- Bitcoin and Ethereum have seen a deeper retracement than Solana.

- SOL bulls might need to attend for sentiment to shift of their favor as soon as extra earlier than going lengthy.

Bitcoin [BTC] and Ethereum [ETH] noticed a few of their features from earlier this month retraced. Because the halving approaches, we may see a short-term “promote the occasion” sort of drop in costs earlier than bulls decide up the items as soon as extra.

Then again, Solana [SOL] maintained its bullish power, though it has additionally slowed down over the previous ten days. AMBCrypto assessed their worth charts towards each other to know the place costs could possibly be headed subsequent.

Bitcoin bulls might need to attend for some extra retracement

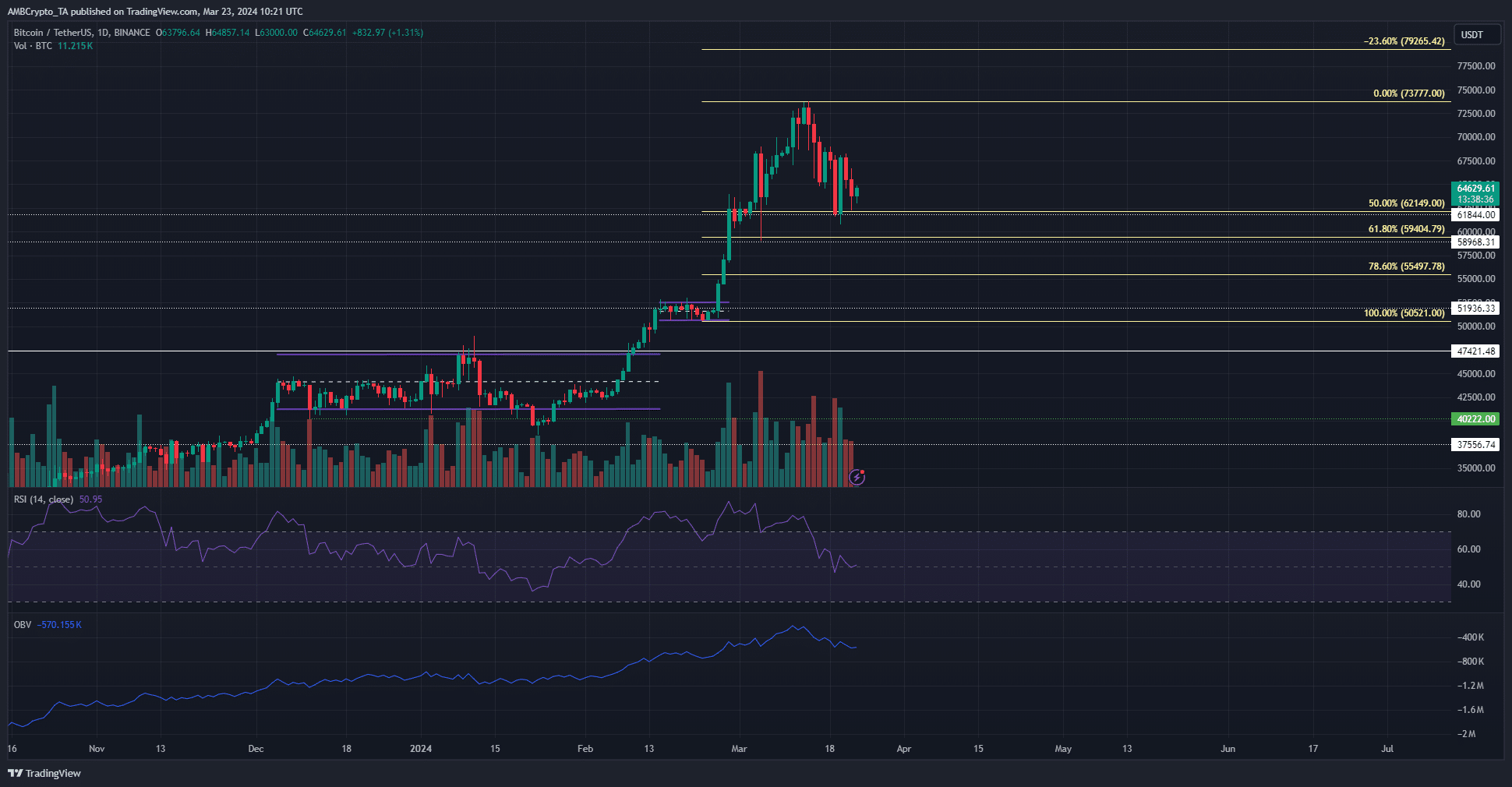

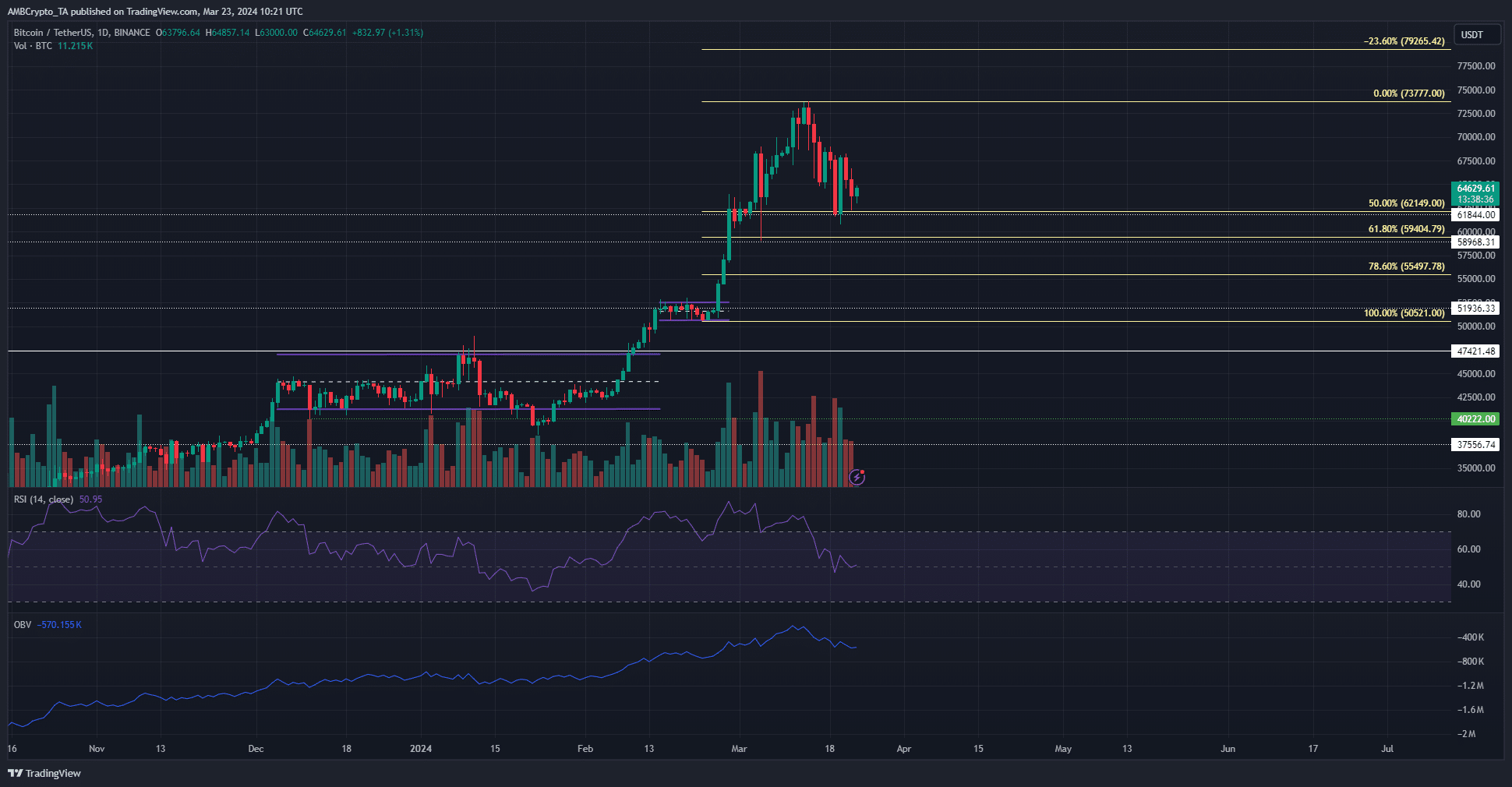

Supply: BTC/USDT on TradingView

The one-day market construction of BTC was bullish. A transfer under $50.5k would flip it bearishly, whereas a transfer above $73.7k would sign a bullish continuation. At press time, the $59.4k and $55.5k Fibonacci retracement ranges (pale yellow) have been vital assist ranges.

AMBCrypto expects that one among these ranges would possible be examined in the hunt for liquidity earlier than the uptrend can resume. This retest may happen shortly, within the type of a liquidation cascade, or it could possibly be a protracted transfer.

The RSI confirmed momentum was impartial and patrons have misplaced their benefit lately. The OBV additionally approached a assist stage in early March. Collectively, it signaled that patrons won’t be capable to maintain costs above the $60k mark.

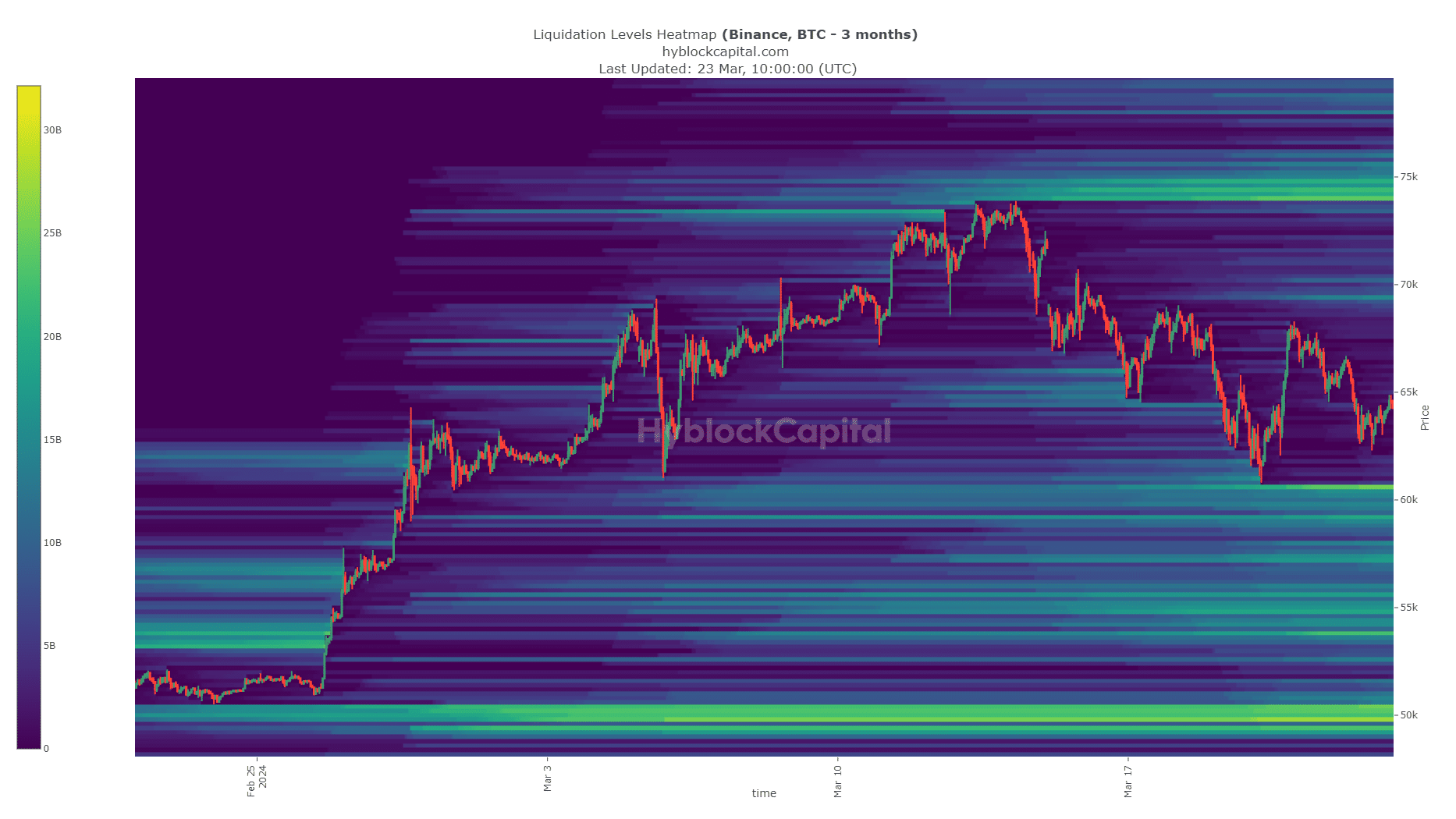

Analyzing the liquidation ranges confirmed the place BTC could possibly be interested in subsequent. The $50k psychological stage was vibrant on the heatmap, however such a drop was unlikely based mostly on the proof at hand.

Nearer to present market costs, the $60.8k, $57.2k, and $55k ranges have been extra attainable targets for the bears. A sweep of those liquidity pockets may pave the best way for Bitcoin to renew its uptrend in earnest.

Ethereum had an ideal retest however confronted rejection anyway

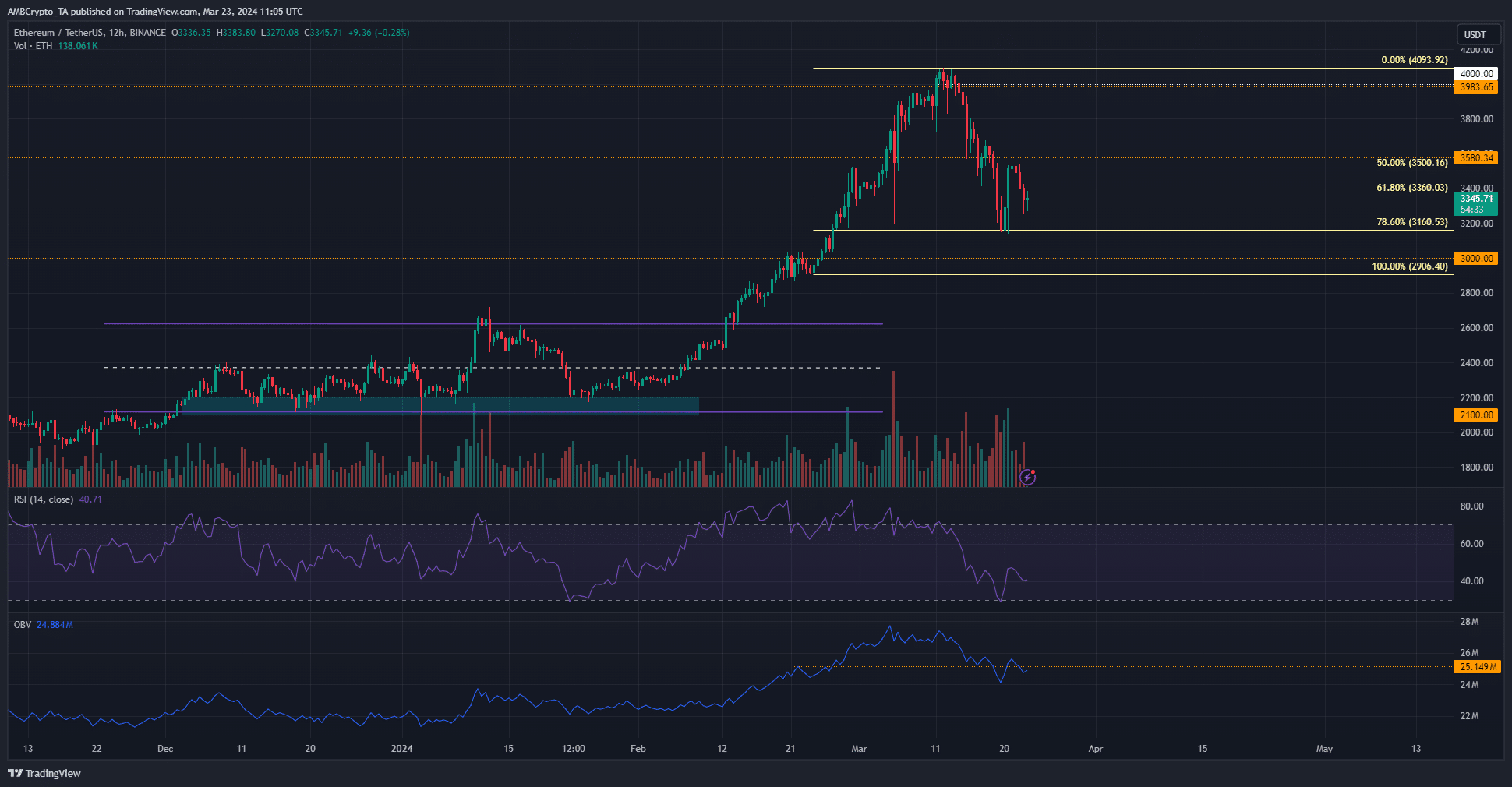

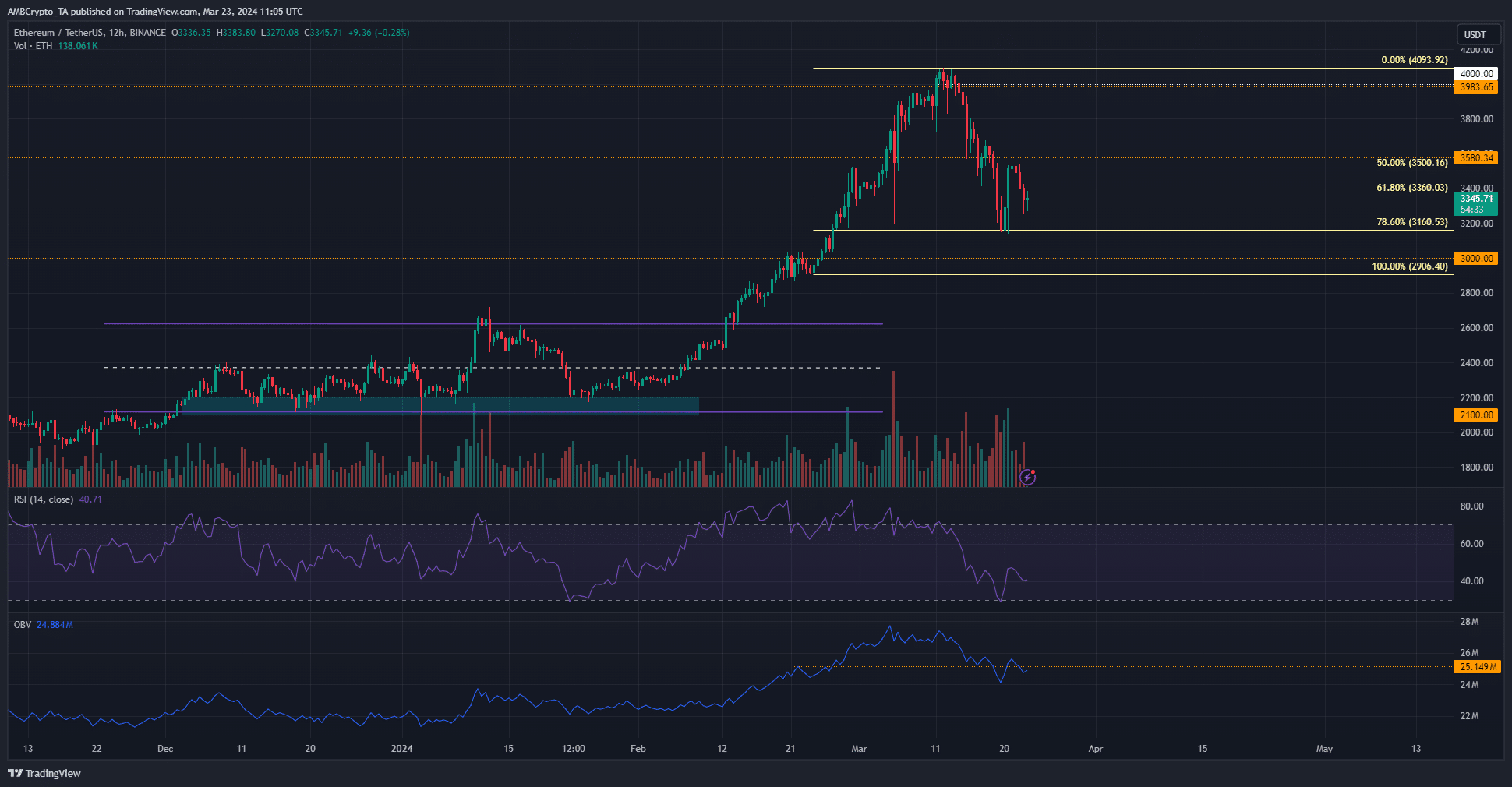

Supply: ETH/USDT on TradingView

Not like Bitcoin, Ethereum already examined its 78.6% retracement stage based mostly plotted based mostly on a latest rally. The drop to the $3160 stage noticed a powerful, fast bullish response that drove costs to $3580.

But it was not sufficient and the bulls confronted rejection just under $3600. The OBV additionally sank to a neighborhood excessive it had made on the twenty first of February when the $3000 mark was a resistance zone.

The RSI has been under impartial 50 for the previous ten days and confirmed bearish momentum was sturdy. Collectively, the indications and worth motion confirmed that the retracement was not essentially over. We may see ETH drop to $3160 or decrease as soon as extra.

There was a major pocket of liquidity at $3000 that costs may take a look at shortly.

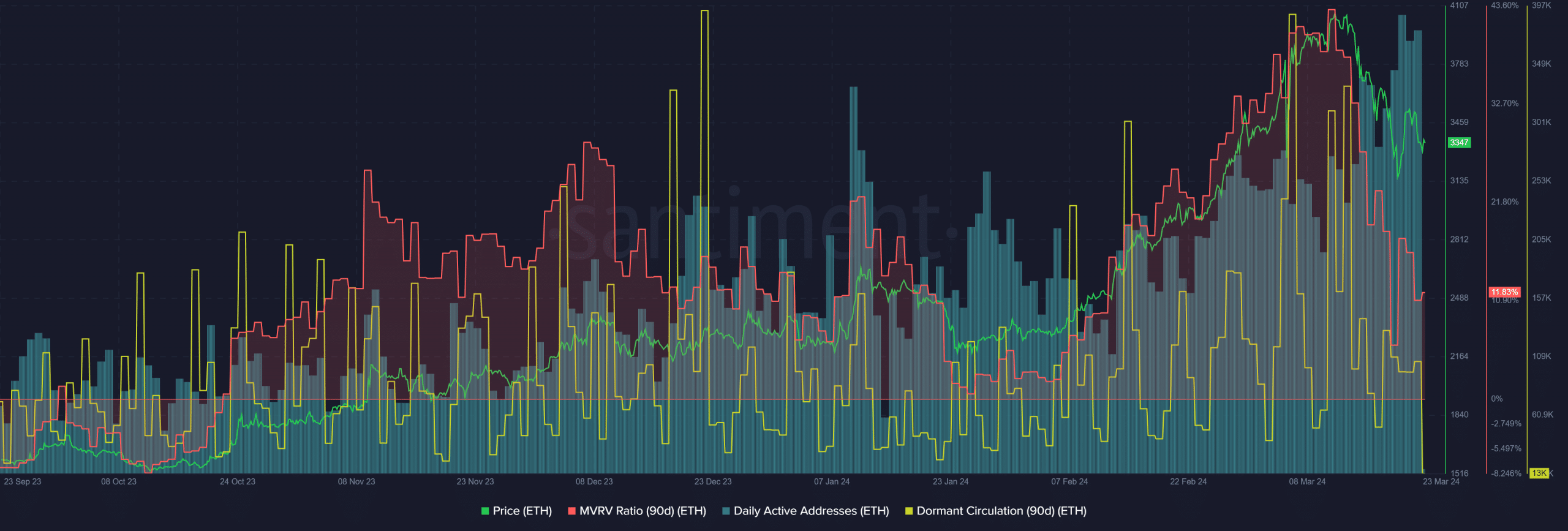

The on-chain metrics have been barely extra encouraging. The MVRV ratio remained optimistic and confirmed holders have been at a revenue. The day by day energetic addresses metric has been trending increased for the reason that tenth of February.

The dormant circulation metric has been profitable in latest months in marking a neighborhood prime. Surges on this metric also can point out panic promoting close to the underside. Subsequently, swing merchants would need to see a pointy drop in costs to key demand zones highlighted earlier.

A spike in dormant circulation alongside this might properly mark the native backside and shopping for alternative.

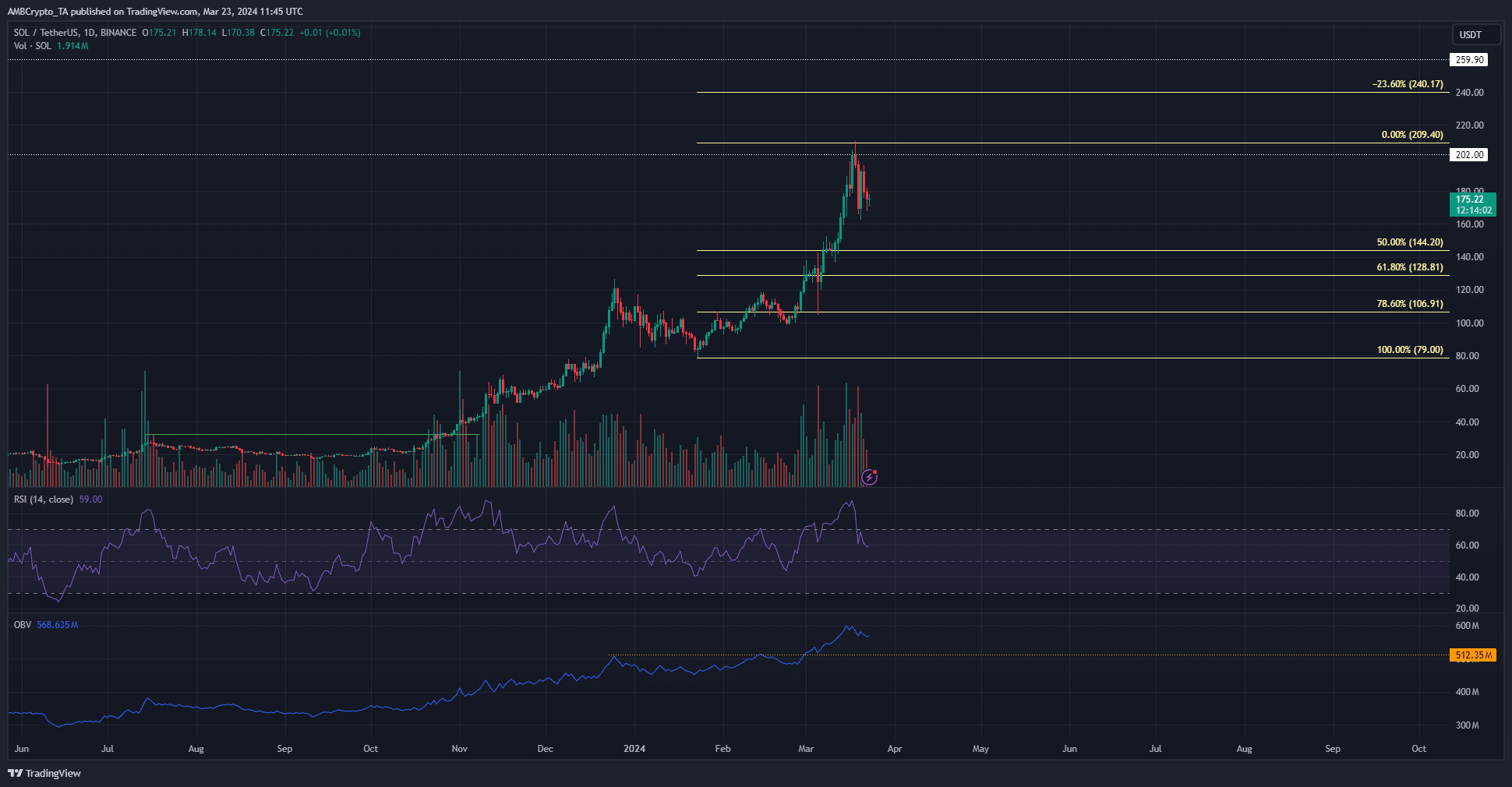

Solana to $130 or $260 subsequent?

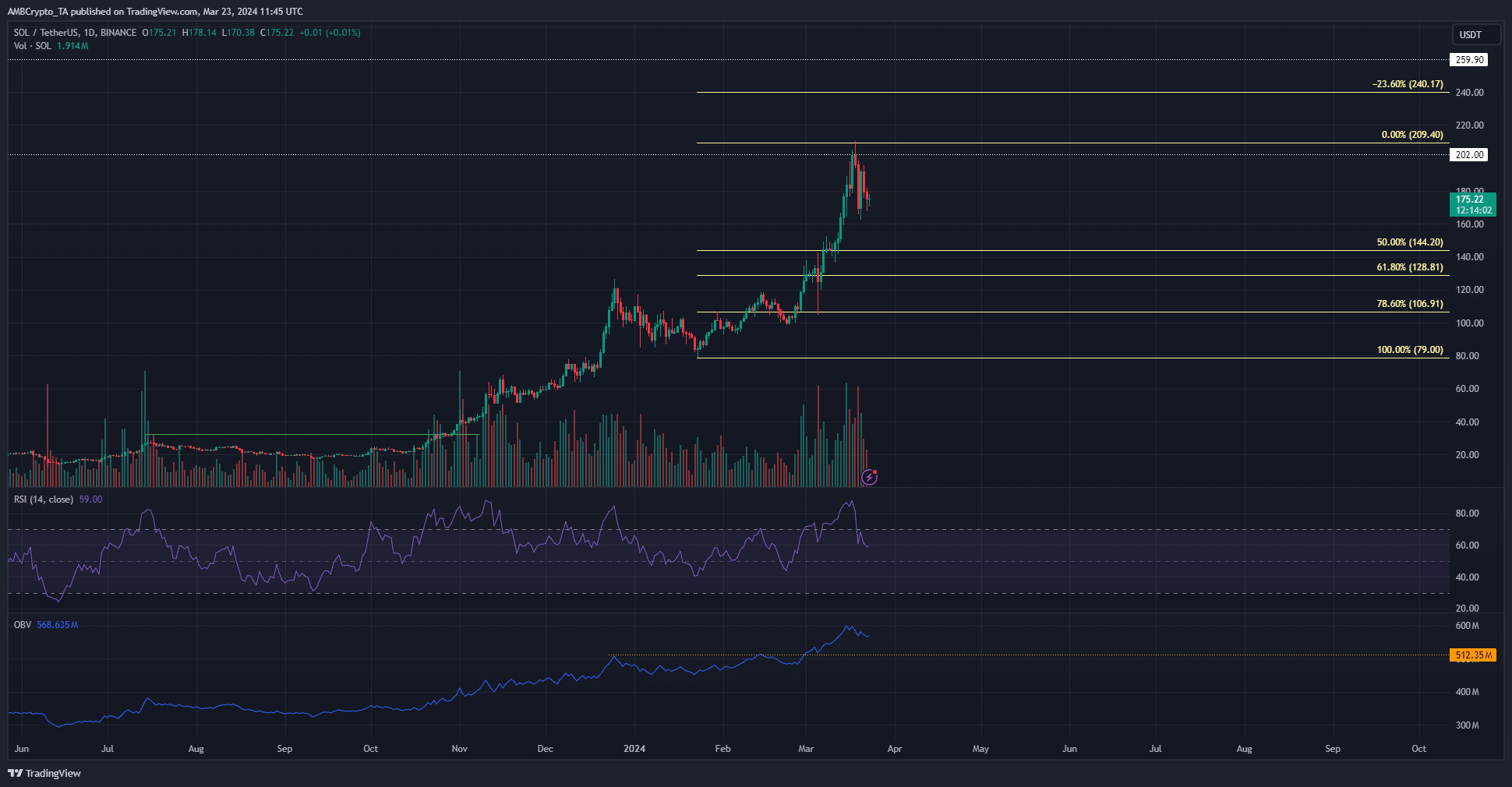

Supply: SOL/USDT on TradingView

Whereas BTC and Ethereum noticed notable retracements, SOL maintained its upward trajectory. It hasn’t closed in on the 50% retracement stage but from the earlier swing low. Though the bulls have been unable to climb above the psychological $200, it nonetheless advised bulls had power.

This was additional strengthened by the OBV staying properly above a resistance stage it broke after a lot effort late in February. In the meantime, the RSI continued to maneuver above impartial 50 to point out bullish momentum was dominant.

The $106.9 and $128.8 assist ranges may nonetheless be retested if Bitcoin falls under the $60k mark. Nevertheless, the indications don’t recommend that such a deep retracement was possible within the coming days.

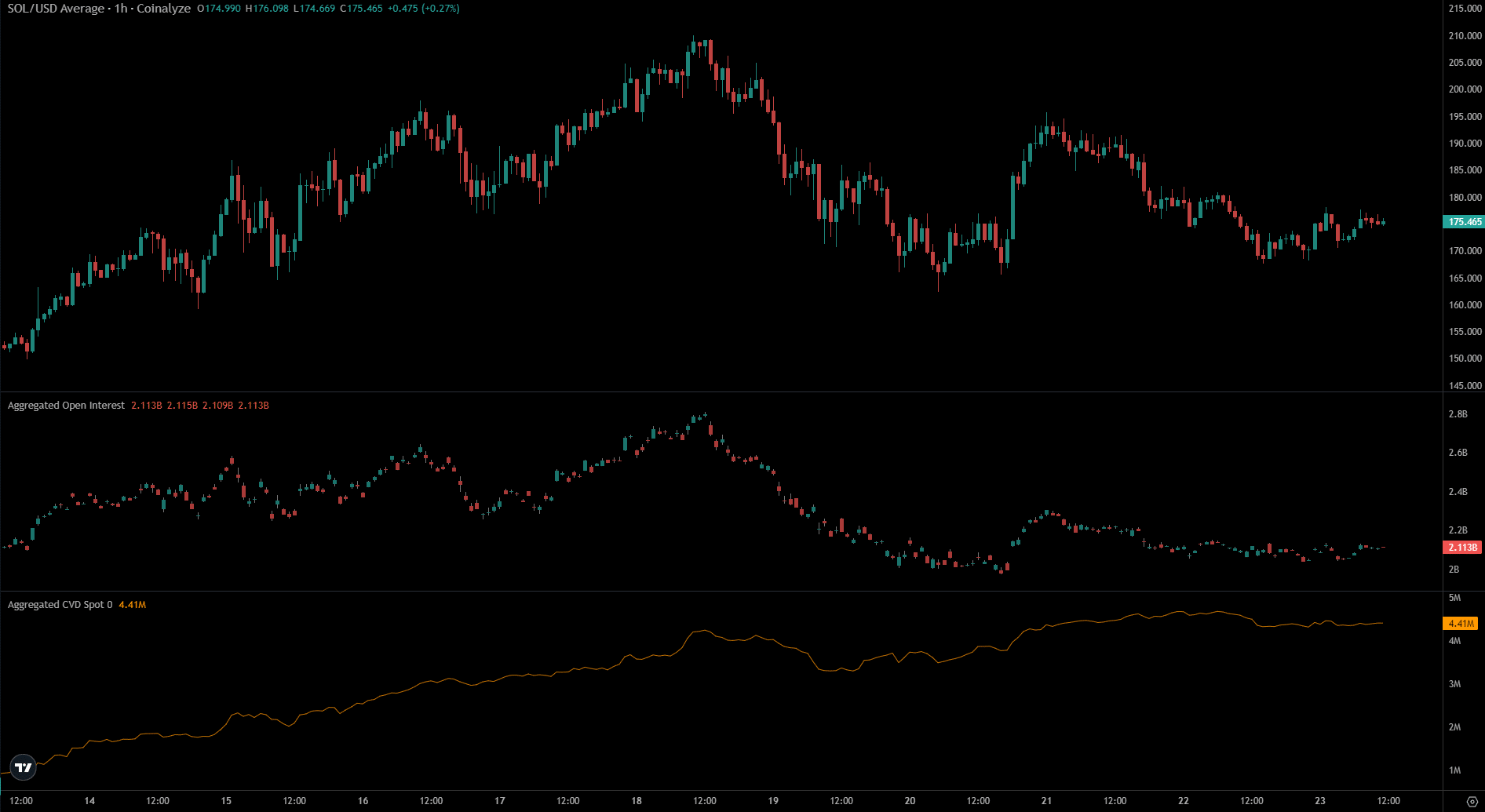

The spot CVD has moved sideways over the previous two days, however was in an uptrend earlier. The spot demand slowed down alongside the Open Curiosity as costs remained under $200 over the previous week.

This advised that bullish conviction was not sturdy but, but in addition that promoting stress has not been exceptional within the spot markets. The bulls may pull off a restoration, offered sentiment behind BTC may shift bullishly as properly.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

General, all three markets had a long-term bullish bias. A Bitcoin transfer again above the $73k stage seems to be a query of when, not if, given the latest demand.

Over the approaching months, the losses of the previous two weeks could possibly be only a blip.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.