- BTC ETF inflows remained regular regardless of Bitcoin’s value correction.

- Miner income soared over the previous month.

After crossing the $70,000 mark, Bitcoin[BTC] witnessed a large correction and got here again to the $67,000 mark. Regardless of the correction in value, the curiosity in BTC was comparatively excessive.

All concerning the inflows

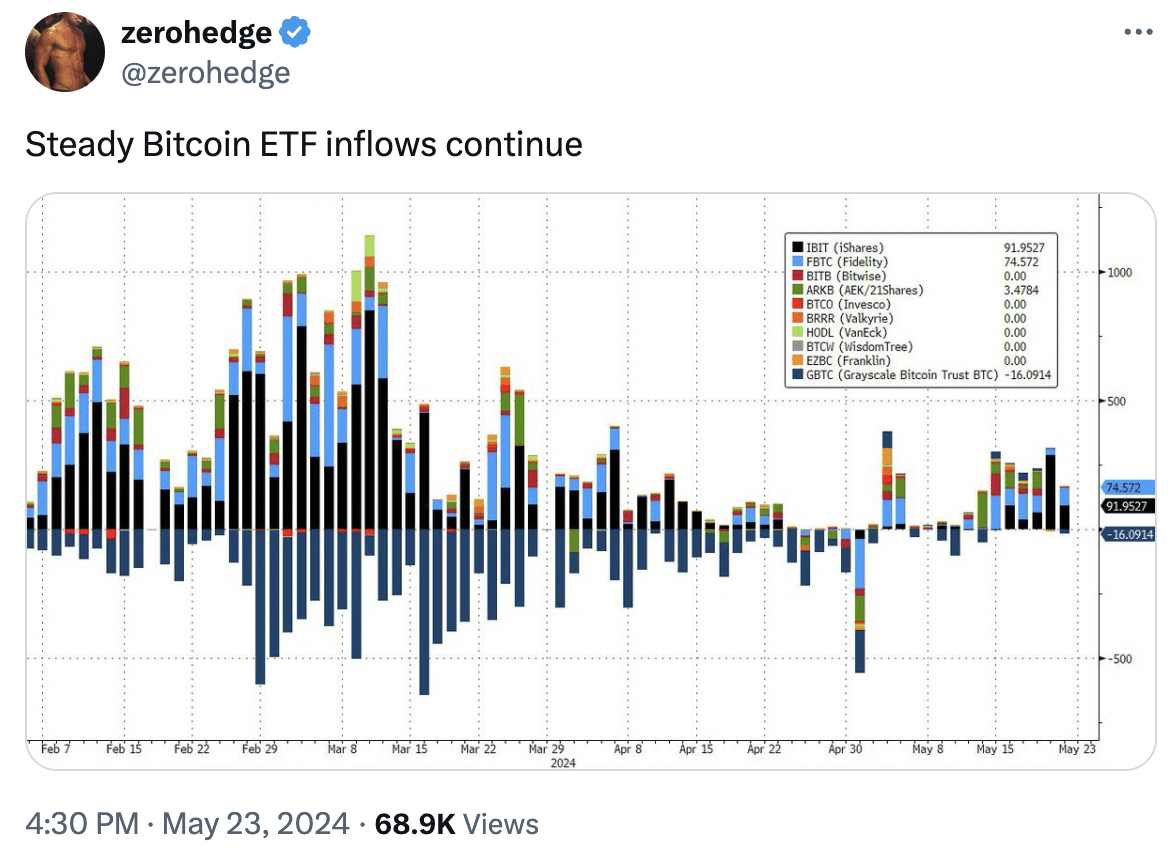

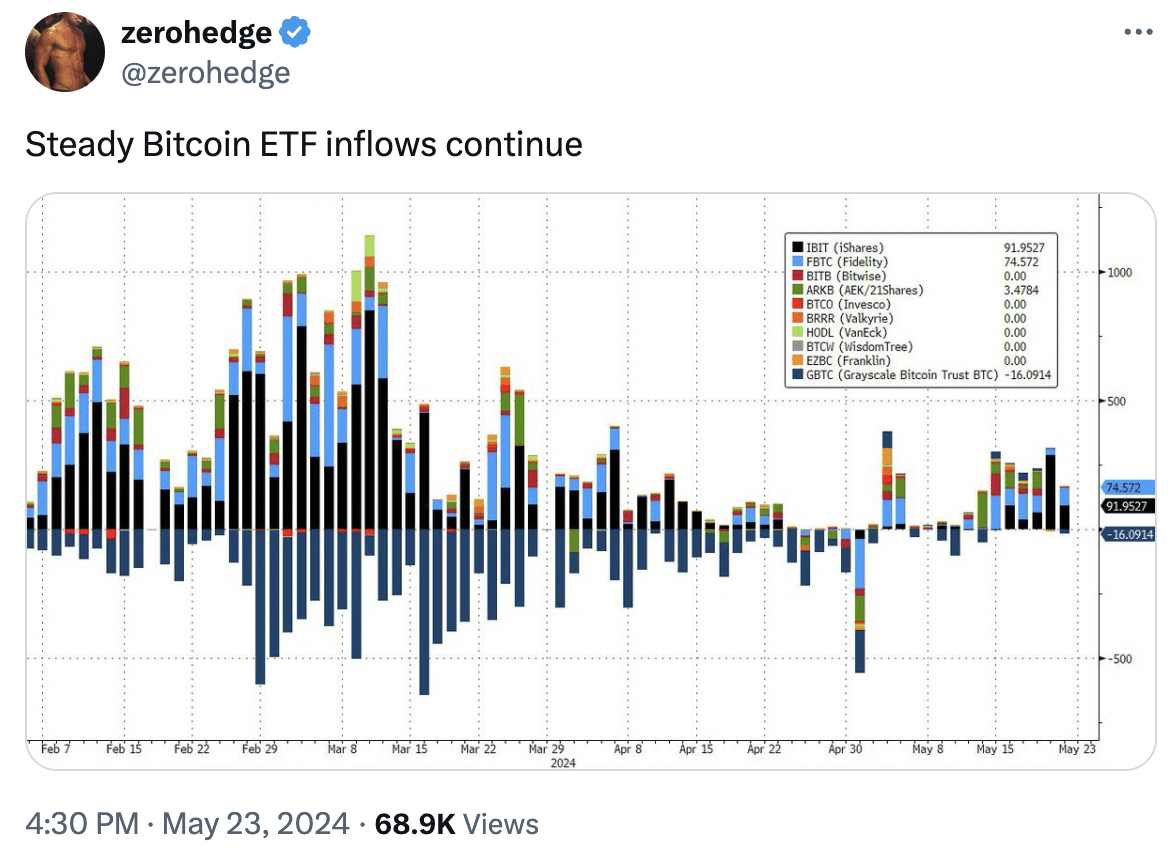

This was showcased by the regular BTC ETF inflows flowing into the market. Latest experiences point out that U.S. Bitcoin ETFs have amassed a complete of 850,707 BTC since January this 12 months.

This important accumulation is led by Grayscale’s GBTC ETF, which, regardless of a notable discount from its preliminary reserves, retains the biggest share at 289,280 BTC.

BlackRock’s iShares Bitcoin Belief (IBIT) has demonstrated outstanding development, increasing its reserve from simply 225 BTC at launch to a formidable 283,203 BTC.

Different key gamers within the U.S. market embody Constancy’s Clever Bitcoin ETF with 160,620 BTC and the Ark 21Shares ETF (ARKB) with 48,414 BTC.

Moreover, smaller contributors such because the Bitwise Bitcoin ETF (BITB), VanEck Bitcoin Belief (HODL), and Valkyrie BTC ETF (BRRR) have notable holdings of 36,092 BTC, 9,729 BTC, and eight,561 BTC, respectively.

Additional contributions come from Invesco Galaxy’s BTCO ETF, Franklin Templeton’s EZBC, and WisdomTree and Hashdex Bitcoin ETFs, with BTCO, EZBC, BTCW, and DEFI holding 7,245 BTC, 6,148 BTC, 1,237 BTC, and 178 BTC, respectively.

On a worldwide scale, Bitcoin ETFs have collectively amassed 986,769 BTC. Canada’s Function Bitcoin ETF is on the forefront exterior the U.S., holding 27,407 BTC.

Germany’s ETC Group Bodily Bitcoin Fund follows with 20,808 BTC, whereas the newly launched Hong Kong Bitcoin ETFs have amassed a reserve of three,608 BTC.

Supply: X

This surge in accumulation of BTC ETFs regardless of the decline in value indicated that curiosity within the king coin had continued to develop throughout the globe. As adoption rises, BTC stands to profit.

State of BTC

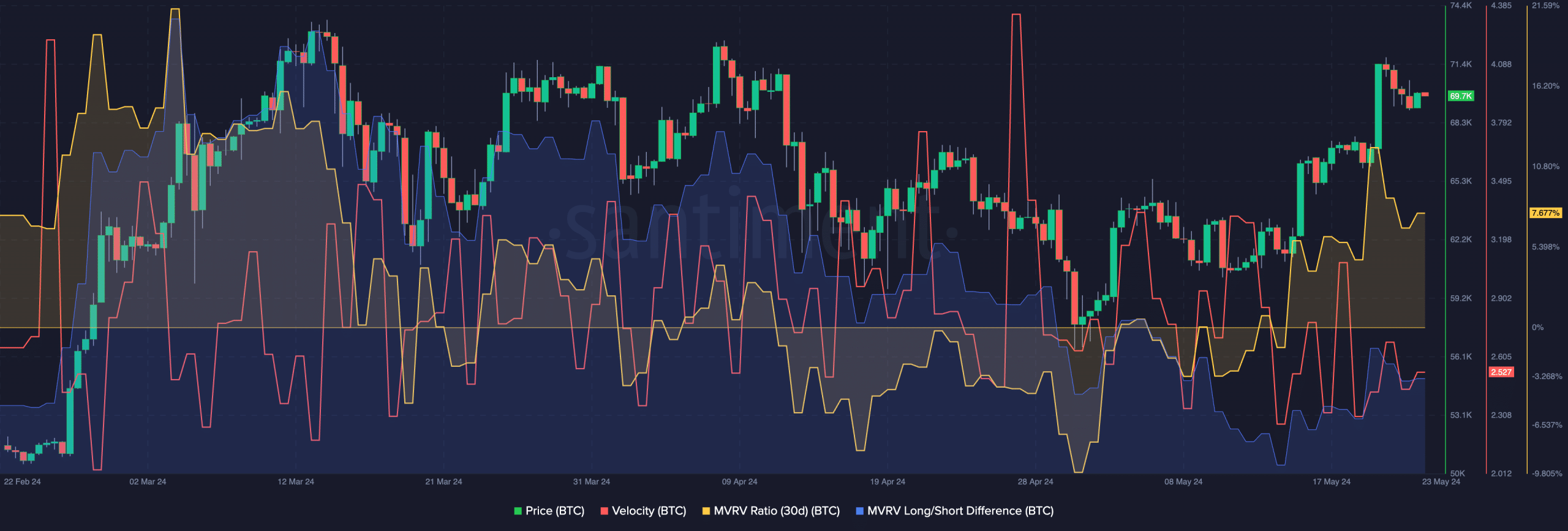

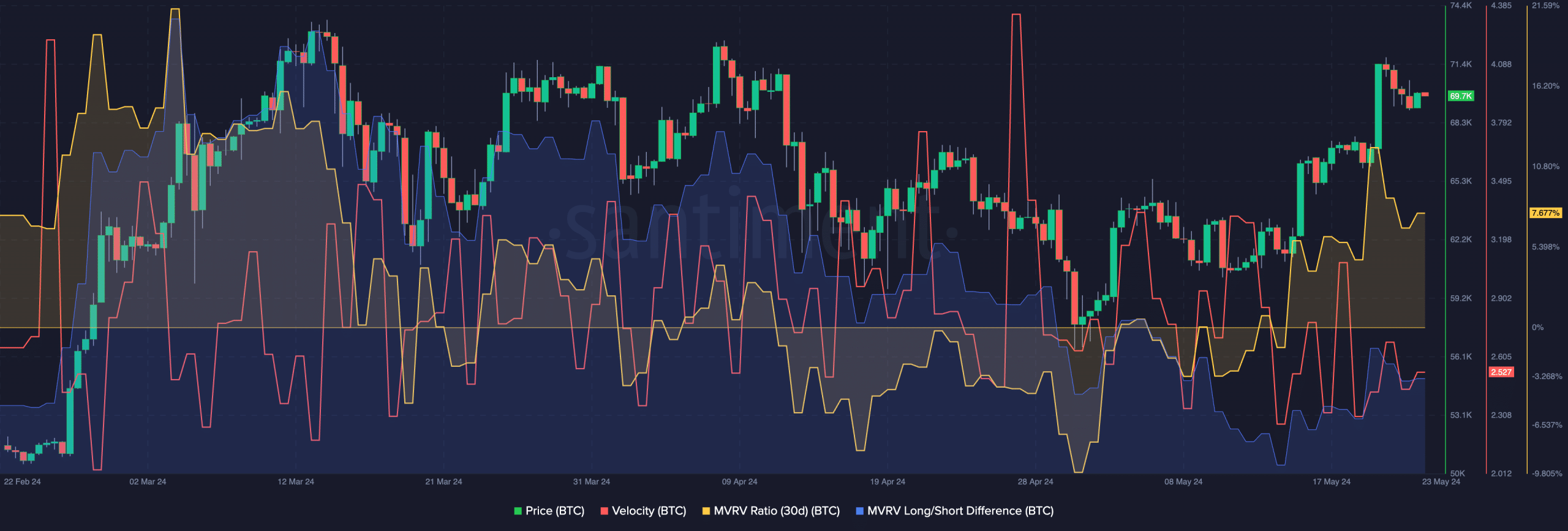

At press time, BTC was buying and selling at $66,865.51 as its value had declined by 3.85% within the final 24 hours. One of many causes for the decline in value can be the truth that most short-term holders had turned worthwhile as a result of latest uptick in BTC’s value, inflicting them to take pleasure in profit-taking.

Despite the fact that huge promote offs of BTC had occurred in the previous few days, the MVRV ratio remained excessive, implying that the variety of addresses in revenue was comparatively excessive.

The hazard of a large dump nonetheless looms round BTC. Nonetheless, on a optimistic be aware, the Lengthy/Quick distinction for BTC grew implying that the variety of long run holders had surged.

Long run holders are much less more likely to promote their holdings throughout market fluctuations. Furthermore, the rate of BTC additionally fell, indicating that the frequency with which BTC was being traded had fallen.

This meant that an growing variety of addresses had been holding on to their BTC.

Supply: Santiment

Learn Bitcoin’s [BTC] Value Prediction 2024-25

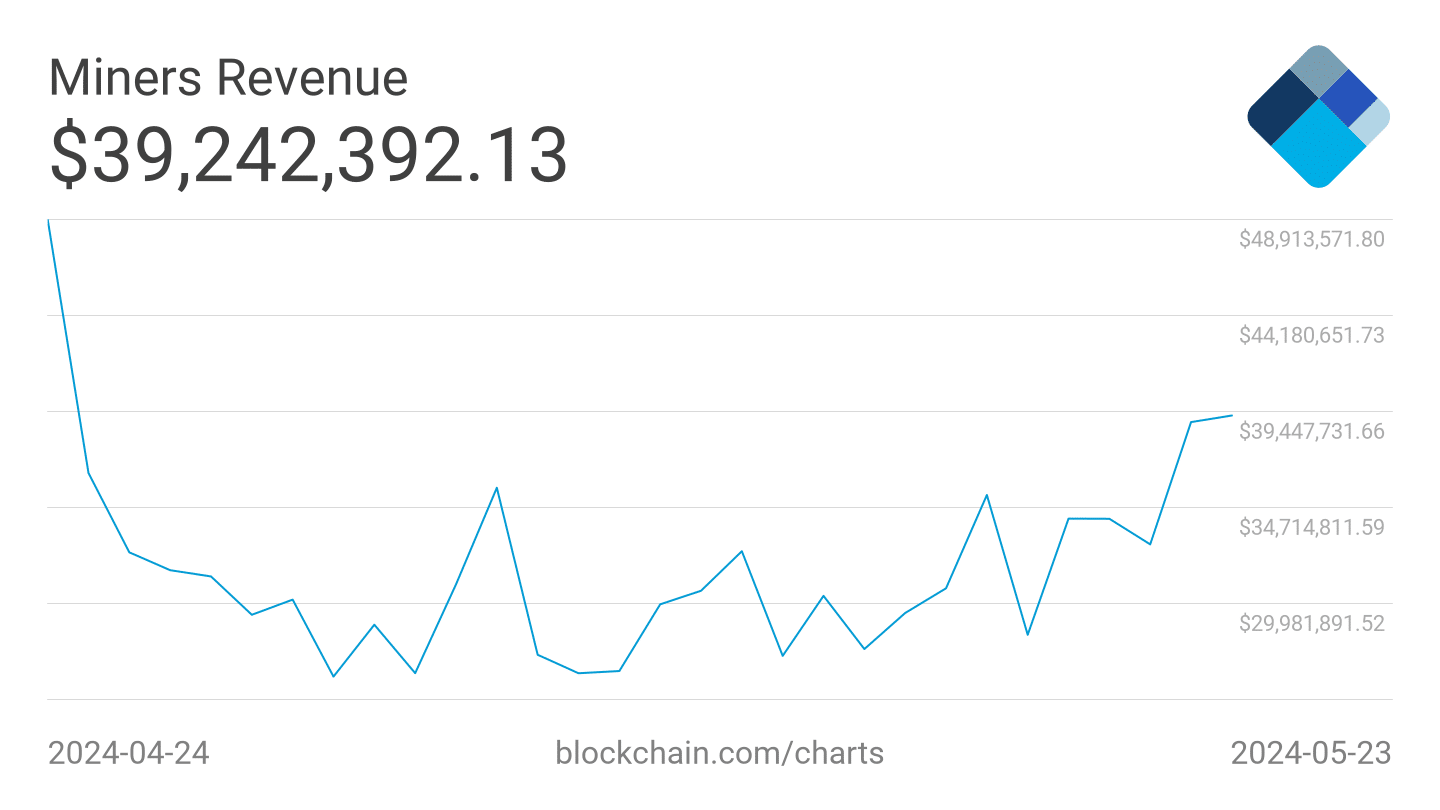

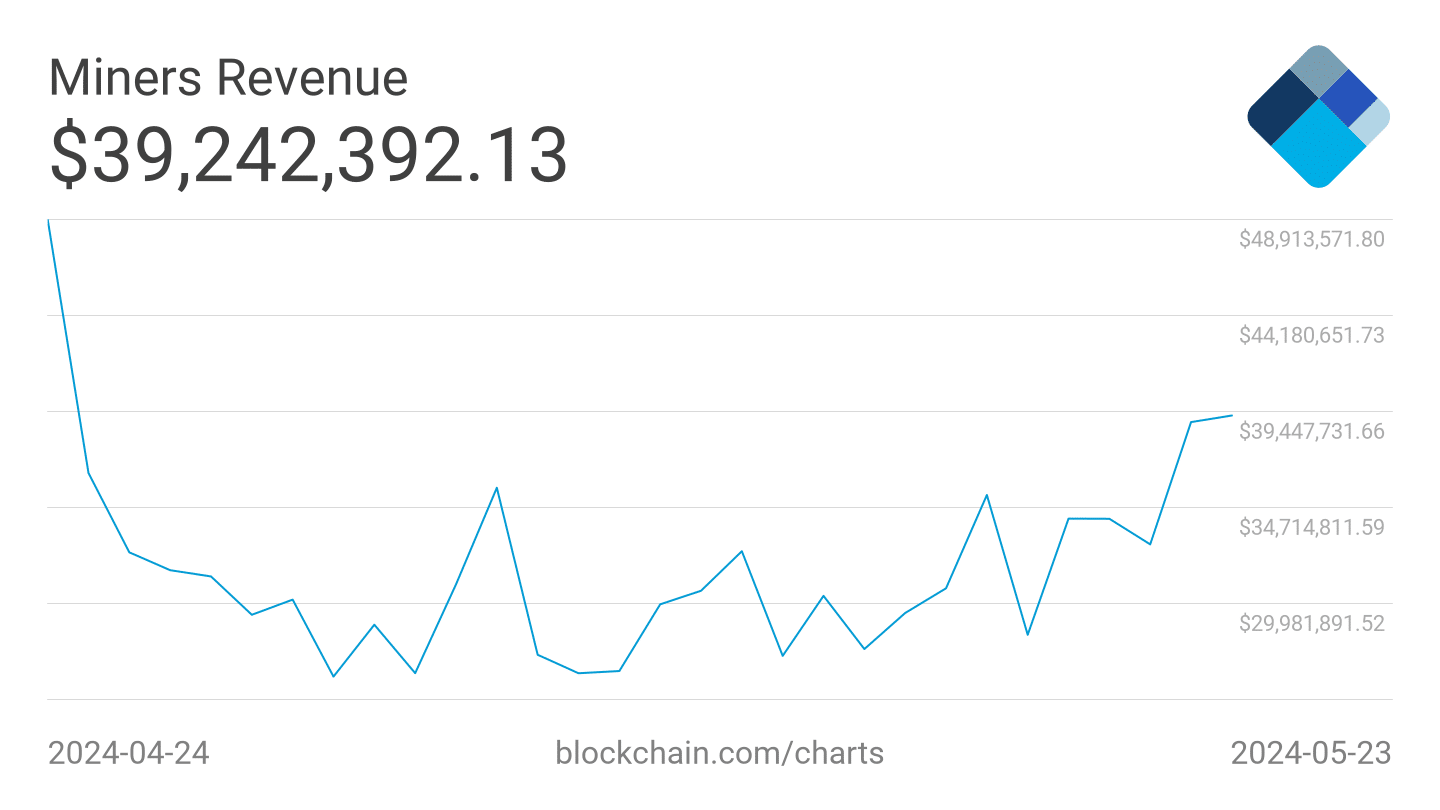

An element that might affect the value of BTC can be the state of the Bitcoin miners. If the income generated by miners declines, it incentivizes them to promote their holdings to remain afloat.

On the time of writing, the miners had been doing comparatively nicely. Over the previous month, the every day income generated by miners had surged from $29,981,891 to $39,242,392.

Supply: Santiment