- 32,000 BTC and 206,000 ETH Choices expiring quickly might result in main market shifts

- BTC, ETH face excessive uncertainty with elevated implied volatility ranges above 60%

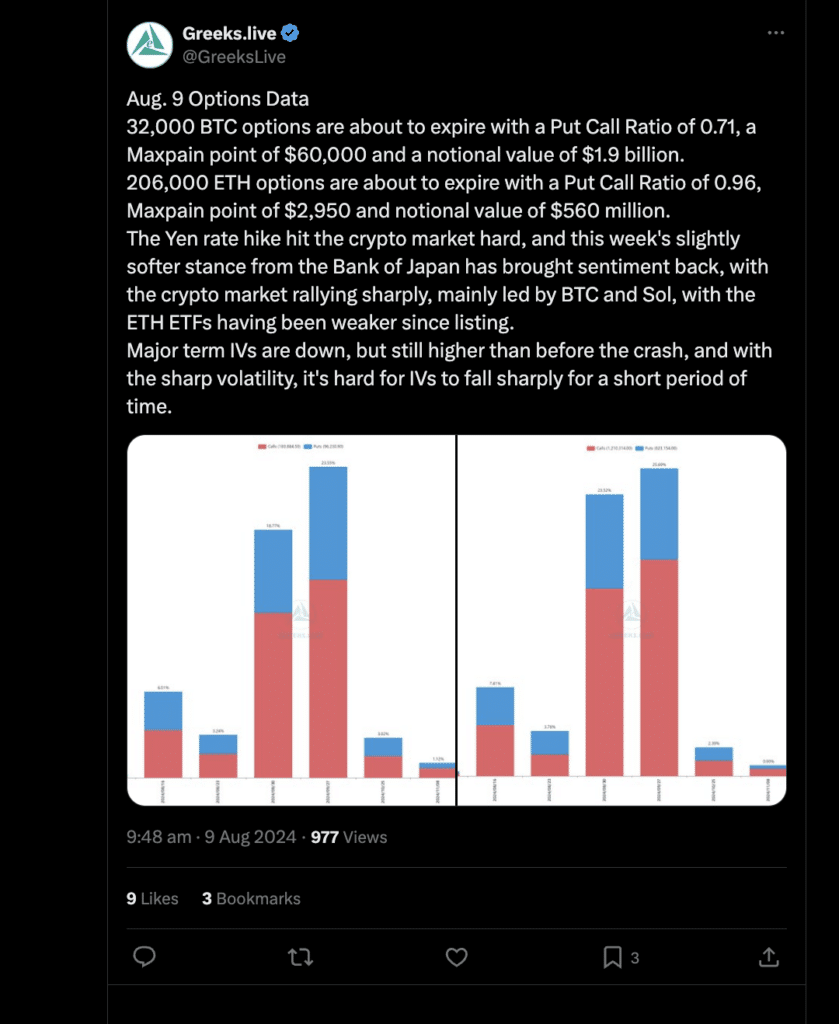

The upcoming expiry of serious BTC and ETH Choices is drawing consideration from market individuals. In truth, in keeping with Greeks.live on X, 32,000 BTC Choices are set to run out with a Put/Name ratio of 0.71.

In the meantime. the max ache level, the worth degree at which probably the most Choices expire nugatory, is $60,000. This expiry includes a notional worth of $1.9 billion, suggesting potential market turbulence as costs method this essential degree.

Equally, 206,000 ETH Choices are approaching expiry too. With a Put/Name ratio of 0.96, the sentiment within the ETH market seems extra balanced. The max ache level for ETH appeared to be $2,950, with a notional worth of $560 million.

These expiries might result in vital market shifts, particularly if costs align intently with the Max ache factors. This might gasoline notable monetary losses for Choices holders.

Market response to macroeconomic shifts

The latest Yen fee hike had a significant impression on the crypto market, resulting in a brief decline in costs. Nonetheless, a softer stance from the Financial institution of Japan this week has helped the market get well.

Bitcoin (BTC) and Solana (SOL) led this restoration, with BTC costs hitting $60,678.35, marking a 5.99% hike within the final 24 hours. Regardless of this rally, nonetheless, BTC noticed a 6.23% decline over the past seven days – Indicating ongoing volatility.

Ethereum (ETH) additionally registered a major worth hike, rising 7.52% within the final 24 hours to $2,632.92. Nonetheless, it fell by 16.48% over the previous week.

The market’s total concern index stays excessive too – An indication of sustained uncertainty regardless of the latest worth rebounds.

Excessive implied volatility and realized volatility

Moreover, Choices knowledge revealed that implied volatility (IV) for main phrases stays above 60%, suggesting that market uncertainty remains to be prevalent. The BTC 7-day realized volatility (RV) spiked to 100%, far exceeding the IV degree – Signaling sustained sharp worth actions.

The excessive IV is an indication that the market will not be anticipating volatility to say no considerably within the quick time period.

Volatility typically has a lingering impact, with giant worth fluctuations resulting in prolonged intervals of elevated IV. This pattern means that market individuals ought to put together for continued instability within the close to future. Choices sellers, particularly, might discover alternatives to construct positions progressively, profiting from the sturdy IV assist.

The mix of main Choices expiries, excessive volatility, and ongoing macroeconomic shifts create an atmosphere ripe for potential market swings.

Lastly, as BTC and ETH Choices close to their expiry dates, merchants and traders ought to stay vigilant.