- A take a look at how Bitcoin is faring in an excessive concern setting.

- Why liquidations might have performed a task in pushing BTC beneath $60k.

Bitcoin [BTC] has as soon as once more pulled again beneath the $60,000 value vary after a short restoration final week. This comes simply days after the market began to regain optimism for a restoration.

The present Bitcoin value efficiency is a mirrored image of the prevailing sentiment. The Bitcoin/crypto concern and greed sentiment dropped from concern to excessive concern within the final 24 hours.

This has subsequently resulted within the circulation of liquidity from the cryptocurrency.

This end result means that the market is probably not out of the woods but after final week’s crash. BTC’s short-lived rally noticed it push as excessive as $62,754 throughout Thursday’s buying and selling session. It had a press time value of $58,172, a 7.58% drop from its weekly excessive.

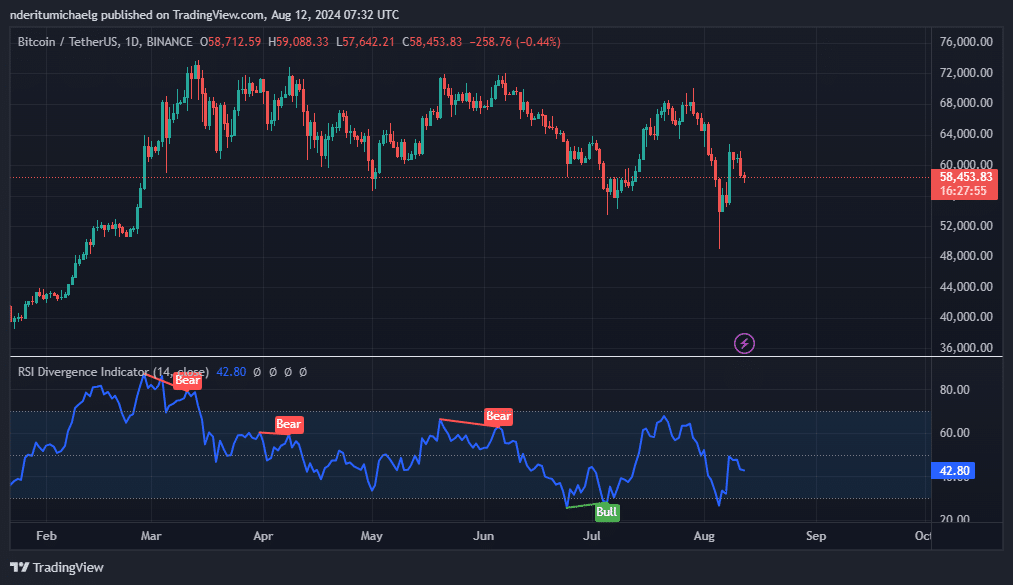

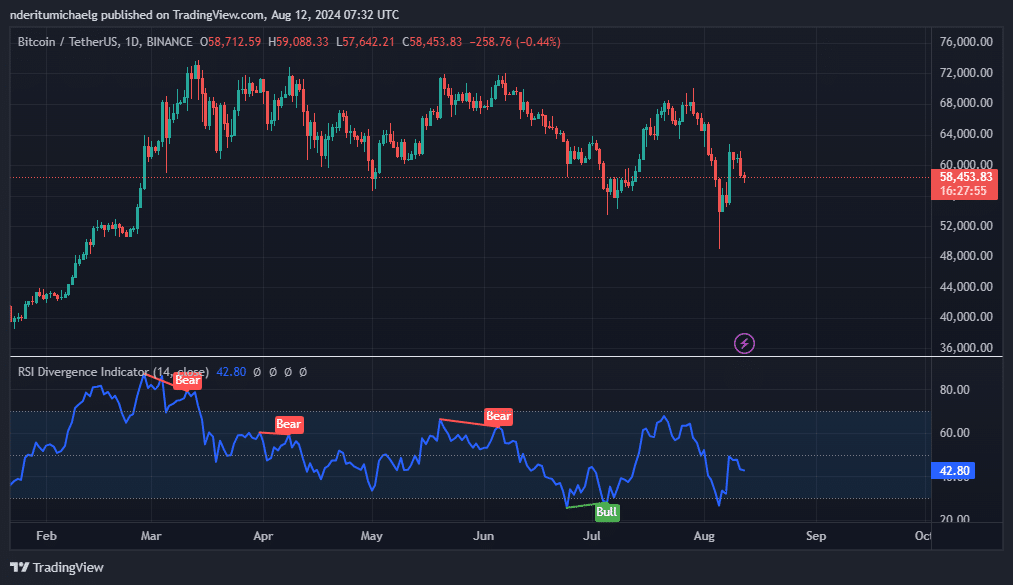

Supply: TradingView

The newest retracement occurred on the RSI mid-point. That is vital as a result of it alerts an elevated concentrate on short-term profit-taking amongst Bitcoin merchants. In spite of everything, the market is presently going via a part of heightened uncertainty.

There have been rising issues in regards to the state of the worldwide financial markets after the latest unwind of the Japanese Yen carry commerce.

Some analysts concern that extra financial fallout is likely to be on the way in which. This additionally comes amid rising FUD concerning a recession.

Extra gasoline for the bears?

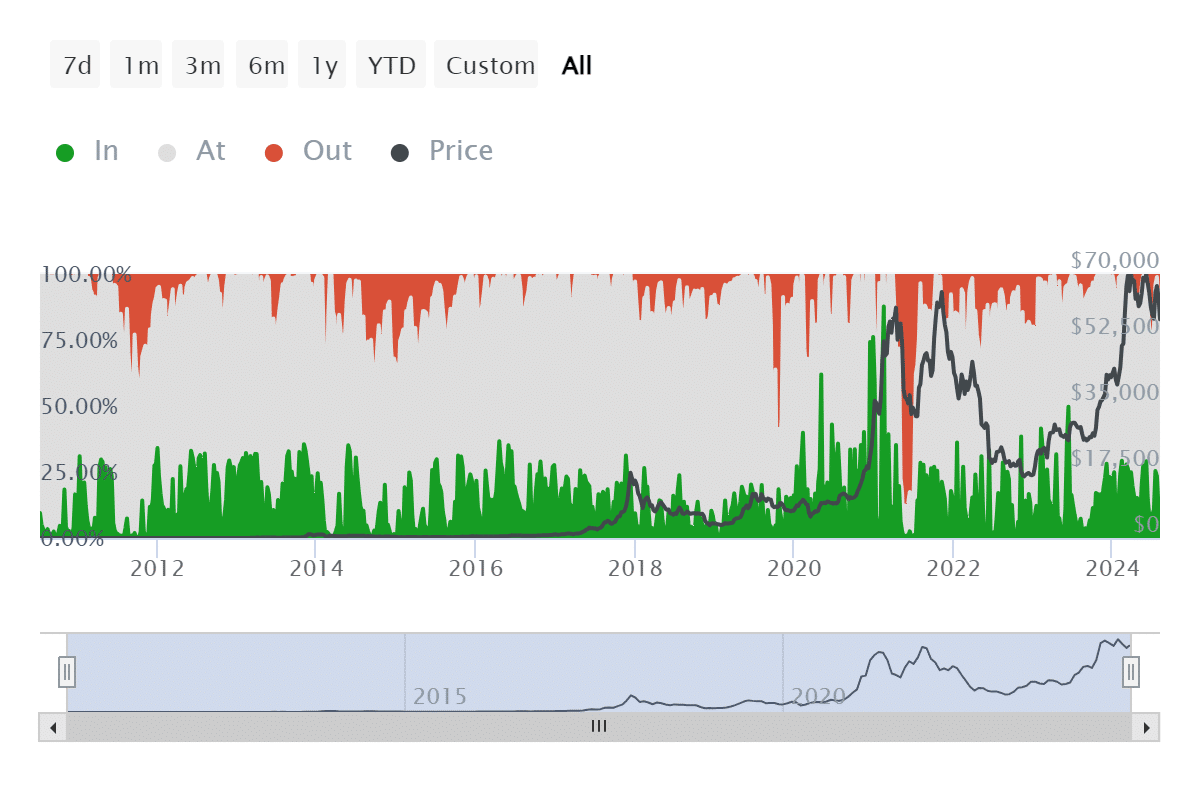

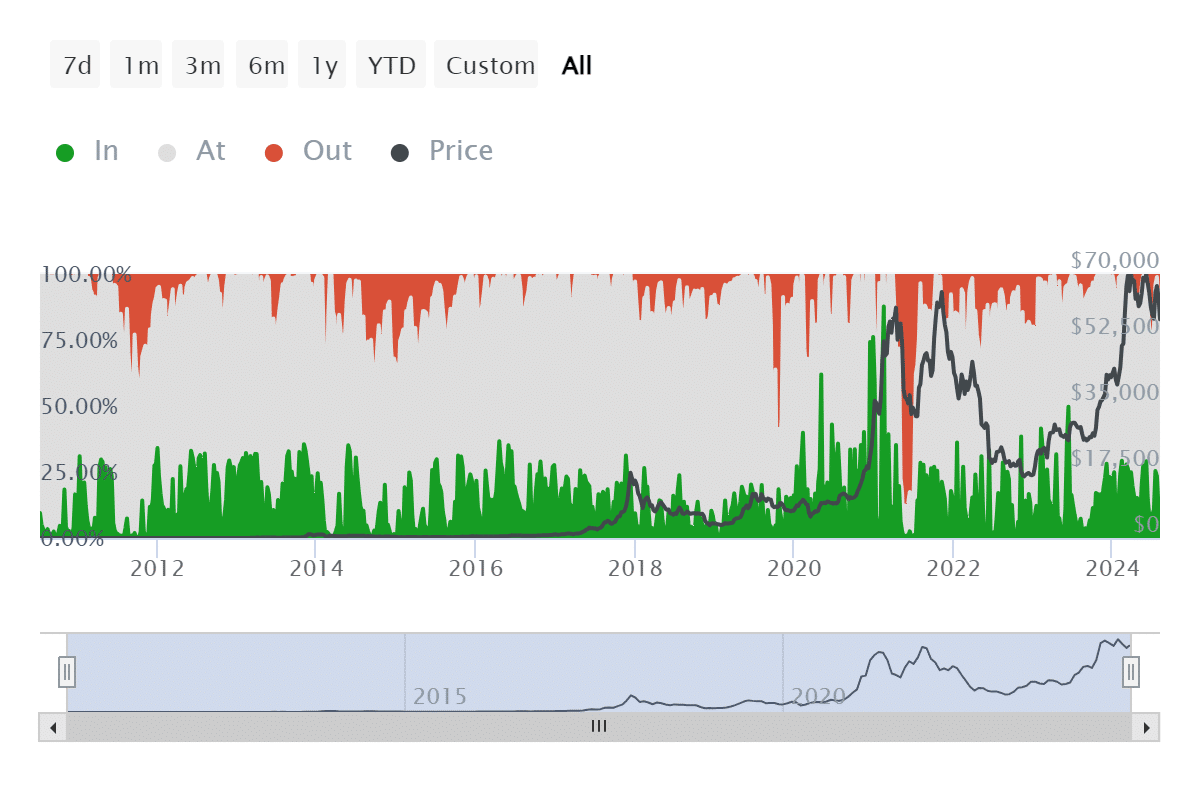

An evaluation of Bitcoin from a liquidity perspective reveals potential publicity to liquidations. Our evaluation revealed that addresses out of the cash peaked at 20.3% which is roughly 10.84 million addresses on the top of the latest dip on fifth August.

The variety of addresses out of the cash as of eleventh August was 7.14 million (13.38%).

Supply: IntoTheBlock

Roughly 3.7 million addresses had injected liquidity into Bitcoin close to latest lows. In the meantime, the latest hype that shortly pushed BTC might have inspired extra hype and urge for food for leverage.

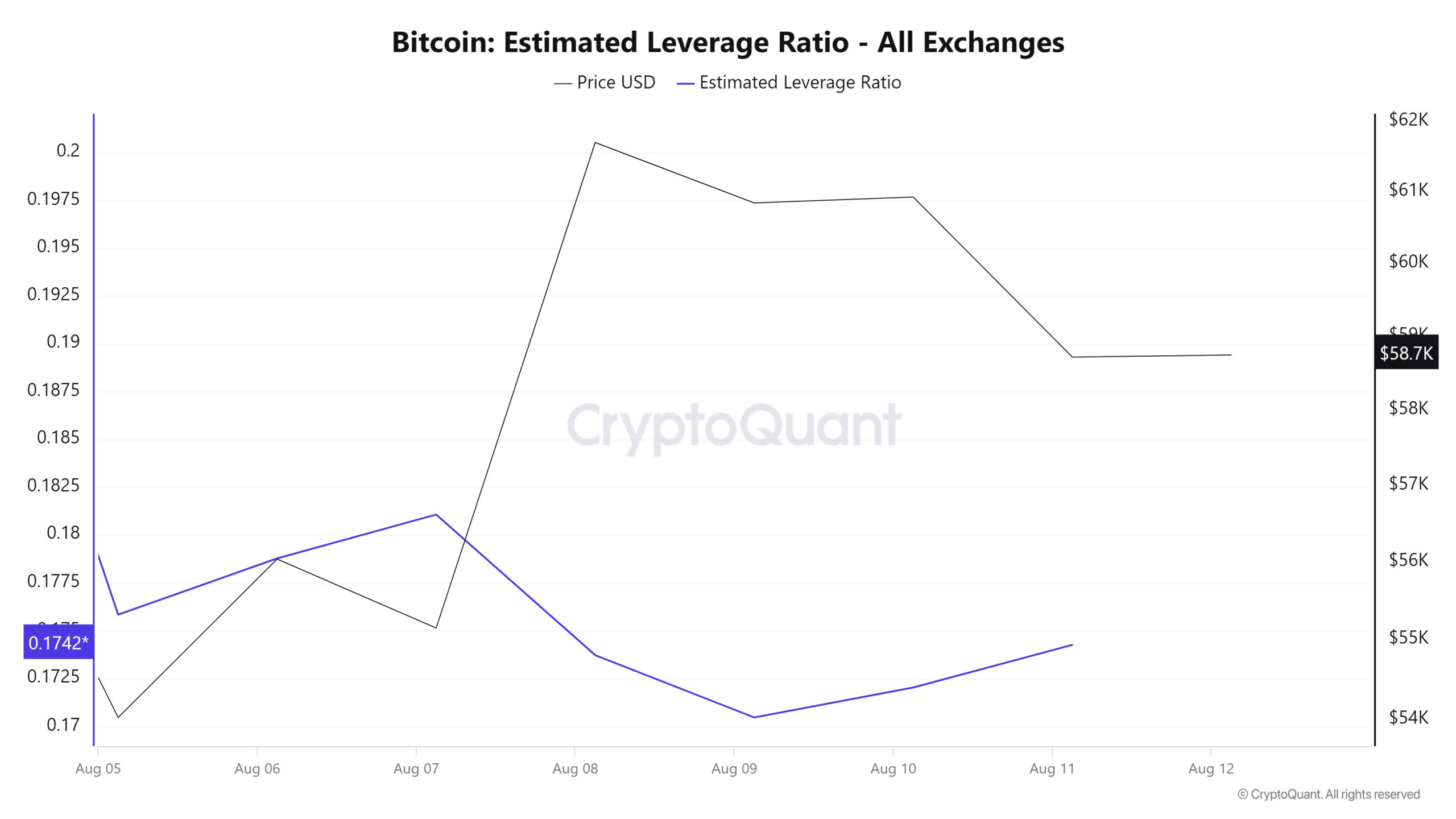

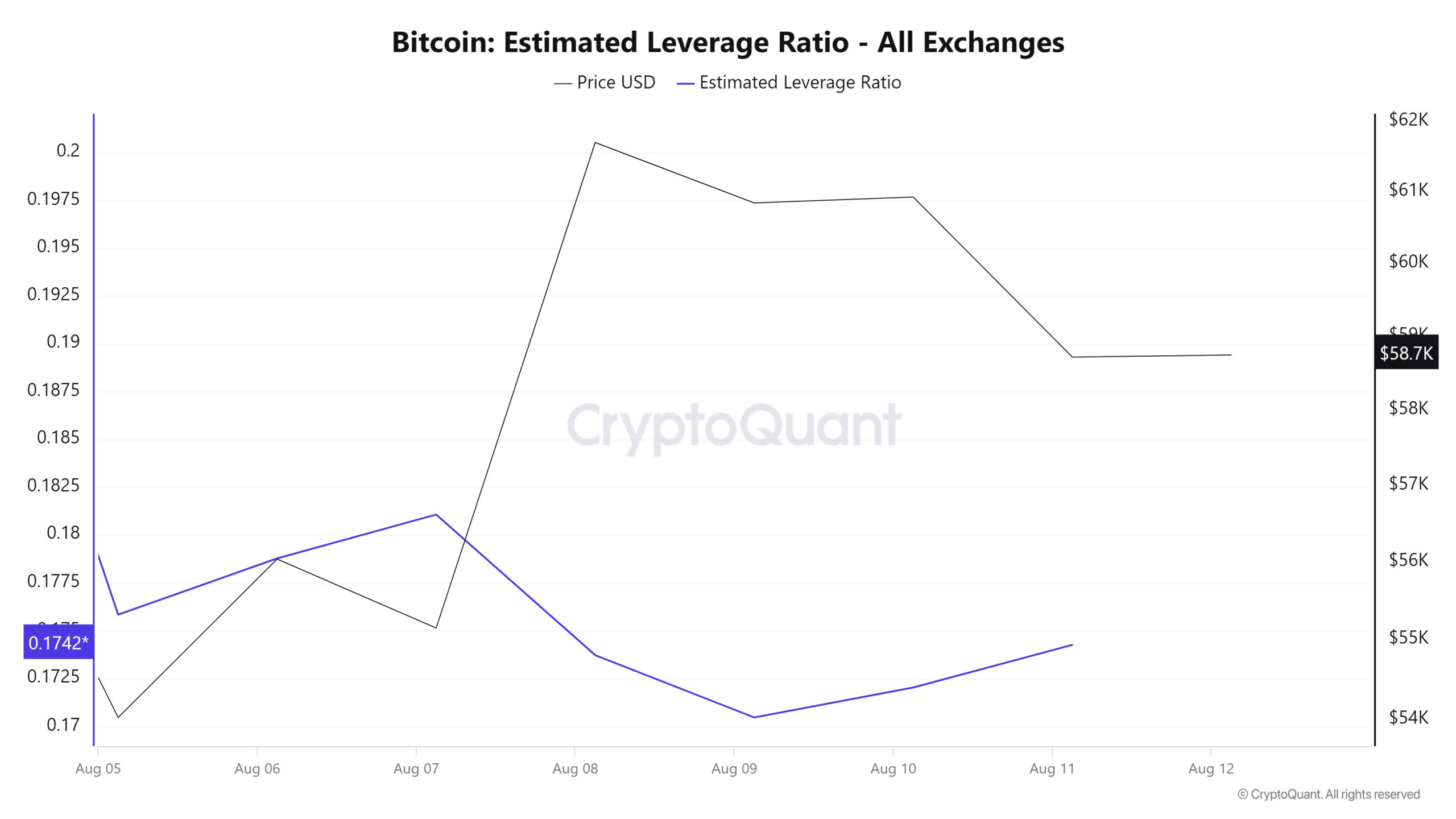

BTC’s estimated leverage ratio registered an uptick between ninth and eleventh August.

Supply: CrptoQuant

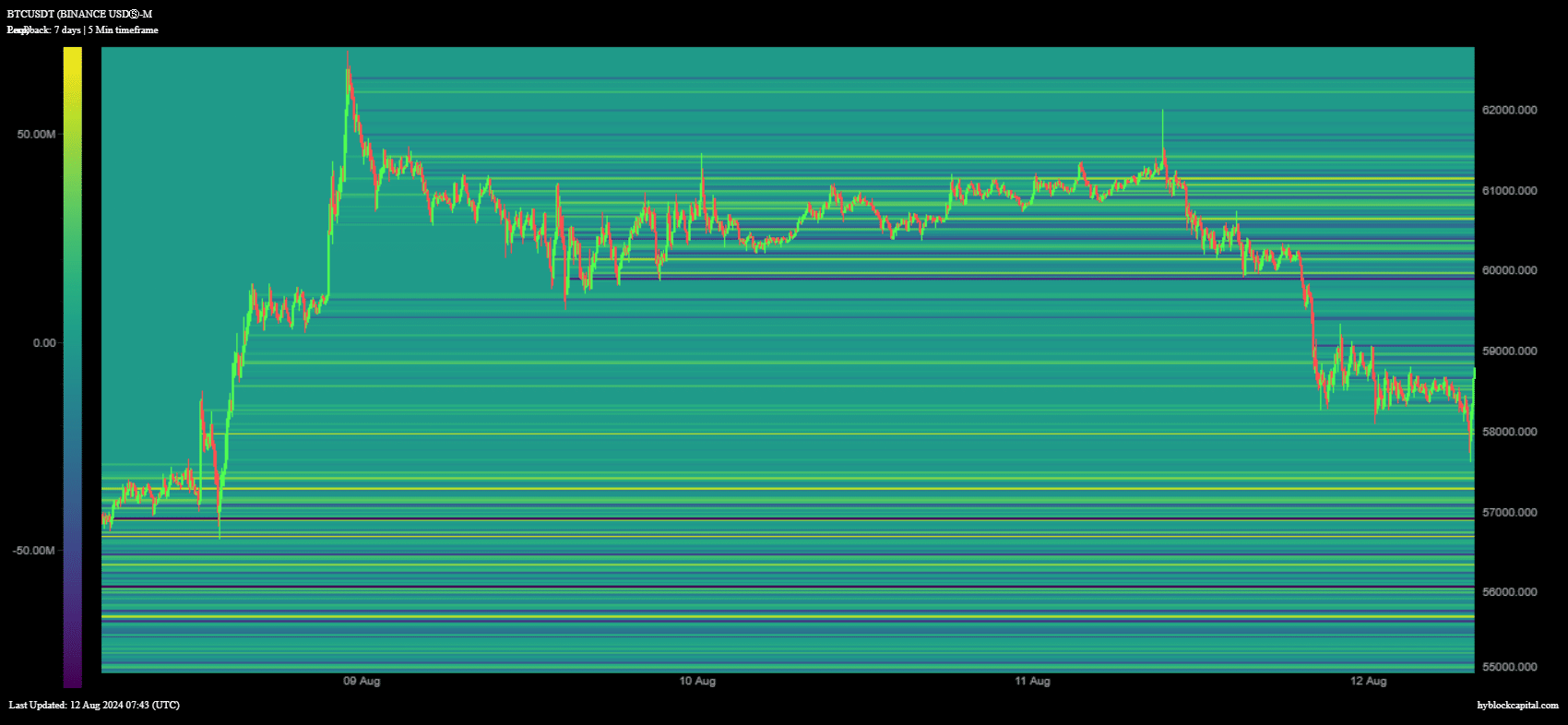

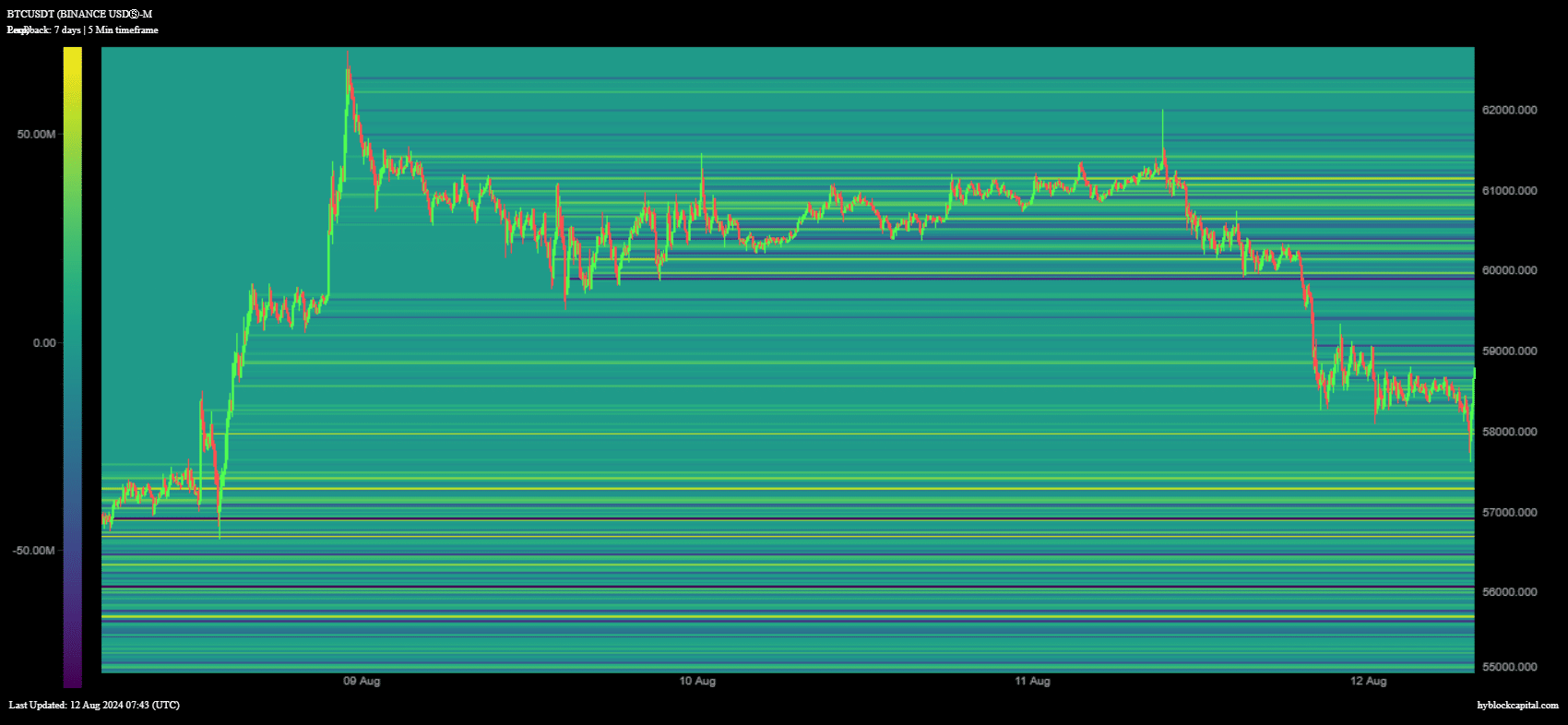

Bullish expectations and leverage might have created a conducive setting for an additional wave of liquidations. BTC internet longs peaked at $53.92 million on eleventh August at across the $61,129 value vary.

This was simply earlier than a powerful bearish transfer that pushed the value beneath $60,000.

Supply: HyblockCapital

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

These findings point out that leveraged longs liquidations might need closely influenced BTC’s value motion within the final 2 days.

Whereas liquidations might have performed into Bitcoin’s present dip beneath the $60,000 value, there isn’t any doubt that the market dangers extra draw back if sentiment stays weak.