- Bitcoin has entered the $69,000 value zone.

- The brand new value zone may influence the week’s ETF circulate.

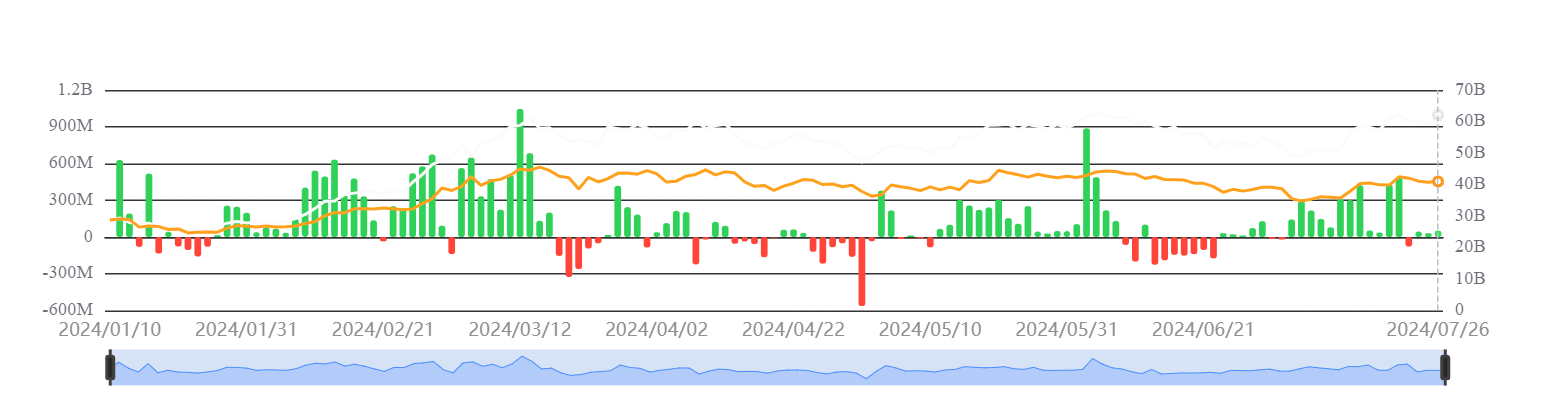

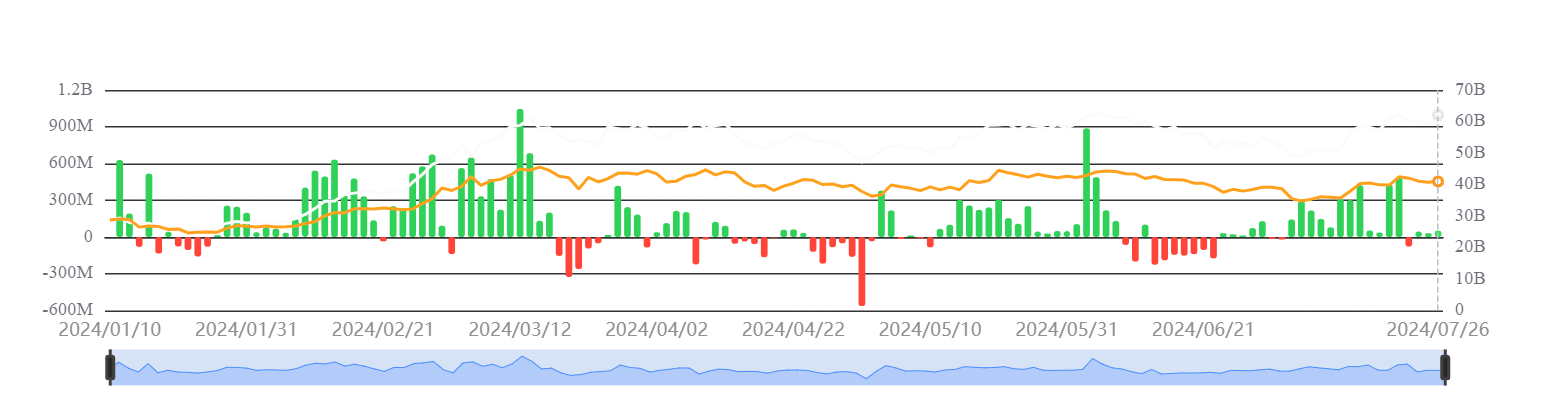

The newest Bitcoin ETF replace revealed that almost all ETF companies skilled constructive capital inflows over the previous week, indicating sturdy investor curiosity.

Just one main ETF agency reported a destructive circulate, marking it as an outlier in an in any other case bullish pattern in ETF investments. Moreover, aside from one, on daily basis of the week noticed constructive flows.

The Bitcoin ETF circulate pattern

In keeping with the newest Bitcoin ETF replace information from Sosovalue, spot ETFs skilled a internet influx of $535 million previously week.

Nonetheless, not all funds noticed constructive actions; Grayscale (GBTC) reported a internet outflow of $120 million, making it the one ETF with a destructive circulate for the week.

However, BlackRock’s Bitcoin ETF (IBIT) recorded the very best influx, with $758 million coming in over the week. Constancy’s Bitcoin ETF (FBTC) additionally noticed a wholesome influx, including $29.61 million.

Supply: Sososvalue

Bitcoin spot ETFs’ complete internet asset worth now stands at $62.095 billion. The ETF internet asset ratio, which measures the market worth of those ETFs relative to Bitcoin’s complete market worth, is at present 4.67%.

Moreover, the historic cumulative internet influx into Bitcoin spot ETFs has reached $17.587 billion, indicating a big and rising curiosity in Bitcoin via these funding automobiles.

Bitcoin begins the week sturdy

The Bitcoin value pattern has proven a constructive begin to the week, with its present buying and selling value round $69,500, marking a rise of over 1.8%. This rise brings it again into the $69,000 value vary for the primary time in over a month.

Additionally, it edged nearer to the numerous $70,000 threshold.

Supply: TradingView

Moreover, this upward motion has additionally nudged it nearer to the overbought territory, as indicated by its Relative Energy Index (RSI), which at present stands at round 69.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

How the value may have an effect on Bitcoin ETF traits

Given this sturdy begin to the week, we would anticipate a reactive motion within the Bitcoin ETF market, as ETFs typically reply to important value actions within the underlying asset.

Additionally, this might enhance buying and selling volumes and potential changes in ETF holdings and methods.