- Hashdex filed for the primary index-based US crypto ETF holding Bitcoin and Ethereum.

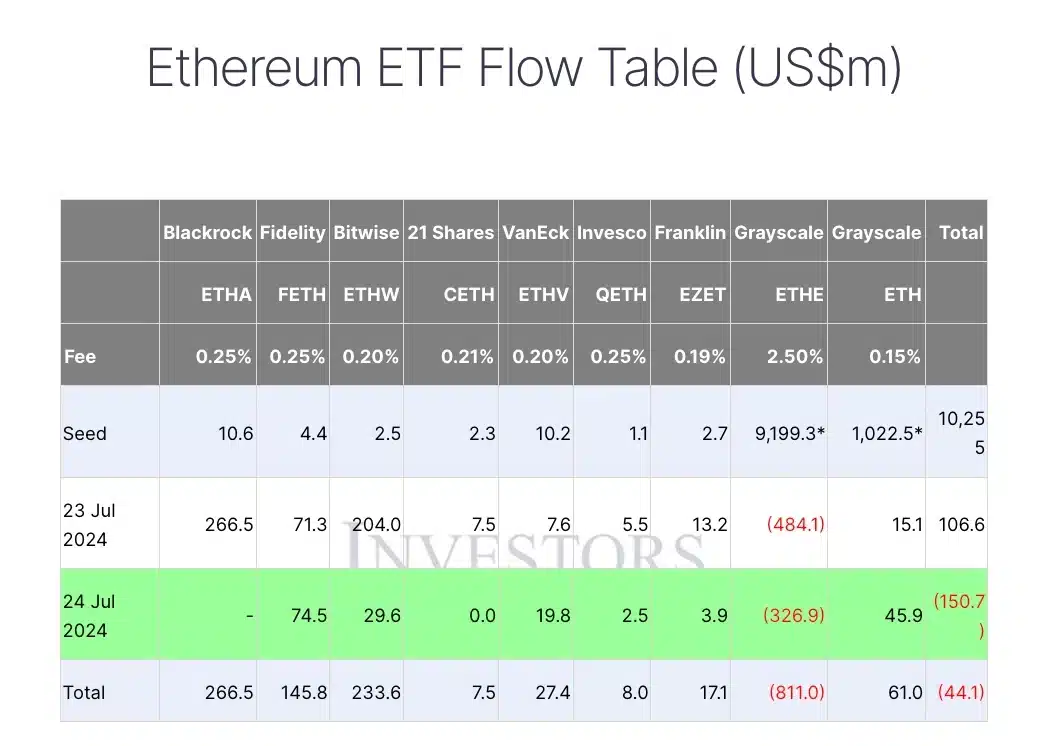

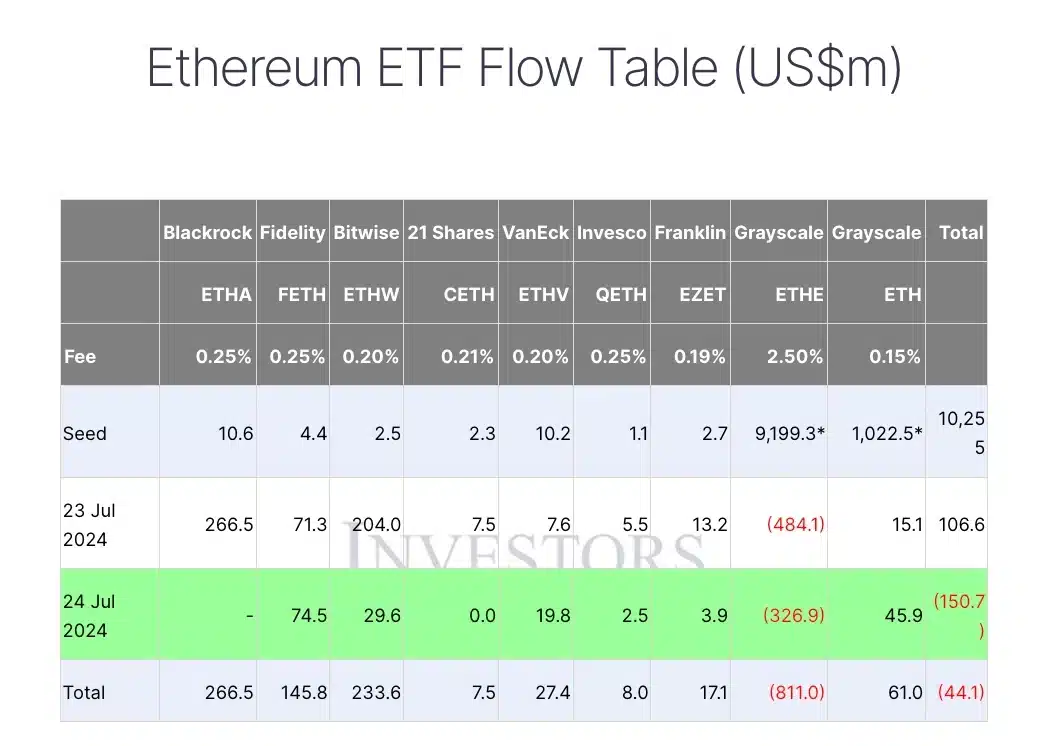

- ETH ETFs noticed $176.2 million inflows; Grayscale skilled $326.9 million outflows.

Crypto asset administration agency Hashdex has taken a big step in direction of launching a groundbreaking exchange-traded fund (ETF) that instantly holds spot Bitcoin [BTC] and Ethereum [ETH].

In a transfer that might set up the primary index-based crypto ETF in the USA, Hashdex submitted its S-1 registration assertion with the U.S. Securities and Change Fee.

Hashdex’s ETF plans

The proposed fund, named the Hashdex Nasdaq Crypto Index US ETF, goals to incorporate BTC and ETH initially, with the potential for extra belongings as regulatory situations evolve.

This milestone follows weeks of preparation and marks a significant development in Hashdex’s imaginative and prescient inside the crypto funding panorama.

Increasing on the identical, the S-1 submitting filed by Hashdex famous,

“If any crypto asset aside from bitcoin and ether turns into eligible for inclusion within the Index, the Sponsor will transition to a pattern replication technique, with solely bitcoin and ether in the identical proportions decided by the Index.”

Reiterating the identical, Bloomberg ETF Analyst James Seyffart took to X and mentioned,

“Will begin with simply #Bitcoin & #Ethereum however can add different belongings if and when permitted by the SEC.”

In a separate post, the analyst emphasised that this transfer was not surprising, and added,

“Shouldn’t be a shock to anybody — makes a variety of sense.”

What’s extra to it?

Seyffart additionally hinted at a possible date for the SEC’s remaining choice on the Hashdex Nasdaq Crypto Index US ETF, stating that the approval deadline “needs to be someday across the first week of March 2025.”

That being mentioned, Hashdex’s latest submitting coincides with the ultimate approval for spot Ethereum ETFs that began buying and selling simply two days in the past.

Moreover, in contrast to these newly sanctioned ETFs, Hashdex’s proposed mixed spot cryptocurrency ETF notably excludes Ether staking from its choices.

Bitcoin & Ethereum ETF evaluation

Within the meantime, ETH ETFs noticed substantial inflows, whereas the Grayscale Ethereum Belief skilled vital outflows of $326.9 million on twenty fourth July. In distinction, BlackRock’s ETH ETF reported no exercise.

Supply: Farside Buyers

On the Bitcoin aspect, BTC ETFs recorded inflows of $44.5 million, with Grayscale’s GBTC attracting $26.2 million and BlackRock’s IBIT bringing in $66 million on the identical day as per Farside Investors.