- Cboe has re-filed its Bitcoin ETF software to incorporate choices.

- BTC ETF has seen an outflow of over $17 billion.

Months in the past, the approval of the Bitcoin ETF marked a big milestone. It broadened the scope for buying and selling alternatives and facilitated elevated institutional involvement.

Because the market adjusts to this improvement, the BTC ETF choices are on the horizon and will arrive earlier than many anticipated.

Bitcoin ETF choices functions see actions

Current developments recommend that Bitcoin ETF choices may very well be out there as quickly because the fourth quarter of 2024.

This hypothesis has been fueled by feedback from Bloomberg Intelligence analyst James Seyfarrt, who expressed optimism in regards to the timeline for these choices.

Additional proof of motion on this course got here when Cboe re-filed its software to record choices on spot Bitcoin exchange-traded funds (ETFs) after initially withdrawing it. This refiling occurred late on a Thursday, as famous by business commentators.

Eric Balchunas, one other analyst, highlighted that the Securities and Alternate Fee’s (SEC) feedback on Cboe’s software had been encouraging, drawing parallels to the regulatory suggestions acquired earlier than the approval of Bitcoin ETFs.

This comparability has raised expectations that the trail in direction of launching Bitcoin ETF choices is changing into clearer.

A Bitcoin ETF possibility would permit traders to have interaction with Bitcoin in a manner that gives each the flexibleness of choices buying and selling and the regulatory safeguards related to conventional ETFs.

Traders would have the appropriate, although not the duty, to purchase or promote shares of a BTC ETF at a set value earlier than the choice expires, including a layer of potential strategic funding within the cryptocurrency area.

How the Choices ETF may Impression Bitcoin

Approving Bitcoin ETF choices may considerably improve liquidity and enhance value discovery. This could entice extra institutional traders to the market.

Additionally, this improvement may introduce elevated volatility as a result of speculative buying and selling and potential market manipulation.

Moreover, the worth of Bitcoin may see a bullish impression from heightened demand whereas bringing the crypto market nearer to conventional monetary programs.

Nevertheless, elevated regulatory scrutiny and the potential for Bitcoin to turn into extra correlated with conventional markets may additionally comply with.

BTC ETF previously week

In accordance with sosovalue, Bitcoin spot ETFs skilled a internet outflow of $169 million previously week. Grayscale ETF GBTC noticed a big weekly outflow of $392 million, whereas BlackRock ETF IBIT and WisdomTree ETF BTCW had inflows of $220 million and $129 million, respectively.

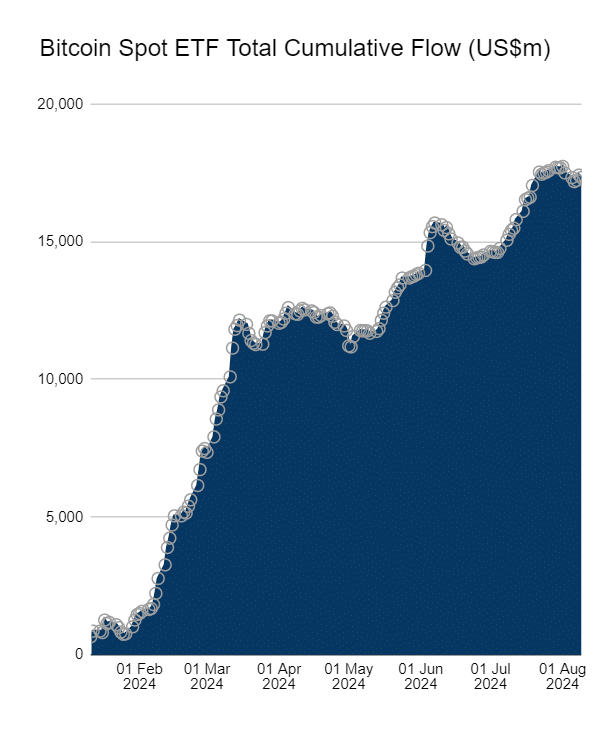

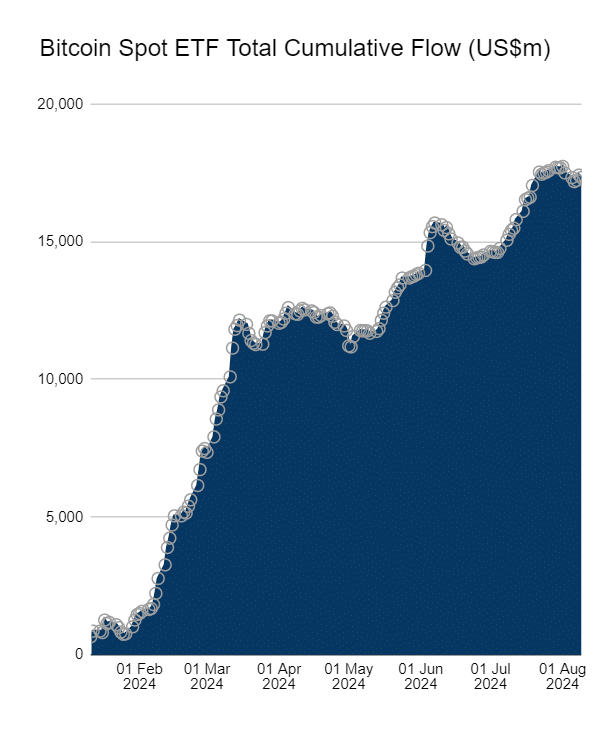

Moreover, cumulative knowledge from Farside Investors exhibits that U.S. BTC spot ETFs have garnered a internet influx of $17.341 billion since their inception.

Grayscale GBTC had a internet outflow of $19.451 billion, contrasted by BlackRock IBIT’s internet influx of $20.317 billion and Constancy FBTC’s $9.722 billion influx.

Supply: Farside