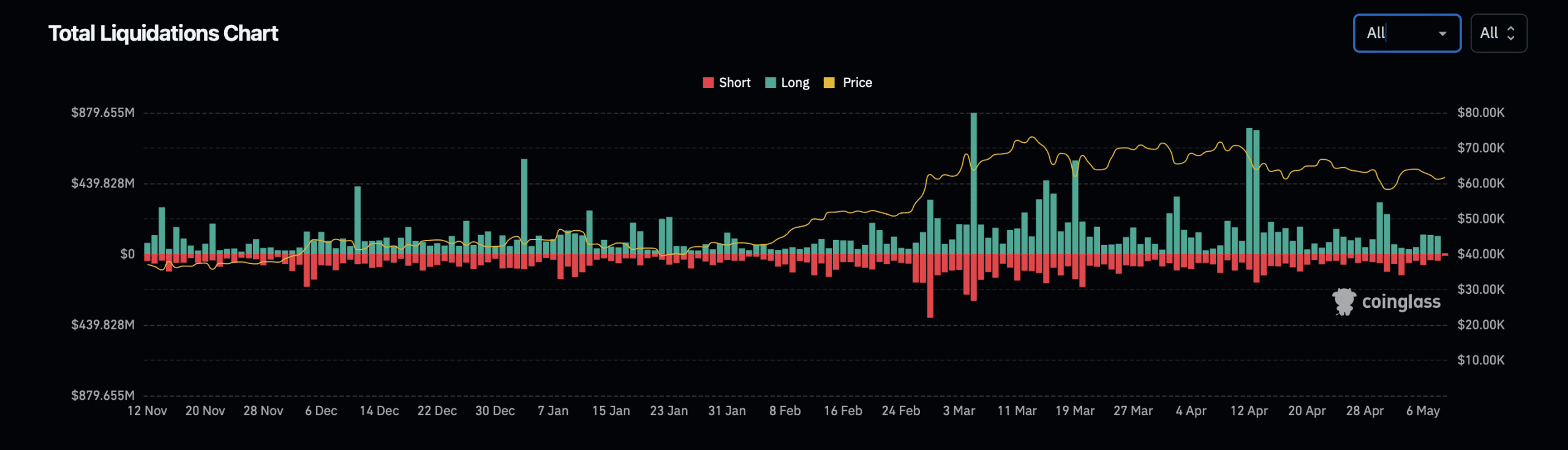

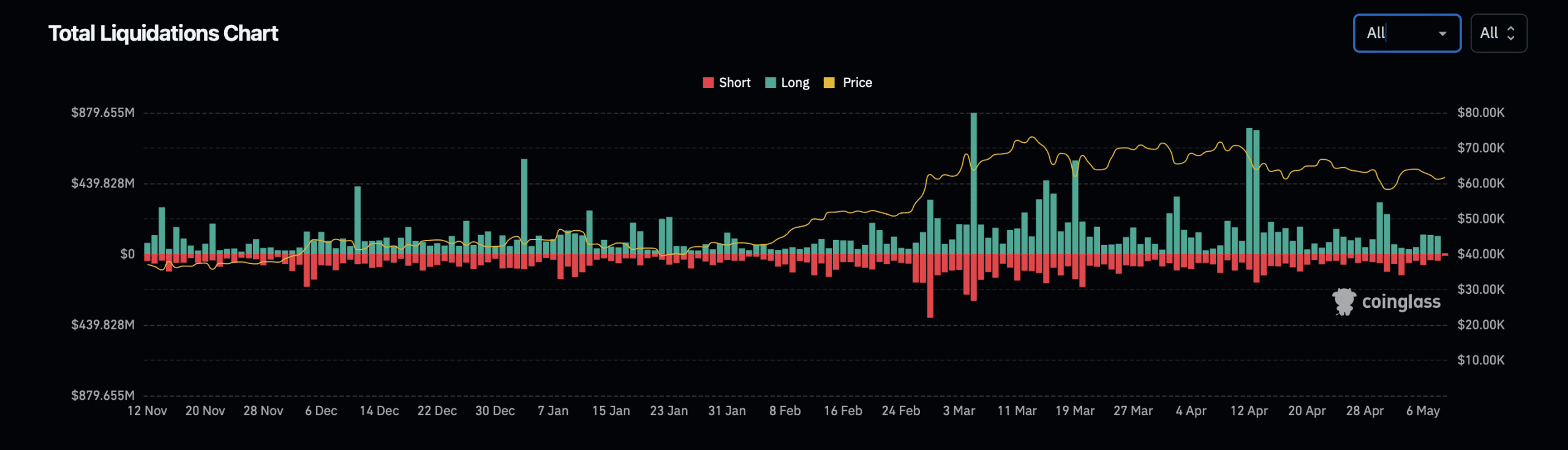

This era has not been with out its challenges, as information from Coinglass revealed that the previous day alone noticed 61,419 merchants liquidated, culminating in $133.87 million in complete liquidations.

This volatility underlines the delicate state of the market, but it doesn’t dampen the spirits of some trade stalwarts.

Supply: Coinglass

One notable voice, Max Keiser, a vocal Bitcoin advocate and former monetary journalist, has reiterated his bullish stance on Bitcoin’s future.

Keiser took to his X (previously Twitter) account to share his perception that Bitcoin may soar to the $220,000 mark, a prediction he has persistently been pushing out over time.

This newest forecast is pushed by what Keiser identifies as a vital dynamic available in the market: a “demand shock meets provide shock” situation, indicating a tightening of Bitcoin’s provide at a time of accelerating demand.

A deep dive into Bitcoin’s potential

Keiser pointed to the lowering Bitcoin provide on cryptocurrency exchanges, which he notes are hitting all-time lows, signaling a “provide scarcity incoming,” as said by X consumer Vivek.

Supply: Vivek/X

This provide contraction, paired with rising demand, types the premise for Keiser’s prediction of a ‘God candle’ on Bitcoin charts — a dramatic value surge that would doubtlessly elevate Bitcoin to the $220,000 degree.

This isn’t the primary time Keiser has projected such highs for Bitcoin. Thus far, it seems the Bitcoin advocate retains predicting this value mark for the asset at any catalyst in sight.

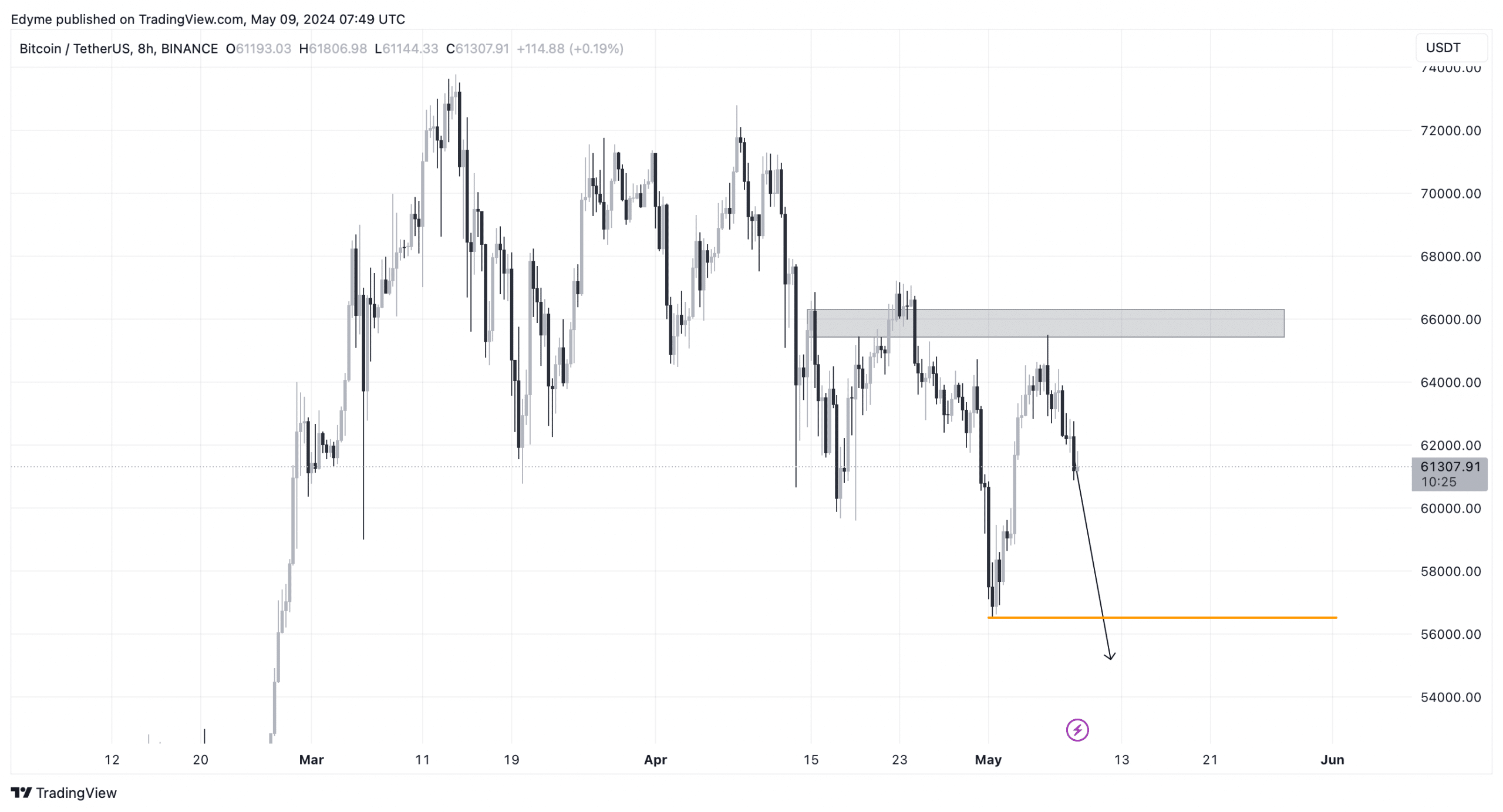

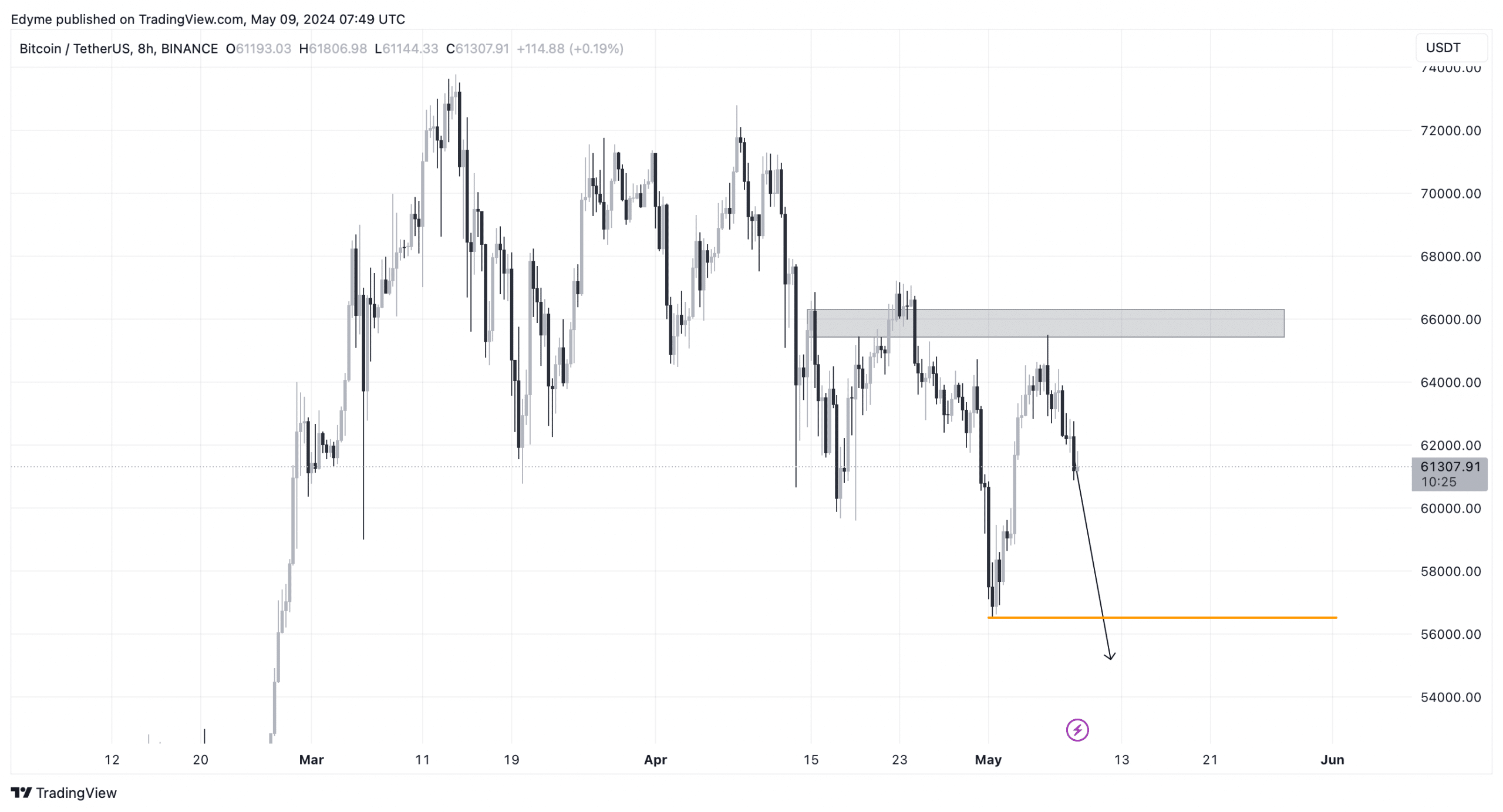

Regardless, a more in-depth examination of Bitcoin’s each day chart reveals the asset step by step breaking construction to the draw back over current months, resulting in liquidity accumulation at every structural break.

Just lately, Bitcoin surged to seize this liquidity on the high, which means that the asset is looking for a possible continuation of the downtrend, indicating bearish strain forward.

Supply: TradingView

Market information echoes bearish sentiments

Supporting this bearish outlook, data from Glassnode revealed a decline within the variety of energetic Bitcoin addresses and a slowdown in new deal with momentum.

Supply: Glassnode

This instructed that the market could be dropping hope in a short-term bullish restoration, resulting in a decline in these essential areas.

Supply: Glassnode

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

AMBCrypto just lately reported that the current market correction has led to a lower in Bitcoin’s provide in revenue, shaking investor confidence.

This development is a transparent indicator of the market’s skepticism about an imminent bullish turnaround, regardless of optimistic predictions from figures like Keiser.