- Bitcoin’s short-term holders now maintain their cash at a revenue.

- BTC’s future open curiosity has risen to a two-month excessive.

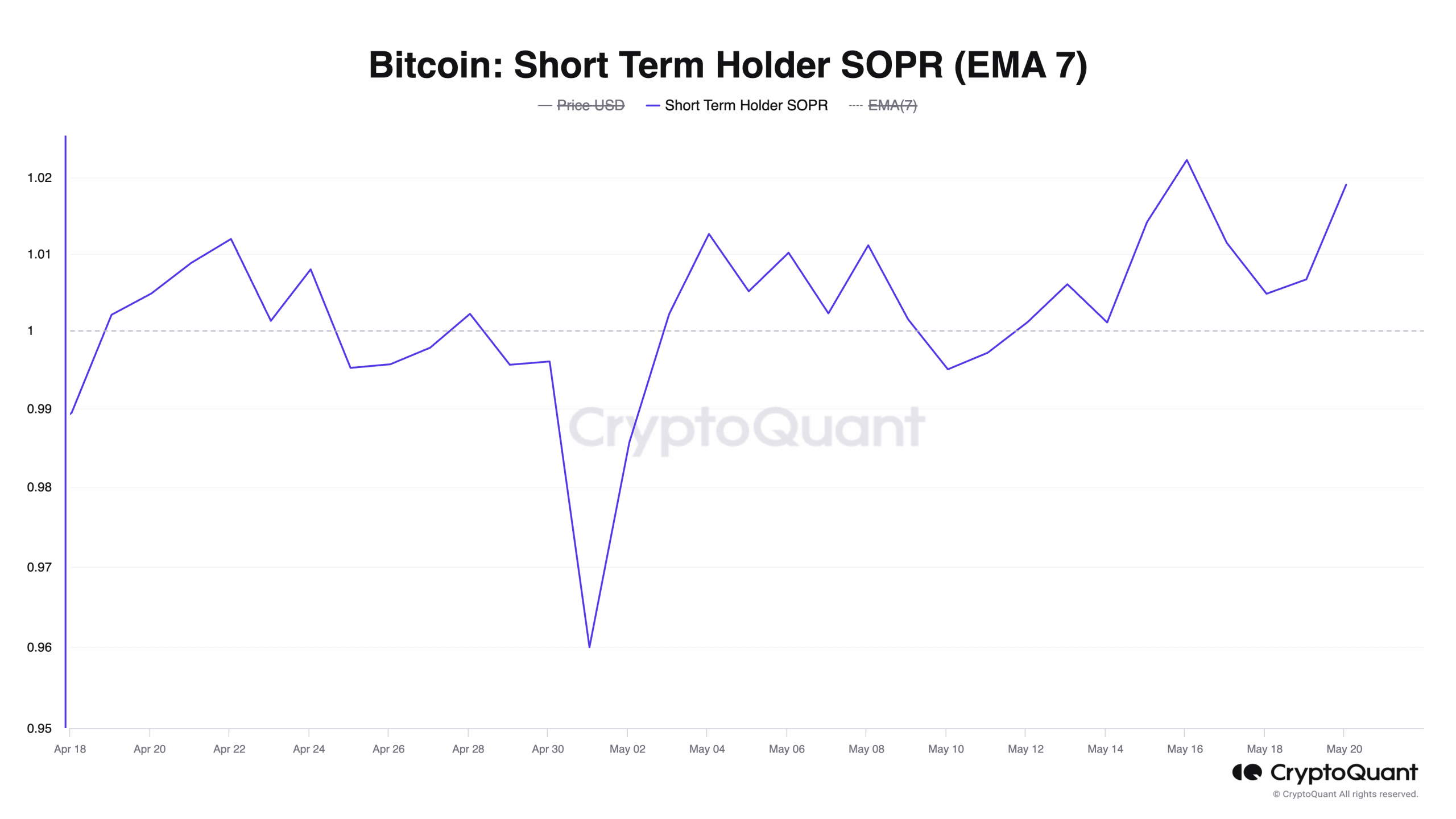

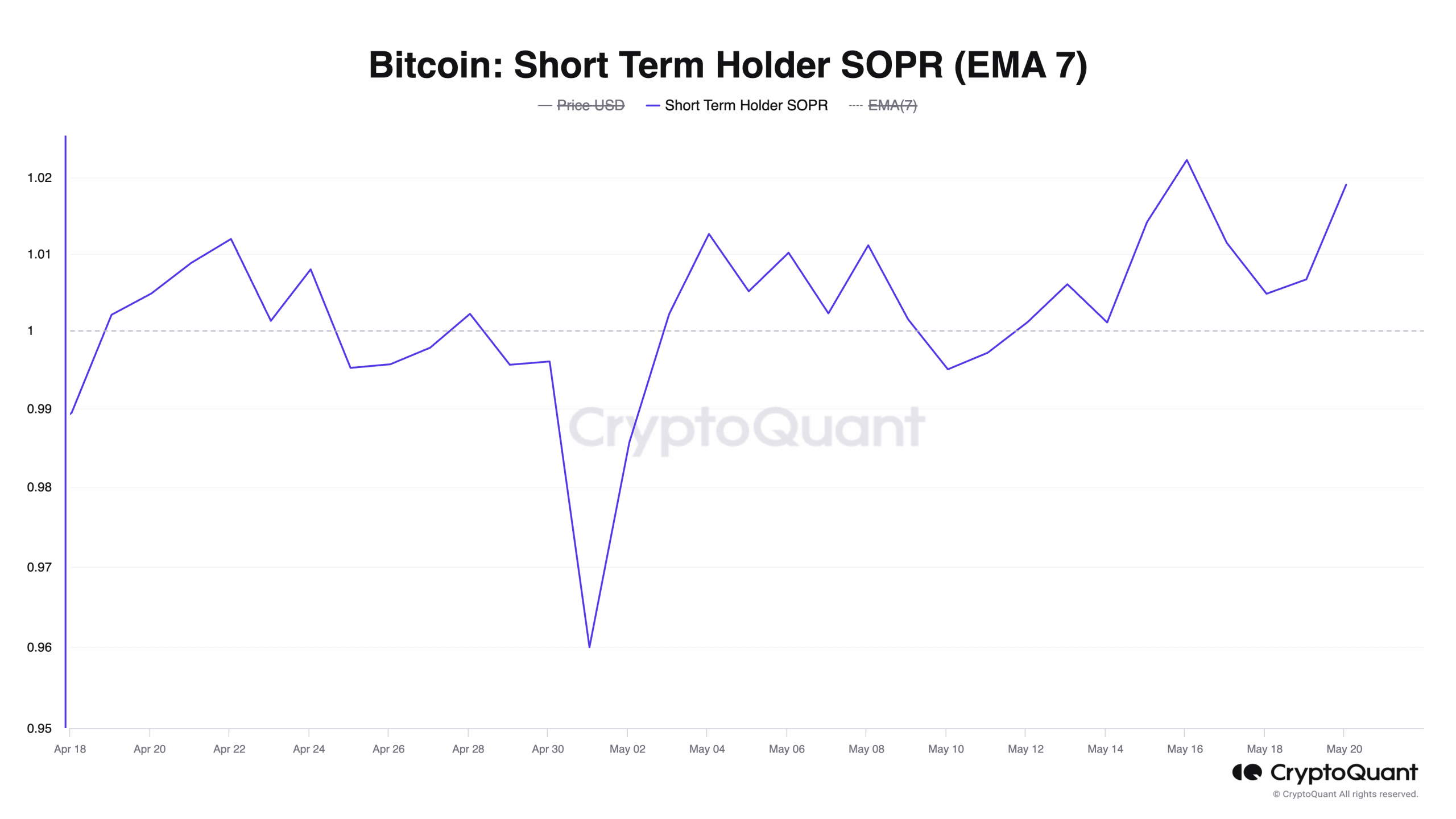

Bitcoin’s [BTC] Spent Output Revenue Ratio (SOPR) for its short-term holders (STH) has rallied above 1, signaling that this cohort of traders now holds their cash at a revenue.

In a brand new report, pseudonymous CryptoQuant analyst Phi Deltalytics discovered that the uptick on this metric’s worth above 1 suggests the presence of “bullish sentiment available in the market.”

BTC’s STH-SOPR measures whether or not traders who’ve held the coin for 3 to 6 months are promoting at a revenue or a loss.

When it returns a worth above 1 reminiscent of this, it signifies that short-term holders, on common, are promoting their cash at a revenue. Conversely, if the STH-SOPR is under 1, it means that these holders are promoting at a loss.

Why the worth above 1 is critical

In line with CryptoQuant’s information, BTC’s STH-SOPR was 1.019 at press time.

Supply: CryptoQuant

Earlier than this metric steadied at this level, it had cratered to the 1 stage however didn’t drop under it, Deltalytics discovered.

In line with him, when that occurred, the coin traded at a value at which sellers have been neither making nor shedding cash. This led many market contributors to carry on to their cash as a substitute of promoting them. This was a optimistic signal for the market, signaling low promoting stress.

The analyst added that BTC’s STH-SOPR should keep above 1. If this occurs, the market will “take up” any profit-taking by sellers with out the danger of a major value drop.

Predicting that this may assist the sustainability of the BTC’s present value rally, Deltalytics added:

“With the market not overly heated, this dynamic has the potential to push Bitcoin’s value upwards.”

Is your portfolio inexperienced? Try the BTC Revenue Calculator

BTC amid the current value rally

The main coin has benefitted from the market rally previously 24 hours. At press time, BTC was buying and selling at $71,212, and its value had grown 6% throughout that interval.

The interval underneath evaluate has been marked by a major uptick in buying and selling exercise in BTC’s derivatives market. In line with Coinglass’ information, BTC’s derivatives quantity has risen 112% previously 24 hours.

At $35 billion on the time of writing, BTC’s futures open curiosity sat at its highest stage since March.