- About 311,000 wallets exited the community within the final 10 days.

- The 30-day MVRV ratio indicated that the coin might produce extra beneficial properties.

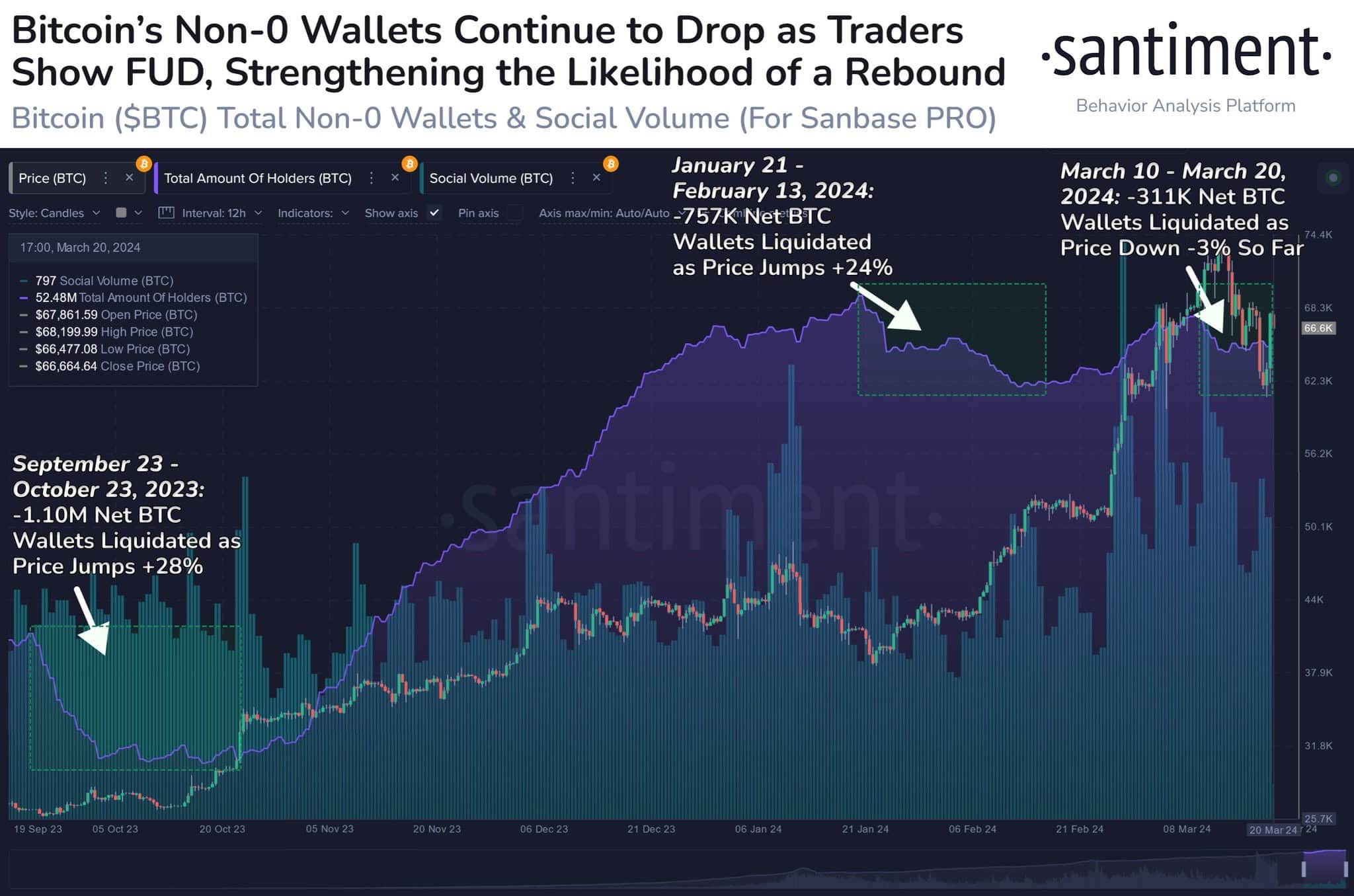

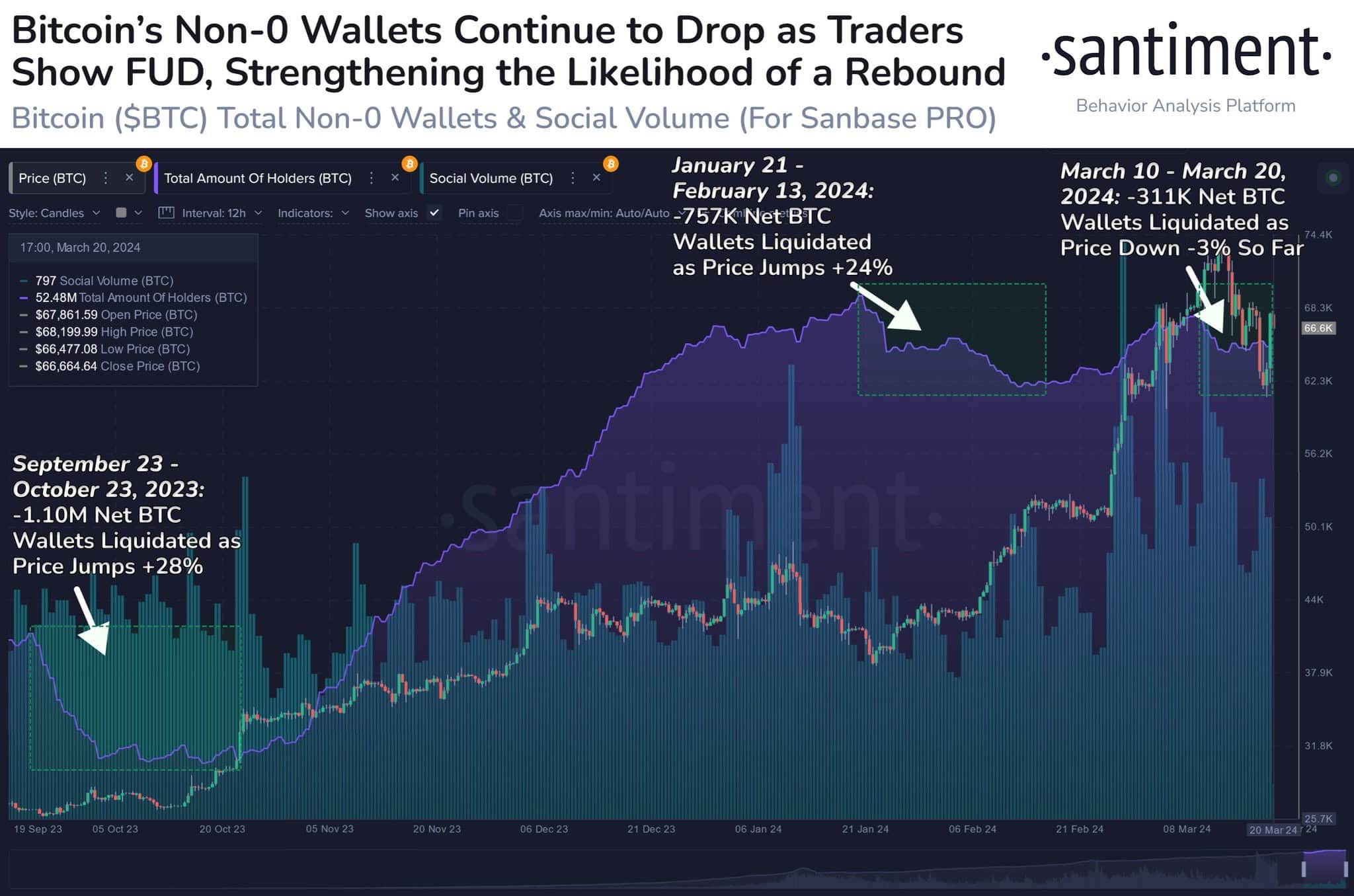

Although Bitcoin’s [BTC] value virtually hit $68,000 once more, on-chain knowledge confirmed that the sooner correction led to vital exits. In accordance with AMBCrypto’s evaluation, 311,00 non-zero addresses left the Bitcoin community within the final 10 days.

Our investigation confirmed that the exodus was a results of Worry, Uncertainty, and Doubt (FUD) as costs collapsed. Nonetheless, those that are accustomed to the market terrain can affirm that this departure ought to set off panic.

The coin’s showtime isn’t over

As an alternative, it gave whales, the chance to purchase low cost BTC on the expense of these “paper fingers.” Past that, Santiment knowledge showed Bitcoin sometimes beneficial properties from a situation like this.

For example, between September and October 2023, 1.10 million non-zero addresses left the community. However the ensuing final result was a 28% value improve.

Supply: Santiment

Likewise, between twenty first January and thirteenth February, some addresses departed. However the value of BTC rose by 24% in a while. At press time, Bitcoin was at a 3% adverse 10-day efficiency.

If historical past repeats itself, Bitcoin might head towards $83,000 in a couple of weeks. Nonetheless, it is usually vital to take a look at BTC from one other angle.

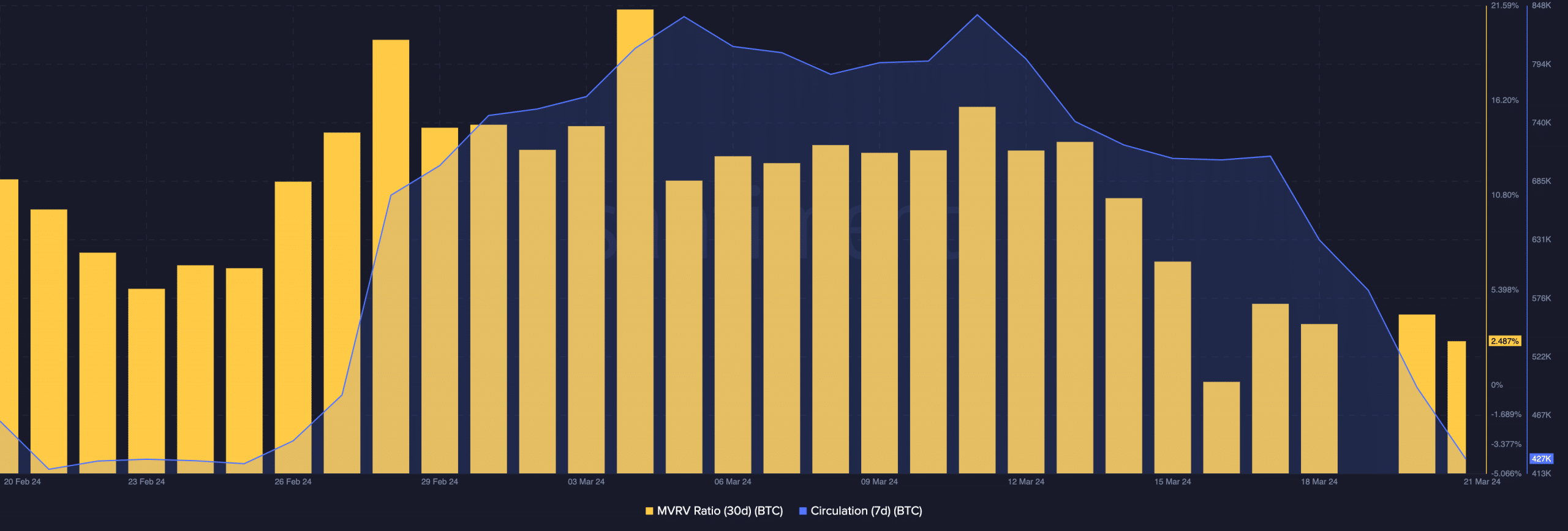

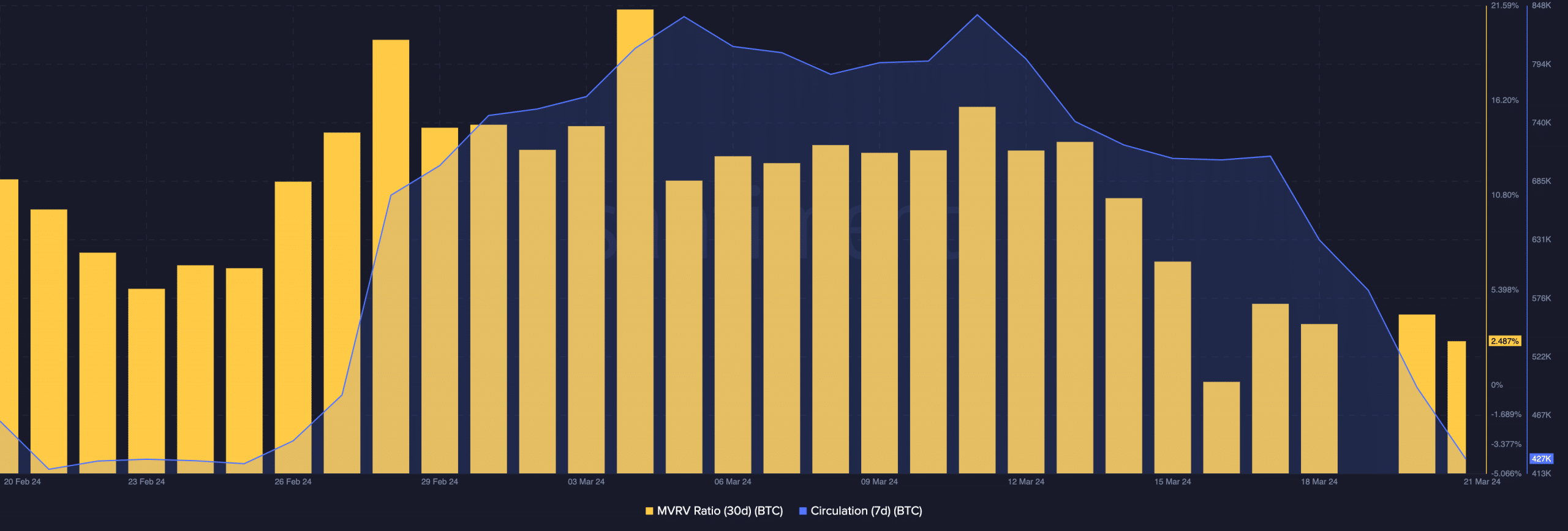

As such, AMBCrypto checked its Market Worth to Realized Worth (MVRV) ratio. Usually, the MVRV ratio displays the typical revenue or lack of all cryptocurrencies at the moment in circulation. It additionally signifies whether or not an asset is at honest worth or not.

Will optimism return?

As of this writing, the 30-day MVRV ratio was 2.487%, indicating that BTC holders had been hit arduous by the latest correction. However the situation of the metric looks like excellent news for the worth. At such a low ratio, the worth of Bitcoin has the potential to climb larger.

On a seven-day foundation, on-chain knowledge confirmed that Bitcoin circulation had decreased. At press time, the circulation was 427,000. This was virtually 50% down from what it was on the eleventh of March.

Supply: Santiment

Regarding the value motion, the lower in circulation signifies that BTC may expertise much less promoting stress. Because of this, the worth of the coin can admire.

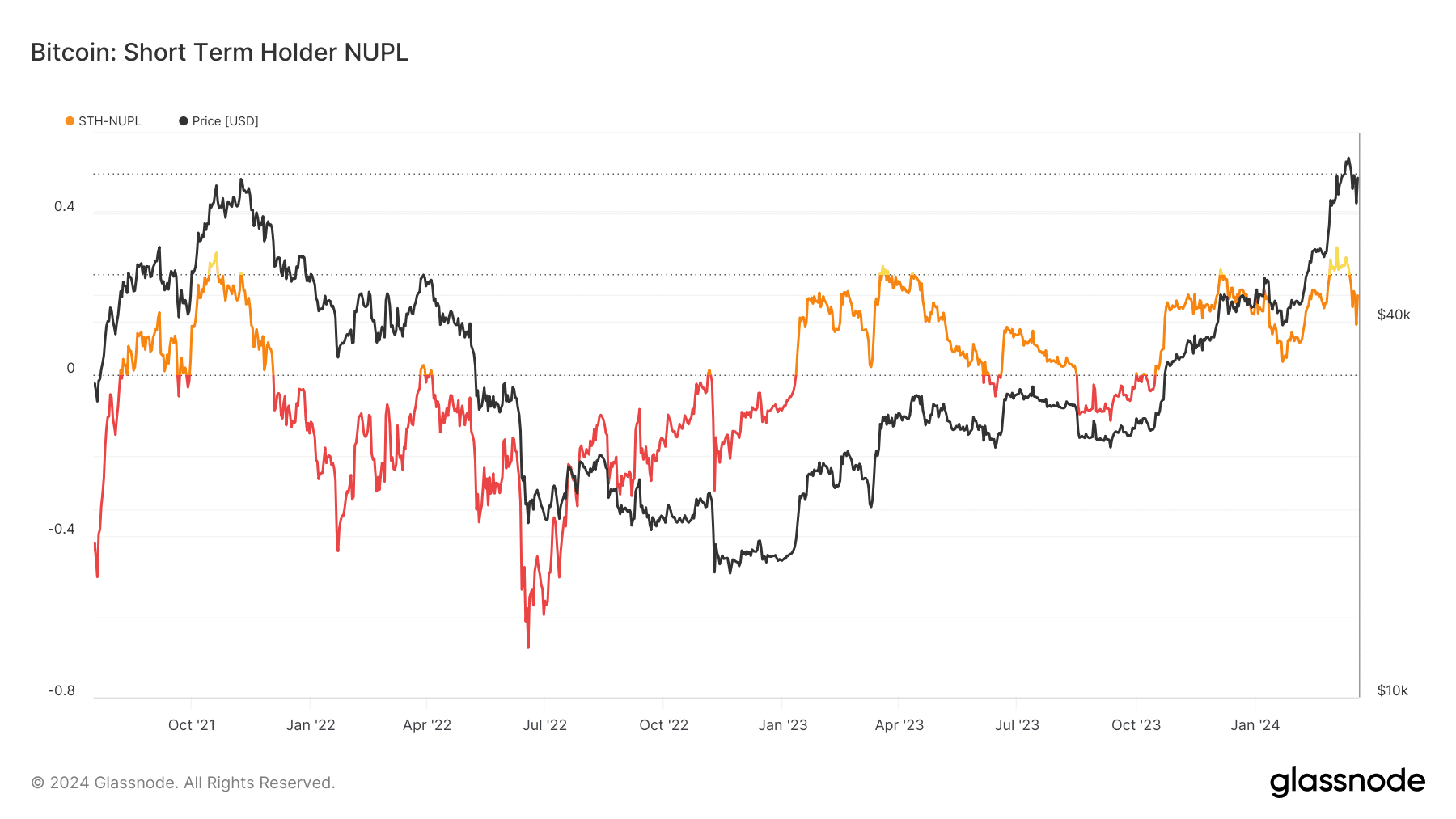

Moreover, AMBCrypto noticed that there was a change within the short-term sentiment round Bitcoin. We obtained this inference after analyzing the Quick Time period Holder- Web Unrealized Revenue/Loss (STH-NUPL).

The STH-NUPL serves as an indicator of the habits of short-term traders. When March started, the metric moved from hope (orange) to optimism (yellow).

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Nonetheless, the switch to the brighter shade didn’t final lengthy. As of this writing, the STH-NUPL was again within the hope-fear territory, indicating that traders had been skeptical about betting on a value improve.

However on the identical time, this means a slight lower in greed, suggesting that the market was not overheated. Ought to this stay the case, the coin value may rise larger than $67,631.

Supply: Glassnode