Earlier this week, Bitcoin broke above the $27,000 barrier on the information about Grayscale’s court docket victory in opposition to the SEC.

The choice marks a pivotal win for Grayscale and carries profound ramifications for upcoming spot Bitcoin ETF purposes. As highlighted by CryptoSlate earlier, the court docket’s verdict on this case would possibly affect the end result of a number of spot Bitcoin ETF purposes submitted earlier within the yr.

Grayscale’s victory additionally appears to have bolstered the boldness of Bitcoin merchants. This renewed confidence is seen within the futures market, the place on-chain indicators have proven a notable uptick in leverage.

The Estimated Leverage Ratio (ELR) is a vital metric that gives insights into the extent of danger merchants are keen to imagine. It represents the ratio of the open curiosity in Bitcoin futures contracts to the Bitcoin steadiness of the corresponding alternate. A rising ELR means that merchants leverage their positions extra, indicating an elevated urge for food for danger.

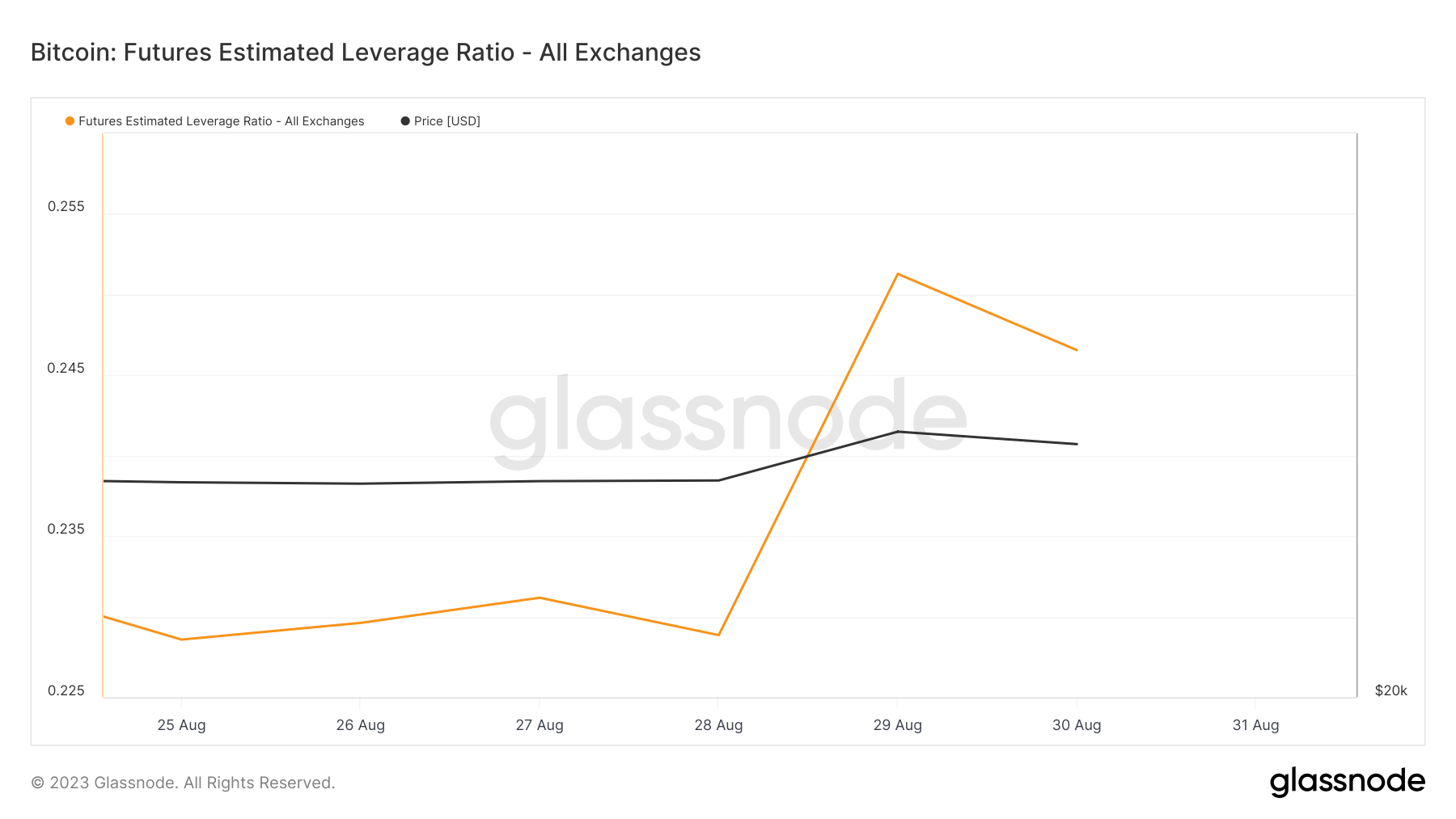

The Estimated Leverage Ratio (ELR) skilled a bounce from 0.22 to 0.25 on Aug. 30, following Bitcoin’s bounce from $26,100 to $27,700.

On one hand, the rise in ELR underscores that merchants are more and more bullish. For each Bitcoin saved in an alternate, there’s a corresponding uptick within the futures contracts being traded. This pattern means that merchants, carried by constructive market sentiment, are keen to imagine larger dangers in anticipation of favorable returns.

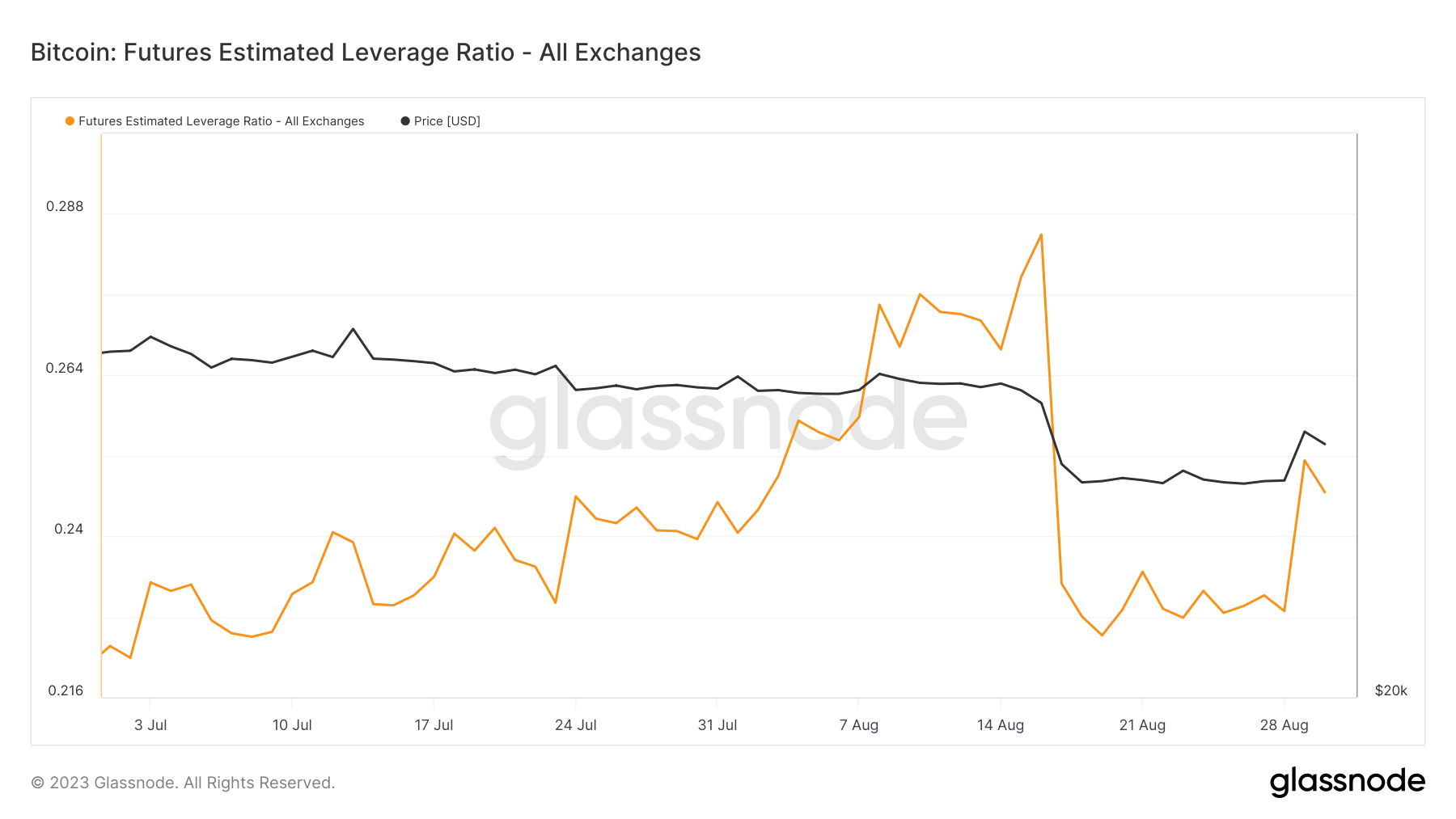

Nonetheless, a broader perspective reveals one other narrative. The present ELR mirrors the degrees noticed initially of August. In mid-August, the market witnessed a big dip within the ELR, plummeting from 0.28 to 0.22. This decline occurred in tandem with Bitcoin’s value drop, which slid from $29,000 to $27,000.

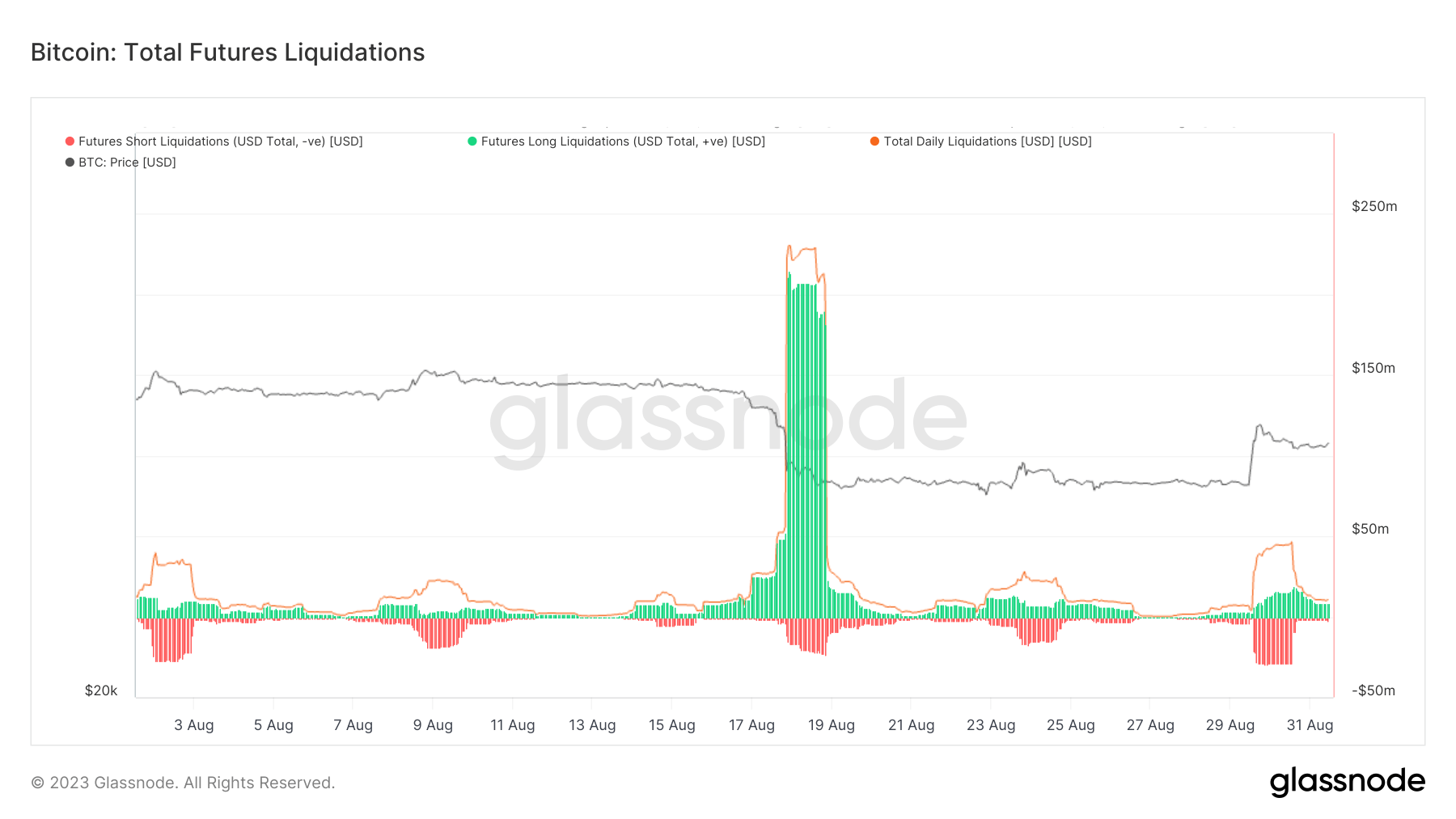

Nonetheless, the present ELR ranges trace at a market danger profile harking back to early August. This implies the market stays weak to sharp value oscillations, very like those noticed earlier within the month. It’s important to do not forget that BiBitcoin’sescent under $28,000 in mid-August triggered a cascade of liquidations. These compelled closures of leveraged positions launched further volatility to an already tumultuous market.

Whereas Bitcoin’s latest value surge and the corresponding rise in ELR point out a bullish sentiment amongst merchants, the market ought to stay cautious. The market’s present danger profile, mirroring early August, may nonetheless expertise important volatility.

The put up Bitcoin futures present renewed confidence amidst value surge appeared first on CryptoSlate.