- Bitcoin neared a loss of life cross at press time, suggesting attainable additional declines.

- Historic developments confirmed that restoration was attainable post-death cross, as seen in 2020 and 2021.

Bitcoin [BTC] was buying and selling at a worth of $57,389 at press time.

This doesn’t solely marked a 3.9% improve in BTC’s worth over the previous day, however was additionally a notable rebound from BTC’s decline on the fifth of August, which introduced its worth to commerce as little as $49,781.

Whatever the gradual rebound in BTC’s worth, on the time of writing, the asset was nonetheless down roughly 22.2% from its all-time excessive (ATH) above $73,000 in March.

Dying cross looms over Bitcoin

Amid this, Bitcoin gave the impression to be teetering on the sting of a technical configuration often known as a “loss of life cross.”

This time period in buying and selling refers to a situation the place the 50-day transferring common drops beneath the 200-day transferring common, historically a bearish indicator for merchants.

Supply: Barchart on X

Based on data from Barchart, this sample was rising as Bitcoin’s short-term beneficial properties had not sustained above its long-term beneficial properties.

Traditionally, Bitcoin has confronted comparable patterns; as an illustration, a loss of life cross occurred in March 2020, nevertheless, it was adopted by a brand new all-time excessive later that 12 months.

One other occasion was famous in June 2021, which additionally preceded a major rally to file ranges.

Whereas this can be a bearish indicator, if historic situation is to go by, then BTC could as properly be on the verge of a breakout to the upside.

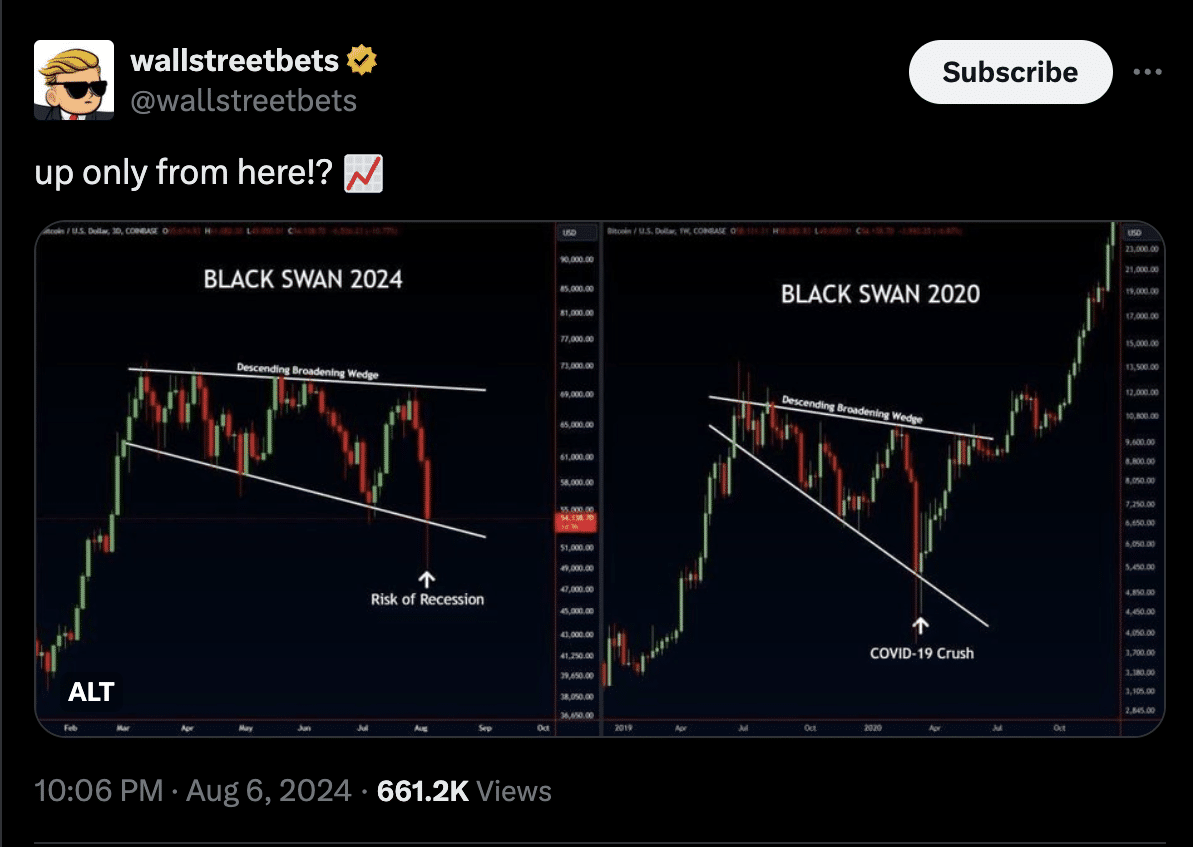

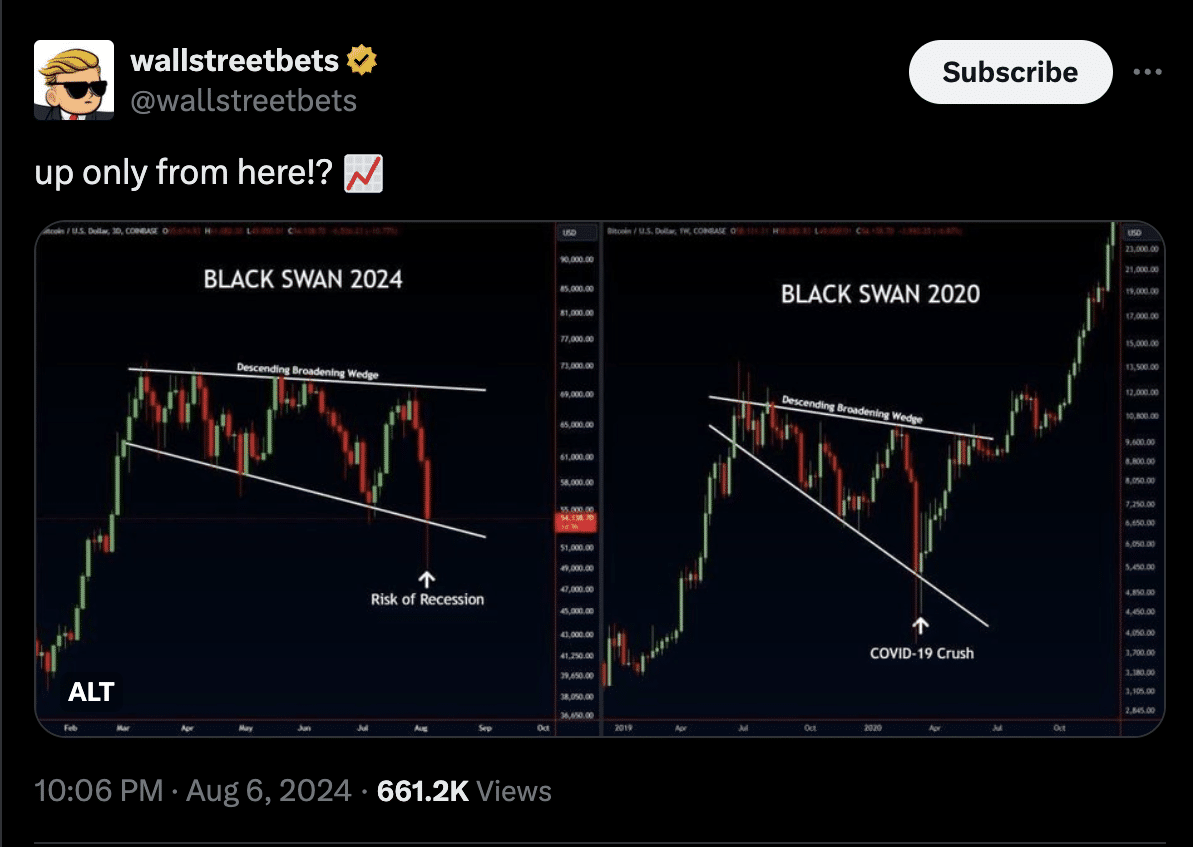

Including to this sentiment, a notable crypto fanatic recognized on X (previously Twitter) as ‘walltreetbets’ has highlighted a compelling sample in Bitcoin’s chart.

This sample intently mirrored the one seen in 2020, when Bitcoin fell right into a descending broadening sample through the COVID-19 crash, solely to rebound sharply from beneath $5,000 to over $20,000.

Supply: wallstreetbets on X

Based on Wallstreetbets’ evaluation, the 2024 chart urged an identical development.

Bitcoin has fashioned one other descending broadening sample amidst the latest financial downturn and appeared to have bottomed out, setting the stage for a possible surge akin to the restoration noticed in 2020.

Basic outlook

Aides technical evaluation, analyzing Bitcoin’s fundamentals may present perception into its future course.

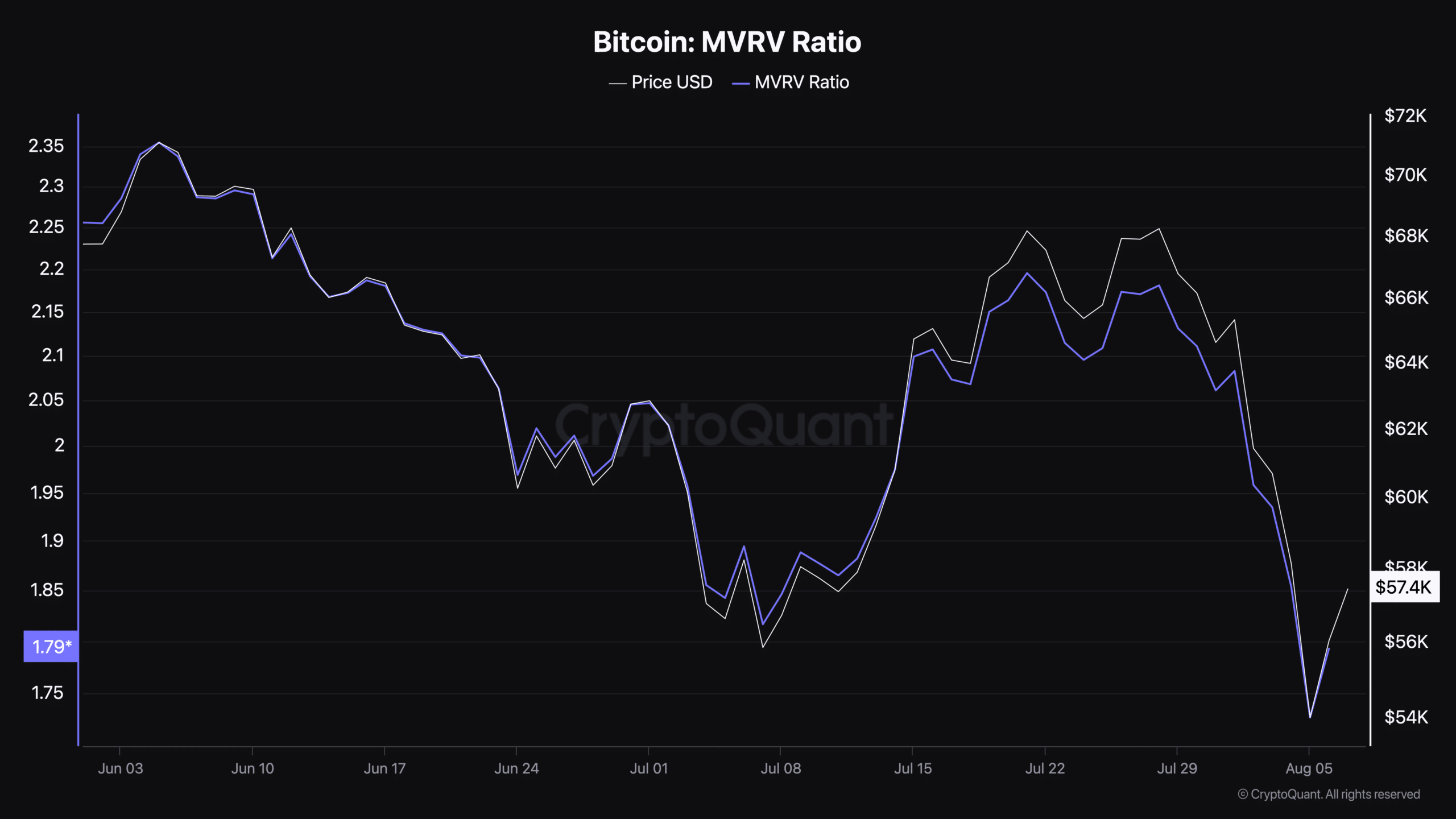

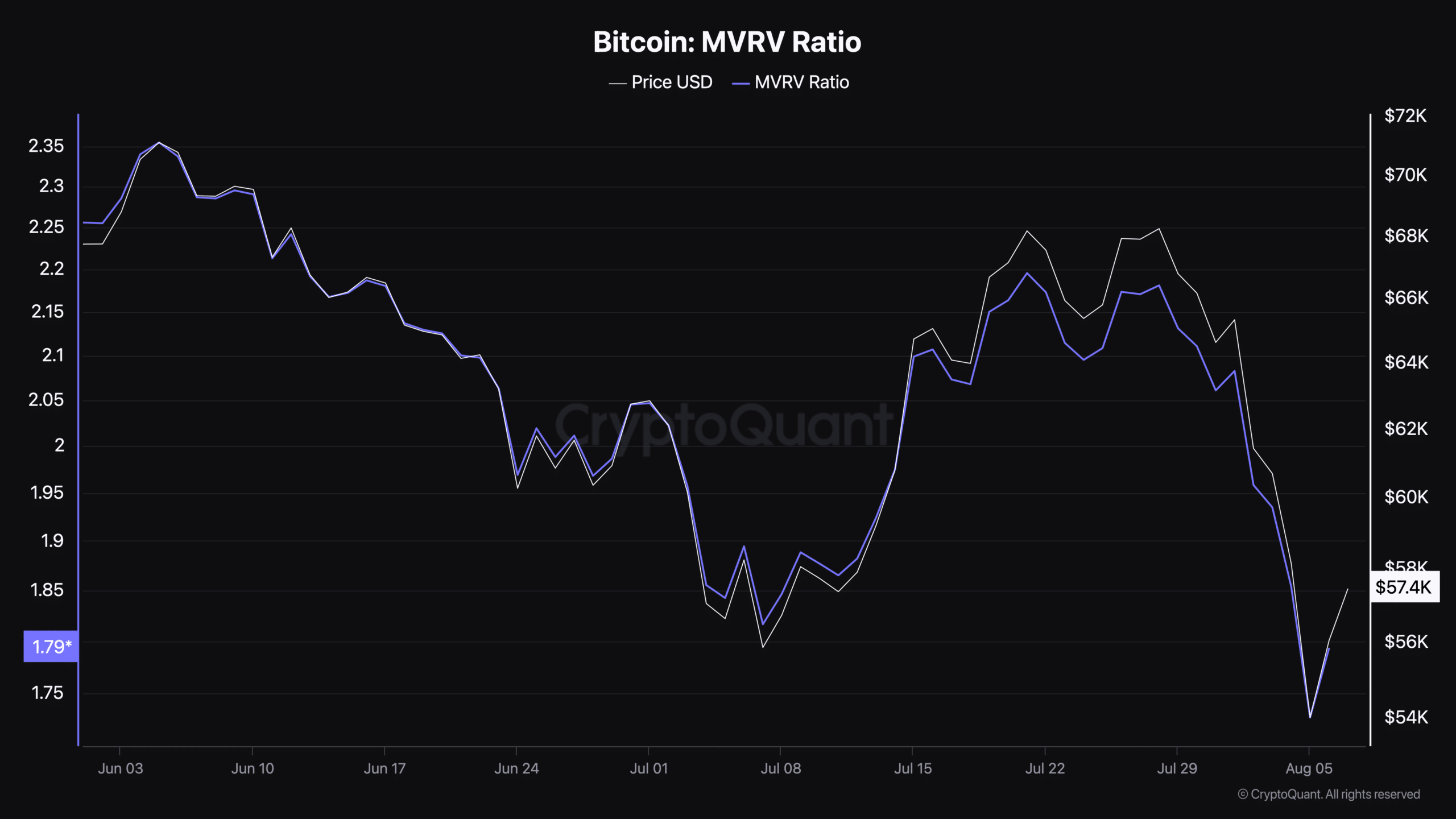

Notably, Bitcoin’s Market Worth to Realized Worth (MVRV) ratio, which measures the discrepancy between market worth and precise worth, was 1.79 at press time.

Supply: CryptoQuant

This ratio suggested that Bitcoin was undervalued on the time of writing, as a worth beneath 2 usually signifies that the asset was buying and selling beneath its honest worth, presenting a possible shopping for alternative.

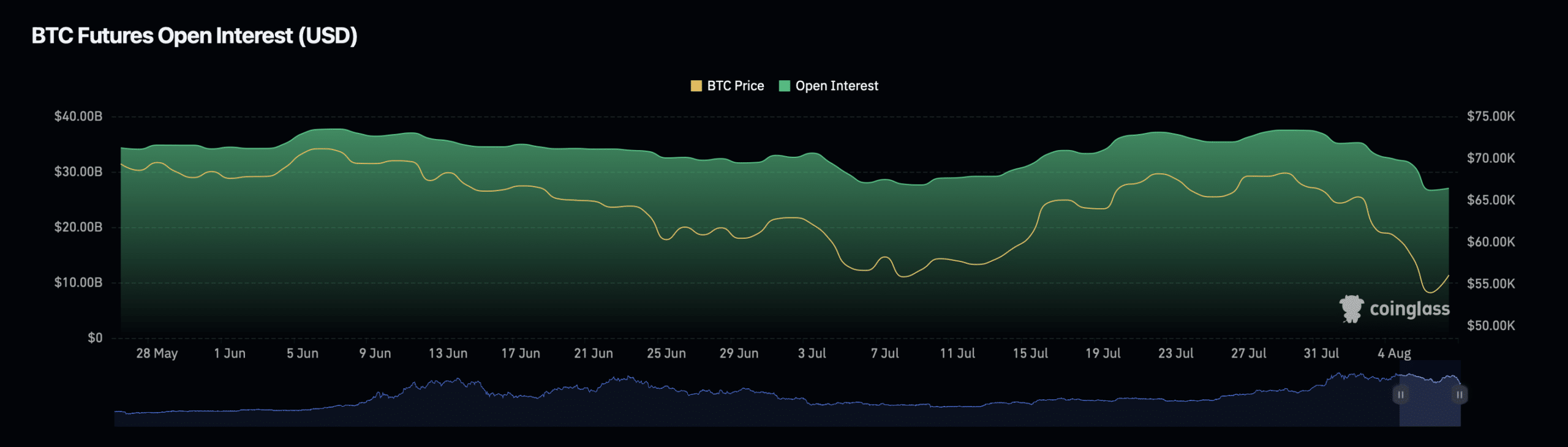

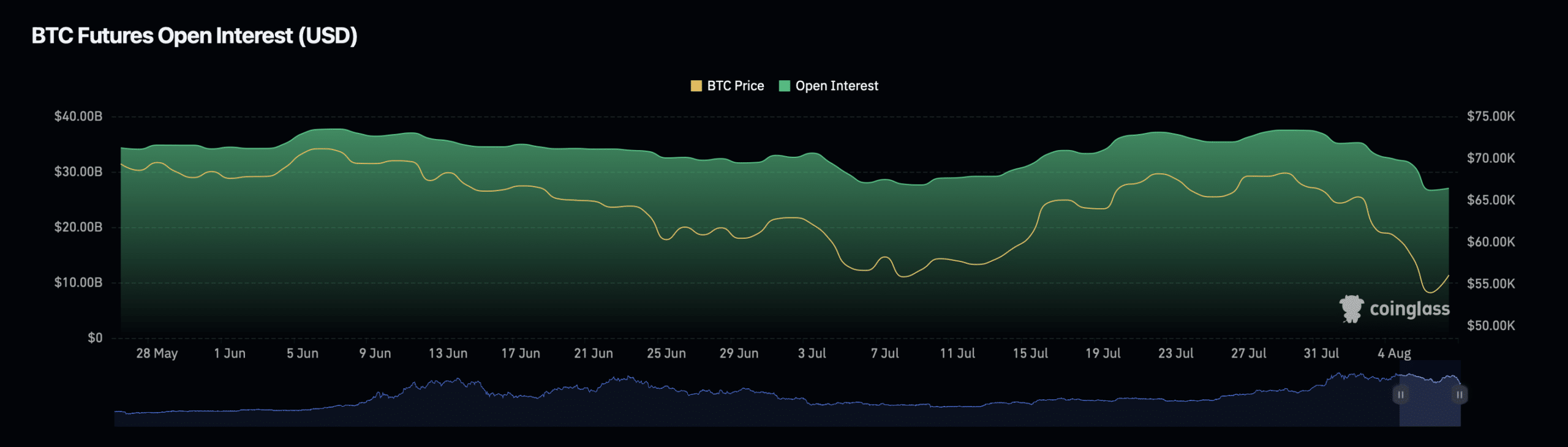

Moreover, Bitcoin’s Open Curiosity, representing the entire variety of excellent spinoff contracts like Futures and choices which have but to be settled, rose by 3.81% prior to now 24 hours to $28.24 billion.

Supply:: Coinglass

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Regardless of this improve, the Open Curiosity quantity noticed a major decline of 48%, standing at $80.12 Billion at press time.

This divergence usually signifies that whereas extra contracts are open, the general worth of buying and selling has decreased, suggesting a cooling off in market momentum or a shift in dealer sentiment.